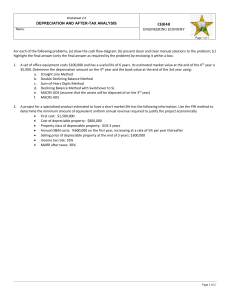

1. An investment of $1,000,000 generates annual net incomes of $400,000 and salvage value of $300,000 after 4 years. At MARR=10% and an effective tax rate of 30% use MACRS with the depreciation life of 3 years to determine after tax PW. 2. Repeat problem 1 when 50% of the investment is borrowed at an annual interest rate of 10% to be paid back in three equal installments.