The CGA Program of Professional Studies is a part

advertisement

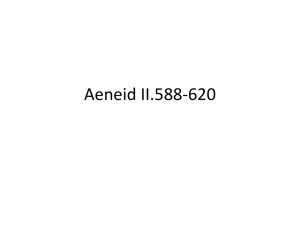

CGA’s program of professional studies is designed to offer students the opportunity to study part-time while pursuing full-time employment and career advancement. The program offers four sessions annually and students normally register for one course per session as they are working full-time. Please refer to the CGA Manitoba web site at www.cga-manitoba.org for a listing of course prerequisites. LEVEL Course commences Foundation Studies Level 1 FALL SESSION 1 WEEK OF SEP 6, 2011 WINTER SESSION 2 WEEK OF DEC 5, 2011 SPRING SESSION 3 WEEK OF MAR 12, 2012 SUMMER SESSION 4 WEEK OF JUN 4, 2012 FA1 FA1 FA1 *FA1 *LW1** EM1 LW1 *EM1 Level 2 FA2 Level 3 Advanced Studies Level 4 PACE EXAMS *LW1 *FA2 *FA2 QU1 MA1 *MA1 *CM1 *CM1 FA3 FN1 MS1 *BC1 *FA3 *FA3 *BC1 *BC1 MA2 AT1 AU1 *MA2 FA4 TX1 *AT1 *AU1 *BC2 *TX1 *BC2 *BC2 *FA4 MU1 FN2 TX2 *FN2 MS2 *MU1 *TX2** AU2 PA1 PA1 PA2 PA2 PF1 Nov 28-Dec 3, 2011 Mar 5-10, 2012 *BC1 *PF1 Jun 4-9, 2012 Aug 28-Aug 30, 2012 * Courses & business cases listed with (*) are normally offered in that session without in-class lecture support. ** Limited enrollment. Course and exam will be based on 10/11 materials. Students deferring these exams or writing a supplemental will be responsible for updating to the 11/12 materials. The CGA Program of Professional Studies is a part-time program delivered through online studies. To ensure success in the program a variety of flexible learning resources have been developed. CERTIFIED GENERAL ACCOUNTANTS ASSOCIATION OF MANITOBA 4 DONALD STREET SOUTH, WINNIPEG, MANITOBA R3L 2T7 TEL: (204) 477-1256 OR TOLL-FREE: 1-800-282-8001 FAX: (204) 453-7176 www.cga-manitoba.org E-mail: info@cga-manitoba.org Additional support resources include: • online audio lectures • optional in-class lectures • online access to course directors • peer-to-peer discussion boards • practice examinations • examination blueprints • interactive module notes • model financial statements The CGA association evaluates post-secondary courses for transfer credit in the CGA program. The Transfer Credit Schedule is prepared for information and guidance only. As course numbers and content change depending on the year of study, this schedule is subject to change without notice. Transfer credits granted will be based on the Association’s evaluation of the students’ academic credentials. Students may apply for advanced standing by forwarding a completed Application for Advanced Standing to the CGA office, along with official transcripts of marks and a resume of any related experience. Where multiple university/college courses are listed for a CGA credit, all the courses must be completed. A minimum course grade of C+ is normally required for transfer credit, unless otherwise stated. The Application for Advanced standing can be found on the CGA Manitoba website at www.cga-manitoba.org. MBA ACC 1100 ACC 6050 27001 16.151 Business Admin Business Admin Diploma Business Admin Degree ACCT -1002 ACCT -2044 ACCT-1971 ACCT-2043 ACCT-0003 ACCT-0004 ACCT0014 ACCT0015 ACCT0017 MGT1010 MGT1020 CO-101 CO-102 ACC 1101 473.23 BUS 110 Red River College LW1 Business Law GMGT 3300 FA2 Financial