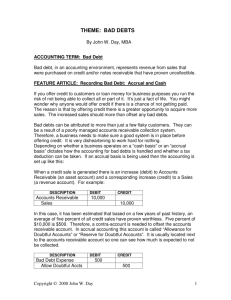

1.2 billion of bad debt

advertisement

Bad Debt Protect your bottom line against the risk of bad debt Protect your bottom line against the risk of bad debt You can’t open a newspaper today without reading about the latest companies to fall into financial difficulty. Whilst Australia came through the GFC relatively unscathed compared to many other countries, its impact has left an indelible mark on the Australian economy. The insolvency levels for the 2011-12 financial year were the highest they had been in the preceding 12 years, with nearly 900 companies a month on average declaring themselves bankrupt. The current financial year is not looking any better*. Add to this the recent spate of natural disasters which have caused many businesses to falter, and we’re faced with a precarious economic landscape which could cause your business untold financial damage. There is currently $1.2 billion of bad debt across Australia. And no one is immune. Some of our most iconic brand names have recently had to close their doors. With the evidence showing that no company is immune, it’s no longer safe to think that a big name is a guarantee of financial stability. Why this matters to you With the economic uncertainty prevailing today, companies to whom you have extended credit may very easily become insolvent or default on their payment obligations. The ensuing bad debt goes straight to your bottom line and, without insurance in place, can have a significant impact on your ability to trade. That’s a risk that no company should take. In fact, good corporate governance and recent financial legislation call for the management and mitigation of all risks, and that includes credit risk. Markets are in a constant state of flux and the success of your business is intrinsically linked to the state of your industry. Now consider the implications of a downturn in your industry. New sales become harder to find. Competition squeezes your margins. Funding is increasingly difficult to secure. So your trading situation becomes much more uncertain. On top of this, the risk of customer insolvency increases which adds additional financial pressure. Most companies today which operate in a B2B market extend credit for the goods and services they render. It’s standard practice. But you only need to look at the Accounts Receivable item on your balance sheet to realise how much of your working capital is tied up in the debts owed. Generally speaking, Accounts Receivable makes up 30-40% of your balance sheet, making it one of your company’s largest assets. So why wouldn’t you want to protect yourself against the loss of these assets? We use insurance to protect so many things that are important to us, but fall worryingly short when it comes to our balance sheet. What replacing a Bad Debt can cost you Let’s assume that your company operates on a 5% net profit margin. One of your clients has defaulted on a payment of $200,000. If you were to replace that debt, based on a net profit margin of 5%, you would need to make an extra $4 million in new sales. That’s a lot of sales to bring you back to status quo. As a general rule, TCI can return 90% of your money. In this case then, you would only be down $20,000. Which scenario would you prefer? How could Trade Credit Insurance help you? What is Trade Credit Insurance? Regardless of whether you operate in the domestic or overseas markets, Trade Credit Insurance provides cover against non-payment of debts and helps you manage your risk exposure. Having the right cover in place encourages open account trade and dispenses with the need for unwieldy letters of credit. With other companies providing easy trading terms you need to remain competitive. TCI lets you do this without exposing you to unnecessary risk. Trade Credit Insurance protects your Accounts Receivable, one of the most easily cash-convertible assets on your balance sheet. It effectively safeguards your business against 100% financial loss in the event of payment default, and protects your bottom line. TCI is especially beneficial to companies that are looking to grow by branching out into new products or exporting to new markets. These growth activities often mean that your business can be exposed to a number of unknown quantities and new risks. With insurance cover in place, you can explore new opportunities with confidence knowing that you’re protected. Having a credit-insured book helps your business grow in other ways too. If you’re applying for finance or funding, TCI can boost your borrowing power by providing the banks with additional peace of mind about the security of your business. One of the hidden benefits of having TCI cover is the access it gives you to an early warning system for your industry. Your broker has access to information from across the insurance industry which enables him to pinpoint where risks are likely to occur. With outside eyes monitoring industry trends for you, you are one step ahead when it comes to identifying credit risks. COM0048B 0513 * Source: ASIC insolvency statistics Depending upon the type of cover you have, in the event of a proven loss you will generally be reimbursed for up to 90% of the loss. With larger debts, that can sometimes mean the difference between staying afloat and running into financial difficulties yourself. Trade Credit Insurance isn’t a one-size-fits-all solution. It’s very much a bespoke type of insurance. After all, all companies are different, subject to different market forces, and face different risks. Trade Credit Insurance cover is built around the customer to ensure the best possible fit. What should you do next? Talk to your Aon client manager directly to arrange an appointment. Our team works closely with clients to negotiate the most competitive combination of price and cover. It helps clients proactively manage trade credit risk by providing ongoing support throughout the policy period ensuring clients minimise their exposure to high-risk debtors. The benefits of trade credit insurance Protects company P&L statements and balance sheets by transferring non-payment risk away from the business. nhances business growth E byfacilitating trade, protecting profit andincreasing funding opportunities. nhances access to financing E and improved terms from the banking market. rovides an early warning system P forrisks in your industry and from your keycustomers. upports growth into new S markets and expansion of existing operations. Helps with cashflow management. ispenses with the need D for Lettersof Credit. Reduces financial loss by up to 90%. rovides access to Trade Credit P evaluation tools and expert credit decision support for more accurate Trade Credit management.