Alfred University - Academic HealthPlans

advertisement

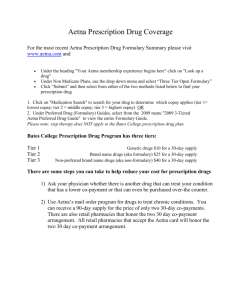

Alfred University 2014-2015 Student Health Insurance Your school-endorsed Plan offers you these benefits, services and programs. Academic HealthPlans and Aetna Student Health, working with Alfred University, offers a student-focused health insurance plan that helps protect students at school, at home and while traveling or studying abroad. What is the Plan all about? Your Student Health Insurance Plan offers you access to: Aetna’s nationwide network of doctors, hospitals, pharmacies and specialists throughout the country. No Benefit Maximum . Informed Health® Line – Call our toll-free number to talk to registered nurses. They can share information on a range of healthy topics. Savings on vision, fitness, alternative health care, weight management, books and many more! Travel assistance services and worldwide medical coverage while traveling or studying abroad. Prescription drugs are covered after $30 Copay for each Brand Name Prescription Drug or a $15 Copay for each Generic Prescription Drug. No Benefit Maximum Covered medical expenses for preventative care are paid at 100%. How much does it cost? ANNUAL INSURANCE RATE SPRING / SUMMER INSURANCE RATE 08/14/14 to 08/13/15 01/14/15 to 08/13/15 August 5, 2014 January 11, 2015 Student Only* $1,499 $875 Spouse Only $4,762 $2,766 All Children $2,458 $1,428 Coverage Dates WAIVER DEADLINE *The rate above includes both premium for the student health plan underwritten by Aetna Life Insurance Company and a $10 Administrative fee charged by Alfred University. Who is eligible? All registered students (matriculating and non-matriculating) are required to show proof of health insurance. Once you register at AU, you will be automatically enrolled in the Plan and the insurance premium will be applied to your student account. If you have family or private health insurance, you may waive enrollment into the Alfred University Student Health Insurance Plan. The waiver form must be completed online at http://www.alfred.myahpcare.com. The waiver must be completed by August 5, 2014. Please note that international students on F-1 visas are not eligible for this waiver and must carry the AU insurance. Learn More! Call Toll Free (855) 844-3016 www.alfred.myahpcare.com This Plan may not cover all of your health care expenses. You are strongly encouraged to research the Plan online and to contact the AU Wellness Center with questions at healthinsurance@alfred.edu or call (607) 871-2400. The Alfred University Student Health Insurance Plan is underwritten by Aetna Life Insurance Company and administered by SM Chickering Claims Administrators, Inc. Aetna Student Health is the brand name for products and services provided by these companies and their applicable affiliated companies. 15.03.410.1 B Plan Maximum Unlimited Deductible Non-Preferred Care: $250 for each Covered Person per Policy Year Student Health Center Coverage Benefits will be paid at 100% of Usual & Customary Charge up to the limits specified in the schedule for covered expenses incurred, with the exception of Prescription Drugs and Mental Health Services. Prescription drugs will be paid at $15 copay for generic prescriptions and $30 for brand name prescriptions. Mental Health Services will be paid at 100% of the Covered Expenses. In Patient Benefits Hospital Room and Board Expense Preferred Care Non-Preferred Care* 80% of the Negotiated Charge for the semi-private room rate for an overnight stay. 60% of the Reasonable Charge for the semi-private room rate for an overnight stay after Deductible. Surgical Expense- In Patient & Out Patient 80% of the Negotiated Charge. 60% of the Reasonable Charge. Outpatient Benefits Preferred Care Non-Preferred Care Covered Medical Expenses include, but are not limited to: Physician’s office visits, hospital or out-patient department or emergency room visits, durable medical equipment, physical therapy, clinical lab, radiological facility or other similar facility licensed by the state. Outpatient Miscellaneous Expense 80% of the Negotiated Charge 60% of the Reasonable Charge Physician’s Office Visits (Copay waived for preventive services) 100% of the Negotiated Charge after $25 Copay 60% of the Reasonable Charge X-Rays 80% of the Negotiated Charge. 60% of the Reasonable Charge. Laboratory 80% of the Negotiated Charge. 