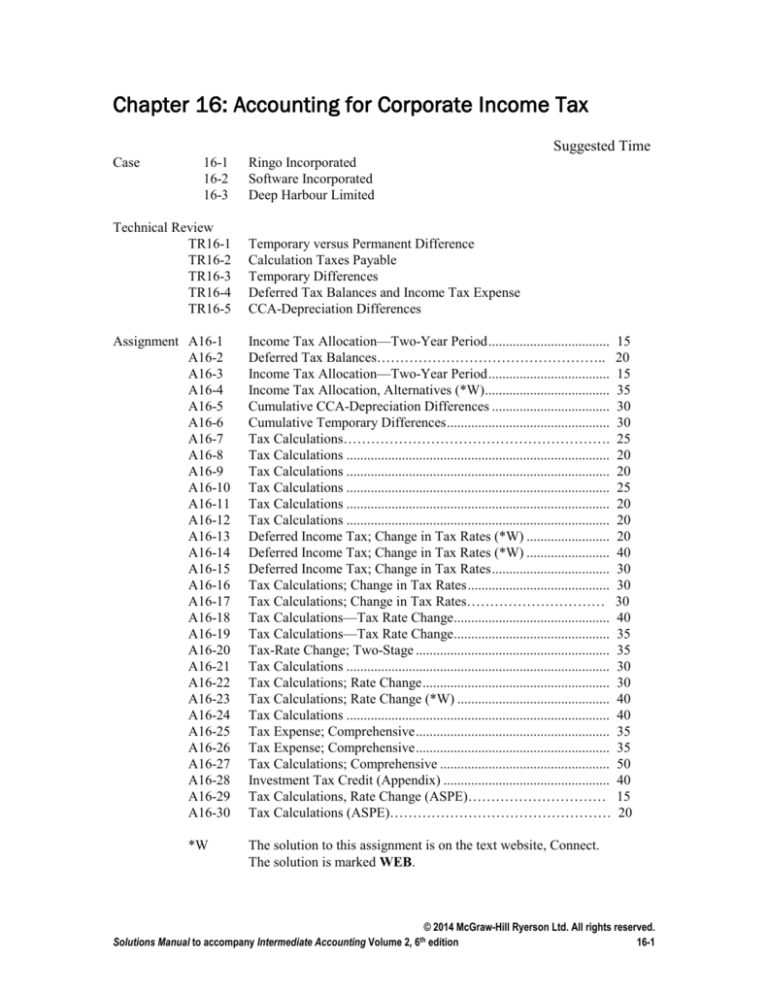

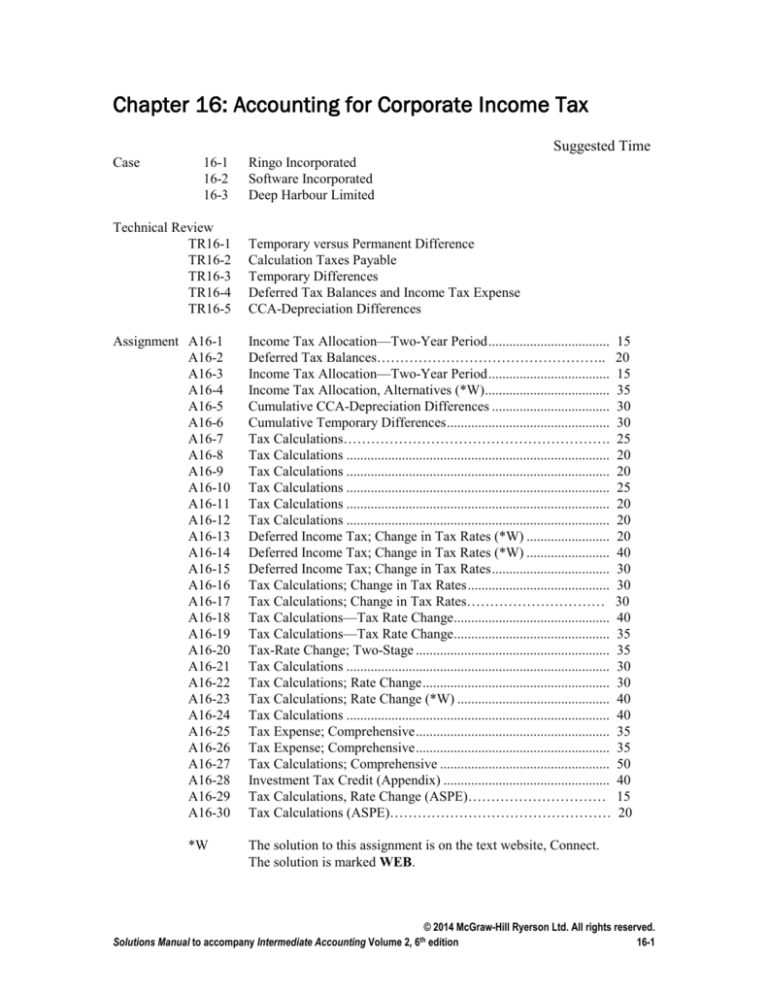

Chapter 16: Accounting for Corporate Income Tax

Suggested Time

Case

16-1

16-2

16-3

Ringo Incorporated

Software Incorporated

Deep Harbour Limited

Technical Review

TR16-1

TR16-2

TR16-3

TR16-4

TR16-5

Temporary versus Permanent Difference

Calculation Taxes Payable

Temporary Differences

Deferred Tax Balances and Income Tax Expense

CCA-Depreciation Differences

Assignment A16-1

A16-2

A16-3

A16-4

A16-5

A16-6

A16-7

A16-8

A16-9

A16-10

A16-11

A16-12

A16-13

A16-14

A16-15

A16-16

A16-17

A16-18

A16-19

A16-20

A16-21

A16-22

A16-23

A16-24

A16-25

A16-26

A16-27

A16-28

A16-29

A16-30

Income Tax Allocation—Two-Year Period ................................... 15

Deferred Tax Balances………………………………………….. 20

Income Tax Allocation—Two-Year Period ................................... 15

Income Tax Allocation, Alternatives (*W) .................................... 35

Cumulative CCA-Depreciation Differences .................................. 30

Cumulative Temporary Differences ............................................... 30

Tax Calculations…………………………………………………. 25

Tax Calculations ............................................................................ 20

Tax Calculations ............................................................................ 20

Tax Calculations ............................................................................ 25

Tax Calculations ............................................................................ 20

Tax Calculations ............................................................................ 20

Deferred Income Tax; Change in Tax Rates (*W) ........................ 20

Deferred Income Tax; Change in Tax Rates (*W) ........................ 40

Deferred Income Tax; Change in Tax Rates .................................. 30

Tax Calculations; Change in Tax Rates ......................................... 30

Tax Calculations; Change in Tax Rates………………………… 30

Tax Calculations—Tax Rate Change ............................................. 40

Tax Calculations—Tax Rate Change ............................................. 35

Tax-Rate Change; Two-Stage ........................................................ 35

Tax Calculations ............................................................................ 30

Tax Calculations; Rate Change ...................................................... 30

Tax Calculations; Rate Change (*W) ............................................ 40

Tax Calculations ............................................................................ 40

Tax Expense; Comprehensive ........................................................ 35

Tax Expense; Comprehensive ........................................................ 35

Tax Calculations; Comprehensive ................................................. 50

Investment Tax Credit (Appendix) ................................................ 40

Tax Calculations, Rate Change (ASPE)………………………… 15

Tax Calculations (ASPE)………………………………………… 20

*W

The solution to this assignment is on the text website, Connect.

