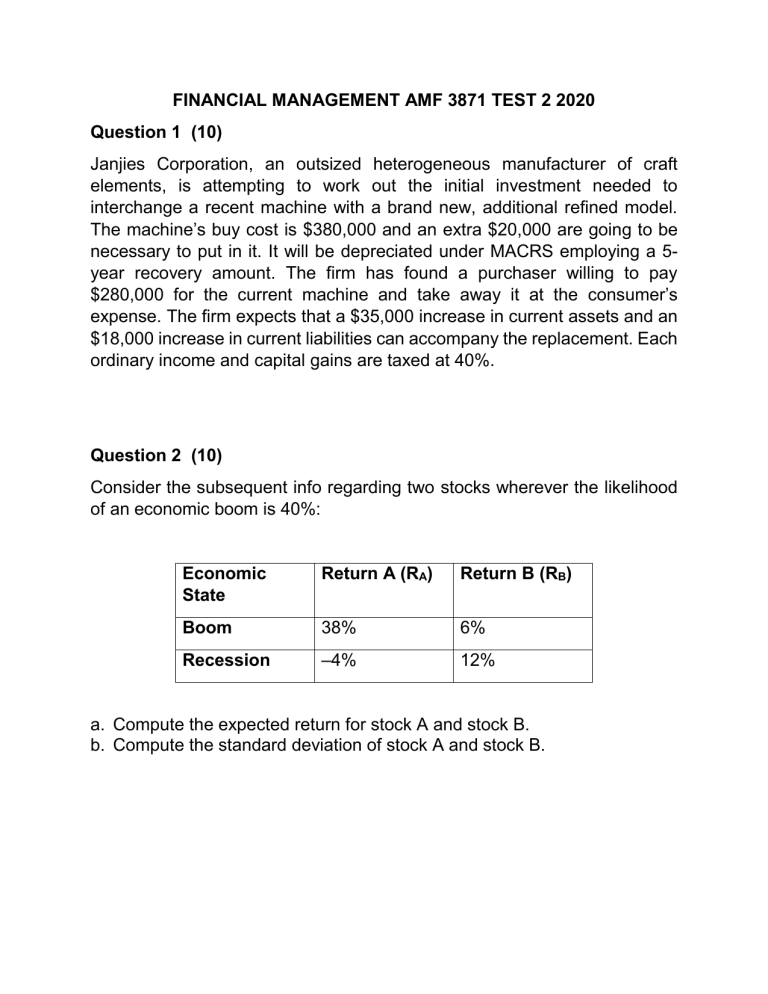

FINANCIAL MANAGEMENT AMF 3871 TEST 2 2020 Question 1 (10) Janjies Corporation, an outsized heterogeneous manufacturer of craft elements, is attempting to work out the initial investment needed to interchange a recent machine with a brand new, additional refined model. The machine’s buy cost is $380,000 and an extra $20,000 are going to be necessary to put in it. It will be depreciated under MACRS employing a 5year recovery amount. The firm has found a purchaser willing to pay $280,000 for the current machine and take away it at the consumer’s expense. The firm expects that a $35,000 increase in current assets and an $18,000 increase in current liabilities can accompany the replacement. Each ordinary income and capital gains are taxed at 40%. Question 2 (10) Consider the subsequent info regarding two stocks wherever the likelihood of an economic boom is 40%: Economic State Return A (RA) Return B (RB) Boom 38% 6% Recession –4% 12% a. Compute the expected return for stock A and stock B. b. Compute the standard deviation of stock A and stock B.