We see more than numbers.

advertisement

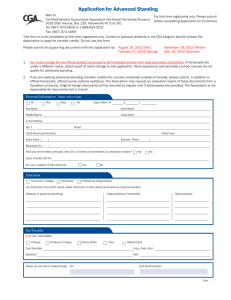

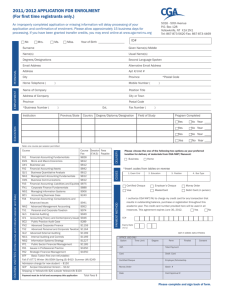

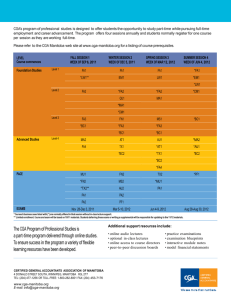

09/10 Program of Professional Studies C E R T I F I E D G E N E R A L ACCO U N TA N T S A S S O C I AT I O N O F M A N I TO B A We see more than numbers. Did you know Cover photo: Left: Angela Romeo, B.Comm.(Hons.), CGA, Auditor, Investors Group Inc. Right: Angela Guerra Walczak, B.Comm.(Hons.), CGA, Senior Auditor, Investors Group Inc. A PROGRAM DESIGNED FOR YOU • CGAs hold top positions and command maximum earning power • CGAs hold the most senior financial positions such as Presidents, CEOs, CFOs, Directors and Partners • CGAs rank in the TOP FIVE PERCENT of income earners in Canada • By picking up this Program and reading through it you have made the first step towards YOUR CGA Designation The CGA designation is recognized throughout Canada and around the world. It represents a network of 71,000 members and students working in Canada and abroad. TOP FIVE REASONS STUDENTS CHOOSE THE CGA PROGRAM 5. International mobility and global opportunities 4. Excellent employment prospects and a range of employment options 3. A well-recognized and highly respected designation and program 2. The ability to work while studying 1. Freedom to study anywhere, through online course delivery The CGA Program of Professional Studies provides you with the tools to succeed in business, no matter where your career takes you. You will possess the applied knowledge and demonstrated expertise that employers want, including specialized technical knowledge, sector-specific competencies, problem solving skills and the ethical integrity to lead. CGA’s competency-based curriculum is the best preparation for a successful career in financial management. It allows you to choose a professional studies path combined with real-world experience that best match your career aspirations. The Certified General Accountants Association of Manitoba is the largest and fastest-growing accounting body in the province. CGA Manitoba is the choice for professional education, training and support services. It is committed to innovation, member service excellence and advancing the public interest. Working full-time while studying sophisticated business concepts and applying them to comprehensive assignments and exams is a challenge that requires dedication. Students who put in the effort that the program demands will experience a lifetime of rewards. The designation will provide you the flexibility to work in any type of organization, in any industry, and at any level of management. Salary is commensurate with experience; refer to the salary chart below for exact numbers. With a CGA designation your opportunities are limitless. CGA Manitoba students are in demand — enjoying an employment rate of over 99%! The Accounting profession is recession-proof. AVERAGE STUDENT INCOME * AVERAGE GRADUATE INCOME * Level of the CGA Program Years following CGA certification $100,000 $50,000 $0 $120,000 $85,000 $36,000 1 $40,000 $43,000 $44,000 2 3 4 $54,000 5 $61,000 NEW CGA $75,000 2-8 9-15 ›15 * Source: Annual CGA Membership Survey thinkcga.org CERTIFIED GENER AL ACCOUNTANT S ASSOCIATION OF MANITOB A 0 9/10 P R O G R A M O F P R O F E S S I O N A L S T U D I E S 2 THE CGA DIFFERENCE – OPPORTUNITY, FLEXIBILITY, & FINANCIAL REWARD The CGA designation offers aspiring professionals a distinctive edge – opening doors to unlimited career opportunity. Enrollment in the CGA Program of Professional Studies develops the professional competencies that ensure success wherever you decide to take your business career. EXPAND YOUR OPPORTUNITIES GLOBALLY CGAs are committed to continuing professional development, adhere to a strict code of professional conduct and practice in the widest range of industries. For these reasons, the CGA designation is recognized throughout Canada and around the world as a pre-eminent standard of excellence and professionalism in all aspects of finance and business management. A CGA designation opens doors internationally and global mutual recognition agreements with the GETTING STARTED WHO CAN ENROLL? The CGA program is open to candidates with a variety of educational backgrounds: secondary school graduates, those with post-secondary credits, people with non-accounting degrees or diplomas, and internationally educated students