The solution is marked WEB.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-1

Questions

1.

It is common for companies to label income tax expense as a provision to cover all

circumstances. When a company has a loss the entry for income tax may be a credit

rather than a debit. Rather than switch from expense to benefit they use the word

provision.

2.

Differences between accounting and taxable income can be:

a) Temporary differences—asset or liability where accounting and tax basis are

different. The differences are included in accounting income in one period and in

taxable income in another period (under tax law). Temporary differences reverse

in one or more subsequent periods; they require interperiod income tax

allocation.

b) Permanent differences—items which are reported on the income statement or tax

return but not on both. They do not reverse; they are not subject to income tax

allocation.

3

a) Straight-line versus accelerated amortization causes a temporary difference

because (1) the amounts in the financial statements will differ from those in the

tax return, and (2) the tax effect will reverse or turn around over the life of the

asset.

b) Golf club dues cause a permanent difference because (1) the expense is

recognized for accounting purposes but not for income tax purposes and (2) the

differences will not reverse or turn around in any subsequent period.

4.

A temporary difference is said to originate when the difference between accounting

and taxable income first arises, or if it is increasing in a given direction. A reversal

follows origination and causes the accumulated temporary difference to decrease.

5.

Examples of permanent differences: (see also Exhibit 16-1)

dividends received from taxable Canadian corporations

equity earnings of significantly–influenced investees

golf club dues.

Examples of temporary differences: (see also Exhibit 16-1)

depreciation vs. CCA

warranty expense vs. claims paid

sales revenue vs. cash collected (contracts where payment is delayed)

fair value gains/losses (i.e. derivatives mark-to-market)

foreign exchange mark-to-market

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-2

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

6.

The two alternatives that exist to deal with the extent of tax allocation (i.e., the extent

to which temporary differences are allowed to give rise to deferred income tax

balances and tax expense):

a) No allocation: Income tax expense equals tax payable or receivable and no

deferrals exist. This option is only allowed in ASPE not in IFRS.

b) Comprehensive or full allocation: All temporary differences cause deferred or

future income tax and affect tax expense.

7.

Discounting is considered inappropriate for deferred income tax liabilities because

both the discount rate and the timing of reversals are difficult to determine. This is

explicitly not allowed in the standards.

8.

20x4

Income tax payable .................. $60,0001

Income tax expense .................. 40,0001

1

($100,000 + $50,000) x .4

2

($500,000 – $50,000) x .4

20x5

20x6

$120,000 $180,0002

120,000 200,0002

Total

$360,000

360,000

Income tax expense and income tax payable are equal over time because the

temporary difference has reversed.

9.

Income tax expense ($80,000 + $20,000 – $15,000)………… 85,000

Deferred income tax asset (Given) ........................................... 15,000

Deferred income tax liability (Given) ..................................

Income tax payable ($200,000 x .40) ...................................

20,000

80,000

10. Balance in deferred income tax: $80,000 ($200,000 x .40)

11. The accounting carrying value of the gain at the end of year 1 is $1,000,000: the

receivable. The tax basis of the gain is zero, as nothing has been recognized for tax

purposes. The balance in deferred income tax would be $400,000 at the end of Years

1 and 2, (a credit), $350,000 at the end of Year 3, and zero at the end of Year 4.

12. The tax basis of the assets is $900,000 ($1,000,000 - $100,000). The accounting

carrying value of the assets is $800,000 ($1,000,000 - $200,000). This would result

in a deferred tax asset of $20,000 (($900,000 - $800,000) x .20.)

13. Statement of financial position items have a different accounting and tax basis when

their treatment is different for tax and accounting purposes. This is usually because

the timing of the related revenue or expense takes place in different periods for

accounting than for tax. One has to imagine a tax statement of financial position, and

compare book values for tax to the accounting statement of financial position.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-3

14. The tax basis and accounting carrying value of statement of financial position items

related to permanent differences are identical.

15. Deferred income taxes may be debits or credits on the statement of financial position.

They are debits if originating temporary differences cause,

a) Tax expense to be less than accounting expense.

b) Tax revenue to be more than accounting revenue.

They are credits if originating temporary differences cause,

a) Tax expense to be more than accounting expense.

b) Tax revenue to be less than accounting revenue.

A debit to a future income tax account may either increase or decrease the account,

depending on its nature (asset or liability/ deferred credit), as may a credit.

16. If the tax rate were to decrease when the liability method was used, the deferred

income tax account would decline, remeasured using the new tax rate.

17. Most of the differences between effective and statutory rates are explained by

permanent differences. Another factor is different tax rates in other jurisdictions

(other examples exist), when the business operates globally.

18. An investment tax credit is a reduction in tax payable that a corporation is given

because of a qualifying expenditure of some type.

19. a) The flow-through approach, where the reduction to income tax payable directly

reduces the tax expense and thus income for the year increases.

b) The cost-reduction approach, where the ITC is deducted from the expenditure

that qualified for the ITC. Since the ITC relates to a capital asset, the ITC will

end up amortized to income over a period of years.

20. An ITC that relates to a capital asset can be shown on the statement of financial

position, to the extent it has yet to be depreciated, as,

a) A deduction from the related asset, or

b) A separate deferred credit.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-4

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Cases

Case 16-1 Ringo Incorporated

Overview:

The purpose of this case is to understand the future tax implications related to capital

assets. The student is required to calculate the accounting book value, the tax value and

as a result the temporary difference and the future tax amount. Further, the student is

required to understand the accounting implications of a change in accounting policy and

how a change in accounting policy regarding the treatment of depreciation on capital

assets impacts the future tax accounts.

Issues:

1. Future taxes

2. Capital cost allowance/amortization calculations

3. Change in accounting policy

Analysis and Conclusions:

As the bank requires that the capital assets be accounted for using the future taxes

method, this would qualify as a change in accounting policy. ASPE Handbook section

1506.09(f) states that an entity can change from the taxes payable method, to the future

tax method, without meeting the general conditions required for a change in accounting

policy found in 1506.06. It is not required to show how the change results in more

relevant and reliable information for the users. As such this change qualifies, as a change

in accounting policy and 1506.10 requires that the change be accounting for

retrospectively.

As ASPE requires that comparative financial statements be presented, paragraph 1506.13

states that all changes be adjusted on the balance sheet of each component of equity

affected (in this case retained earnings). As a result, the accounting policy change would

first be reflected the December 31st, 20x12 comparative financial statements. The

calculations related to this change can be found in Exhibit II. In order to determine what

the future income tax asset or liability would be on the opening balance sheet, a detailed

calculation of depreciation was prepared and a detailed calculation of capital cost

allowance was prepared. As a result of the change in accounting policy from the taxes

payable method, to the future taxes method a future income tax liability would be

recorded for $145,070. The January 1st, 20x12 opening retained earnings balance will

decrease by $133,130 and the closing retained earnings will decrease by $145,070. A

future income tax expense of $11,940 will be recorded on the 20x12 financial statements.

Exhibit I shows a summary of changes to the financial statements.

As a result of the changes described above, the January 1st, 20x13 retained earnings will

also be decreased by $145,070. The December 31st, 20x13 future income tax liability

would be $193,527 (2012 - $145,070), which would result in a future income tax expense

of $48,457.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-5

The old capital assets were re-evaluated during 20x13 and several incurred changes to the

residual value and/or useful life. These changes qualify as a change in estimate, and are

dealt with prospectively under 1506.23. These changes would affect the net book value

of the assets and therefore were considered in the calculations of future income tax

amounts. In order to calculate the depreciation for 20x13, the book value on January 1st,

20x13 served as the new depreciation base prospectively. The new useful life and

or/residual value were then applied to calculate the new depreciation. The new

calculations for depreciation are found in exhibit II.