Accounting: Assets ACC 2010 QU1 Business Quantitative Analysis STAT 1000 GMGT 7080 STAT-1201 62.171 MATH-1020 MATH-0002 STAT 2000 MSCI 2150 ACC 1110 MSCI 6070 STAT-2102 62.172 62.272 BUS-2003 16.252 MATH-3001 MATH-0003 ECON-1102 22.131 ECON-1103 ECON-1022 ECON-0006 ECON-2000 ECON-0007 MGT1200 MGT1210 AD-106 AD-206 ECON 120 473.11 473.12 ECO 110 ECO 120 BUS-3660 16.293 ADMIN-3001 LAWG-0001 MGT1400 AD-102 GMGT 3301 471.34 BUS 394 BUS-3102 16.253 MGT2000 MGT2010 C0-201 ACC 2011 MA-201 STAT 1001 CO-205 STAT 2001 MSCI 2151 ACC 1111 Management Accounting Fundamentals ACC 6060 27035 27039 473.24 BUS 212 CM1 Business Communications GMGT 2000 GMGT 7710 FA3 Financial Accounting: Liabilities & Equities ACC 2020 FN1 Corporate Finance Fundamentals FIN 2200 FIN 6070 ADVANCED STUDIES Managing Information Systems BC1 Accounting Business Case MA2 Advanced Management Accounting Personal & Corporate Taxation TX1 MIS 2000 MIS 6150 *** External Auditing ACC 4010 Accounting Theory & ACC 4030 Contemporary Issues FA4 † Financial Accounting: Consol- ACC 3030 idations & Advanced Issues FN2 Advanced Corporate Finance FIN 3410** FIN 7070 FIN 3480** FIN 7150 ACCT-0006 MGT2020 BUS-3103 CO-202 27002 ECON-2819 16.278 MATH-1051 BUSN-0018 ECON-2820 FNCE-3002 BUSN-0017 ACS-1803 ACCT-3003 ACCT-0007 MGT2000 MGT2010 FI-202 FI-205 16.170 16.180 COMP-1975 COMP-0006 EBUS-1311 COMP-0010 IN-103 IN-104 *** ACCT-3002 COMP-0160 ACCT-3001 COMP-0161 *** *** BUS 3550 BUS 4005 16.355 16.454 BUS 4002 16.453 * For courses completed in 2008/09 and subsequent years. ** course exemption only – CGA challenge examination required *** Transfer credit for BC1 will be granted in cases where the applicant has completed the noted course and a college business diploma or a university business degree with transfer credits in FA1, FA2, FA3, CM1, MA1, MS1 and FN1. Credit in these courses alone is not sufficient for transfer credit in BC1. GMGT 2001 212.11 OR GMGT 2141 213.13 471.12 ACC 2021 FI-201 MGT2500 FNCE-3008 BUSN-0016 BUS-3003¤ 16.352 16.452 BUS 3120 16.356 16.459 AU1 AT1 ACCT-3004 27037 *** ACC 3040 ACC 4040 ACC 3050 ACCT 2005* ACCT-0005 CO-206 AN-102 AN-104 27041 ECON 1000 ECON 1010 LAWG-0002 ACCT-3000 ACCT-0008 MGT2030 RHET-1105 16.160 COMM -1110 COMM-1000 COMM-0006 COMM-0006 ART - 1310 16.260 COMM-2115 COMM-2000 COMM-0232 COMM-0232 ART - 1322 16.254 Canadian Mennonite University Office Admin ECON 1200 MA1 College Universitaire de SaintBoniface Business Admin Micro & Macro Economics 27034 University College of the North Business Admin EM1 MS1 PACE Assiniboine Community College Applied Accounting Financial Accounting Fundamentals FA1 MBA BUS-2002 Booth College B. Comm Continuing Education § 16.294 FOUNDATION STUDIES Program of Professional Studies Providence College Brandon University University of Manitoba CGA University of Winnipeg MGT - 2550 *** FIN 2201 474.32 BUS 270 MIS 2001 IN-202 *** *** BUSN-0108‡ BUSN-0109‡ BUSN-0110‡ ACC-4031 ¤ For courses completed in 2000/01 and subsequent years. § For courses completed in 2004/05 and subsequent years only. A grade of B or better required for CGA credit. ‡ A grade of B or better is required for CGA credit † Applicable for new students enrolling in the 2005/06 and subsequent years only. BUSI 2010