[Insert DD Month YYYY] [Insert Client Name] [Insert Client Position

advertisement

![[Insert DD Month YYYY] [Insert Client Name] [Insert Client Position](http://s3.studylib.net/store/data/008961031_1-9a680caec907673272a1c092ea3671af-768x994.png)

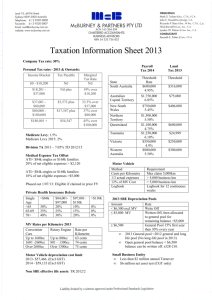

[Insert DD Month YYYY] [Insert Client Name] [Insert Client Position] [Insert Company Name] [Insert Company Address] [Suburb State Post Code] Dear [Insert Client Name] Re: SUPERANNUATION YEAR END PLANNING As the end of the 2014-2015 financial year is now upon us, I am writing to encourage you to contact our office to arrange a meeting to discuss some tax saving options for your business relating to superannuation matters. Executive Summary Superannuation contributions are divided into two categories – concessional and nonconcessional contributions: i) concessional contributions – includes employer contributions (including salary sacrificed contributions) and contributions by self-employed persons which are claimed as a tax deduction ii) non-concessional contributions – generally all contributions where a tax deduction is not claimed (i.e. contributions from after tax dollars, co-contribution and spouse contributions). Current treatment of contributions into superannuation i) Concessional Contributions An employer is eligible to claim a full tax deduction for all super contributions made on behalf of an employee (subject to contribution rules being satisfied). Furthermore, those individuals that that are self-employed are able to claim a full deduction for their superannuation contributions as well as being eligible for the Government co-contribution for their after-tax contributions. The following tables set out the caps for concessional contributions: General Cap Income year Concessional Contributions Cap (p.a.) 2014 $25,000 2015 $30,000 Concessional contributions cap for ‘older Australians’ Income year Cap for those aged 49 years or over on 30 June 2014 $35,000 2015 $35,000 Importantly, since 1 July 2013, contributions made by an employer (or a self-employed individual) into a superannuation fund in respect of an employee that exceed the annual concessional contribution caps (see table above) are not subject to excess contributions tax. The employee is required to include the excess amount in their assessable income to be taxed at the employee’s marginal tax rate, but will be entitled to an offset equal to the 15% tax paid on the contribution by the superannuation fund. In addition, the excess contributions will attract the Excess Concessional Contribution (ECC) charge to recognise that the tax is collected later than normal income tax. The ECC charge is payable on the increase in tax liability in the year the excess concessional contributions are made. The ECC charge is calculated from the start of the income year in which the excess contributions were made until the date that the tax is due to be paid under the tax assessment for the year that includes the excess concessional contributions 1. Employees may also elect to withdraw up to 85 percent of their excess concessional contributions from their superannuation fund. Any excess concessional contributions withdrawn from their fund will not count towards their non-concessional contributions cap. Careful consideration should also be given to employees (and the self-employed) whose adjusted taxable income and concessional contributions, when added together, exceed $300,000 (the “Division 293 threshold”). In these situations, the amount of the concessional contributions made on behalf of the employee (or by the self-employed) to the superannuation fund, which is in excess of the $300,000 Division 293 threshold, will be subject to 15% tax. We highlight that this tax on contributions that exceed the Division 293 threshold is in addition to the standard 15% tax on concessional superannuation contributions. ii) Non concessional Contributions The non-concessional cap is $180,000 for the 2015 income year for all individuals under the age of 752. Individuals that are aged 64 and under have the option of bringing forward the next two years’ contributions, which allows additional non-concessional contributions to be made, up to a maximum of $360,000 in the 2014-15 year. By way of illustration, this means you can make a non-concessional contribution of $540,000 in the 2014-15 year. Under this approach you will not be able to make a further non-concessional contribution until the beginning of the 2017-18 year. Individuals may also elect to withdraw any excess concessional contributions made since 1 July 2013 and 85 per cent of any associated earnings from their superannuation fund. These earnings will be taxed at the individual’s marginal tax rate. Any excess non-concessional contributions not withdrawn will be taxed at 47% and the amount of tax paid in relation to the excess non-concessional contributions must be withdrawn from the super fund under the compulsory release authority issued by the ATO. Note that in addition to the above, where an entity is eligible to apply the Small Business 15 year exemption or the Small Business CGT Retirement concession, the entity will be eligible to rollover up to an additional $1,355,000 (CGT cap amount) into the superannuation fund of a “significant individual” of the entity. The $1,355,000 amount will not count toward either the concessional contribution cap or the non-concessional contribution cap. To arrange a meeting to further discuss the superannuation regime, please do not hesitate to contact me on [insert telephone number of partner]. Yours faithfully [insert name of partner] 1 The ECC charge rates for March 2015 and June 2015 quarters are 5.75% and 5.36% respectively. 2 If a member is 75 or over a fund is only permitted to accept employer superannuation contributions (i.e. concessional contributions)