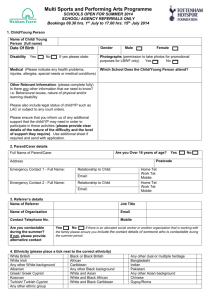

Tottenham Hotspur plc Annual Report 2007

advertisement