are all eligible to enter the CGA program. To start the program, students must be a resident of Manitoba, with Canadian Citizenship or permanent resident status, or be legally permitted to work or study in Canada. ADVANCED STANDING Each applicant with previous related post-secondary education can have their credentials assessed through the Advanced Standing process to determine their entry point into the program. Transfer credits reduce the number of courses required to complete the CGA program. For more information on transfer credits, go to www.cga-manitoba.org. 3 Association of Chartered Certified Accountants (ACCA) , the largest and fastest-growing international accounting body in the world, and The Certified Public Accountants of Australia, the 6th largest accounting body, allow for international mobility for CGA members. EARN WHILE YOU LEARN The CGA program allows you to work full-time in a related position while you complete your CGA studies—to earn and learn. It is a signature advantage of the CGA program, allowing you to enjoy the benefits of a full-time salary and career advancement while learning as a parttime student. While the CGA program is academically demanding, the use of the latest integrated technologies will provide you with additional learning supports such as online audio lectures, course directors, study groups, and so on. PROGRAM ADMISSION REQUIREMENTS You must have a good understanding of the essential elements of business arithmetic and basic algebra, including: arithmetic operations, algebraic concepts, simple and compound interest, annuities and statistics. In addition, you are expected to have at least Grade 12 written and spoken English skills. Applicants with English as an Additional Language should possess a minimum Canadian Language Benchmark score of at least a 7 in each category. STUDY SKILLS The CGA Program of Professional Studies is a demanding program. You will also be working in the profession of your choice while completing your designation. Therefore, it is recommended that all students ensure they have effective study skills and are able to balance the significant demands of student/work life. To help them prepare for their studies, all new CGA students have access to the CGA Study Guide within the online learning environment. 0 9/10 P R O G R A M O F P R O F E S S I O N A L S T U D I E S STUDY METHOD CGA’s Program of Professional Studies is designed to offer you the opportunity to study part-time while pursuing full-time employment and career advancement. The program consists of fours sessions per year and students normally enroll in one course per session. Most CGA courses are structured with 10 weekly modules of required readings for each session. CGA’s innovative course design integrates a wide range of technologies, using online learning resources to support efficient learning and business software to develop students’ abilities to use technology as an effective business decision tool. The flexible online course delivery of the CGA program will allow you to complete your studies from virtually any location! In 2008 the average amount of time CGA students needed to put into their studies was 20 to 25 hours per week. One last thing Remember—accountants who just count beans are like students who don’t think outside the box—you’ll succeed but you certainly won’t get what you dreamed of. Now’s your chance to find what you’ve been searching for. CERTIFIED GENER AL ACCOUNTANT S ASSOCIATION OF MANITOB A thinkcga.org The CGA Program The CGA Program consists of three requirements: 1 CGA Courses and Exams 2 Degree Requirement 3 Practical Experience WHERE DO I BEGIN IN THE PROGRAM? The CGA program is a flexible program of professional studies. Your previous education determines your starting place within the program. We identify your starting point based on a review of your post-secondary transcripts. We want to be sure that you begin your professional studies at the right level. Wor Expe k rien ce BUSINESS DEGREE BUSINESS DIPLOMA l: PACE Leve rogram P e e r g e ed D Integrat Level 4 : s e i d u t dS Advance s 1–3 l e v e L : Studies n o i t a d Foun SINESS DEGREE OR DIPLOMA THE OP 4 ACCESS PATH 0 9/10 P R O G R A M O F P R O F E S S I O N A L S T U D I E S CERTIFIED GENER AL ACCOUNTANT S ASSOCIATION OF MANITOB A thinkcga.org CGA Courses and Exams The CGA Program of Professional Studies consists of 