ASC 740 Income Tax Accounting Challenges in 2013

advertisement

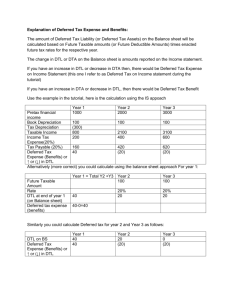

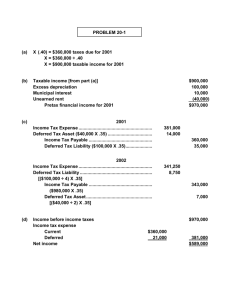

Presenting a live 110-minute teleconference with interactive Q&A ASC 740 Income Tax Accounting Challenges in 2013 Tackling Valuations of Deferred Tax Assets, Tax Expense and UTP Reporting, and Other Issues TUESDAY, MAY 28, 2013 1pm Eastern | 12pm Central | 11am Mountain | 10am Pacific Today’s faculty features: Douglas Sayuk, Partner, Clifton Douglas, San Jose, Calif. Cindy Frank, Senior Director, Tax Process Efficiency and Technology, BDO USA, Phoenix Jeffrey Zawada, Director, FreedMaxick CPAs, Buffalo, N.Y. For this program, attendees must listen to the audio over the telephone. Please refer to the instructions emailed to the registrant for the dial-in information. Attendees can still view the presentation slides online. If you have any questions, please contact Customer Service at 1-800-926-7926 ext. 10. Tips for Optimal Quality Sound Quality Call in on the telephone by dialing 1-866-873-1442 and enter your PIN when prompted. If you have any difficulties during the call, press *0 for assistance. You may also send us a chat or e-mail sound@straffordpub.com immediately so we can address the problem. Viewing Quality To maximize your screen, press the F11 key on your keyboard. To exit full screen, press the F11 key again. Continuing Education Credits FOR LIVE EVENT ONLY Attendees must stay on the line throughout the program, including the Q & A session, in order to qualify for full continuing education credits. Strafford is required to monitor attendance. Record verification codes presented throughout the seminar. If you have not printed out the “Official Record of Attendance,” please print it now. (see “Handouts” tab in “Conference Materials” box on left-hand side of your computer screen). To earn Continuing Education credits, you must write down the verification codes in the corresponding spaces found on the Official Record of Attendance form. Please refer to the instructions emailed to the registrant for additional information. If you have any questions, please contact Customer Service at 1-800-926-7926 ext. 10. Program Materials If you have not printed the conference materials for this program, please complete the following steps: • Click on the + sign next to “Conference Materials” in the middle of the lefthand column on your screen. • Click on the tab labeled “Handouts” that appears, and there you will see a PDF of the slides and the Official Record of Attendance for today's program. • Double-click on the PDF and a separate page will open. • Print the slides by clicking on the printer icon. ASC 740 Income Tax Accounting Challenges in 2013 Seminar May 28, 2013 Cindy Frank, BDO USA cfrank@bdo.com Jeffrey Zawada, FreedMaxick CPAs jeff.zawada@freedmaxick.com Douglas Sayuk, Clifton Douglas douglas@cliftondouglas.com Today’s Program Overview Of ASC 740 And Related Guidance [Cindy Frank] Slide 8 – Slide 26 Specific Income Tax Accounting Issues, Best Practices [Douglas Sayuk, Cindy Frank and Jeffrey Zawada] Slide 27 – Slide 96 Notice ANY TAX ADVICE IN THIS COMMUNICATION IS NOT INTENDED OR WRITTEN BY THE SPEAKERS’ FIRMS TO BE USED, AND CANNOT BE USED, BY A CLIENT OR ANY OTHER PERSON OR ENTITY FOR THE PURPOSE OF (i) AVOIDING PENALTIES THAT MAY BE IMPOSED ON ANY TAXPAYER OR (ii) PROMOTING, MARKETING OR RECOMMENDING TO ANOTHER PARTY ANY MATTERS ADDRESSED HEREIN. You (and your employees, representatives, or agents) may disclose to any and all persons, without limitation, the tax treatment or tax structure, or both, of any transaction described in the associated materials we provide to you, including, but not limited to, any tax opinions, memoranda, or other tax analyses contained in those materials. The information contained herein is of a general nature and based on authorities that are subject to change. Applicability of the information to specific situations should be determined through consultation with your tax adviser. Cindy Frank, BDO USA OVERVIEW OF ASC 740 AND RELATED GUIDANCE FAS 109/ASC 740 Objectives Recognize: 1. The amount of taxes payable or refundable for the current year 2. Deferred tax liabilities and assets for the future tax consequences 9 Basic Principles 10 • A current tax liability or asset is recognized for the estimated taxes payable or refundable on tax returns for the current year. • A deferred tax liability or asset is recognized for estimated future taxes created by temporary differences. • The measurement of current and deferred taxes is based on the provisions of the enacted tax law. • Measurement of deferred tax assets is reduced if they will not be recognized. • These principles apply to domestic federal income taxes, and foreign and state and local taxes that are based on income. Components Of Income Tax Expense Current income tax expense (benefit) +/- Deferred income tax expense (benefit) = 11 Total income tax expense (benefit) Current Income Tax Expense Item Pre-tax book income Permanent differences Financial taxable income Temporary differences Taxable income per return Amount $1,000,000 100,000 $1,100,000 200,000 $1,300,000 Tax rate Tax liability (current portion of tax expense) 40% $520,000 This example replicates a typical tax return expense calculation and represents only the current portion of income tax expense. Without FAS 109/ASC 740 principles, our tax expense would be $520,000. 