Lecture - Economia

advertisement

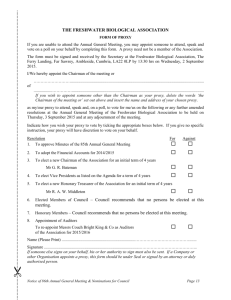

Istituto Universitario di Studi Superiori di Pavia (IUSS) PhD Program in Economics, Law and Institutions (ELI) Università di Pavia – International Summer and Winter Schools Corporate governance: Board Representation of Activist Shareholders Matteo Erede (Università Bocconi – Dipartimento di Studi Giuridici) (University of Pennsylvania Law School – SJD Candidate) Summer School 2011 “Corporate Governance After the Financial Crisis” Pavia – June 9, 2011 Introduction • Berle & Means, The Modern Corporation and Private Property (1932) • Shares’ value maximization and agency costs • Switch from executive to monitoring board of directors • Shareholder activism: defined as proactive efforts to change firm behavior or governance rules (Black 1998) • The role played by institutional investors in a transforming financial market Economic and legal factors affecting institutional investor activism • Size and liquidity of shareholding > collective action • Investment strategies > indexing vs stock picking • Ownership structure of institutional investors > conflicts of interest towards prospect clients • Ownership structure of issuers > dispersed vs concentrated • Degree of cooperation among institutional investors > costs, risks, and structure forms • Legal framework > Corporate vs securities law, State vs federal law Hedge funds vs. Institutional investors • HF pursue shareholder activism as a profitable strategy to effectively increase earnings. • Endogenous advantages: – Economic incentive through managers’ compensation; – No serious conflict of interests; – Strategic and ex ante activism. • Exogenous advantages: – Less intense or rather absent regulatory framework, affecting disclosure requirements, limits on investment choices, ability to take on debt, ability to limit investors’ right to withdraw funds. Activist HF strategies • Undervalued, profitable, financially healthy companies are more likely to be a HF activist’s target. • Two ways to increase shares value: – Redirection of investments; – Reduction of excess cash holdings (through increased dividends, higher debt loads, shares buybacks). • No need to acquire the control. • Strategies aiming to either block or facilitate an existing M&A transaction (by monitoring empire building and cash-out). • Strategies directed to change a company business plan (offer to buy the company, cash payments, sale of assets, governance changes). Activist HF strategies and the legal structure of the corporation • Shareholders rights are limited: – Vote on directors and on structural corporate changes; – Sell the stock; – Sue directors and officers. • But HF know how to boost their voting power through: – Short-selling; – Share lending and empty voting; – Proxy solicitations, “short slate” and proxy access. • HF reputation helps collecting other investors’ support. Voting systems • Plurality voting – just more votes than anybody else + policy for resignation when receiving less than 50% of the votes cast • Majority voting – “absolute” or “simple” • Straight voting – for each open directorship • Cumulative voting – on a single candidate • Dual class shares • One-share/one-vote Cumulative voting • Cumulative voting allows minority SH to accumulate all of their votes and allocate them among a few or even one candidate • votes = shares owned * number of directors to be elected • It’s tricky! A majority SH may vote in such a way that he elects only a minority of the directors. • This is more likely to occur when one SH votes “straight” and another cumulates. Cumulative voting / 2 • If A has 60 shares and B 40, with five directors to be elected, and B can cumulate: – A1-60, A2-60, A3-60, A4-60, A5-60 – B1-67, B2-66, B3-65, B4-1, B5-1 • If B decides to do this, and A knows that B will try to elect three persons, then A, by properly cumulating his votes, can react and get four directors elected, in effect “stealing” one of B’s: – A1-73, A2-74, A3-75, A4-76, A5-2 – B1-67, B2-66, B3-65, B4-1, B5-1 Cumulative voting / 3 • The following formula can be used to determine how many votes of those present is sufficient to elect a specified number of directors using cumulative voting: x = [(a * b) / (c + 1)] + 1 – – – – “a” is the number of directors the SH seeks to elect “b” is the number of shares present and voting “c” is the number of directors being elected “x” is the number of shares needed to elect the specified number of directors. Cumulative voting / 4 • Another formula allows you to determine how many directors you can elect with a given number of shares: x = (n – 1) (d + 1) / s – “n” is the number of shares to be voted by the SH – “d” is the number of directors to be elected – “s” is the total number of directors that can be elected by n shares The nominees • A slate of director nominees is selected by the issuer’s board. It is included in the issuer’s proxy materials, paid for by the issuer. • SHs may nominate different candidates: – By showing up in person at a meeting – By preparing and distributing its own proxy materials, obtaining a list of SHs from the issuer, all at SH’s cost – “Advance notice” bylaws – 60 to 90, or 90 to 120 dd before the annual meeting – detailed information about the nominating stockholder, its nominees and its security holdings • “Proxy contests” vs “SH proposals” SHs proposals • Precatory proposals • Under Rule 14a-8 typically including