Capital Budgeting Problem - Gamma

advertisement

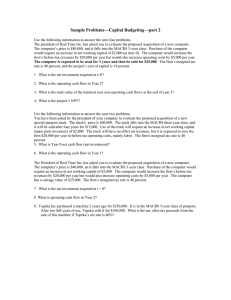

Extra Credit Assignment 15 points! Due 4-Dec 2015 Introduction This project is an application of capital budgeting and cash flow analysis. The Excel template is similar to what I might build in the so-called real world, and could be very useful to have on a flash drive somewhere for future reference To make the project easier, I recommend using the template to build the example problem (based on Holliday Manufacturing, as discussed in the video) before trying the actual problem in the template. Once you have the example built and the numbers match the illustrations below, you know your spreadsheet works correctly. Then substitute the assumptions for the actual project and the spreadsheet will do the computations. Watch the depreciation assumptions on Gamma vs Holliday. The Example Holliday Manufacturing is considering the replacement of an existing machine. The new machine costs $1.2 million and requires installation costs of $150,000. The existing machine can be sold currently for $185,000 before taxes. The old machine is 2 years old, cost $800,000 when purchased, and has a $384,000 book value and a remaining useful life of 5 years. It was being depreciated under MACRS using a 5-year recovery period, so it has the final 4 years of depreciation remaining. If it is held for 5 more years, the machine’s market value at the end of year 5 will be zero. Over its 5-year life, the new machine should reduce operating costs by $350,000 per year, and will be depreciated under MACRS using a 5-year recovery period. The new machine can be sold for $200,000 net of removal and cleanup costs at the end of 5 years. A $25,000 increase in net working capital will be required to support operations if the new machine is acquired. The firm has adequate operations against which to deduct any losses experienced on the sale of the existing machine. The firm has a 9% cost of capital and is subject to a 40% tax rate. Should they accept or reject the proposal to replace the machine? Here’s how the template would be populated with the information for Holliday: Notice the payback period: I don’t normally use a fancy formula to automate the computation, it is too much trouble for the time savings. At the end of Year 3, the company has recouped all but $234,600of the initial investment. That amount divided by the next year’s cash flow (234600/258800) tells me the remainder is 0.91. Add that to the 3 full years I counted and I get the payback period of 3.91 The Project Consider the following scenario: Gamma Inc. is considering the replacement of an existing machine. The new machine costs $1.8 million and requires installation costs of $250,000. The existing machine can be sold currently for $125,000 before taxes. The existing machine is 3 years old, cost $1 million when purchased, and has a $290,000 book value and a remaining useful life of 5 years. It was being depreciated under MACRS using a 5-year recovery period. If it is held for 5 more years, the machine’s market value at the end of year 5 will be zero. Over its 5-year life, the new machine should reduce operating costs by $650,000 per year, and will be depreciated under MACRS using a 5-year recovery period. The new machine can be sold for $150,000 net of removal and cleanup costs at the end of 5 years. A $30,000 increase in net working capital will be required to support operations if the new machine is acquired. The firm has adequate operations against which to deduct any losses experienced on the sale of the existing machine. The firm has a 15% cost of capital, is subject to a 40% tax rate and requires a 42-month payback period for major capital projects. Should they accept or reject the proposal to replace the machine? What is the NPV? What is the IRR? What is the payback period? Use the following table for depreciation: 5-Year MACRS Year 1 20% Year 2 32% Year 3 19% Year 4 12% Year 5 12% Year 6 5% Required Use the Excel template on the class webpage (Capital Budgeting Template.xls) and analyze the scenario above. Answer the questions (Should they accept or reject the proposal to replace the machine? What is the NPV? What is the IRR? What is the payback period?) Turn in a neatly-formatted printout of your spreadsheet and recommendation to Gamma Inc. Check the footer of the spreadsheet if you want to change “Your Name Goes Here” to your actual name If I am not in my office, please turn this in to Faculty Services on the 5th floor of the SBA building.