12 Deferred Tax Expense 13 • SFAS 109 requires the balance sheet approach to compute deferred taxes. • To compute the deferred expense, you must compare the beginning balance of temporary differences to their ending balance. • Temporary difference treatment in FAS 109/ASC 740 smoothens out the rate; there is no impact on book tax expense. Components Of Total Expense Permanent differences: • Arise from income that is permanently non-taxable and expense items are permanently non-deductible • 14 Affect either the financial statements or the tax return, but not both • Will always increase or decrease your effective tax rate • Will either cost tax dollars or save tax dollars Current Income Tax Expense Item Pre-tax book income Permanent differences Financial taxable income Temporary differences Taxable income per return Tax rate Tax liability (current portion of tax expense) 15 Amount $1,000,000 100,000 $1,100,000 200,000 $1,300,000 40% $520,000 Permanent Differences Item Pre-tax book income Amount $1,000,000 Permanent differences • Meals and entertainment 50,000 • Fines and penalties 40,000 • Lobbying expenses 10,000 Total permanent differences $100,000 Financial taxable income $1,100,000 16 Permanent Differences (Cont.) Item Amount Permanent differences • Meals and entertainment 50,000 • Fines and penalties 40,000 • Lobbying expenses 10,000 Total permanent differences Tax rate Tax impact of permanent items 17 $100,000 40% $40,000 Permanent Differences (Cont.) Permanent differences will always affect your rate. Item Pre-tax book income Tax rate Expected tax expense $1,000,000 40% $400,000 Tax related to permanent items 40,000 Total expected tax expense $440,000 Effective tax rate = 440,000/1,000,000 = 44% (this is a short method of testing the rate) 18 Amount Components Of Total Expense Temporary differences: 19 • Will generally have no impact on your effective tax rate • Are book/tax differences that will be deductible or taxable in one or more future years • Will either cost tax dollars or save tax dollars in the current year, and will have the opposite effect in a future year Current Income Tax Expense, Revisited Item Pre-tax book income Permanent differences Financial taxable income Amount $1,000,000 100,000 $1,100,000 Temporary differences 200,000 Taxable income per return $1,300,000 Tax rate Tax liability (current portion of tax expense) 20 40% $520,000 Temporary Differences Year-End 12/31/2011 Bad debt reserve Accrued bonus Total change in temp differences Tax rate Tax impact of temporary differences 21 Current Year Activity Year-End 12/31/2012 $300,000 $250,000 $550,000 200,000 (50,000) 150,000 $500,000 $200,000 $700,000 40% 40% 40% $200,000 $80,000 $280,000 Temporary Differences (Cont.) Entry to record impact of temporary differences Debit Deferred tax asset Income tax expense 22 Credit $80,000 $80,000 Remember Current Expense? Item Pre-tax book income Permanent differences Amount $1,000,000 100,000 Financial taxable income $1,100,000 Temporary differences 200,000 Taxable income per return Tax rate Tax liability (current portion of tax expense) 23 $1,300,000 40% $520,000 Journal Entries Entries to record tax provision Debit Deferred tax asset $80,000 Income tax expense Income tax expense Current tax payable 24 Credit $80,000 $520,000 $520,000 Income Tax Expense Income statement looks like: Item Deferred tax benefit (reduces tax expense Current income tax expense Total income tax expense 25 Amount $(80,000) 520,000 $440,000 Remember This Shortcut Method? Item Pre-tax book income Tax rate Expected tax expense Tax related to permanent items Total expected tax expense Effective tax rate = 440,000/1,000,000 = 44% (this is a short method of testing the rate) 26 Amount $1,000,000 40% $400,000 40,000 $440,000 Douglas Sayuk, Clifton Douglas Cindy Frank, BDO USA Jeffrey Zawada, FreedMaxick CPAs SPECIFIC INCOME TAX ACCOUNTING ISSUES, BEST PRACTICES VALUING AND REPORTING DEFERRED TAX ASSETS Calculating The Deferred Tax Asset Deferred Tax Assets – General Approach Step 1: Identify temporary differences Step 2: Identify NOL carryovers Cumulative timing differences Step 3: Determine applicable tax rate Deferred tax asset before credits Step 4: Identify tax credits Example $3,000,000 7,000,000 $10,000,000 40.00% $4,000,000 500,000 Step 5: Calculate gross deferred tax assets $4,500,000 Step 6: Value the deferred tax assets (2,500,000) Step 7: Calculate net deferred tax assets $2,000,000 In steps 5-7, current deferred tax assets/liabilities and non-current deferred tax assets/liabilities should be aggregated, for balance sheet presentation purposes. 29 Deferred Tax Assets: Specific Issues I. Applicable tax rate A. Use enacted tax rate applicable when differences are expected to affect the taxes payable B. Consider effect of federal deductions for state taxes C. 1. Generally, this has the effect of reducing the state rate to 65% of the full amount (100% – 35% federal rate). 