19 courses and examinations plus two comprehensive business cases. CGA courses and business cases are divided into three components: I. Levels 1, 2 and 3 II. Level 4 III. PACE Level FOUNDATION STUDIES: LEVELS ONE TO THREE PACE LEVEL: PROFESSIONAL APPLICATIONS AND COMPETENCE EVALUATIONS Foundation Studies provides a solid understanding of full-cycle financial accounting. LEVEL ONE Financial Accounting Fundamentals Micro & Macro Economics Business Law FA1 EM1 LW1 LEVEL TWO Financial Accounting: Assets Business Quantitative Analysis Management Accounting Fundamentals Business Communication FA2 QU1 MA1 CM1 LEVEL THREE Financial Accounting: Liabilities & Equities Corporate Finance Fundamentals Managing Information Systems Accounting Business Case FA3 FN1 MS1 BC1 PACE is the final level of studies prior to certification as a CGA. At this level, students must complete four courses, each course having a four-hour professional certification examination. These 16 hours of examinations are the certification exams used to assess the competencies and knowledge required to receive the CGA designation. PACE CAREER ELECTIVES Advanced Studies covers advanced topics in financial and management accounting as well as the key professional concepts and knowledge in audit and taxation. FA4 MA2 TX1 AT1 AU1 BC2 Choose from six different PACE Career Elective courses: Public Sector Financial Management Information Systems Strategy Internal Auditing & Controls Advanced Corporate Finance Advanced Personal & Corporate Taxation Advanced External Auditing thinkcga.org PF1 MS2 MU1 FN2 TX2 AU2 FINANCIAL MANAGEMENT CAREER OPTIONS The following are suggested financial management career option streams for the PACE elective courses. Corporate and small-medium enterprise (SME) For students interested in managing the resources of corporate entities, including SMEs, with emphasis on capital investment decisions, long-term planning, and competitive analysis. Suggested electives: Information technology For students pursuing careers related to the analysis, design, and implementation of computer-based information systems from a management end-user perspective, or for those involved in management auditing, including IT auditing, and systems development activities. Suggested electives: Students choose the two courses and examinations that will best prepare them for success in the area or sector they wish to concentrate on for their careers. ADVANCED STUDIES: LEVEL FOUR Financial Accounting: Consolidations & Advanced Issues Advanced Management Accounting Personal & Corporate Taxation Accounting Theory & Contemporary Issues External Auditing Public Practice Audit Case Foundation Studies Advanced Studies Professional Applications and Competence Evaluations FN2 & MU1 or MS2 MS2 & MU1 Government and not-for-profit For students pursuing careers in the public sector, association management, charitable and not-for-profit organization management, health service organizations, and education. Emphasizing public sector accounting, not-for-profit reporting issues, expenditure controls, and strategic planning. Suggested electives: PF1 & MU1 or MS2 Public practice Prepares students to succeed in a public practice career providing accounting, auditing, tax planning, and business consulting services to corporate and SME clients. Suggested electives: AU2 & TX2, TX2 & MS2 Other options Students may design a personal career option different from any of the four recommended financial management career options. It must include PA1 and PA2, and two other elective courses/ exams selected from the PACE level, but may not include both the MU1 and AU2 electives. CERTIFIED GENER AL ACCOUNTANT S ASSOCIATION OF MANITOB A 0 9/10 P R O G R A M O F P R O F E S S I O N A L S T U D I E S 5 Degree Requirement All CGA students are required to obtain a bachelor’s degree prior to certification. The degree may be from any approved post-secondary degree-granting institution and may be obtained in any field of study. While not an entrance requirement to the CGA program, CGA students must meet the degree requirement prior to certification. No degree? No problem! CGA’S EXCLUSIVE INTEGRATED DEGREE OPPORTUNITY PACE CAPSTONE COURSES The final two compulsory academic requirements of the CGA program are the PACE Capstone Courses and examinations. These professional applications courses use case studies and business simulations to