The new capital assets were added in to the book value and un-depreciated capital cost

calculations in order to determine the appropriate future income tax amount to record.

Exhibit I – Summary of changes on the financial statements

Schedule of Impact on Financial Statements

Balance Sheet 20x12

Future Income Tax Liability

Retained Earnings (Opening)

Retained Earnings Closing

145,070.39

(133,130.15)

(145,070.39)

Income Statement 20x12

Future Income Tax Expense

11,940.23

Balance Sheet 20x13

Future Income Tax Liability

193,527.41

Income Statement 20x13

Future Income Tax Expense

48,457.02

Exhibit II – Future Tax Calculations

Book Value Calculations:

Item

Purchase

Price

498,645

20x9

Depreciatio

n*

41,487.69

20x10

Depreciatio

n

47,414.50

20x11

Depreciatio

n

47,414.50

Total

Depreciatio

n

136,316.69

December

31, 20x11

Book Value

362,328.31

20x12

Depreciatio

n

47,414.50

December

31, 20x12

Book Value

314,913.81

20x13

Depreciatio

n

39,364.23

December

31, 20x13

Book Value

275,549.59

Manufacturi

ng Machine

#1

Manufacturi

ng Machine

#2

Manufacturi

ng Machine

#3

Office

Furniture

Lap Top

368,950

31,561.25

36,070.00

15,300.00

103,701.25

265,248.75

36,070.00

229,178.75

18,910.73

210,268.02

156,000

2,550.00

15,300.00

15,300.00

33,150.00

122,850.00

15,300.00

107,550.00

9,955.00

97,595.00

17,800

1,557.50

1,780.00

1,780.00

5,117.50

12,682.50

1,780.00

10,902.50

1,090.25

9,812.25

10,560

1,540.00

1,760.00

1,760.00

5,060.00

5,500.00

1,760.00

3,740.00

935.00

2,805.00

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-6

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Computers

Building

Manufacturi

ng Machine

#4

Manufacturi

ng Machine

#5

Manufacturi

ng Machine

#6

Total

797,000

562,350

23,245.83

26,566.67

26,566.67

76,379.17

720,620.83

694,054.17

-

15,423.43

37,261.15

678,630.74

525,088.85

678,900

-

58,918.13

619,981.88

110,000

-

18,497.50

91,502.50

128,891

1,360,339

200,355

2,511,234

20x12 CCA

20x13 CCA

62,305.69

December

31, 20x12

Book Value

145,379.95

43613.9849

December

31, 20x13

Book Value

101,765.96

3,200,205

101,942

128,891

128,891

359,725

1,489,230

*Only considers 10.5 months (with the exception of Machine #3 – only considers 2 months)

26,566.67

Tax Value Calculations:

Item

Purchase

Price

20x9 CCA*

20x10 CCA

20x11 CCA

Total CCA

Manufacturi

ng Machine

#1

Manufacturi

ng Machine

#2

Manufacturi

ng Machine

#3

Office

Furniture

Lap Top

Computers

Building

Manufacturi

ng Machine

#4

Manufacturi

ng Machine

#5

Manufacturi

ng Machine

#6

Total

498,645

74,796.75

127,154.48

89,008.13

290,959.36

December

31, 20x11

Book Value

207,685.64

368,950

55,342.50

94,082.25

65,857.58

215,282.33

153,667.68

46,100.30

107,567.37

32270.2118

75,297.16

156,000

23,400.00

39,780.00

27,846.00

91,026.00

64,974.00

19,492.20

45,481.80

13644.54

31,837.26

17,800

1,780.00

3,204.00

2,563.20

7,547.20

10,252.80

2,050.56

8,202.24

1640.448

6,561.79

10,560

10,560.00

-

-

10,560.00

-

-

-

0

-

797,000

562,350

15,940.00

31,242.40

29,992.70

77,175.10

719,824.90

28,793.00

691,031.90

27641.276

84,352.50

663,390.62

477,997.50

678,900

101,835.00

577,065.00

110,000

16,500.00

93,500.00

321,498

2,027,415.3

0

3,200,205

181,819

295,463

215,268

692,550

1,156,405

158,742

997,663

*Considers the half year rule (with the exception of Lap Top computers where the half year rule does not apply)

CCA Rates

Class 1,

4%,

Building

Class 8,

20%,

Furniture

Class 43,

30%

Manufacturi

ng

Equipment

Lap Top

Computers,

100%, No

half year

rule

Future Tax Calculations:

Calculated of

Future Tax

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-7

Amounts

Item

Manufacturin

g Machine #1

Manufacturin

g Machine #2

Manufacturin

g Machine #3

Office

Furniture

Lap Top

Computers

Building

Manufacturin

g Machine #4

Manufacturin

g Machine #5

Manufacturin

g Machine #6

Total

December

31, 20x11

Book Value

362,328.31

December

31, 20x11

Tax Value

207,685.64

Temporary

Difference

Tax

Rate

December

31, 20x12

Book Value

314,913.81

December

31, 20x12

Tax Value

145,379.95

Temporary

Difference

Tax

Rate

0.4

FTA/L

Amount

20x11

61,857.07

154.642.67

265,248.75

153,667.68

122,850.00

December

31, 20x13

Book Value

275,549.59

December

31, 20x13

Tax Value

101,765.96

Temporary

Difference

Tax

Rate

0.4

FTA/L

Amount

20x12

67,813.55

173,783.62

0.4

FTA/L

Amou

20x14

69,51

169,533.86

111,581.08

0.4

44,632.43

229,178.75

107,567.37

121,611.38

0.4

48,644.55

210,268.02

75,297.16

134,970.86

0.4

53,98

64,974.00

57,876.00

0.4

23,150.40

107,550.00

45,481.80

62,068.20

0.4

24,827.28

97,595.00

31,837.26

65,757.74

0.4

26,30

12,682.50

10,252.80

2,429.70

0.4

971.88

10,902.50

8,202.24

2,700.26

0.4

1,080.10

9,812.25

6,561.79

3,250.46

0.4

1,300

5,500.00

-

5,500.00

0.4

2,200.00

3,740.00

-

3,740.00

0.4

1,496.00

2,805.00

-

2,805.00

0.4

1,122

720,620.83

719,824.90

795.94

0.4

318.37

694,054.17

691,031.90

3,022.27

0.4

1,208.91

678,630.74

525,088.85

663,390.62

477,997.50

15,240.12

47,091.35

0.4

0.4

6,096

18,83

619,

981.88

91,502.50

577,065.00

42,916.88

0.4

17,16

93,500.00

(1,997.50)

0.4

(799.0

133,130.1

5

145,070.3

9

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-8

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Case 16-2 Software Incorporated

Overview

This case involves a private company that is contemplating going public. They currently

are using accounting standards for private enterprises and if they go public would need to

switch to international accounting standards. This case includes a large number of issues.

SI has a bank loan with a covenant that requires a minimum current ratio. They have a

strong motivation to maintain this ratio. It is critical that recommendations are ethical and

not just made to meet this ratio. With taxable losses in the current year income

minimization is not a current objective.