2. A few states permit a deduction for other state income taxes. Always use the regular tax rate, even when in an AMT situation D. Understand implications of tax holidays with limited durations II. Foreign branches 30 A. Foreign DTAs result in a reduction to the future U.S. foreign tax credit. B. Thus, a DTL must be established for the future reduction to the FTC. C. This has the effect of eliminating a double-counting of branch DTAs. Valuing The Deferred Tax Assets I. II. Consider other DTA reductions prior to valuation allowance A. Worthless DTAs – Sect. 382 B. ASC 740-10 (FIN 48) DTA reductions (e.g., R&D credit reserves) Valuation allowance A. Remaining gross DTA subject to VA under more-likely-than-not standard B. While not a bright-line test, the prior three years of cumulative financial operations (pre-tax income +/- permanent items) is often considered strong objective evidence. C. Partial VAs based on forecasted future taxable income are not uncommon, but these can appear to distort the tax rate if sustained for multiple years. D. VA should be allocated pro rata between current and non-current DTAs (without netting of DTLs), regardless of the specific asset to which it is related. 31 Slide Intentionally Left Blank Valuation Allowance Allocation DTA/(DTL) Current DTA A Current DTL Total current DTA $2,000,000 A/(A+B) 20.00% -0- n/a $2,000,000 Non-current DTA B $8,000,000 Non-current DTL C $(1,000,000) Total non-current DTA $7,000,000 Total gross DTA $9,000,000 A+B+C Valuation allowance Net DTA DTA Ratio VA VA Allocated x $9,000,000 = $1,800,000 $(1,800,000) B/(A+B) 80.00% Classified $200,000 x $9,000,000 = $7,200,000 $(7,200,000) $(200,000) (9,000,000) $- 0 - 100.00% $- 0 - General rules for classification: 1. Tracks balance sheet classification of underlying asset/liability (e.g., fixed asset DTAs are non-current) 2. Where not tied to an actual balance sheet account, based on when DTA is expected to reverse (i.e., less than one year is current, greater than one year is non-current) 33 DTA Movement Reconciliation: NOL Position Gross Amount Applicable Rate DTA Pre-tax book loss $(10,000,000) n/a Perm differences 2,000,000 n/a Temp differences 3,000,000 40.00% 1,200,000 $(5,000,000) -40.00% 2,000,000 500,000 100% 500,000 Taxable loss Tax credits Change to DTA $3,700,000 Gross Amount Applicable Rate DTA Pre-tax book loss $(10,000,000) -40.00% $4,000,000 Perm differences 2,000,000 -40.00% (800,000) 500,000 100% 500,000 Tax credits Change to DTA 34 $3,700,000 Return To Provision (RTP) Adjustment • During the provision preparation, a comparison is performed to identify any differences between the numbers used in last year’s tax provision and the amounts used on the tax return. • • Generally computed during Q3 The differences are “trued up” as part of the tax provision preparation process for the succeeding year. 35 Return To Provision (RTP) Adjustment Adjustment resulting from the comparison of individual items included in the prior year provision to the final income tax returns • Adjustments related to permanent items impact the current income tax expense on the income statement • Adjust deferred income tax asset/liability in succeeding year to reflect impact of discrepancy on amount of tax paid in prior year Change in Estimate • Change in estimate when new information ,not available when the provision was prepared, becomes available after the provision is completed. 36 Error • Change can be attributed to facts known or knowable at the time the provision was prepared. • Incorrect computation • Incorrect information used during provision preparation Return To Provision (RTP) Adjustment Return 12/31/2011 Pre-tax book income Provision 12/31/2011 Difference * Tax Effected $1,000,000 $1,000,000 $0 $0 Meals and entertainment 50,000 40,000 10,000 4,000 Allowance for bad debts 60,000 80,000 (20,000) (8,000) Tax depreciation (300,000) (400,000) 100,000 40,000 Taxable income $810,000 $720,000 $90,000 $36,000 * Assume 40% federal and state statutory rate 37 Return To Provision (RTP) Adjustment Entries to record tax provision true-up Debit Current income tax expense $ 4,000 Deferred income tax expense 32,000 Income taxes payable 38 Credit $36,000 ANALYZING AND REPORTING UNCERTAIN TAX POSITIONS Uncertain Tax Positions: Brief Overview I. Recognition: Determine whether position is sustainable on a more-likelythan-not basis (“on-off” switch) A. Based on technical merits B. Administrative practices and precedents II. Measurement: Calculate the expected benefit of the position, based on cumulative probability approach A. Benefit greater than 50% of being realized upon settlement B. Assume taxing authority has full knowledge of facts III. Unrecognized tax benefits (UTBs): Tax effect of UTPs A. FIN 48 liabilities recorded on balance sheets B. Reduction of DTA (whether or not valuation allowance in recorded) C. Excludes interest and penalties and well as “indirect benefits” 40 Change In Recognition And Measurement I. A change in recognition or measurement may occur when: A. Management changes its judgment on the position. B. The statute of limitations tolls. C. The position is effectively settled. II. Change in judgment A. Critical issue: Was there a change in fact or authority? B. A simple reassessment of existing facts can result in a restatement issue. C. Consistency must be maintained; significant consideration should be given to when establishing a methodology. III. Statute of limitations A. Net operating loss and tax credit carrybacks/carryforwards B. Jurisdictional differences 41 Change In Recognition And Measurement (Cont.) IV. Effective settlement A. B. 42 A tax position is considered “effectively settled” when: 1. The taxing authority has completed its examination procedures. 