Tottenham Hotspur plc Annual Report 2007

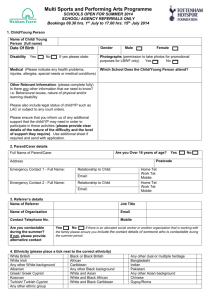

advertisement