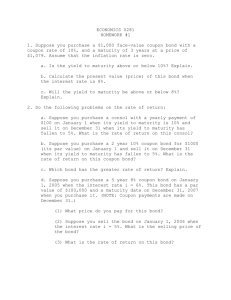

十四 Asset Valuation: Debt Investments: Basic Concepts

advertisement