2. The company does not intend to appeal or litigate any aspect of the tax position. 3. Possibility is remote that the taxing authority would examine or reexamine the tax position, assuming it has full knowledge of all relevant information. Examination closure: Key considerations 1. A tax position does not need to be legally extinguished, and its resolution need not be certain, in order to re-measure a tax reserve. 2. Consider whether the issue was specifically reviewed or examined 3. If not, is it remote the tax period will be re-examined? 4. Effective settlement may not affect the tax position in other years, especially where the issue was not reviewed or “horse-trading” occurred. Common Unrecognized Tax Benefits I. Transfer pricing A. Benefits and limitations of contemporaneous documentation B. Potential indirect effects – competent authority and withholding taxes II. State nexus/permanent establishment A. Consider taxing authorities’ administrative policies and practices on SOL B. Potential indirect effects – throwback and FTCs III. Foreign withholding taxes A. Who is liable? Joint vs. separate liability B. Potential indirect effects – FTC (or deductions) IV. R&D credits V. Anti-deferral provisions (Subpart F, Sect. 956, etc.) 43 Example Of Indirect Effects Facts: A U.S. company determines that $100 of foreign taxes should have been withheld on royalty payment made to it by a foreign customer. The company determines that it has joint liability for payment of the tax in the foreign jurisdiction and that a reserve is required for this amount. However, the company concludes that it will also receive a $100 foreign tax credit for the taxes withheld, which it can use to offset U.S. taxes. Conclusion: Ignoring potential interest and penalties, this has no potential future net cash impact to the company, as the FTC will fully offset the foreign taxes paid. However, this must still be disclosed as a $100 UTB. The journal entries would be as follows: Dr. tax expense Cr. FIN 48 reserve $100 $100 To record withholding tax reserve Dr. DTA Cr. tax expense To record FTC DTA 44 $100 $100 Uncertain Tax Positions: Required Disclosures I. All entities A. B. C. II. Interest and penalties 1. Classification 2. Current and cumulative amounts Reasonably possible increases or decreases in UTBs within next 12 months 1. Nature of uncertainty and potential event causing the change 2. Estimate of amount (or statement that cannot be reasonably estimated) Tax years that remain open to examination in major jurisdictions Public companies A. B. 45 Tabular reconciliation of UTBs 1. Increases: Current year and prior year 2. Decreases: Settlements, tolling of statutes, changes in judgment Total amount of UTBs, if recognized, would affect the ETR. FINANCIAL STATEMENT DISCLOSURES: OVERVIEW, ISSUES AND SEC COMMENTS Reported, Discussed And Disclosed Reported amounts 47 • Balance sheet presentation • Income statement presentation • Statement of cash flows (SFAS No. 95) • Changes in equity, net of taxes Reported, Discussed And Disclosed (Cont.) Discussions • MD&A (management discussions and analysis) • Commission guidance regarding management’s discussion and analysis of financial condition and results of operations: • 48 MD&A should be a discussion and analysis of a company’s business as seen through the eyes of those who manage that business. Management has a unique perspective on its business that only it can present. As such, MD&A should not be a recitation of financial statements in narrative form or otherwise uninformative series of technical responses to MD&S requirements, neither of which provides this important management perspective. Reported, Discussed And Disclosed (Cont.) Discussions (Cont.) 49 • Effective tax rate • Forecasted rate for following year • Critical accounting policies • Liquidity • Contractual obligations Reported, Discussed And Disclosed (Cont.) Disclosed • Significant accounting policies • Income taxes including, but not limited to: • Components of income before taxes • Income tax expense (domestic and/or foreign) • Rate reconciliation (for public enterprise) • 50 Individual items in excess of 5% • Components of net deferred tax asset/liability, valuation allowances • Certain information related to FIN 48 amounts Disclosure Requirements Financial statement presentation 51 • Classification • Entities • Jurisdictions Disclosure Requirements (Cont.) Financial statement disclosure 52 • Components of the net