Royalty Manager™ Brochure

advertisement

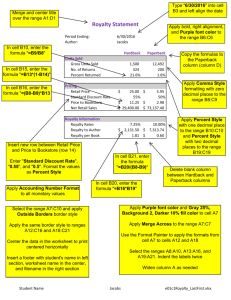

n o r t h w e s t o i l , g a s , a n d m in e r a l m a n a g e m e n t s e r v i c e s NEW Royalty Manager 4 Production and Royalty Verification ™ We speak the gas company’s language. 4 Tax Information Reporting 4 Automated Royalty Payment Processing Let us help protect your interests.* 1-800-572-6972 ext. 78901 • OilandGasHelp.com *Northwest Savings Bank provides this information for general guidance only, and the contents do not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting. NEW Royalty Manager ™ Northwest can give you the confidence, certainty, and information you need to better understand what is happening with your lease and affecting your future.* Designed for: • • • • • • • Individuals or businesses Farmers and timber acreage owners Landowner groups Owners of severed oil, gas, and mineral interests Absentee royalty owners Municipalities, authorities, and other government agencies Charities, endowments, and foundations We’ve got the answers: • Helpful Tips • Interactive Shale Maps • Upcoming Events • Oil and Gas Expert Blog OilandGasHelp.com n o r t h w e s t o i l , g a s , a n d m in e r a l m a n a g e m e n t s e r v i c e s Why You Need It • Make More Sense of Your Royalty Dollars. Complex and detailed oil and gas royalty documents can be a nightmare to read and comprehend – let alone verify. Northwest’s Royalty Manager™ summarizes, organizes, and prepares custom statements of your royalty income so you have a comprehensive record for tax purposes. • Keep Your Royalty Income on a Need to Know Basis. You value your land. You also value your privacy. When royalties roll in, curiosity can grow. Discreet in-home banking from Northwest’s Royalty Manager™ will ensure your private business stays that way. • Make the Most of a Taxing Situation. Northwest’s Royalty Manager™ provides timely statements for tax preparation and looks for potentially deductible expenses you may have missed to help you and your tax preparer offset oil and gas income and prevent the overpayment of taxes. • Be Sure You’re Paid for Selling Something You Can’t See. When a farmer sells his crop, or a landowner his timber, he can easily verify the basis for payment. But when you receive royalties, you’re selling something you can’t see. How do you know if you are being paid what you are owed? Let the experts at Northwest help. Features and Benefits • Trust. Enjoy peace of mind with expert verification of payments and auditing of royalty calculations. • Convenience. Discreet in-home banking, including automated deposit of royalty checks and automated direction of funds. • Expertise. You’ll have the expert resources oil and gas companies have always had, including timely statements for tax preparation. • Experience. Learn from the experiences of others to avoid making the same mistakes, including lease offer review and evaluation. n o r t h w e s t o i l , g a s , a n d m in e r a l m a n a g e m e n t s e r v i c e s 1 2 Enroll: Once you sign up with Northwest’s Royalty Manager,™ your oil and gas royalty payments are received and processed by our staff each month. Review: Your royalty account statement or check detail is examined and compared to your lease, division order, and declaration of pooling and unitization. Reconcile: 3 4 5 Production, price, and expense data is reviewed and any discrepancies are flagged, triggering the Royalty Manager™ reconciliation process. How Royalty Manager Works ™ Deposit: Your royalty proceeds are deposited within 24-48 hours of verification into the checking, savings, tax escrow, investment, trust, or other accounts of your choosing. Summarize: Detailed account data is compiled and summarized for your ready reference in monthly Royalty Manager™ statements from Northwest. Additional Resources • Most customers find it helpful to consult with Northwest’s financial advisors, free of charge, when deciding upon the allocation of their monthly royalty deposits. • We recommend that you consult with your tax advisor to learn the best percentage to set aside each month in a tax reserve account to cover future tax liabilities. • In addition to the monthly statement, you will also receive an annual statement which will include a year-to-year review of the price, production and expense items shown in the monthly statements, as well as an itemized statement of expense items for tax preparation purposes. Royalty Manager™ protects your interests, simplifying what’s complicated and confusing. JOHN DOE 123 MAIN STREET ANYTOWN, PA 45678 1 3 2 4 5 6 7 8 9 10 11 12 13 22 14 15 16 17 18 19 20 21 23 24 25 1 Property Location Description 2 State and County 15 Gross Value of Owner Net 3 Product Transaction Date: Month-Year 16 Tax Amount from Owner Net 4 Type of Product 17 Tax Code 5 Owner Decimal Interest 18 Deduction Amount from Owner 6 Type of Interest 19 Deduction Code 7 British Thermal Unit (Measure of the Heat Value of Gas) 20 WPT 8 Unit Price Per Barrel or MCF 21 Net Value of Owner, After Taxes and Deductions 9 Quantity of Product Transacted in Barrels or MCF 22 Property Number and Name 10 Total Value: Volume x Unit Price 23 Sum of Net Amount for All Properties 11 Tax Deducted from Gross 24Sum of Net Amount for Oil 12 Deduction Amount from Gross 25Sum of Net Amount for Gas 13 Gross Value After Tax and Deductions 14 Net Volume: Owner’s Net Interest 1-800-572-6972 ext. 78901 • OilandGasHelp.com *Northwest Savings Bank provides this information for general guidance only, and the contents do not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting. The right bank. The right people. The right answers. About Us Northwest Bancshares, Inc. is the chartered savings and loan holding company that operates Northwest Savings Bank, headquartered in Warren, PA. Founded in 1896, the bank operates community banking offices in Pennsylvania, New York, Ohio, and Maryland. In light of this history of service — and in an effort to better address our customer’s growing current and future needs — Northwest identified a need to provide a special level of service to its landowner customers throughout this expanding oil and gas producing region. Northwest Savings Bank has long experience working with oil and gas royalty owners, helping our customers throughout Pennsylvania’s traditional oil and gas “patches” with their banking, lending and investment needs. We have branches in most of the counties in which Marcellus and Utica Shale leasing has occurred or is likely to occur. The result? Our Oil, Gas, and Mineral Services Division. Our goal is to serve as your trusted, local resource and advisor in this often confusing and intimidating industry. We hope you’ll come to think of Northwest as “The Right Bank, The Right People, The Right Answers.” If you would like to schedule an appointment to discuss specific oil and gas lease income issues, contact us today for a free consultation. Attorney Bud Shuffstall Senior Oil, Gas, and Mineral Officer (800) 572-6972, ext. 78902 bshuffstall@nwbcorp.com Tabitha Bean Operations Officer (800) 572-6972, ext. 78901 tbean@nwbcorp.com Attorney Chris Junker Oil, Gas, and Mineral Officer (800) 572-6972, ext. 78903 cjunker@nwbcorp.com Pictured from left to right: Bud Shuffstall, Tabitha Bean, Chris Junker 1-800-572-6972 ext. 78901 • OilandGasHelp.com