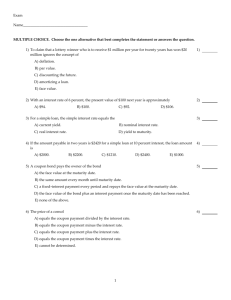

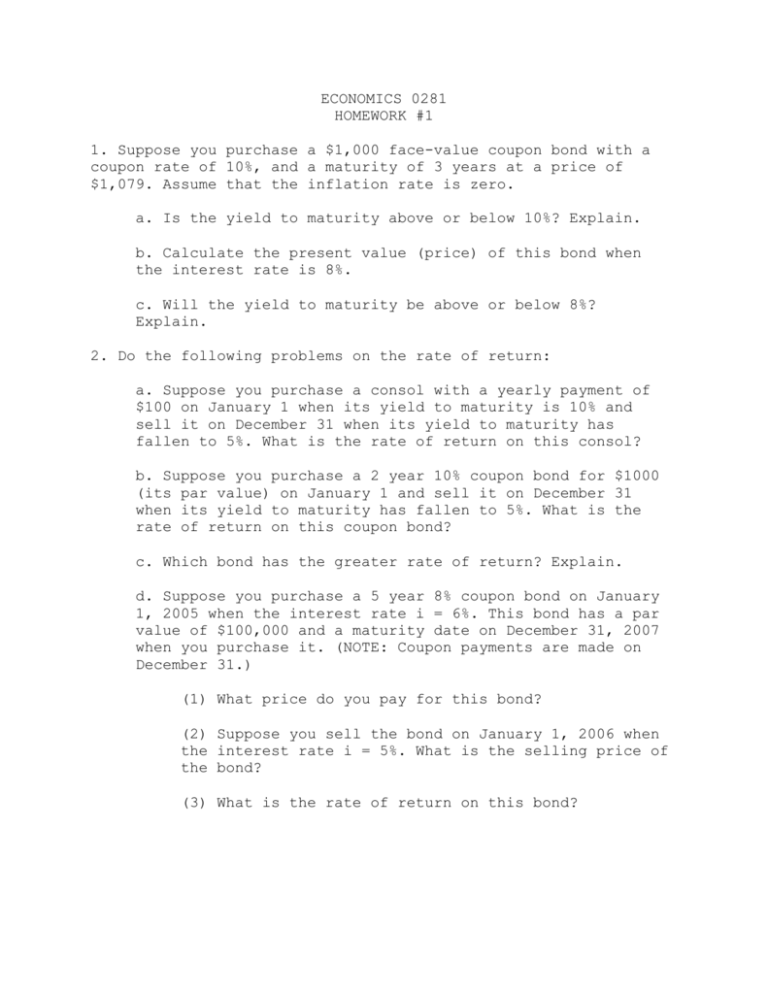

ECONOMICS 0281 HOMEWORK #1 1. Suppose you purchase a

advertisement

ECONOMICS 0281 HOMEWORK #1 1. Suppose you purchase a $1,000 face-value coupon bond with a coupon rate of 10%, and a maturity of 3 years at a price of $1,079. Assume that the inflation rate is zero. a. Is the yield to maturity above or below 10%? Explain. b. Calculate the present value (price) of this bond when the interest rate is 8%. c. Will the yield to maturity be above or below 8%? Explain. 2. Do the following problems on the rate of return: a. Suppose you purchase a consol with a yearly payment of $100 on January 1 when its yield to maturity is 10% and sell it on December 31 when its yield to maturity has fallen to 5%. What is the rate of return on this consol? b. Suppose you purchase a 2 year 10% coupon bond for $1000 (its par value) on January 1 and sell it on December 31 when its yield to maturity has fallen to 5%. What is the rate of return on this coupon bond? c. Which bond has the greater rate of return? Explain. d. Suppose you purchase a 5 year 8% coupon bond on January 1, 2005 when the interest rate i = 6%. This bond has a par value of $100,000 and a maturity date on December 31, 2007 when you purchase it. (NOTE: Coupon payments are made on December 31.) (1) What price do you pay for this bond? (2) Suppose you sell the bond on January 1, 2006 when the interest rate i = 5%. What is the selling price of the bond? (3) What is the rate of return on this bond? 3. Suppose Alphonso has just bought a 5 year coupon bond with a $10,000 face value and a 5% coupon rate. The interest rate is 7%. a. If the bond is not indexed and the inflation rate is 2% in the first year, 3% in the second year, 4% in the third year, 5% in the fourth year, and 6% in the fifth year, calculate the nominal and real value of this bond. b. If the bond is indexed, calculate part a. again. 4. Use the concepts from the lecture material on interest rates to answer the following: a. The Fed can decrease the money supply by selling Treasury securities to the public. Using the supply and demand for bonds framework show what effect this Fed policy has on interest rates. b. What effect will a sudden increase in the volatility of gold prices have on interest rates? Show and explain. c. Show and explain what effect an increase in the riskiness of bonds has on interest rates. Use the supply and demand for bonds framework in your answer. d. Predict what would happen to interest rates if the public suddenly expects a large increase in stock prices. Show and explain. e. Predict what would happen to the market for long-term AT&T bonds if interest rates are expected to rise. Show and explain. 5. Use the concepts from the lecture on the term structure of interest rates to answer the following: a. Assuming the expectations hypothesis is the correct theory of the term structure, calculate the yields for maturities of one to five years and plot the resulting yield curves for the following series of one year interest rates over the next five years: (1) 3%, 5%, 7%, 9%, 11% (2) 5%, 5%, 5%, 5%, 5% (3) 7%, 6%, 5%, 4%, 3% b. Now assume that investors prefer short term securities to long-term securities with the term premium knt for one through five year bonds being 1%, 2%, 3%, 4%, 5%. Redo part a. and explain what you find. *c. Use the term premiums in part b and see if you can construct a series of one year interest rates over five years which results in an inverted yield curve. d. Suppose that the expected inflation rate over the next five years is rising: 1%, 1.5%, 2%, 2.5%, and 3%. Show and explain how this affects the yield curve by using the interest rates in a.(1) or a.(2). Then speculate on how a decline in expected inflation should affect the yield curve.