deferred tax asset or liability • Information for certain deferred tax liabilities not recognized • Components of income tax expense (continuing operations) • Income tax expense or benefit allocated to continuing operations and separately allocated to other items • Rate reconciliation (public enterprise) • Certain carryforwards and certain valuation allowances • Certain disclosures for members of a consolidated group Disclosure Requirements (Cont.) FIN 48 disclosure 53 • Policy on interest and penalty classification • Tabular reconciliation • Unrecognized tax benefit that, if recognized, would affect the effective tax rate • Total interest and penalties • Unrecognized tax benefits – reasonable possible of significant change in the next 12 months • Nature of uncertainty • Nature of even that could occur • Estimate of range of possible change or a statement that an estimate cannot be made • Tax years open to examination Disclosure Requirements (Cont.) What to remember: • Understand the netting rules when it comes to current and non-current deferred tax assets and liabilities • Understand how amounts are compiled and reported from different jurisdictions • Significant accounting policies related to tax should be disclosed (SFAS 109, FIN 48, policies on interest and penalties). • Components of income (from different jurisdictions) • Components of expense (by jurisdiction, by classification) • Rate reconciliation (dollars or percentages) • Details for amounts > 5% of total for public companies • Robust disclosures for estimates and changes in estimates (valuation allowances, uncertain tax positions) 54 SEC Comments: Areas Of Focus Management estimates and judgments • • 55 Valuation allowances • Basis for having or not having a VA • Timing of recording changes • Consistency with other forward-looking information FIN 48-related items • Paragraph 21 disclosures • Interest and penalty policy disclosures • Disclosures and adjustments on adoption • Timing of recording changes SEC Comments: Areas Of Focus (Cont.) Management estimates and judgments (Cont.) • • Adequacy of disclosure • Rate reconciliation items • Deferred tax assets and liabilities • Uncertain tax positions • Timing of reversal • Expiration of NOLs in various jurisdictions Other • 56 Contingency obligations table SEC Comments: Areas Of Focus (Cont.) What to remember – SEC Comments • SEC may ask for clarification related to management’s material estimates and/or judgments. • Changes in estimates should be well-documented. • Responses to SEC comment letters are easier if the company has documentation related to: • Alternative views considered • Company policies that provide guidance on estimates • Criteria used in evaluation • Consider information that could be important to the user of the financial statements 57 Slide Intentionally Left Blank DECIDING ON APPROPRIATE INTRA-PERIOD ALLOCATIONS Intraperiod Tax Allocations I. Income tax expense or benefit should be allocated among: A. Continuing operations B. Other components 1. Discontinued operations 2. Extraordinary items 3. Other comprehensive income 4. Items charged or credited directly to shareholders’ equity II. Steps in allocation process A. Step 1 - Calculate total tax expense B. Step 2 - Determine tax related to continuing operations C. Step 3 - Allocate remainder to other components (disc. ops, OCI, etc.) 60 Intraperiod Tax Allocations: Example NOL Carryover w/ VA No NOL Carryover No VA NOL Carryover No VA Pre-tax Income – cont. ops $3,000,000 $3,000,000 $3,000,000 Pre-tax Income – disc. ops (1,000,000) (1,000,000) (1,000,000) Pre-tax income $2,000,000 $2,000,000 $2,000,000 NOL carryover (2,000,000) -0- -0- $- 0 - $2,000,000 $2,000,000 40.00% 40.00% 40.00% $800,000 $800,000 1,200,000 Taxable income Tax rate Total tax expense A $- 0 - Related to continuing ops B -0- $3MM x 40%= 1,200,000 A-B -0- Current benefit (400,000) Allocated to disc. ops Deferred benefit (400,000) Note: Net operating losses and other deferred tax assets are utilized before the impact of other components are considered. 61 Application Of ASC 740-20-45-7 Under this exception to the general rules, all components should be considered in determining the tax benefit resulting from continuing operations losses. NOL Carryovers/Full Valuation Allowance Pre-tax income – cont. ops Year X1 $(2,000,000) $2,000,000 2,000,000 (2,000,000) $-0- $-0- 40.00% 40.00% Pre-tax gain/(loss) – OCI (AFS) Pre-tax income Tax rate Total tax expense Related to continuing ops Allocated to disc. ops Year X2 $-0- No tax expense due to NOL C/F and valuation allowance $(2MM) x 40%= (800,000) -0- $2MM x 40%= 800,000 -0- Note: Even though the two-year impact of the OCI gain/loss is $nil, the tax effect of the Year X1 application of this rule does not reverse out in Year X2. Rather, the disproportionate tax effects become lodged in OCI and only reverse under very limited circumstances. 62 $-0- INTERIM PERIOD TAX COMPUTATION CALCULATIONS Interim Period Tax Computation I. Guidance A. ASC 740-270-25-2 1. The tax (or benefit) related to ordinary income (or loss) shall be computed at an estimated annual effective tax rate, and the tax (or benefit) related to all other items shall be individually computed and recognized when the items occur. 