Issues

1. Revenue recognition

2. Warranty

3. Accounting for income tax

4. Forward contract and shares

5. Asset retirement obligation

6. Convertible bonds

7. Stock options

Analysis and Conclusions

1. Revenue recognition

The earliest revenue can be recognized is when there is performance. The fee paid by the

customer includes the software and installation, monitoring and maintenance. This would

be considered a multiple deliverable. The fee would need to be split between the amount

related to the product software compared to the amount related to the services of

monitoring and maintenance.

Performance for the software and installation would be when it is delivered to the

customer and installed. There is still a risk related to payment since the fee is due 30 days

after installation. There is also a risk related to the warranty. For the portion of the fee

related to the software one alternative is to recognize revenue when the software is

installed and estimate bad debt and warranty expense. Since SI has been in business since

the 1990’s they have historical evidence on which to make estimates. A second

alternative is to recognize the revenue when the cash is received in 30 days. A third

alternative would be to delay revenue recognition until the warranty expires. I recommend

for the portion of the fee related to the software revenue be recognized when the software

is installed since this is when performance has occurred. There is historical evidence to be

able to estimate bad debt expense and warranty costs.

Performance for the service portion of the fee is over time as the service is provided over

three to five years. Assuming the service would be provided on an even basis revenue

should be recognized on a straight-line basis over the service period.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-9

If SI goes public the accounting for this issue would be similar.

2. Warranty

As mentioned above the warranty relates to the sale of the product. A warranty expense

and estimated warranty liability should be recognized when revenue for the software is

recognized. The liability decreases the current ratio, which is undesirable but necessary.

The estimated warranty liability for 20x9 is $12 million (8+5-1). This creates a temporary

difference. Since SI uses the taxes payable method of accounting for income taxes SI will

not recognize any deferred tax assets or liabilities. If SI goes public the liability method

would be required. The temporary difference for SI would then be recognized as a

deferred tax asset if it is probable SI will generate taxable income.

Factors to support that it is probable is theit history of earnings historically and they have

a new product that they are bringing to market with anticipated significant sales. Factors

that support it may not be probable are the large loss this year. I conclude that it would be

probable and the deferred tax asset would be recognized.

3. Accounting for income tax

SI is currently a private company and has elected to use the taxes payable method which

is an option in accounting standards for private enterprises. This option will no longer be

allowed if SI makes the decision to go public. They will be required to adopt the liability

method that will recognize deferred tax assets and liabilities.

SI has an anticipated taxable loss of $10 million in 20x9. They will carryback the loss for

the last three years and recognize an income tax receivable. The amount that they will

carryback will be $2 million in 20x6, $5 million in 20x7 and $1 million in 20x8. They

will recover the taxes they actually paid in those years which would be $2 million x

38%=$760,000; $5 million x 39%=$1,950,000; and $1 million x 40%=$400,000 for a

total of $3,110,000. There remains a taxable loss of $2 million which will be carried

forward and applied against future income taxes. If SI goes public this loss would then be

recognized as a deferred tax asset if it is probable SI will generate taxable income. The

factors to support if it is probable or not are the same as discussed above for the warranty.

4. Forward contract and shares

The forward contract is a derivative. SI will need to decide if they want to elect hedge

accounting or not. Since they often enter into hedging relationships it may be beneficial.

If SI does not elect hedge accounting the forward contract would be measured at fair

value every reporting date. The changes in value would impact net income. If they did

elect hedge accounting it would need to be determined if it was a critical match of key

terms. If yes there would be no impact on the financial statements until the hedge was

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-10

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

terminated. If SI went public and did not elect hedge accounting the derivative would be

classified in fair value through profit or loss. The forward contract would still be

measured at fair value every reporting date and the changes would impact net income. If

they elected hedge accounting this would be a cash flow hedge and it would be recorded

in OCI.

The shares would be a non-strategic investment. It must be determined if these shares are

quoted in an active market. If they are which is likely since they are a portfolio of

investments then the shares would be measured at fair value every reporting date and the

changes in value would impact net income. If the shares are for companies not traded in

an active market then they would be measured at cost or they could elect to use fair value.

If SI went public the shares would be recorded either in fair value through profit or loss or

in fair value through OCI. I am assuming that SI will decide to early adopt IFRS 9. In

both situations they would be recorded at fair value every reporting date. In fair value

through profit and loss the changes would impact net income. Or if in fair value through

OCI the changes would impact other comprehensive income. Since these investments are

traded on an active basis it is likely they would meet the criteria for held for trading and

be recorded in fair value through profit and loss.

5. Asset retirement obligation

The satellite towers would be recorded as an item of property, plant and equipment. The

regulatory obligation to dismantle the towers would be an asset retirement obligation.

This would be measured at the present value of $2.5 million using an appropriate

discount rate. The incremental borrowing rate of 10% would provide an asset retirement

obligation of $2.5 (10%,20 years)(.14864)=$371,600. The satellite towers would be

recorded at $15,371,600 and depreciated over 20 years. At the end of the first year

depreciation expense would be $768,580. The asset retirement obligation would be

recorded at $371,600 and accretion expense of $37,160 would be recognized at the end of

the year. If SI goes public the accounting for this issue would be similar. The asset

retirement obligation would be classified as a long term liability and would have no

impact on the current ratio.

6. Convertible bonds

The convertible bond is a hybrid instrument. In accounting standards for private

enterprises SI can assign a zero amount to the equity component. The convertible bond

would all be measured as debt. Or they could determine the fair value of the bond

assuming this is the most measurable component and record that as debt since the

company has to make the interest and principal payments. The remaining value would go

to the conversion rights since this amount never has to be paid back. The current portion

of the debt would have a negative impact on the current ratio. If SI went public in

international standards they would need to record the conversion rights at fair value using

the incremental method. The debt portion would be recorded at fair value and any

remaining amount would be allocated to the conversion rights.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-11

The fair value of the bond is using the incremental borrowing rate of 10%. Since semiannual payments use 20 payments and 5%:

15,000,000 (.37689) = 5,653,350

600,000 (12,46221) = 7,477,326

13,130,676

The bond would be recorded as follows:

Cash

14,800,000

Discount 1,869,324

Bond

15,000,000

Conversion Rights 1,669,324

7. Stock options

Stock option expense needs to be recorded using a fair value model. The Black Scholes

method would be considered an appropriate model. A decrease in the expected life of the

options would decrease the stock option expense since the time period in which to

exercise the options is less. A decrease in the stock price volatility would also decrease

stock option expense since it is likely the shares would be at a favourable price. A

decrease in the risk free interest rate will decrease stock option expense.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-12

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Case 16-3 Deep Harbour Limited

Assessment

Deep Harbour Limited (DHL) is a plastic molding company with a profitable past and a

strong equity position ($5.7 million on total assets of $17.4 million; 33%). They have

new CBC (bank) financing of $7 million this year, incurred to finance manufacturing

equipment. As a result, they must adopt the tax allocation accounting method for

corporate income tax and meet several ratio requirements. It is unclear if DHL is using

accounting standards for private enterprise or international accounting standards. This

must be clarified with the bank. I am assuming the bank requires international accounting

policies. An equally valid assumption is that the bank would allow accounting standards

for private enterprises to be used and the bank would specify which accounting policy

must be applied where there is a choice as there is in income taxes. The current ratio is

1.08 in the draft financial statements and must be at least 1. The total-debt-to-equity ratio

is 2.06 and must be less than 4. The current ratio is a concern, as DHL has no cash and

an operating line of credit.

Issues

1.

2.

3.

4.

5.

6.