cover new topics, and provide students with the opportunity to integrate and apply knowledge they have acquired throughout the first four levels of the program. Students hone their skills and knowledge and develop key competencies in communication, strategy, time management and leadership. Issues in Professional Practice Strategic Financial Management PA1 PA2 Issues in Professional Practice (PA1) draws on knowledge of financial reporting, taxation and auditing. This course requires students to integrate and apply competencies that a professional accountant external to the organization must possess. Students develop and demonstrate the ability to anticipate and solve the real-world problems faced by external auditors and professionals providing business advisory services. Strategic Financial Management (PA2) develops the professional competencies required to effectively manage an organization’s financial affairs from an internal perspective. Students must demonstrate their ability to integrate and apply knowledge of management accounting, finance and management information systems. thinkcga.org Through an innovative post-secondary partnership with Laurentian University, CGA offers students who enter the CGA program without a bachelor’s degree an efficient way to achieve one. CGA’s integrated degree courses are designed for part-time distance learning and are completed as students study towards their CGA designation. CGA students can complete an Honours Bachelor of Commerce degree concurrently with their CGA studies. CGA jointly administers the degree course registration and delivery processes – offering an efficient and affordable path to achieving an accredited business degree and satisfying CGA’s degree requirement. The Honours Bachelor of Commerce Degree Program combines versatile management education and core business skills that compliment CGA’s accounting and financial management professional studies. It provides students a breath of highly relevant professional business competencies. For more information, visit www.cga.laurentian.ca CGA and MBA – A Powerful Graduate and Professional Education Partnership Students enrolling in the CGA program with a Bachelors degree may be interested in taking advantage of CGA’s unique partnership with Laurentian University to obtain an MBA degree concurrently with their CGA studies. Admission to this graduate level business degree is competitive, based on an applicant’s portfolio of demonstrated experience and education. Find out more at www.cga.laurentian.ca. Have a degree from outside of Canada? Equivalent international degrees may also meet this requirement. Be sure to include your transcripts when you apply for advanced standing. The Five Sectors of Business in which CGAs Work CERTIFIED GENER AL ACCOUNTANT S ASSOCIATION OF MANITOB A 0 9/10 P R O G R A M O F P R O F E S S I O N A L S T U D I E S 6 Practical Experience The application of knowledge through practical experience, concurrent with the study of conceptual knowledge, is integral to developing a well-rounded professional. Further, the freedom to obtain experience in a variety of accounting and financial management positions is one of the major advantages of CGA’s certification process. GROWTH THROUGH RESPONSIBILITY CGA practical experience is assessed on the basis of demonstrated professional competencies. To qualify for certification, candidates must demonstrate through approved work experience, a professional level of proficiency in a broad set of relevant competencies. The competency set is determined and continuously updated by CGA Canada’s practice analysis research. Achieving sufficient competency generally requires 36 months of full time employment, with a component at a professional level. The evaluation of your experience will occur throughout your time in the program. The assessment is completed through an online experience assessment questionnaire that will be validated by your employer and assessed by the Association. For the experience to be considered acceptable, you are expected to be employed in a position that requires the application of knowledge, independent thinking, and responsibility for preparing and interpreting financial information. EXPERIENCE IN ANY SECTOR You may obtain practical experience in any sector of the economy. During the course of their studies, many students change their employment position, moving not