2. Ordinary income or loss a. Includes continuing operations before income taxes or benefit b. Excludes significant unusal or infrequently occuring items (rare) c. Excludes extraordinary items, cumulative effects of changes in accounting principles and discontinued operations 64 Interim Period Tax Computation (Cont.) I. Calculation A. Caluclate estimated effective tax rate 1. Forecast annual pre-tax income by entity/tax filing jurisdiction 2. Calculate current and deferred provisions 3. Consider federal, state and foreign B. Apply estimated effective tax rate 1. Multiply estimated effective tax rate by actual yearto-date worldwide pre-tax income C. Layer on items recorded discretely 65 Interim Period Tax Computation (Cont.) I. Items recorded discretely in the interim period A. Prior-year uncertain tax positions B. Current-year uncertain tax positions related to income excluded from the effective tax rate calculation C. Interest and penalties related to uncertain tax positions D. Change in tax law E. Change in tax status F. Changes in realizability of deferred tax assets G. Changes in judgment regarding APB 23 items (unremitted earnings of foreign subsidiaries and other outside basis items) H. Changes in estimates from prior-year provisions (provision to return adjustments) 66 Interim Period Tax Computation (Cont.) I. Modification to estimated effective tax rate approach (ASC 740-27030-30 through ASC 740-270-30-34) A. Loss limitation (year-to-date loss exceeds the full-year expected loss, and full realization of tax benefit is assured, i.e. no need for a valuation allowance) A. Recalculate tax based on year-to-date results B. Good example: ASC 740-270-55-16 B. Loss limitation (year-to-date loss exceeds the full year expected loss, and partial realization of tax benefit is assured) A. Calculate estimated effective tax rate based on amount of tax benefit assured B. Recalculate tax based on year-to-date results C. Good example: ASC 740-270-55-20 67 Interim Period Tax Computation (Cont.) I. Example – ASC 740-270-55-16 Ordinary Income Tax Overall Estimated Reporting Period First Qtr Annual Year-to- Year-to- Less Reporting Year-to- Effective Date - Date - Previously Reporting Period Date Tax Rate Computed Limited Reported Period 20,000 20,000 60% 12,000 - 12,000 Second Qtr (80,000) (60,000) 60% (36,000) 12,000 (48,000) Third Qtr (80,000) (140,000) 60% (84,000) (36,000) (44,000) Fourth Qtr 40,000 (100,000) 60% (60,000) (80,000) 20,000 Fiscal Year (100,000) (60,000) Year to date ordinary loss ($140,000 X 50%) (70,000) Estimated Tax Credits (10,000) (80,000) 68 (80,000) Interim Period Tax Computation (Cont.) I. Example – ASC 740-270-55-20 (overall ETR limited to partial unrealizable losses) Ordinary Income Tax Overall Estimated Reporting Period First Qtr Annual Year-to- Year-to- Less Reporting Year-to- Effective Date - Date - Previously Reporting Period Date Tax Rate Computed Limited Reported Period 20,000 20,000 20% 4,000 - 4,000 Second Qtr (80,000) (60,000) 20% (12,000) 4,000 (16,000) Third Qtr (80,000) (140,000) 20% (28,000) (12,000) (8,000) Fourth Qtr 40,000 (100,000) 20% (20,000) (20,000) - Fiscal Year (100,000) 69 (20,000) (20,000) Interim Period Tax Computation (Cont.) C. ASC 740-270-30-36(a) – If a separate jurisdiction has yearto-date ordinary loss or anticipates ordinary loss for the year, and no tax benefit can be recognized, then that entity should be excluded from the estimated effective tax rate calculation. 70 Interim Period Tax Computation (Cont.) I. Example – ASC 740-270-55-39 Anticipated ordinary income for the fiscal year: In the United States In Country A Total Anticipated tax for the fiscal year: In the United States ($60,000 at 50% statutory rate) In Country A ($40,000 at 20% statutory rate) Total Overall estimated annual effective tax rate ($38,000 / $100,000) 71 $ 60,000 40,000 $ 100,000 $ $ 30,000 8,000 38,000 38% Interim Period Tax Computation (Cont.) I. Example – ASC 740-270-55-40 – quarterly tax computation Ordinary Income Tax Overall Estimated Annual Reporting United Period States First Qtr Country A Total Less Year-to- Effective Year-to- Previously Reporting Date Tax Rate Date Reported Period 5,000 15,000 20,000 20,000 38% 7,600 - 7,600 Second Qtr 10,000 10,000 20,000 40,000 38% 15,200 7,600 7,600 Third Qtr 10,000 10,000 20,000 60,000 38% 22,800 15,200 7,600 Fourth Qtr 35,000 5,000 40,000 100,000 38% 38,000 22,800 15,200 Fiscal Year 60,000 40,000 100,000 72 38,000 Interim Period Tax Computation (Cont.) I. Example – ASC 740-270-55-41 – ordinary loss; realization not MLTN I. Country B history of losses, 40% rate, expected tax benefit will not be realized on these losses Ordinary Income Tax Overall Reporting United Period States Year-to- Annual Date - Less Year-to- Effective Excluding Previously Reporting Date Tax Rate Country B Reported Period Country A Country B 5,000 15,000 (5,000) 15,000 15,000 38% 7,600 - 7,600 Second Qtr 10,000 10,000 (25,000) (5,000) 10,000 38% 15,200 7,600 7,600 Third Qtr 10,000 10,000 (5,000) 15,000 25,000 38% 22,800 15,200 7,600 