Interest capitalization

Investment tax credit

Warranty

Depreciation method

Accounting for income tax

Current liquidity

Analysis and Conclusions

Before income tax accounting can be applied, accounting policies must be evaluated and

changed in other areas to provide a “clean” starting point.

1.

Interest capitalization

DHL has capitalized interest on the new machinery for the period during which it

was being installed. Interest is capitalized for qualifying assets that take a

substantial amount of time for completion. Otherwise, interest is an operating

cost, and is expensed as a period cost. The installation period was only a short

period of time therefore would not meet the criteria of a qualifying asset. It is

hard to see how this asset has enhanced future cash flow because of delays in

installation. Therefore, $35,000 of interest has been expensed. Amortization of

$3,500 on the capitalized amount has been eliminated.

On the financial statements, this reduces the value of capital assets (see Exhibit 1)

and reduces accounting income (Exhibit 2). Reconciliation items in the

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-13

calculation of taxable income change (Exhibit 3), but changes do not affect the

total taxable income.

2.

Investment tax credit

The investment tax credit (ITC) is assumed to be correctly calculated, at $1,200.

On the revised statement of financial position (Exhibit 2), the $1,200 receivable

has been offset to income tax otherwise payable (see tax entries, Exhibit 5).

As an offset to the cost of capital assets, the ITC may be credited directly to capital

assets or shown as a deferred credit. DHL has chosen the latter, which is

acceptable. However, to eliminate the deferred credit, which would be a liability in

the debt-to-equity ratio, the ITC has been netted with capital assets in Exhibit 1.

Furthermore, the ITC must be amortized over the same term as the capital assets

to which it relates; that is, ten years, not four. This means that 20X8 amortization

must be $120, not $300. The adjustment is $180 and the balance is $1,020.

On the financial statements, this decreases capital assets (Exhibit 1) and reduces

accounting income (Exhibit 2). It changes the starting point and reconciliation

items of taxable income, but not the total taxable income (Exhibit 3).

3.

Warranty

Accounting policies recognize a warranty liability when it is probable and

estimable. This allows the financial statements to report the financial position of

the company with greater integrity, and also promotes matching on the income

statement. These policies are appropriate and likely required to satisfy the

primary financial statement user, CBC. The liability decreases the current ratio,

which is undesirable but necessary.

Since a range has been given, the low value is recorded at $60,000. This reflects

concern that the current ratio remains over 1. Exhibit 1 reflects this liability as a

current liability. Accrual has decreased net income this year (Exhibit 2).

Retrospective application is not possible, as experience was not available at the

beginning of the year. Taxable income starts with the revised net income, but

now must be adjusted for the temporary difference. Again, the end result is no

change to taxable income.

4.

Depreciation method

DHL should consider its depreciation policies. Capital assets are material, and

thus depreciation will impact current earnings and net assets in significant terms.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-14

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Existing policies are acceptable and have not been changed. However, DHL

should consider their policy for:

(i)

Partial year amortization

A full year of depreciation is charged for assets purchased halfway through

the year. DHL has recorded $820,000 of depreciation on assets used only

for April to November (nine months). Half-year or exact proration could

be considered.

(ii)

Components

DHL must determine if any machinery have significant components. If

there are then each component should be depreciated separately. Without

further information we will assume there are no significant components.

(iii)

Estimates of useful life

DHL should carefully review estimates of useful life on an annual basis.

Longer lives would lower depreciation and increase net assets; shorter

lives would have the opposite effect.

5.

Accounting for income tax

Using the liability method, deferred income tax is established in all cases where

the tax basis of assets is different than the accounting basis. DHL has three such

differences:

(i)

Inventory

The write-down to LCM is recorded for accounting purposes, but not for

tax. It is tax-deductible only when the inventory is sold. The accounting

carrying value, after write-down, is $513, but the tax basis is $40 higher, at

$553. This creates a deferred tax asset of $16.8. (See Exhibit 4.)

(ii)

Capital assets

Accounting carrying value is $11,738.5, after the capitalized interest and

ITC are removed (see Exhibit 1) . The tax basis, after the ITC, is given at

$9,100. More CCA has been charged to date than depreciation, creating a

deferred tax liability of $1,108.2 (see Exhibit 4).

(iii)

Warranty

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-15

The warranty liability is $60,000 on the revised statement of financial

position, but the tax basis is zero as the warranty expense is not claimed

for tax purposes until cash is paid. This creates a deferred tax asset of

$25.2 (see Exhibit 4).

The deferred tax liability caused by the capital assets is a long-term liability. The

deferred tax assets caused by current inventory and warranty are both long-term

assets, classified as one element in Exhibit 1.

To adjust DHL’s financial statements to the liability method, deferred income tax

amounts are combined with income tax payable to record the expense. Note that

some of this expense would impact prior years, but this breakdown has not been

requested by DHL at this time. The entry to record tax is shown in Exhibit 5, and

the deferred income tax amounts are reflected on the statement of financial

position in Exhibit 1. Note that taxable income (Exhibit 3) did not change as a

result of adjustments.

The adjustments in Exhibit 5 also show application of the ITC to the current year

payable, and consideration of the $120 of current year installment payments. A

refund of $84 can be claimed because installment payments were too high.

Note the large decrease to shareholders’ equity caused by:

6.

(i)

The current tax on 20X8 income, not recorded in the draft financial

statements.

(ii)

The large net deferred income tax liabilities, now recorded.

Current liquidity

Revised financial statements show a current ratio of .99 or close to one and a debtto-equity ratio of 3.84. The covenant for the current ratio is just below the

allowable limit of 1 and the debt to equity ratio is met, but not with any margin for

comfort. DHL would be well advised to review its current position. Accounts

receivable are high, as are accounts payable. Both should be reduced, beginning

with collections from customers, to provide some liquidity. DHL could also

consider increasing long-term debt, using capital assets as collateral, to improve

the current position. If the bank allows accounting standards for private

enterprises the current ratio would not be violated since the deferred tax asset

would be classified as a current asset not long-term.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-16

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

EXHIBIT 1

DHL—REVISED STATEMENT OF FINANCIAL POSITION

as of 30 November 20X8

(in thousands)

Assets

Current

Accounts receivable .....................................................................

Inventory, at lower of cost or market ...........................................

Prepaid expenses ($219 – $120) ..................................................

Investment tax credit receivable ($1,200 – $1,200) .....................

Income tax refund receivable ($84) .............................................

$ 2,690.0

513.0

99.0

0.0

84.0

3,386.0

42.0

11,738.5

$15,166.5

Deferred income tax ($16.8 + $25.2) .......................................................

Capital assets, net of depreciation ($12,850 – $35 + $3.5) – $1,080)......

Liabilities

Current liabilities:

Bank operating line of credit .......................................................

Accounts payable and accrued liabilities .....................................

Deferred ITC ($900 – $900) ........................................................

Warranty payable ($60) ................................................................

$

295.0

3,071.0

0.0

60.0

3,426.0

7,500.0

1,108.2

12,034.2

3,132.3

$15,166.5

Long-term debt ...................................................................................

Deferred income tax ($1,108.2) ...............................................................

Total liabilities ........................................................................................

Shareholders’ equity ($5,706 – $271.5 (Exhibit 2) – $2,302.2) ..............

EXHIBIT 2

DHL—REVISED ACCOUNTING INCOME

(in thousands)

Accounting income, as previously reported ................................

Less: Additional interest expense ............................................

Amortization eliminated .................................................

ITC amortization change .................................................

Warranty accrual .............................................................

Revised net income ....................................................................