only from one industry to another, but from one branch of the profession to another. The freedom to obtain experience in a variety of accounting and financial management positions is one of the major advantages of the CGA program. Examples of Professional Level Responsibilities: Finance, Accounting & Management Control • Accounting for business combinations • Calculating earnings per share • Supervising employees • Performing job costing • Preparing budgets and variance analysis • Cash flow planning • Evaluating cost of capital Information Systems • Performing analysis of requirements • Preparing systems and user procedures • Testing systems Taxation • Share disposition on reorganization of capital • Purchase or sale of assets of a business • Computing capital dividend election Auditing • Audit of sales and collection cycle • Testing of internal controls • Analyzing audit results • Program development • Auditing through the computer system Public Service • Accounting for funds, revenues and expenditures • Exercising commitment authority • Preparing budgetary reports • Presenting public information General Management • Strategic planning • Team building • Preparing and delivering presentations PUBLIC PRACTICE CORPORATE EDUCATION GOVERNMENT NON-PROFIT Karen Duthie, CGA, Sole Practitioner, Karen G. Duthie Certified General Accountant Professional Corporation Bill Lovatt, B.Comm.(Hons.), FCGA Executive Vice-President & CFO Great-West Life Assurance Company Charles Mossman, B.A., M.B.A., Douglas McLean, B.A., CGA Director, Winnipeg Tax Services Office, Canada Revenue Agency Beverly Passey, FCGA Director of Operations, United Way of Winnipeg Roxanne Chan, BAccS, CGA Chief Financial Officer, Town of Churchill Tara Pointkoski, H.B.Com., CGA Financial Analyst, Cancer Care Manitoba Gerry McFaddin, CGA Director, Commercial Credit Risk Canadian Wheat Board Amanda Kerr, CGA Controller, The Winnipeg Humane Society Tanis Olafson, CGA Partner, Olafson & Jones, Certified General Accountants, Professional Corporation Tyler Curry, B.Sc., CGA Manager, Chochinov Porter Hetu Certified General Accountants thinkcga.org John Olfert, B.A., CGA Chief Operating Officer, True North Sports & Entertainment Limited Angela Carfrae, B.A. (Hons.), CGA VP, Risk Management Services Ceridian Canada Ltd. Domenic Grestoni, CGA Managing Partner, Investors Group Ph.D., FCGA Associate Dean, I.H. Asper School of Business Cameron Morrill, BA, Ph.D, CGA Associate Professor, I.H. Asper School of Business Janet Morrill, Ph.D, CA, CGA Associate Professor, I.H. Asper School of Business Laurel Read, B.R.S., CGA Controller, Sport Manitoba Inc. CERTIFIED GENER AL ACCOUNTANT S ASSOCIATION OF MANITOB A 0 9/10 P R O G R A M O F P R O F E S S I O N A L S T U D I E S 7 123 enrolling is as easy as… Have your transcripts evaluated. Enroll as a CGA student online. Register for online courses. Fill out an Application for Advanced Standing and submit your updated resumé and original transcripts to the CGA Manitoba office. Go online to the CGA Manitoba website and follow the easy one-click steps. Select your course, pay the fees, and begin your studies! w w w. c g a - m a n i to b a . org important dates SESSION 1 | FALL | SEPTEMBER – DECEMBER SESSION 3 | SPRING | MARCH – JUNE August 18th, 2009 Last date to submit Application for Advanced Standing for Session 1 admission August 25th, 2009 Last date to enroll in Session 1 courses September 8th, 2009 Session 1 courses begin November 30th to December 5th, 2009 Session 1 exams February 23rd, 2010Last date to submit Application for Advanced Standing for Session 3 admission March 2nd, 2010 Last date to enroll in Session 3 courses March 15th, 2010 Session 3 courses begin June 7th to June 12th, 2010 Session 3 exams SESSION 2 | WINTER | DECEMBER – MARCH SESSION 4 | SUMMER | JUNE – AUGUST November 17th, 2009 Last date to submit Application for Advanced Standing for Session 2 admission November 24th, 2009 Last date to enroll in Session 2 courses December 7th, 2009 Session 2 courses begin March 8th to March 13th, 2010 Session 2 exams May 18th, 2010 Last date to submit Application for Advanced Standing for Session 4 admission May 25th, 2010 Last date to enroll in Session 4 courses June 9th, 2010 Session 4 courses begin August 31st to September 2nd, 2010 Session 4 exams This calendar is published several months in advance of the beginning of the academic year to