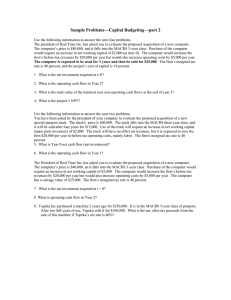

indiv & bus tax problems

advertisement

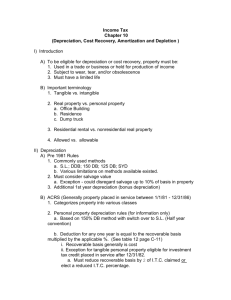

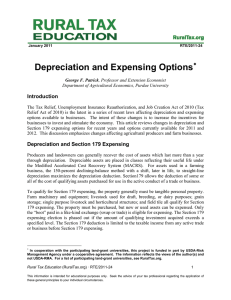

Review of Depreciation and Section 179 Expensing Depreciation allows recovery of the capital invested in an asset over the life of the asset Section 179 allows immediate recovery of some or all of the cost of an asset 1 Depreciation (MACRS) Modified Accelerated Cost Recovery System 2 MACRS Classes of Property Personal property (not real estate) • 3-year: breeding hogs and tractor unit of a semi • 5-year: cows, computers and office equipment • 7-year: machinery and equipment 3 MACRS Classes of Property Real property • 10-year: single purpose structures and orchards and groves • 15-year: field tile and land improvements • 20-year: general purpose farm buildings 4 MACRS Classes of Property Real property • 27.5-year: residential rental real estate • 39-year: nonresidential real property • Land is NOT depreciable 5 MACRS Depreciation Year 1st 3-yr. 5-yr. 7-yr. 10-yr. 25.0% 15.0% 10.7% 7.5% 2nd 3rd 4th 37.5% 25.5% 19.1% 13.9% 25.0% 17.9% 15.0% 11.8% 12.5% 16.7% 12.3% 10.0% 5th 0% 16.7% 12.3% 8.74% 6 MACRS Depreciation 1. One-half year in the year an asset is placed in service 2. Takes an extra year to get full recovery of investment 3. One-half year in the last year or year of disposition 7 Bonus or Additional First-Year Depreciation An extra 30% or 50% for new (not previously used) assets acquired before 12/31/04 Can elect not to take this bonus depreciation Post 9/11 law – expires this year 8 Section 179 Expensing Allows an immediate write-off of some or all of the cost of qualifying asset the year it is placed in service 9 Section 179 Expensing – Qualifying Property 1. Used in active conduct of a trade or business Cannot be a personal use, hobby, or a fixed rental situation 10 Section 179 Expensing – Qualifying Property 2. Tangible property depreciated under MACRS rules (3, 5, 7, 10 and 15-year MACRS) 3. Must be acquired by purchase or in a trade 11 Section 179 Expensing – Qualifying Property 4. Can be new or used 5. If acquired in a trade, only the “boot” portion qualifies Some differences between bonus depreciation and Section 179 12 Section 179 Election 1. Limited by qualifying property placed in service in year 2. Phased out $1 for $1, if qualifying property placed in service exceeds $410,000 ($420,000 in ’05) 13 Section 179 Deduction Limited to taxable income of an active trade or business before Section 179 expensing 1. Cannot cause a loss 2. Includes wages as well as business income 14 Section 179 Election Section 179 deduction that is limited by income can be carried forward to next tax year Greater flexibility in making and revoking election for ’03 and later year returns 15 Tax Management Deduct now with Section 179 vs. later with MACRS 1. Marginal tax rates – a higher rate increases value of deduction 2. Time value of money – deduction now is worth more than one later 16