$ 2,252.0

(35.0)

3.5

(31.5)

(180.0)

(60.0)

$ 1,980.5

Net income has been reduced by $271.5 ($1,980.5 – $2,252)

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-17

EXHIBIT 3

DHL - REVISED TAXABLE INCOME

Accounting income (Exhibit 2) ..........................................................

Depreciation ($1,306 – $3.5) .................................................

Capital cost allowance ...........................................................

Inventory write-down to LCM ...............................................

Interest capitalized ($35 – $35) (1) ........................................

Non-deductible entertainment and marketing expenses ........

Amortization of deferred investment tax credit .....................

Warranty accrual ....................................................................

Taxable income unchanged ................................................................

Income tax payable (@42%) ..............................................................

(1) Allowable tax expense now on the income statement.

$ 1,980.5

1,302.5

(404.0)

40.0

0.0

84.0

(120.0)

60.0

$ 2,943.0

$ 1,236.0

EXHIBIT 4

DHL - DEFERRED INCOME TAX BALANCES

(in thousands)

Tax

Basis

Inventory

Capital

Assets

Warranty

1

2

553 1

9,100

0

Accounting

Basis

513

11,738.5 2

(60)

Diff.

Deferred

Income

Tax @ .42

40

16.8

(2,638.5)

(1,108.2)

60

25.2

Opening

Balance

Adjustment

0

0

16.8

(1,108.2)

0

25.2

$513 + $40

See Exhibit 1

EXHIBIT 5

DHL—INCOME TAX ENTRIES, 20X8

Deferred income tax – inventory............................................

Deferred income tax – warranty ............................................

Retained earnings ...................................................................

Deferred income tax – capital assets ................................

Income tax payable (Exhibit 3) ........................................

16.8

25.2

2,302.2

Income tax payable ................................................................

Investment tax credit receivable ......................................

1,200

Income tax receivable ...........................................................

Income tax payable ................................................................

Prepaid expenses ..............................................................

84

36

1,108.2

1,236.0

1,200

120

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-18

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Technical Review

Technical Review 16-1

Requirement 1

Golf club dues – add back $20,000 since expense on income statement but not allowed

deduction for income taxes.

Depreciation expense – add back $60,000 since expense on income statement but not

allowed deduction for income taxes.

Development costs – deduct $100,000 since capitalized. The costs incurred this year are

deductible for income taxes.

Warranty costs accrued – add back accrued costs 30,000 since expense on income

statement but not allowed deduction for income taxes.

Interest and penalty – add back $25,000 since expense on income statement but not

allowed deduction for income taxes.

CCA – subtract $180,000 since this amount is an allowable tax deduction and has not

been included on income statement.

Amortization development costs – add back $10,000 since expense on income statement

but not allowed deduction for income taxes.

Costs incurred warranty – subtract $22,000 since costs incurred for warranty work this

year are deductible for income taxes.

Requirement 2

Golf club dues – permanent difference

Depreciation expense – temporary difference

Development costs – temporary difference

Warranty costs accrued – temporary difference

Interest and penalty – permanent difference

CCA – temporary difference

Amortization development costs – temporary difference

Costs incurred warranty – temporary difference

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-19

Technical Review 16-2

Requirement 1

Net income ...................................................................2,200,000

Add: Golf club dues ..........................................................20,000

Depreciation expense ...............................................60,000

Accrued warranty costs ...........................................30,000

Interest and penalties ................................................25,000

Amortization ............................................................10,000

Subtract: CCA .................................................................180,000

Costs incurred development ............................100,000

Costs incurred warranty ....................................22,000

Taxable income ............................................................2,043,000

Requirement 2

Income tax payable 2,043,000 x 40% = $817,200.

Technical Review 16-3

a.

b.

c.

d.

e.

f.

credit

debit

credit

credit

debit

debit

Technical Review 16-4

Requirement 1

Depreciation vs. CCA - $120,000 x 40% = $48,000 deferred tax liability

Warranty costs - $8,000 x 40% = $3,200 deferred tax asset

Development costs - $90,000 x 40% = $36,000 deferred tax liability

Requirement 2

Income tax expense

898,000

Deferred tax asset

3,200

Deferred tax liability

Deferred tax liability

Income tax payable

48,000

36,000

817,200

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-20

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Technical Review 16-5

Tax basis

Accounting basis

Temporary difference

Deferred income tax expense

Deferred income tax balance

20X6

$1,080,000

$960,000

$120,000

$40,800 cr.

$40,800 dr.

20X7

$864,000

$720,000

$144,000

$8,160 cr.

$48,960 dr.

20X8

$689,000

$480,000

$209,000

$22,100 cr.

$71,060 dr.

Assignments

Assignment 16-1

Requirement 1

Tax expense:

20x8

20x9

$ 182,400

456,000

$ 638,400

($480,000 × .38)

($1,200,000 × .38)

This measurement of tax expense is potentially misleading because of its poor correlation

with accounting income. The implied tax rate is 22.8% ($182,400/$800,000) in 20x8 and

51.8% ($456,000/$880,000) in 20x9.

Requirement 2

Tax expense:

20x8

20x9

$ 304,000

334,400

$ 638,400

Deferred income tax:

($800,000 × .38)

($880,000 × .38)

$121,600 cr. increase; $121,600 cr. balance

$121,600 debit decrease; $0 balance

Total expense is the same because the $304,000 temporary difference between accounting

and taxable income has reversed over the two-year time frame.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-21

Assignment 16-2

Development Costs

Tax basis

Accounting basis

Temporary difference

Deferred income tax balance

Asset or Liability

20X6

$

0

$90,000

$(90,000)

$36,000

Liability

20X7

$

0

$172,000

$(172,000)

$65,360

Liability

20X6

20X7

$

0

$ 5,000

$ 5,000

$ 2,000

Asset

$

0

$ 10,000

$ 10,000

$ 3,800

Asset

20X8

0

$254,000

$(254,000)

$96,520

Liability

20X9

$

0

$254,000

$(254,000)

$91,440

Liability

20X8

20X9

$

Warranty Costs

Tax basis

Accounting basis

Temporary difference

Deferred income tax balance

Asset or Liability

$

$

$

$

0

5,000

5,000

1,900

Asset

$

0

$ 30,000

$ 30,000

$ 10,800

Asset

Assignment 16-3

20X8

20X9

$600,000

20,000

620,000

248,000

372,000

–

$500,000

–

500,000

200,000

300,000

26,400

$372,000

$326,400

20x5

$124,000

(92,000)

(10,000)

22,000

20x6

$144,000

(95,000)

(10,000)

39,000

20x7

$164,000

(128,000)

(10,000)

26,000

10,000

(12,000)

(2,000)

$ 20,000

10,000

(8,000)

2,000

$ 41,000

10,000

(4,000)

6,000

$ 32,000

Income from continuing operations, before unusual item,

discontinued operation, and income tax

Gain on sale of capital assets

Income before income tax

Income tax expense

Income from continuing operations

Gain from discontinued operations—net of $17,600 income

tax

Net income

Assignment 16-4 (WEB)

20x4

Revenues ...................................... $110,000

Expenses ...................................... (80,000)

Depreciation, straight line ............ (10,000)

Pretax accounting income (given)

20,000

Temporary differences for depreciation:

Add accounting depreciation

expense.................................

10,000

Less capital cost allowance .... (16,000)

Net temporary difference .............

(6,000)

Taxable income ............................ $ 14,000

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-22

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Computation of income tax payable:

Taxable income ............................ $ 14,000

Income tax rate .............................