which it applies. CGA Manitoba reserves the right to change or amend the programs, fee structure and regulations at any time. CERTIFIED GENERAL ACCOUNTANTS ASSOCIATION OF MANITOBA 4 DONALD STREET SOUTH, WINNIPEG, MANITOBA R3L 2T7 TEL: (204) 477-1256 OR TOLL-FREE: 1-800-282-8001 FAX: (204) 453-7176 www.cga-manitoba.org E-mail: info@cga-manitoba.org thinkcga.org CERTIFIED GENER AL ACCOUNTANT S ASSOCIATION OF MANITOB A 0 9/10 P R O G R A M O F P R O F E S S I O N A L S T U D I E S 8 09/10 Course Offerings CGA’s program of professional studies is designed to offer students the opportunity to study part-time while pursuing full-time employment and career advancement. The program offers four sessions annually and students normally register for one course per session as they are working full-time. Please refer to the CGA Manitoba web site at www.cga-manitoba.org for a listing of course prerequisites. LEVEL Course commences Foundation Studies Level 1 FALL SESSION 1 Week of SEP 7, 2009 WINTER SESSION 2 WEEK OF DEC 7, 2009 SPRING SESSION 3 WEEK OF MAR 15, 2010 SUMMER SESSION 4 WEEK OF JUN 16, 2010 FA1 FA1 FA1 *FA1 *LW1** EM1 LW1 *EM1 *LW1 Level 2 FA2 *FA2 *FA2 *QU1 MA1 *CM1 *MA1 *CM1 Level 3 Advanced Studies Level 4 FA3 FN1 MS1 *BC1 *BC1 *FA3 *FA3 *BC1 *BC1 MA2 AT1 AU1 *MA2 FA4 TX1 *AT1 *AU1 *BC2 *TX1 *BC2 *BC2 *FA4 PACE EXAMS MU1 FN2 TX2 *FN2 MS2 *MU1 *TX2** AU2 PA1 PA1 PA2 PA2 PF1 Nov 30-Dec 5, 2009 Mar 8-13, 2010 Jun 7-12, 2010 Aug 31-Sep 2, 2010 * Courses & business cases listed with (*) are normally offered in that session without in-class lecture support. ** Limited enrollment. Course and exam will be based on 08/09 materials. Students deferring these exams or writing a supplemental will be responsible for updating to the 09/10 materials. The CGA Program of Professional Studies is a part-time program delivered through online studies. To ensure success in the program a variety of flexible learning resources have been developed. CERTIFIED GENERAL ACCOUNTANTS ASSOCIATION OF MANITOBA 4 DONALD STREET SOUTH, WINNIPEG, MANITOBA R3L 2T7 TEL: (204) 477-1256 OR TOLL-FREE: 1-800-282-8001 FAX: (204) 453-7176 www.cga-manitoba.org E-mail: info@cga-manitoba.org Additional support resources include: • online audio lectures • optional in-class lectures • online access to course directors • peer-to-peer discussion boards • practice examinations • examination blueprints • interactive module notes • model financial statements Transfer Credit Schedule 09/10 The CGA association evaluates post-secondary courses for transfer credit in the CGA program. The Transfer Credit Schedule is prepared for information and guidance only. As course numbers and content change depending on the year of study, this schedule is subject to change without notice. Transfer credits granted will be based on the Association’s evaluation of the students’ academic credentials. Students may apply for advanced standing by forwarding a completed Application for Advanced Standing to the CGA office, along with official transcripts and a resume of any related experience. Where multiple university/college courses are listed for a CGA credit, all the courses must be completed. A minimum course grade of C+ is normally required for transfer credit, unless otherwise stated. B. Comm MBA Continuing Education § FA1 Financial Accounting Fundamentals ACC 1100 ACC 6050 27001 EM1 Micro & Macro Economics ECON 1200 LW1 Business Law GMGT 3300 Program of Professional Studies BUS-2002 16.151 Computer Accounting Technician Business Admin ACCT -1002 ACCT -2044 ECON-1102 22.131 ECON-1103 BUS-3660 16.293 MBA Computer Analyst Programmer FOUNDATION STUDIES Financial Accounting: Assets QU1 Business Quantitative Analysis MA1 Management Accounting Fundamentals FA3 Financial Accounting: Liabilities & Equities ACC 2020 FN1 Corporate Finance Fundamentals FIN 2200 Managing Information Systems MIS 2000 ADVANCED STUDIES PACE Accounting Business Case MA2 Advanced Management Accounting Personal & Corporate Taxation TX1 27035 Business Admin Business Admin Diploma Business Admin Degree ACCT-1971 ACCT-2043 ACCT-0003 ACCT-0004 ACCT0014 ACCT0015 ACCT0017 MGT1010 MGT1020 CO-101 CO-102 ACC 1101 473.23 ECON-1022 ECON-2000 ADMIN-3001 ECON-0006 ECON-0007 LAWG-0001 MGT1200 MGT1210 MGT1400 AD-106 AD-206 AD-102 ECON 120 GMGT 3301 473.11 473.12 471.34 MGT2000 MGT2010 C0-201 STAT 1001 STAT 2001 MSCI 2151 ACC 1111 473.24 LAWG-0002 BUS-3102 16.253 