Fourth Qtr 35,000 5,000 (5,000) 35,000 60,000 38% 38,000 22,800 15,200 Fiscal Year 60,000 40,000 (40,000) 60,000 First Qtr Total Estimated Note: Format above different than actual ASC 740-270-55-41 example 73 38,000 Interim Period Tax Computation (Cont.) I. Example – ASC 740-270-55-41 – what if country B was included Anticipated ordinary income for the fiscal year: In the United States In Country A In Country B Total Anticipated tax for the fiscal year: In the United States ($60,000 at 50% statutory rate) In Country A ($40,000 at 20% statutory rate) Total Overall estimated annual effective tax rate ($38,000 / $60,000) 74 $ 60,000 40,000 (40,000) $ 60,000 $ $ 30,000 8,000 38,000 63.33% Interim Period Tax Computation (Cont.) I. Example – ASC 740-270-55-41 – what if country B was included (Cont.) I. Country B history of losses, 40% rate, expected tax benefit will not be realized on these losses Ordinary Income Tax Overall Reporting United Period States Year-to- Annual Date - Less Year-to- Effective Including Previously Reporting Date Tax Rate Country B Reported Period Country A Country B 5,000 15,000 (5,000) 15,000 15,000 63.33% 9,500 - 9,500 Second Qtr 10,000 10,000 (25,000) (5,000) 10,000 63.33% 6,333 9,500 (3,167) Third Qtr 10,000 10,000 (5,000) 15,000 25,000 63.33% 15,833 6,333 9,500 Fourth Qtr 35,000 5,000 (5,000) 35,000 60,000 63.33% 37,998 15,833 22,166 Fiscal Year 60,000 40,000 (40,000) 60,000 First Qtr Total Estimated Note: Format above different than actual ASC 740-270-55-41 example 75 37,998 Slide Intentionally Left Blank MERGER AND ACQUISITION TOPICS Business Combinations: Key Steps Step 1: Determine transaction structure (stock vs. asset acquisition) • Stock – historical tax basis carryover; can lead to significant DTA/DTLs • Asset – tax basis stepped up to FMV; DTA/DTL may be minimal Step 2: Identify existing deferred tax assets and liabilities • Typically, a short period cut-off provision is calculated. • Consider the impact of stock awards and other non-recurring charges. • When combined returns will be filed with the acquirer, the applicable tax rate in valuing DTA/DTLs should be reassessed. Step 3: Calculate DTA/DTL from purchase accounting fair value adjustments 78 • In a stock transaction, every FV adjustment will result in a DTA/DTL. Nongoodwill intangibles often result in a significant DTL. • Consider the impact of an acquired DTL on the acquirer’s VA, as the benefit of any release will be recorded to P&L. Business Combinations: Key Steps (Cont.) Step 4: Evaluate deferred tax asset valuation • Consider whether the combined operation’s financial position changes the assessment of deferred tax asset utilization • Changes to the acquired company’s VA are recorded in purchase accounting, while the acquirer’s VA is recorded outside of purchase accounting. • Also consider the need to write-off DTAs due to Sect. 382, SRLY or other acquisition related limitations Step 5: Consider tax reserve needs 79 • Leverage off of conclusions reached in due diligence • Consider the impact of indemnifications • Continue to evaluate information available at the acquisition date during the one-year measurment period STOCK AWARD ISSUES Stock Awards I. Guidance A. When the settlement of an award creates or increases a net operating loss A. This provides that the excess tax benefit and the credit to APIC (and our APIC pool) for the windfall should not be recorded until the deduction reduces income taxes payable. B. ASC 718-740-25-10 A. A share option exercise may result in a tax deduction before the actual realization of the related tax benefit because the entity, for example, has a net operating loss carryforward. In that situation, a tax benefit and a credit to additional paid-in capital for the excess deduction would not be recognized until that deduction reduces taxes payable. 81 Stock Awards (Cont.) I. Result A. Net operating losses A. The deferred tax asset on the company’s net operating losses will differ from the net operating losses actually on its tax return. B. The net operating losses relating to this windfall tax benefit will have to be tracked separately. C. The net operating losses disclosed in the footnote should be the actual net operating losses per the tax return. D. The footnote should also disclose the amount of benefit still to be recorded in additional paid-in capital once the net operating loss carryforward is realized. 82 Stock Awards (Cont.) I. Accounting policy A. Generally two approaches allowed: A. With and without – results in windfall tax benefits being realized last B. Tax law ordering – results in windfall tax benefit being realized first (should be less complex) B. Election of method is an accounting policy that must be applied consistently. 