1. The Social Marginal cost function is MC . The optimal quantity is

advertisement

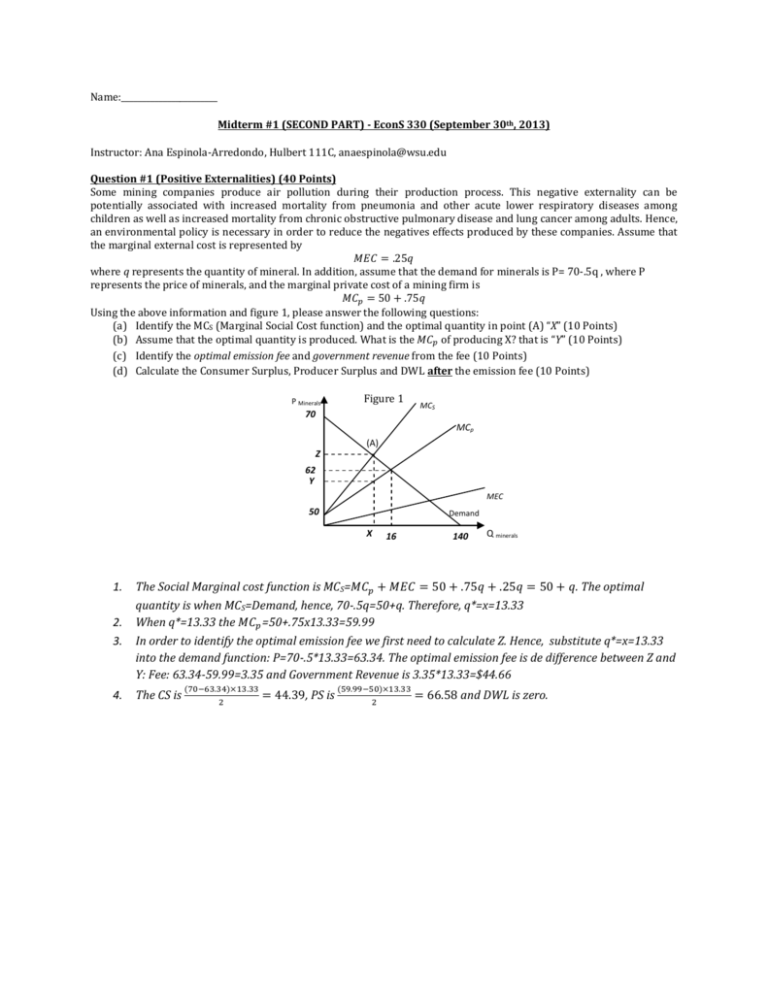

Name:_______________________ Midterm #1 (SECOND PART) - EconS 330 (September 30th, 2013) Instructor: Ana Espinola-Arredondo, Hulbert 111C, anaespinola@wsu.edu Question #1 (Positive Externalities) (40 Points) Some mining companies produce air pollution during their production process. This negative externality can be potentially associated with increased mortality from pneumonia and other acute lower respiratory diseases among children as well as increased mortality from chronic obstructive pulmonary disease and lung cancer among adults. Hence, an environmental policy is necessary in order to reduce the negatives effects produced by these companies. Assume that the marginal external cost is represented by where q represents the quantity of mineral. In addition, assume that the demand for minerals is P= 70-.5q , where P represents the price of minerals, and the marginal private cost of a mining firm is Using the above information and figure 1, please answer the following questions: (a) Identify the MCS (Marginal Social Cost function) and the optimal quantity in point (A) “X” (10 Points) (b) Assume that the optimal quantity is produced. What is the of producing X? that is “Y” (10 Points) (c) Identify the optimal emission fee and government revenue from the fee (10 Points) (d) Calculate the Consumer Surplus, Producer Surplus and DWL after the emission fee (10 Points) P Minerals Figure 1 70 MCS MCp (A) Z 62 Y MEC 50 Demand X 16 140 Q minerals 2. 3. The Social Marginal cost function is MCS= . The optimal quantity is when MCS=Demand, hence, 70-.5q=50+q. Therefore, q*=x=13.33 When q*=13.33 the =50+.75x13.33=59.99 In order to identify the optimal emission fee we first need to calculate Z. Hence, substitute q*=x=13.33 into the demand function: P=70-.5*13.33=63.34. The optimal emission fee is de difference between Z and Y: Fee: 63.34-59.99=3.35 and Government Revenue is 3.35*13.33=$44.66 4. The CS is 1. , PS is and DWL is zero. Question #2 (Coase Theorem) (20 Points) The government wants to preserve a forest which has 10,000 acres of oaks. The policy-makers are concerned about the efficient number of oaks that should be preserved. They also want to know what will be the net present value of preserving the forest during 4 years when the interest rate is equal to 8% (Hint: assume that the net benefit is the same in every year and start in period t=1). Assume that the demand is equal to P = 150 – 0.5Q, where P and Q are the price and quantity, respectively. In addition, the Marginal Cost is MC= Q. / divided by 1.5 Price of oaks Marginal Cost 150 Net Benefit = 150X100/2 = 7,500 100 Demand Quantity of oaks 300 100 Question #3 (Dynamic Efficiency) (40 Points) You have been assigned to determine the Dynamic Efficient allocation of oil (Depletable