Econ 121 Midterm Exam – II

advertisement

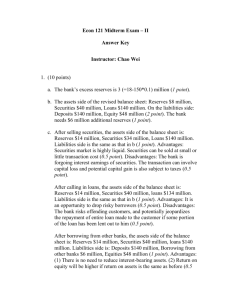

Econ 121 Midterm Exam – II Instructor: Chao Wei Provide a BRIEF AND CONCISE answer to each question. There are 25 points on this exam. 1. (6 points) Prepare the balance sheet of a bank that has $19 million in reserves, $40 million in securities, $140 million in loans, $180 million in deposits, and $19 million in equity capital. a. What are the bank’s excess reserves if the reserve requirement is 10% of deposits? (1 point) Excess reserves = $19 - $180*10% = $1 million b. Suppose that checks drawn on the bank’s accounts withdraw $10 million. Show what the revised balance sheet looks like? (0.5 point) How much additional reserve does the bank need? (0.5 point) Assets side: $9 million in reserves, $40 million in securities, $140 million in loans; Liabilities side: $170 million in deposits, and $19 million in equity capital. Excess reserves = $9 - $170*10% = -$8 million c. Suppose that the bank chooses one of the following transactions to make up its reserve deficiency: (1) sell securities; (2) call in loans; (3) borrow from other banks; (4) issue equity shares. For each of the above 4 options, show what the balance sheet looks like after each transaction. (0.5 point for each transaction). After selling securities, the assets side of the balance sheet is: Reserves $17 million, Securities $32 million, Loans $140 million. Liabilities side is the same as that in b. After calling in loans, the assets side of the balance sheet is: Reserves $17 million, Securities $40 million, loans $132 million. Liabilities side is the same as that in b. After borrowing from other banks, the assets side of the balance sheet is: Reserves $17 million, Securities $40 million, loans $140 million. Liabilities side is: Deposits $170 million, Borrowing from other banks $8 million, Equities $19 million After borrowing from the Fed, the asset side of the balance sheet is: Reserves $17 million, Securities $40 million, loans $140 million. Liabilities side is: Deposits $170 million, Discount Loan (or: borrowing from the Fed) $8 million, Equities $19 million. d. What are the advantages and disadvantages of using each of the following two methods to make up reserve deficiency: (1) sell securities; (2) borrow from other banks (2 points) The advantages of selling securities: very liquid market, low transaction cost (0.5 point); The disadvantages of selling securities: forgone interest earnings; possible capital loss (0.5 point). The advantages of borrowing from other banks: also a liquid market convenient to borrow; no need to forgo profitable opportunities due to lack of resources (0.5 point); The disadvantages of borrowing from other banks: reduce the ratio of equity to the total asset, thus making the bank more risky (0.5 point). 2. (3 points) GAP Analysis. Suppose that you are the manager of a bank that has $18 million of fixed-rate assets, $30 million of rate-sensitive assets, $28 million of fixed-rate liabilities, and $20 million of rate-sensitive liabilities. Conduct a gap analysis for the bank, and show what will happen to bank profits if the interest rate rises by 5 percentage points. GAP = Rate-sensitive assets – Rate-sensitive liabilities = 30 – 20 = $10 million Change in bank profits = 5%*(30-20) = $0.5 million Given the GAP, bank profits will increase by $0.5 million if the interest rate rises by 5 percentage points. 3. (3 points) Suppose that the First National Bank has the following balance sheet (in million dollars): Assets: Reserves 10; Loans 90; Liabilities: Deposits 90; Bank capital 10. Suppose that the Second National Bank has the following balance sheet (in million dollars) Assets: Reserves 10; Loans 90; Liabilities: Deposits 95; Bank Capital 5. a. If net profits of the First and Second National Banks are both $1 million dollars, then what are the return on asset (0.5 point) and the return on equity for each bank (0.5 point)? For the First National Bank, ROA = 1/100 = 1% ROE = 1/10 = 10% For the Second National Bank ROA = 1/100 = 1% ROE = 1/5 = 20% b. Suppose that both banks suffer a loan loss of $6 million, How will their balance sheets look like now? (0.5 point for each balance sheet) For the First National Bank, Assets: Reserves 10; Loans 84; Liabilities: Deposits 90; Bank Capital 4. For the Second National Bank, Assets: Reserves 10, Loans 84; Liabilities: Deposits 95, Bank Capital -1. c. Based on your answer to b, what has happened to the Second National Bank? Explain your answer. The Second National Bank has gone bankrupt due to the loan loss. (0.5 point) This is because its assets are now insufficient to cover all the liabilities to outside creditors (0.5 point). 4. (4 points) Joe deposits $1 million dollars in a bank called Magna, which pays commission to Ace Mortgage Brokers to make loans on its behalf. Ace mortgage brokers make mortgage loans to Bob without verifying his income or employment records. George the government regulator is assigned the duty to monitor Magna’s loan activities. Briefly describe all the moral hazard problems for the five parties involved and identify the principal and the agent for each moral hazard problem. 1) Joe the principal and Magna the agent. Magna tends to take on too much risk using Joe’s deposits. 2) Magna the principal and Ace the agent. Ace tends to make risky loans for commission instead of carefully checking borrowers’ background on Magna’s behalf. 3) Ace the principal and John the agent. John tends to take out risky mortgage loans from Ace and thus having a high chance of bankruptcy. 4) Joe the principal and George the government regulator. George is hired to monitor Magna on behalf of Joe. But George tends to shirk his duties since it is not his own deposits being misused by Magna. 5. (5 points) Questions on adverse selection, moral hazard and collateral. (a) Give an example of adverse selection on the securities market. (One of the examples is sufficient.)(1 point) Examples include: (1) Investors often could not distinguish good firms from bad firms if the firms are relatively unknown. As a result, good firms tend to be undervalued, while bad firms are often overvalued. Consequently, good firms would not be willing to raise funds on the securities market, and investors would not like to invest in securities issued by unknown firms. (2) The borrowers who are most eager for loans, who would be willing to promise to take out loans at any interest rates are often very risky borrowers. (b) Give an example of moral hazard on the securities market. (One of the examples is sufficient.)(1 point) Examples include: (1) Borrowers take on too much risk; (2) Borrowers default or engage in activities not in the interest of lenders. (c) Explain why collateral is a useful tool to reduce adverse selection and moral hazard problems.(2 points) By requiring collateral, the lender is able to seize collateral in case of default. Those borrowers who are most likely to default thus would not take out loans from the lender, fearful of the loss of collateral. As a result, adverse selection problem is reduced. With the collateral at stake, the borrower typically would avoid activities which might lead to the loss of collateral. As a result, moral hazard is reduced. (d) Mortgage loans are typically secured by collateral. That is, if you fail to make your mortgage payments, the lender can take title to your house, auction it off, and use the receipts to pay off the loan. Please briefly explain why the prevalence of collateral (house) in mortgage loan contracts still could not prevent the subprime mortgage crisis. (1 point) Collateral is not a perfect tool, especially when the market value of collateral declines. As the market value of collateral declines, it is much less costly for borrowers to walk away from their obligations, as happened in the subprime mortgage crisis. 6. (4 points) Describe two ways in which financial intermediaries help lower transaction costs in the economy. (Two of the three ways below are sufficient. Two points for each.) Financial intermediaries help lower transaction costs through the following ways: a. Economies of scale. Financial intermediaries bundle investors’ funds together to reduce transaction cost for each investor. b. Expertise. Financial intermediaries are also better able to develop expertise to lower transaction costs. c. Diversification. By bundling funds together, financial intermediaries can diversify the risk exposure of investors.