83 Stock Awards (Cont.) I. Examples I. 84 Facts: NOL carryforward from prior years – actual per tax return $500,000 Deferred tax asset on NOL at 40% $200,000 Current-year taxable income (before excess tax deduction for stock-based comp) $600,000 Current-year excess tax deduction for stock based compensation $250,000 Stock Awards (Cont.) Example 1: No valuation allowance With and Without Without Tax Law Ordering With Taxable income before NOL and excess tax deduction $ 600,000 $ 600,000 $ 600,000 $ 600,000 Current year excess tax deduction for stock based compensation NOL Carryforward from prior years $ $ (250,000) $ (500,000) $ $ (500,000) $ (100,000) (500,000) $ $ (250,000) (350,000) Taxable Income or NOL carryforward to next year $ (150,000) $ 100,000 $ Journal Entry Income Taxes Payable Current Tax Expense Deferred Tax Expense Deferred Tax Asset Additional Paid-in Capital $ $ $ $ $ - 40,000 200,000 (200,000) (40,000) $ $ $ $ $ $ - 100,000 140,000 (140,000) (100,000) Memo Entry - Debit / (Credit) Deferred Tax Asset $ 60,000 $ Additional Paid-in Capital $ (60,000) $ - With and Without - memo entry to reflect the $150,000 excess tax deduction for which there has been no cash benefit yet received Actual Remaining Net Operating Losses Deferred Tax Asset 85 $ $ (150,000) 0% $ $ - (150,000) 60,000 40% Stock Awards (Cont.) Example 2: Full valuation allowance With and Without Without Tax Law Ordering With Taxable income before NOL and excess tax deduction $ 600,000 $ 600,000 $ 600,000 $ 600,000 Current year excess tax deduction for stock based compensation NOL Carryforward from prior years $ $ (250,000) $ (500,000) $ $ (500,000) $ (100,000) (500,000) $ $ (250,000) (350,000) Taxable Income or NOL carryforward to next year $ (150,000) $ 100,000 $ Journal Entry Income Taxes Payable Current Tax Expense Valuation Allowance Deferred Tax Asset Additional Paid-in Capital $ $ $ $ $ - 40,000 200,000 (200,000) (40,000) $ $ $ $ $ $ - 100,000 140,000 (140,000) (100,000) Memo Entry - Debit / (Credit) Deferred Tax Asset $ 60,000 $ Additional Paid-in Capital $ (60,000) $ - With and Without - Memo entry to reflect the $150,000 excess tax deduction for which there has been no cash benefit yet received Actual Remaining Net Operating Losses Deferred Tax Asset Valuation Allowance 86 $ $ $ (150,000) - $ $ $ - (150,000) 60,000 (60,000) CURRENT AUDITOR RED FLAGS Current Auditor Hot Topics I. PCAOB materiality guidelines II. Deferred tax asset disclosure A. Classification – current vs. non-current B. Stock-based compensation C. 1. Terminations and cancellations 2. Sect. 83(b) elections Cost basis – fixed/intangible assets D. “True-up” impact – estimate vs. error III. Permanent reinvestment of foreign earnings rep under APB 23 88 A. Ability – sufficient cash to fund domestic operations B. Intent – established company policy; earnings need to fund operations C. Reasonable estimate of deferred taxes Current Auditor Hot Topics (Cont.) IV. Valuation allowance A. Allocation between current and non-current assets B. Jurisdictional issues (e.g., cost plus entities) V. ASC 740-10 (FIN 48) A. Statute of limitation periods B. Disclosure regarding changes in next 12 months VI. Intraperiod tax allocations to OCI 89 Current Auditor Red Flags I. Effective tax rate reconciliation A. Foreign effective tax rate varies significantly from statutory rate. II. Business combinations A. Contingent liabilities and consideration III. Deferred tax roll IV. Uncertain tax positions A. Inter-company transactions/transfer pricing B. Foreign audits 90 Slide Intentionally Left Blank RISK MITIGATION Risk Mitigation I. Valuation allowance documentation II. ASC 740-30-25-17 (APB 23) documentation III. Tax provision software IV. Department capability and internal controls 93 Risk Mitigation (Cont.) I. Valuation allowance documentation I. Four sources of taxable income A. Taxable income in carryback years 1. Consider character of income B. Future reversal of existing temporary differences 1. Consider timing of future reversals C. Tax planning strategies 1. Must be prudent and feasible 2. Must be something management wouldn’t ordinarily take 3. Must prevent deferred tax asset from expiring unused 4. Must result in the realization of a deferred tax asset 94 Risk Mitigation (Cont.) I. Valuation allowance documentation (Cont.) D. Future taxable income exclusive of reversing temporary differences and carryforwards 1. Three-year cumulative pretax book earnings 2. Forecast accuracy!!! 3. How many years of forecasted pre-tax income would be needed to realize all of the deferred tax assets? 4. Document and consider company liquidity, backlog, market trends, losses of significant customers, forecast divestitures, and expected restructuring or changes in operations. 95 Risk Mitigation (Cont.) I. ASC 740-30-25-17 (APB 23) documentation A. Document policy of permanent reinvestment B. Consider all aspects of outside basis differences (unremitted earnings, cumulative translation adjustments, transactions with non-controlling shareholders and other comprehensive income) C. Document uses of excess cash at foreign subsidiary (working capital needs, capital expenditures, acquisitions, repay inter-company obligations, loan to other foreign entities, etc. D. Document or forecast need or lack thereof of cash at the parent company 1. E. Consider history of earnings remittances 1. F. 96 Operations, debt service, acquisitions, capital expenditures, intercompany obligations Consider policy of not remitting past earnings Consider dispositions/available for sale entities