× .40

Income tax payable ...................... $ 5,600

Deferred income tax, balance sheet

Net temporary differences (see req 1) (6,000)

Tax rate ...........................................

.40

Change in period ............................. (2,400)

Cumulative balance in DIT ......... (2,400) cr.

$ 20,000

× .40

$ 8,000

(2,000)

.40

(800)

(3,200) cr.

$ 41,000

× .40

$ 16,400

2,000

.40

800

(2,400) cr.

$ 32,000

× .40

$ 12,800

6,000

.40

2,400

____0

A table can also be used for calculations:

Tax Carrying

Temp Deferred Op. Bal. Adjustment

(in 000's) Basis

Value

Diff

Tax

20x4 40%

Cap.Assets

$ 24

$ 30

$(6) $ (2.4)

0

$ (2.4)

20x5 40%

Cap.Assets

12

20

(8)

(3.2)

(2.4)

(.8)

20x6 40%

Cap.Assets

4

10

(6)

(2.4)

(3.2)

.8

20x7 40%

Cap.Assets

0

0

0

0

(2.4)

2.4

Income tax expense, liability method of tax allocation:

20x4

20x5

Income tax expense:

Income tax payable ......................

$5,600

$8,000

Temporary differences .................

2,400

800

$8,000

$8,800

20x6

20x7

$16,400

(800)

$15,600

$12,800

(2,400)

$10,400

Net income, liability method of tax allocation

20x4

Pre-tax .......................................... $20,000

Income tax expense ......................

8,000

$12,000

20x6

$39,000

15,600

$23,400

20x7

$26,000

10,400

$15,600

20x5

$22,000

8,800

$13,200

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-23

Assignment 16-5

Requirements 1 and 2

The depreciation pattern for each asset is as follows:

Year

1

2

3

Book

1/3

1/3

1/3

Tax

1/2

1/3

1/6

For the asset acquired in 20X5, the book-tax depreciation and DIT balance is:

Year

Book

depreciation

Tax

CCA

20X5

20X6

20X7

$60,000

60,000

60,000

$90,000

60,000

30,000

TD

originating

(reversing)

$30,000

0

(30,000)

Accumulated

TD balance

DIT liab.

@40%

$30,000

30,000

0

$12,000

12,000

0

The cost of new equipment goes up to $192,000 in 20X6 and $198,000 in 20X7.

Therefore, the amount of the TD will rise proportionately for each year’s additional

acquisition. The lapsing schedule for the temporary differences will appear as follows:

Year of asset acquisition

20X5

20X6

20X7

Requirement 1: TDs, end of year

Requirement 2: DIT liability @ 40%

Cumulative balances

20X5

20X6

20X7

$30,000

$30,000

0

32,000

$32,000

33,000

$30,000

$62,000

$65,000

$ 12,000

$ 24,800

$ 26,000

Requirement 3

If McQuinn maintains the 20X7 level of investment in equipment (in dollar terms), the

temporary differences will never reverse and therefore the DIT liability will not be drawn

down it will just continue to increase.

Requirement 4

In order for the accumulated timing difference to fall, the monetary investment in these

assets must decline. This can happen either because (1) prices are falling, permitting

maintenance of productive capacity with a lower monetary investment, or (2) McQuinn

ceases to replace assets.

Requirement 5

A reversal will cause a cash outflow (through higher taxes) only if the company has

taxable income during the period during which the reversals occur.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-24

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Assignment 16-6

Requirements 1 and 3

Requirement 3

31 December 20X8:

Equipment

Development costs

Total

31 December 20X9:

Equipment

Development costs

Total

Requirement 1

Temporary

difference

Accounting basis

Tax basis

$2,400,000

600,000

$3,000,000

$1,100,000

0

$1,100,000

$1,300,000

600,000

$1,900,000

Accounting basis

Tax basis

Temporary

difference

$1,470,000††

0

$1,470,000

$ 945,000

500,000

$1,445,000

$2,415,000†

500,000

$2,915,000

† Asset balance, Y/E 20X9 ($4,000,000 + $600,000 – $250,000)

$4,350,000

Accumulated depreciation:

Beginning balance ($4,000,000 × 40%)

$1,600,000

Less depreciation on retired equipment ($250,000 × 40%) (100,000)

20X9 depreciation

($4,000,000 + $600,000 – $250,000) × 10%

435,000* 1,935,000

Accounting basis

$2,415,000

* Assuming full 1st-year convention, based on 40% depreciation (i.e., 10% × 4) at Y/E

20X8. Other assumptions could be used.

††Tax basis

UCC beginning of 20X8

$1,100,000

Assets acquired

600,000

Assets retired (assuming no residual value, there is no net effect on UCC)

—

20X9 CCA = [($1,100,000 – $250,000) × 20%] + [$600,000 × 10%]

(230,000)

Tax basis, Y/E 20X9

$1,470,000

Requirement 2

Deferred income tax balance (long term):

Year-end 20X8: $1,900,000 × 38% = $722,000 credit balance

Year-end 20X9: $1,445,000 × 38% = $549,100 credit balance

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-25

Requirement 4

The balance is decreasing in 20X9 because most of the existing CCA tax shield has

already been used, which suggests that the $4,000,000 in equipment probably was all

acquired at the same time. However, if Carter now maintains a policy of continuous

equipment reinvestment and renewal, CCA again become greater than accounting

amortization, causing an increase in the temporary difference and an increase in future

income tax. The dollar volume of assets in the early stages of CCA will offset the volume

in the later stages, thereby stabilizing the balance of temporary differences. The balance

will decline again only when Carter slows its investment in new assets, due either to nonrenewal or to declining prices for replacement equipment.

Assignment 16-7

20x9

Income tax payable:

Accounting income subject to tax ........................................ $980,000

Permanent difference:

Golf club dues .................................................................. _25,000

Accounting income subject to tax ........................................ 1,005,000

Temporary differences:

Warranty costs accrued ....................................................

80,000

Warranty costs incurred ................................................... (65,000)

Depreciation ..................................................................... 125,000

CCA ................................................................................. (250,000)

Taxable income ................................................................ $895,000

Income tax payable (at 36%) ................................................ $ 322,200

Deferred income tax:

Tax Accounting

Basis

Basis

20x9

Capital assets1,000,000 $1,125,000

Warranty

0

(15,000)

Temporary Deferred tax Opening Adjustment

Difference

Balance

($125,000) ($45,000)

15,000

5,400

Income tax expense ................................................

Deferred income tax ...............................................

Deferred income tax ..................................

Income tax payable ...................................

0

0

($45,000)

5,400

361,800

5,400

45,000

322,200

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-26

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Assignment 16-8

Requirement 1

a. Permanent difference, $20,000. The expense will never be tax deductible.

b. Permanent difference, $680,000. Revenue will never be taxable.

c. Temporary difference, $140,000. The temporary difference will reverse as

warranty costs are incurred.

d. Capital gain of $480,000 total: 50% temporary difference, $240,000; and 50%

permanent difference, $240,000. The temporary difference will reverse in 20X10.

e. Temporary difference, $100,000. The temporary difference will reverse as

development costs are depreciated.

f. Temporary difference of $100,000. The temporary difference will reverse for

individual asset as it is depreciated.

Requirement 2

Income tax expense (6) ..........................................

Deferred income tax (3) .........................................

Deferred income tax (2) .............................

Deferred income tax (4) .............................

Deferred income tax (5) .............................

Income tax payable (1) ...............................