proposals to: – – – – – – Redeem or weaken a company’s poison pill Eliminate staggered board terms Make SH voting confidential Adopt cumulative voting for directors Put the company up for sale Separate the positions of chairman of the board and chief executive officer – Create a nominating or compensation committee of the board composed entirely of independent directors Proxy contests • Typically occuring in connection with the company’s annual meeting of stockholders. • Submission of the nomination notice does not mean that a proxy contest will ensue. The dissident can withdraw its nominations at any time. • Parties generally have ample time for dialogue before the contest is truly joined and many proxy contests settle before a proxy statement is even filed. Proxy contests / 2 • Key aspects of Section 14, Securities Exchange Act of 1934: – The meaning of “solicitation” – The ability to engage in solicitation before furnishing a proxy statement – Exemption of certain communications from the proxy rules – The content of the proxy statement and proxy card – Filing requirements for written soliciting materials – Disclosure and anti-fraud rules Solicitation rules • Pursuant to Rule 14a-1(l)(1), the terms “solicit” and “solicitation” include the following: i. Any request for a proxy whether or not accompanied by or included in a form of proxy; ii. Any request to execute or not to execute, or to revoke, a proxy; or iii. The furnishing of a form of proxy or other communication to security holders under circumstances reasonably calculated to result in the procurement, withholding or revocation of a proxy. • SEC: including communications prior a formal solicitation aiming to influence voting decisions The free-communication rule • Rule 14a-12 allows an insurgent to solicit an unlimited number of shareholders before any proxy statement is filed, so long as no proxy card is furnished. • Written materials must be filed with the SEC, and give full disclosure. • By the time an actual proxy statement is finally ready to mail (if ever) a proxy participant can send all this information out to shareholders and the press, so that few fights will be more likely to be practically over or entirely settled. Important exemptions • Rule 14a-2: – Solicitations by certain persons not seeking proxy authority; – Solicitations of ten or fewer stockholders (the “Rule of Ten”). • Rule 14a-4: – It allows a dissident to run a slate of fewer directors than there are seats up for election by obtaining authority to vote for some of the registrant’s own nominees (the “Short slate” rule); – In 2009 the SEC permitted each of two dissidents to round out its slate by including nominees of the other, not merely nominees of the issuer. The proxy card • In traditional proxy contests, both sides distribute voting forms which permit SHs to vote only for that side’s nominees. • In short slate contests, the dissident may complete the by listing specific company nominees in addition to the dissident nominees. The company’s forms, in turn, will only list its nominees. • Rule 14a-4 specifies requirements for the form of proxy card, designed to ensure that the proxy card itself is an impartial document. The new proxy access rule • Under Rule 14a-11 the company will be required to provide on its proxy card a means to vote for each company and proxy access nominee, enabling investors to vote for any combination of company and dissident nominees. • Limitations: – 3% ownership requirement; – 3 year (+120 days) holding period; – Nominations for up to 25% of the seats on the board of directors – Nominees must meet independence criteria Is proxy access really effective? • “Just vote no” campaigns. • Switch from plurality to majority voting • Elimination of discretionary voting by brokers for “routine” issues, such as all uncontested director elections, absent voting instructions by the customer. • Delaware law now permits SHs to adopt tailor-made proxy access rules. Italy’s slate vote • Article 147-ter, TUF - Election and composition of the Board of Directors: 1. The Statute provides for members of the Board of Directors to be elected on the basis of the list of candidates and defines the minimum participation share required for their presentation, at an extent not above a fortieth of the share capital or at a different extent established by Consob with the regulation taking into account capitalization, floating funds and ownership structures of listed companies. Italy’s slate vote / 2 • Article 144-quater, Consob Rules on Issuers: Submission of lists of candidates for the election of the board of directors Shareholdings required Company’s market capitalization > €15 Bio. 0.5% €3.75 Bio. < x ≤ €15 Bio. 1% €1.875 Bio. < x ≤ €3.75 Bio. 1.5% €750 Mio. < x ≤ €1.875 Bio. 2% €375 Mio. < x ≤ €750 Mio. 2.5% ≤ €375 Mio. 4.5% or 2.5% Italy’s slate vote / 3 • Article 147-ter, TUF: 3. … at least one member shall be elected from the minority slate that obtained the largest number of votes and is not linked in any way, even indirectly, with the shareholders who presented or voted the list which resulted first by the number of votes. Italy’s slate vote / 4 • Compared to traditional proxy contests: – Lower costs – Dissemination of information • Compared to proxy access: – Lower shareholding – No minimum holding period • Compared to cumulative voting: – No tricks – More flexibility in using a ready at hand tool to obtain board representation