60% of the Reasonable Charge. Emergency Care (Copay/deductible if admitted) 100% of the Negotiated Charge after $150 Copay 100% of the Reasonable Charge after $150 deductible. Prescription Drug Benefit Preferred Care Non-Preferred Care Covered Medical Expenses for Outpatient Prescription Drugs associated with a covered Sickness or covered Accident occurring during the Policy Year. Please note: Generic Prescription Drug: 100% after $15 Copay Generic Prescription Drug: 100% after $15 Copay Brand Name Prescription Drug: 100% after a $30 Copay Brand Name Prescription Drug: 100% after a $30 Copay You are required to pay in full at the time of service for all prescriptions dispensed at a Non-Participating Pharmacy. Your student health insurance coverage, offered by Aetna Student Health*, may not meet the minimum standards required by the health care reform law for the restrictions on annual dollar limits. The annual dollar limits ensure that consumers have sufficient access to medical benefits throughout the annual term of the policy. Restrictions for annual dollar limits for group and individual health insurance coverage are $1.25 million for policy years before September 23, 2012; and $2 million for policy years beginning on or after September 23, 2012 but before January 1, 2014. Restrictions for annual dollar limits for student health insurance coverage are $100,000 for policy years before September 23, 2012, and $500,000 for policy years beginning on or after September 23, 2012, but before January 1, 2014. Your student health insurance coverage includes an annual limit of $500,000 on all covered services including Essential Health Benefits. Other internal maximums (on Essential Health Benefits and certain other services) are described more fully in the benefits chart included inside this Plan summary. If you have any questions or concerns about this notice, contact (855) 247-2273. Be advised that you may be eligible for coverage under a group health plan of a parent’s employer or under a parent’s individual health insurance policy if you are under the age of 26. Contact the plan administrator of the parent’s employer plan or the parent’s individual health insurance issuer for more information. PLEASE READ CAREFULLY BEFORE DECIDING WHETHER THIS PLAN IS RIGHT FOR YOU: • Please read the Alfred University Student Health Insurance Plan Summary of Benefits located at www.alfred.myahpcare.com carefully before enrolling. While this document and the Alfred University Student Health Insurance Plan Brochure describe important features of the plan, there may be other specifics of the plan that are important to you and some limit what the plan will pay. • If you want to look at the full plan description, which is contained in the Master Policy issued to the school, you may view it by calling toll-free (855) 844-3016. For more information on plan exclusions, limitations and benefit maximums, please refer to the Alfred University Student Health Insurance Plan Summary of Benefits and Master Policy. This plan pays benefits only for expenses incurred while the coverage is in force and only for the medically necessary treatment of injury or disease. The coverage displayed in this document reflects certain mandate(s) of the state in which the policy was written. However, certain federal laws and regulations could also affect how this coverage pays. Unless otherwise indicated, all benefits and limitations are per Covered Person. This material is for information only. Health insurance plans contain exclusions, limitations and benefit maximums. Discount programs provide access to discounted rates and are NOT insured benefits. The member is responsible for the full cost of the discounted services. Discounts are subject to change without notice. Discount programs may not be available in all states. Discount programs and travel assistance services may be offered by vendors who are independent contractors and not employees or agents of Aetna. Health information programs provide general health information and are not a substitute for diagnosis or treatment by a physician or other health care professionals. Preferred providers are independent contractors and are neither employees nor agents of Aetna Life Insurance Company, Chickering Claims Administrators, Inc. or their affiliates. Policy forms issued in OK include GR-96134. 15.03.410.1 B © 2014 Aetna Inc.