ACCT-3000 ACCT-0005 STAT-1201 STAT-2102 62.171 62.172 62.272 16.252 MATH-1059 MATH-3001 MATH-0002 MATH-0003 ACCT-3004 ACCT-0006 BUS-2003 GMGT 2000 GMGT 7710 FIN 6070 MIS 6150 ACCT 1031* *** RHET-1105 16.160 COMM -1110 COMM-1000 16.260 COMM-2115 COMM-2000 External Auditing ACC 4010 Accounting Theory & ACC 4030 Contemporary Issues FA4 † Financial Accounting: Consol- ACC 3030 idations & Advanced Issues FN2 Advanced Corporate Finance FIN 3410** FIN 7070 FIN 3480** FIN 7150 CO-205 CO-206 AN-102 AN-104 CO-202 16.254 ACCT-3003 ACCT-0007 27002 ECON-2319 16.278 MATH-1059 MGMT-3224 FNCE-3002 COMP-1975 EBUS-1311 BUSN-0018 BUSN-0017 BUSN-0016 COMP-0006 COMP-0010 ACS-1803 16.170 16.180 ACCT-3002 ACCT-3001 *** *** BUS-3003¤ 16.352 16.452 BUS 3120 16.356 16.459 AU1 AT1 MGT2020 BUS-3103 *** ACC 3040 ACC 4040 ACC 3050 CAP Certificate BUS 3550 BUS 4005 16.355 16.454 BUS 4002 16.453 * For courses completed in 2008/09 and subsequent years. ** course exemption only – CGA challenge examination required ***Transfer credit for BC1 will be granted in cases where the applicant has completed the noted course and a college business diploma or a university business degree with transfer credits in FA1, FA2, FA3, CM1, MA1, MS1 and FN1. Credit in these courses alone is not sufficient for transfer credit in BC1. CAP Certificate MA-201 ACCT-0008 MGT2030 COMM-0006 COMM-0006 ART - 1310 COMM-0232 COMM-0232 ART - 1322 27037 27041 COMP-0160 COMP-0161 *** MGT2000 MGT2010 MGT2500 MGT - 2550 *** FI-201 FI-202 FI-205 IN-103 IN-104 IN-202 *** BUSN-0108‡ BUSN-0109‡ BUSN-0110‡ ¤ For courses completed in 2000/01 and subsequent years. § For courses completed in 2004/05 and subsequent years only. A grade of B or better required for CGA credit. ‡ A grade of B or better is required for CGA credit † Applicable for new students enrolling in the 2005/06 and subsequent years only. GMGT 2001 212.11 OR GMGT 2141 213.13 471.12 FIN 2201 MIS 2001 *** 474.32 Canadian Mennonite University Providence College Office Admin 27039 Business Communications BC1 27034 STAT 1000 GMGT 7080 STAT 2000 MSCI 6070 MSCI 2150 ACC 1110 ACC 6060 CM1 MS1 ACC 2010 College Universitaire de Saint-Boniface Business Admin 16.294 FA2 University College of the North Assiniboine Community College Red River College Brandon University University of Winnipeg CGA University of Manitoba The Application for Advanced standing can be found on the CGA Manitoba website at www.cga-manitoba.org. ECON 1000 ECON 1010 09/10 Academic Fees As a not-for-profit association, CGA prices its programs on a cost recovery basis. All students are assessed an annual basic tuition fee, and a fee for each registered course. New students are also assessed a one-time new student entrance fee and if applicable, transfer credit fees. Other services fees may be assessed for individual requests. BASIC TUITION FEE PAYMENT OPTIONS REFUND POLICY All new and re-enrolling students pay an annual basic tuition fee each academic year. This fee represents the costs of education overhead and student services. 1. Full payment for all fees owing with the submission of the student’s application for enrollment. Full payment will be accepted in the form of cash, cheque, credit card or debit. CGA’s refund policy is as follows: New Student Tuition Options First-time enrollees are provided the option of enrolling either for a full academic year or a single session only. New students who initially choose the single-session enrollment option must subsequently re-enroll for the balance of the academic year. COURSE FEES Course fees are structured to include the cost of textbooks, module notes, web-based resources, educational software, and examination fees (except for deferred and supplemental exams). Exemptions include the CICA Handbook and text/software provided with prerequisite courses. 2. A current payment plus post-dated payments accepted by credit card only. The current payment must include basic tuition fees, first session course fee, a $15 handling fee per post-dated payment, other fees as applicable (new student entrance, transfer credits etc.), and GST. Post-dated payments may be made for subsequent course fees (plus GST). The post-dated payment settlement dates are: Winter Session: November 15, 2009 Spring Session: February 15, 2010 Summer Session: May 15, 2010 NEW STUDENT ENTRANCE FEE New enrollees are assessed a one-time entrance fee to cover a portion of the start-up costs. TRANSFER CREDIT FEE A fee per course credit granted is payable upon submission of the Application for Enrollment. CERTIFIED GENERAL ACCOUNTANTS ASSOCIATION OF MANITOBA 4 DONALD STREET SOUTH, WINNIPEG, MANITOBA R3L 2T7 TEL: (204) 477-1256 OR TOLL-FREE: 1-800-282-8001 FAX: (204) 453-7176 www.cga-manitoba.org E-mail: info@cga-manitoba.org 1. If the application is rejected – full refund. 