Regulatory Guide 234 - Australian Securities and Investments

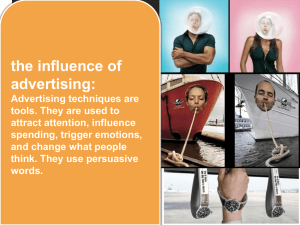

advertisement