resource). Please take into account that the consumption of current generations should not affect the consumption of future generations. Assume that the inverse demand function for silver in period 1 is P1 = 80 – q1 and the demand function in period 2 is half of the demand of period 1. That is, future generations prefer to consume renewable than Depletable resources. Assume that the Marginal Cost in period 1 and Period 2 is constant and equal to MC=$4. In addition, assume that the discount rate is 6%, the total amount of the depletable resource is 70 tons. [Use only the first two significant digits of a number] (a) Find the Dynamic Efficient Allocation (10 Points) [Describe the three main equations: Present, Future and total quantity of the Depletable Resource]. Discuss your results. (b) Determine the optimal prices and Marginal User Cost (MUC) in both periods (present and future).(10 Points) (c) Construct a graph representing the dynamic efficient allocations in both periods. (10 Points) (d) Would the static and dynamic efficiency criteria yield the same answers for this problem? Why? (10 Points) Notice that represents the Marginal User Cost (MUC) Equalizing (1) and (2): Hence, Substituting (B) into (3), and Individuals in period 2 consume considerably less units given the specific characteristic of the demand function. Future generations prefer to consume other type of renewable energy; hence, the total allocation in period 2 is lower. (b) Hence substituting q1 into P1 and q2 into P2, we have that P1=29 and P2=30.5, and MUC1=25 and MUC2=25 (c) graphs: Price Price 80 40 29 30.5 4 MC MC 4 Demand Demand 51 80 Quantity 19 80 Quantity (d)Let us analyze the static efficient allocation: D=MC Period 1: 80-q1=4 hence q=76 Period 2: 40-0.5q2 =72 Hence, the above allocations are higher than those obtained in part (a). In fact, future generation will be worse off, despite the fact that they are represented by a different demand function. In the case of the dynamic efficiency, future generations will consume 19 units, however, using a static point of view they will consume zero units (72>70). The resource will be completed exhausted in period 1. OPTIONAL QUESTION: BONUS POINTS [10 Points] There are three consumers of a public good. The demands for the consumers are as follows: Consumer 1: P1 = 60 – Q Consumer 2: P2 = 100 – Q Consumer 3: P3 = 140 - Q Where Q measures the number of units of the good and P is the price in dollars. The Marginal Cost of the public good is $180. What is the economically efficient level of production of the good? Illustrate your answer on a clearly labeled graph. We know that the MSB = Demand 1 + Demand 2 + Demand 3. Therefore: MSB = 60 – Q + 100 – Q + 140 – Q MSB = 300 – 3Q The economically efficient level of output occurs where MSB = MC. Since this occurs where all three consumers are in the market we have: 300 – 3Q = 180 Q = 120/3 Q = 40