(1) Accounting income

Permanent differences:

Golf club dues

Investment income

Gain on land

Accounting income subject to tax

Temporary differences:

Gain on land disposal

Estimated warranty expense

Development costs incurred

Depreciation

CCA

Taxable income

Income tax payable (38%)

(2)

(3)

(4)

(5)

(6)

581,400

53,200

91,200

38,000

38,000

467,400

$ 2,400,000

20,000

(650,000)

(240,000)

1,530,000

(240,000)

140,000

(100,000)

200,000

(300,000)

$ 1,230,000

$ 467,400

($240,000) × .38 = $91,200 Cr.

$140,000 × .38 = $53,200 Dr.

($100,000) x .38 = $38,000 Cr.

$200,000 – ($300,000) = ($100,000) x .38 = $38,000 Cr.

$91,200 + $38,000 + $38,000 + $467,400– $53,200 = $581,400 Dr.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-27

Requirement 3

Statement of Financial Position

Non-current assets

Deferred tax asset .................................

Current liability

Income tax payable ..............................

Non-current liabilities

Deferred tax liability ............................

Statement of profit and loss

Income tax expense – current ...............

– deferred .............

Total income tax expense.....................

$53,200

$467,400

$167,200

$ 467,400

114,000

$581,400

Assignment 16-9

Requirement 1

This is a temporary difference because the rent revenue is reported for accounting

purposes in 20x6 and 20x7, but the full amount is included in 20x6 as taxable income.

The $4,800 amount ($800 per month × 6 months) is an adjustment that will reverse in

20x7, and gives rise to a debit in deferred income tax asset.

Requirement 2

At the end of 20x6, the accounting basis for unearned rent is $2,400. The tax basis is

zero; $2,400 less $2,400 to be taxable in future periods.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-28

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Requirement 3

20x6:

Pre-tax accounting income ..................................................... $450,000

Temporary differences:

Advance collection of rent .............................................

2,400

Taxable income ...................................................................... 452,400

Tax rate ..................................................................................

× .40

Income tax payable ................................................................ $180,960

Deferred income tax debit, 31 December 20x6 ($2,400 × .4)

$960

Computation of income tax expense:

Income tax payable ........................................................ $180,960

Increase in deferred income tax debit ............................

(960)

Income tax expense in 20x6 ........................................... $180,000

The journal entry to record income tax for 20x6 is:

Income tax expense ................................................................ 180,000

Deferred income tax ...............................................................

960

Income tax payable ........................................................

180,960

20x7:

Pre-tax accounting income .....................................................

Temporary differences:

Advance collection of rent .............................................

Taxable income ......................................................................

Tax rate ..................................................................................

Income tax payable ................................................................

Deferred income tax debit, 31 December 20x7 .....................

Computation of income tax expense:

Income tax payable ........................................................

(Increase) decrease in deferred income tax debit ...........

Income tax expense in 20x7 ...........................................

$38,000

(2,400)

35,600

× .40

$14,240

$0

$14,240

960

$15,200

The journal entry to record income tax for 20x7 is:

Income tax expense .........................................................................

Deferred income tax ................................................................

Income tax payable ..................................................................

15,200

960

14,240

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-29

Requirement 4

Partial statement of profit and loss

Accounting income before income tax ......................................

Income tax expense – current ...................................................

– non-current ............................................

Net income .................................................................................

20x6

20x7

$450,000

180,960

(960)

180,000

$270,000

$38,000

14,240

960

15,200

$22,800

20x6

20x7

Requirement 5

Statement of Financial Position:

Non-current assets

Deferred income tax .....................................................

$960

0

Assignment 16-10

Requirement 1

Unearned rent Warranty

Accounting carrying value, 20x8 (both liabilities) ............... $90,000

$52,000

Tax basis, 20x8 ....................................................................

0

0

Accounting and tax basis for both would be zero at the end of 20x9.

Requirement 2

20x8

Income tax payable:

Accounting income subject to tax ........................................ $210,000

Permanent difference:

membership dues ............................................................. _ _ ____

Accounting income subject to tax ........................................ 210,000

Temporary differences:

Unearned rent revenue .....................................................

90,000

Warranty expense .............................................................

52,000

Taxable income..................................................................... $352,000

Income tax payable (at 40%) ................................................ $140,800

20x9

$230,000

30,000

260,000

(90,000)

(52,000)

$118,000

$ 47,200

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-30

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Deferred income tax:

Tax Accounting

Basis

Basis

20x8

Unearned revenue

Warranty

20x9

Unearned revenue

Warranty

0

0

0

0

($90,000)

(52,000)

Temporary Deferred

Difference

tax

Opening Adjustment

Balance

$90,000

52,000

$36,000

20,800

0

0

0

0

0

0

36,000

20,800

0

0

Income tax expense:

Income tax payable ............................................................... $140,800

Deferred income tax:

Related to rent revenue ($90,000 × 40%) ........................ (36,000)

Related to warranty ($52,000 × 40%) .............................. ( 20,800)

Income tax expense............................................................... $84,000

$36,000

20,800

(36,000)

(20,800)

$47,200

36,000

20,800

$104,000

Requirement 3

20x8

Income tax expense .........................

Deferred income tax ……...............

Income tax payable......................

20x9

84,000

56,800

104,000

56,800

47,200

140,800

Requirement 4

Statement of Profit and Loss:

20x8

Revenues ............................................................................... $660,000

Expenses ............................................................................... 460,000

Income before tax ................................................................. 210,000

Less: income tax expense (current portion, $140,800 in

20x8 and $47,200 in 20x9) .............................................

84,000

Net income ............................................................................ $ 126,000

20x9

$820,000

590,000

230,000

104,000

$ 126,000

Requirement 5

Statement of Financial Position

Non-current asset:

Deferred income tax asset ................................................

20x8

56,800

20x9

None

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

16-31

Assignment 16-11

Tax calculations:

Accounting income before income tax ..................

Temporary difference:

Revenue recognized ...................................

Cash received .............................................

Taxable income ......................................................

Tax rate ......................................................

Current income tax ................................................

20x1

$800,000

20x2

$980,000

(120,000) (420,000)

–

80,000

680,000

640,000

38%

38%

$258,400 $243,200

20x3

$660,000

–

190,000

850,000

40%

$340,000

Deferred income tax:

Tax Accounting

Basis

Basis

20x1

Account receivable

20x2

Account receivable

20x3

Account receivable

Temporary Deferred

Difference

tax

Opening Adjustment

Balance

0

$120,000

($120,000) ($45,600)

0

0

460,000

(460,000)1 (174,800)

0

270,000

(270,000) (108,000) (174,800)

(45,600)

($45,600)

(129,200)

66,800

1120,000 +420,000-80,000 = 460,000

Journal entry for 20x1

Income tax expense ..........................................................

Deferred income tax liability ...............................

Income tax payable ..............................................

Journal entry for 20x2

Income tax expense ..........................................................

Deferred income tax liability ...............................

Income tax payable ..............................................

Journal entry for 20x3

Income tax expense ..........................................................

Deferred income tax liability ...........................................

Income tax payable ..............................................

304,000

45,600

258,400

372,400

129,200

243,200

273,200

66,800

340,000

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved.

16-32

Solutions Manual to accompany Intermediate Accounting Volume 2, 6th edition

Assignment 16-12

Tax calculations:

Accounting income before income tax ......................

Add permanent difference – golf club dues ...............

Accounting income subject to tax ..............................

Temporary differences:

Accrued warranty costs ..................................

Warranty costs................................................

Depreciation expense .....................................

CCA ...............................................................