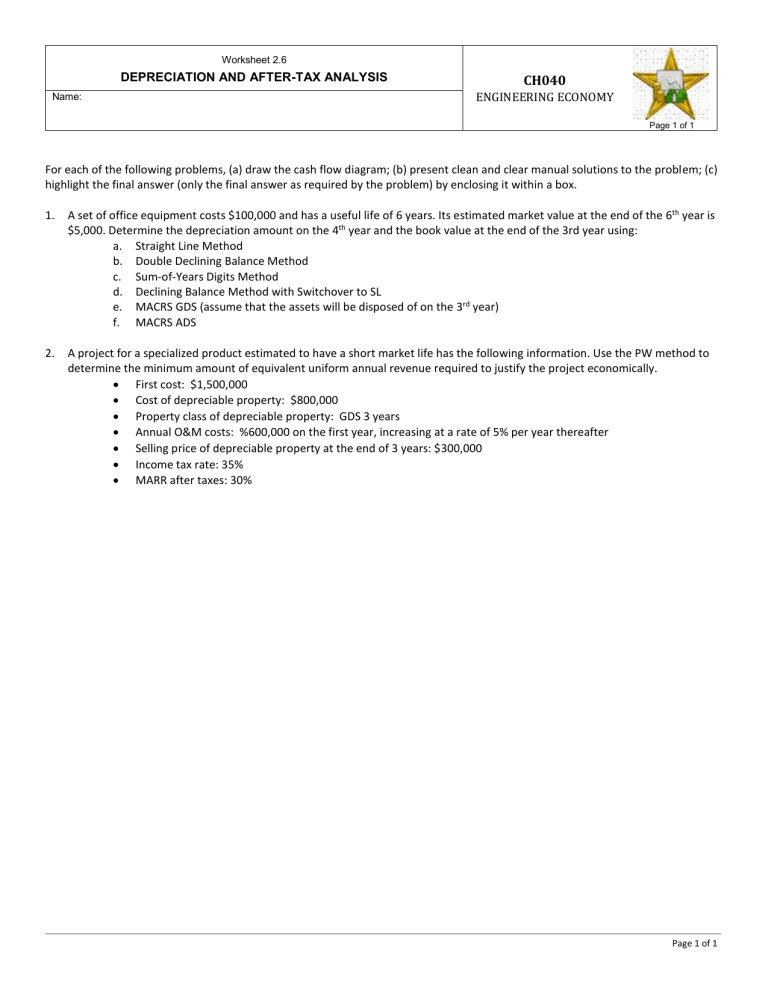

Worksheet 2.6 DEPRECIATION AND AFTER-TAX ANALYSIS Name: CH040 ENGINEERING ECONOMY Page 1 of 1 For each of the following problems, (a) draw the cash flow diagram; (b) present clean and clear manual solutions to the problem; (c) highlight the final answer (only the final answer as required by the problem) by enclosing it within a box. 1. A set of office equipment costs $100,000 and has a useful life of 6 years. Its estimated market value at the end of the 6th year is $5,000. Determine the depreciation amount on the 4th year and the book value at the end of the 3rd year using: a. Straight Line Method b. Double Declining Balance Method c. Sum-of-Years Digits Method d. Declining Balance Method with Switchover to SL e. MACRS GDS (assume that the assets will be disposed of on the 3rd year) f. MACRS ADS 2. A project for a specialized product estimated to have a short market life has the following information. Use the PW method to determine the minimum amount of equivalent uniform annual revenue required to justify the project economically. First cost: $1,500,000 Cost of depreciable property: $800,000 Property class of depreciable property: GDS 3 years Annual O&M costs: %600,000 on the first year, increasing at a rate of 5% per year thereafter Selling price of depreciable property at the end of 3 years: $300,000 Income tax rate: 35% MARR after taxes: 30% Page 1 of 1