Investment Gains and Losses on Trading Account Assets Supporting

advertisement

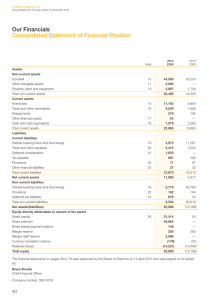

Investment Gains and Losses on Trading Account Assets Supporting Insurance Liabilities and Changes in Experience-Rated Contractholder Liabilities Due to Asset Value Changes Certain products included in the Retirement and International Insurance segments, are experience-rated in that investment results associated with these products are expected to ultimately accrue to contractholders. The investments supporting these experience-rated products, excluding commercial mortgage and other loans, are classified as trading and are carried at fair value. These trading investments are reflected on the statements of financial position as “Trading account assets supporting insurance liabilities, at fair value.” Realized and unrealized gains and losses for these investments are reported in “Asset management fees and other income.” Interest and dividend income for these investments is reported in “Net investment income.” Commercial mortgage and other loans that support these experience-rated products are carried at unpaid principal, net of unamortized discounts and an allowance for losses, and are reflected on the statements of financial position as “Commercial mortgage and other loans.” Adjusted operating income excludes net investment gains and losses on trading account assets supporting insurance liabilities. This is consistent with the exclusion of realized investment gains and losses with respect to other investments supporting insurance liabilities managed on a consistent basis. In addition, to be consistent with the historical treatment of charges related to realized investment gains and losses on investments, adjusted operating income also excludes the change in contractholder liabilities due to asset value changes in the pool of investments (including changes in the fair value of commercial mortgage and other loans) supporting these experience-rated contracts, which are reflected in “Interest credited to policyholders’ account balances.” The result of this approach is that adjusted operating income for these products includes net fee revenue and interest spread we earn on these experience-rated contracts, and excludes changes in fair value of the pool of investments, both realized and unrealized, that we expect will ultimately accrue to the contractholders. Results for the years ended December 31, 2009, 2008 and 2007 include the recognition of net investment gains of $1.601 billion, net investment losses of $1.734 billion, and net investment gains of zero million, respectively, on “Trading account assets supporting insurance liabilities, at fair value.” These net investment gains and losses primarily represent interest-rate related mark-to-market adjustments, which include the impact of changes in credit spreads on fixed maturity securities. Consistent with our treatment of “Realized investment gains (losses), net,” these gains and losses, which are expected to ultimately accrue to the contractholders, are excluded from adjusted operating income. In addition, results for the years ended December 31, 2009, 2008 and 2007 include an increase of $899 million, and decreases of $1.163 billion and $13 million, respectively, in contractholder liabilities due to asset value changes in the pool of investments that support these experience-rated contracts. These liability changes are reflected in “Interest credited to policyholders’ account balances” and are also excluded from adjusted operating income. Net investment gains and losses net of the increase / decrease in contractholder liabilities due to these asset valuation changes resulted in net gains of $702 million in 2009 and net losses of $571 million in 2008. This primarily reflects timing differences between the recognition of the interest-rate related mark-to-market adjustments and the recognition of the recovery of these mark-to-market adjustments in future periods through subsequent increases in asset values or reductions in crediting rates on contractholder liabilities. Decreases to these contractholder liabilities due to asset value changes are limited by certain floors and therefore do not reflect cumulative declines in recorded asset values of $35 million as of December 31, 2009 and $645 million as of December 31, 2008. We have recovered and expect to recover in future periods these declines in recorded asset values through subsequent increases in recorded asset values or reductions in crediting rates on contractholder liabilities. In addition, as prescribed by U.S. GAAP, changes in the fair value of commercial mortgage and other loans held in our general account, other than when associated with impairments, are not recognized in income in the current period, while the impact of these changes in value are reflected as a change in the liability to fully participating contractholders in the current period. Included in the amounts above related to the change in the liability to contractholders as a result of commercial mortgage and other loans are increases of $105 million, decreases of $144 million, and increases of $40 million, for the years ended December 31, 2009, 2008 and 2007, respectively. Valuation of Assets and Liabilities Fair Value of Assets and Liabilities The authoritative guidance related to fair value established a framework for measuring fair value that includes a hierarchy used to classify the inputs used in measuring fair value. The hierarchy prioritizes the inputs to valuation techniques used to measure fair value into three levels. The level in the fair value hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement. See Note 20 to the Consolidated Financial Statements for a description of these levels. Prudential Financial 2009 Annual Report 59