2. CGA Manitoba offers two options for course fee refunds provided written notice of withdrawal is received by the dates as follows: i. The full course fee is refunded provided all course materials are returned unmarked and in reusable condition by: Fall Session: August 25, 2009 Winter Session: November 24, 2009 Spring Session: March 2, 2010 Summer Session: May 25, 2010 ii. 50% of a course fee (not including the business cases) may be refunded by: Fall Session: September 15, 2009 Winter Session: December 15, 2009 Spring Session: March 23, 2010 Summer Session: June 15, 2010 3. The Basic Tuition Fee, New Student Entrance Fee, Transfer Credit Fees, and software licenses are non-refundable. As no departure from this policy is permitted, students should assess their situation carefully before enrolling. See reverse side for 09/10 Academic Fees. 09/10 Academic Fees BASIC TUITION FEES Full Year & Re-enrolling: $485 Fall Enrollment: Fall Session Only: $195* Additional Winter, Spring, and Summer: $315 Winter Enrollment: Winter Session Only: $195* Additional Spring, Summer: $150 Spring Enrollment: Spring Session (includes Summer Session): $195 Summer Enrollment: $195 *The single session enrollment option for new students provides for the sessional examination only. Students who choose to write a deferred or supplemental examination in a subsequent term are required to pay the balance of the applicable basic tuition fee. NEW STUDENT ENTRANCE FEE SUPPLEMENTARY MATERIALS 1. CICA Handbook The AU1, AT1, FA4, AU2, and PF1 courses require access to a current edition of the CICA Handbook. Students may purchase the accounting or assurance module of the CICA Handbook online through the related course for $120 or public sector module for $69. 2. Math Reference Handbook For students needing to upgrade or review their math skills, a math reference handbook may be purchased from the CGA office for $35. Topics in the text include basic arithmetic operations, algebraic concepts, simple and compound interest, annuities, and statistics. 3. Trend Micro Systems This anti-virus software is available online for purchase for $15 through a link in the student area of the CGA Manitoba website www.cga-manitoba.org. $105 TRANSFER CREDIT FEE $25 per course (maximum of $165) Did you know that the majority of students are reimbursed by their employers for the costs of CGA education? Students who pay their own tuition and course fees are normally refunded 85% or more of the total fees through education and tuition credits, in accordance with the Income Tax Act. In addition, CGA graduates are eligible for the Manitoba Tuition Fee Income Tax Rebate program. This program provides a 60% tuition fee rebate for graduates of the CGA program who continue to live and work in Manitoba. Be sure to go onto the CGA Manitoba website to view the list of CGA scholarships, awards, and financial support available as well at www.cga-manitoba.org. COURSE FEES Student Course Fees** FA1 Financial Accounting Fundamentals $530 EM1 Micro & Macro Economics $515 LW1 Business Law $505 FA2 Financial Accounting: Assets $580 QU1 Business Quantitative Analysis $525 MA1 Management Accounting Fundamentals $555 CM1 Business Communications $530 FA3 Financial Accounting: Liabilities & Equities $560 FN1 Corporate Finance Fundamentals $560 MS1 Managing Information Systems $560 BC1 Accounting Business Case $140 MA2 Advanced Management Accounting $580 AT1 Accounting Theory & Contemporary Issues $570 AU1 External Auditing $565 BC2 Public Practice Audit Case $165 TX1 Personal & Corporate Taxation $620 FA4 Financial Accounting: Consolidations & Advanced Issues $600 FN2 Advanced Corporate Finance $675 AU2 Advanced External Auditing $675 TX2 Advanced Personal & Corporate Taxation $675 MU1 Internal Auditing & Controls $675 MS2 Information Systems Strategy $675 PF1 Public Sector Financial Management $675 PA1 Issues in Professional Practice $750 PA2 Strategic Financial Management $750 **Course fees are listed exclusive of the applicable GST