Aggressive Investment, Financing Policy of working capital with

advertisement

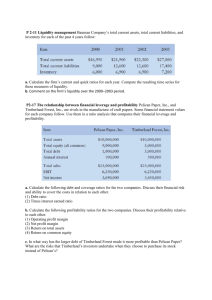

Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org The 2014 third Conference on Modern Management Sciences (CMMS 2014) Aggressive Investment, Financing Policy of working capital with profitability Esmaeil amiri Master Student of Accounting , Shahid Bahonar University of Kerman, Kerman. Esmaeilamiri303@yahoo.com Abstract- In this study, Investigate the relationship between Aggressive Investment Policy and Aggressive Financing Policy of working capital with profitability of Tehran’s stock market were analyzed. For this purpose statistical society includes 93 firms and also, 1 period of 5 years (20052009).with systematic elimination method were selected. The results indicate that there is no relationship between(AFB) and (AIP). Also, there is no significant relationship between AIP with ROA and ROE . Further analysis showed that is no significant relationship between AFP with ROA and is no significant relationship AFP with ROE. Keywords; Aggressive, Conservative, working capital, profitability. 1.Introduction The definition of working capital in accounting literature is current assets minus current debts and indicates the amount company's investment in cash, marketable securities, Commercial receivable accounts, Inventories minus current debts. Some author, define working capital as the sum of the current assets and current debts and expressed their differences as the net working capital. In other words, net working capital represents that part of the current assets which is more than the current debts and is protected through long-term loan and equities. Shabahang, 2008). Today, working capital management which is the resource and current expenditures management are significant for maximizing shareholders wealth as part of the financial management 170 Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org responsibility. Now, the financial management focuses at topics, such as the relationship between risk and return and maximizing the return against risk. Since the financial management has the significant impact on organizations improvement and performance and on function enhancement and their profitability, investment and Financing decisions is the most important financial decision of a company which is considered as the sub-category of working capital management.(Nikoomaram et al, 2006) There are various strategies for working capital which are obtained by modulating current assets and current debts strategies. In working capital management, according to different conditions, some appropriate strategies should be selected in order to handle effectively the current assets and debts of a commercial unit, and the financial needs of the commercial unit provide properly.As a result, the company shareholder return and the shareholders wealth would be increased. The total strategies of working capital management would be categorized into three categories: 1) conservative strategies 2) Aggressive strategies 3) moderate strategies. (Jhankhany and Parsaeian, (2001), RaymondP(1986)). 2.Theoretical Foundations & Background The growing importance of working capital in continuation of business unit has led to several strategies considered for working capital management. Profit units are able to impact the company liquidity by means of using different strategies with regard to working capital management. Each of the various strategies has different risk and efficiency. Financial managers of the companies with regard to conditions prevailing in the company as well as their personality and individuality would select “daring” or risk strategy and/or “conservative” or risk aversion strategy. The liquidity of the company can be influenced by using different strategies in regard to working capital management. The working capital managers are divided into two categories: conservative and Aggressive. Conservative strategy in working capital management causes the increase of liquidity strength excessively. In implementing conservative policies, the risk of the inability of maturity debts refund has been tried to reach to the lowest level. In this strategy, the manager try 171 Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org to keep the large amount of the current assets (whose return rate is low). Hence, companies with this kind of strategy have risk liquidity and less refund. . Aggressive strategy manager, with the lowest current asset, try to take maximum advantage from current debts through daring strategy and manage the company in this way. In implementing this strategy, the liquidity risk would increase and the company which carries out this strategy often encounters such situation that cannot pay the debt maturities. On the other hand, because the amount of current asset is at its lowest level, the rate of the investment refund would be increased (of course, if the company is not bankrupted). Companies that use risk strategy actually accept a high risk and their refund rate is so high. Companies can apply various strategies in managing the current assets and debts.By combining different strategies, a policy can be applied in order to optimize the working capital. Current Assets Strategy Having a strategy in managing the working capital requires determining and maintaining a certain level of each of the current asset andtotal current assets. Conservative Strategy (in current assets management) In this kind of strategy, the company tries to keep the liquidity by maintaining the cash and marketable securities.This is a very low risk strategy. Because having a relatively high liquidity allows the company to provide the goods inventory sufficiently and sell on credit. Risk Strategy (in working capital management) The manager who uses risk strategy always tries to lessen the cash and marketable securities. If the manager acts daringly, he will attempt to reduce the funds which are invested in products inventory. A company which has the courage to decrease the cash and securities should accept the risk of lack of timely payment of debt maturities. Such company may not be able to meet the customers’ needs and it will run at a loss. For compensating this loss, the company tries to use 172 Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org financial resources in order to provide the fixed assets. This strategy means that, the rate of fixed assets refund is much higher than the rate of cash and marketable securities efficiencies. The conservative manager tries to lessen the rate of short-term loan in company’s capital structure. He tries to use long-term loans with floating interest in order to provide current assets. The manager who is so conservative attempts to use other financial resources (shareholders capital) instead of taking out such loans. The structure of the company in which this policy is applied almost consists of two types: debts and equity. If a manager use risk policy, he tries to maximize the level of short-term loans and supplies the current assets from these loans. This policy does not mean that the company never uses the longterm loan. Because the fixed assets can be used from long-term loans. (Jhankhany and Parsaeian, (2001), RaymondP(1986)). Working capital is a vital part of business investment which is essential for continuous business operations. It is required by a firm to maintain its liquidity, solvency and profitability (Pirashanthini et al,2013). Working capital management is an essential part of the short-term finance of a firm. With an efficient working capital management, a firm can release capital for more strategic objectives, reduce the financial costs, and improve profitability. (Taghizadeh et al,2012) studies the relationship of working capital management on performance of firms Listed in Tehran Stock Exchange (TSE). Average Collection Period, Inventory Turnover in days, Average Payment Period, Cash Conversion Cycle, and Net Trading Cycle were used to assess working capital management, and Net Operating Profitability was used to assess firms' performance.. The results showed that the increase in Collection Period, Payment Period, and Net Trading will lead towards the reduction of profitability in the firm. In other words, managers can increase the profitability of their firms reasonably, by reducing Collection Period, Inventory Turnover, and Payment Period. Mohamadi (2009), In study examines the the effect of working capital management on profitability. The variable used as the profitability measure of companies was the ratio of gross profit on total assets. Variables used for the measures of capital investment, were Receivables 173 Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org Collection Period, inventories turnover, creditors deposit period, and convert cycle of cash fund. Variables, which were used as control variables, were company size, sale growth, ratio of financial assets on total assets and financial liabilities to total assets. The result of this research stated that there is negative relation between companies’ profitability and, and convert cycle of cash fund. In the other words, managers can increase their companies’ profitability by logical decreasing Receivables Collection Period, and inventories turnover. The results of this research relating to creditors deposit period states that he more profitable is the company the less is the creditor’s cycle. Malekiniya,(2012). the reviews onthe relationship between working capital policy and profitability of companies in automobile, pharmaceutical and mineral industries in Tehran Stock Exchange. The results of this study indicate that there is no direct and significant relationship between working capital management strategies with earning per share and return on equity, but there is a direct and significant relation between working capital management strategies and return on investment but not very strong correlation, and only 6% of the variation in the return on investment can be justified by the variation in the working capital management strategies. Zohdi(2011),The reason that most bankruptcy corporations’ does not succeed is the unfavorable status and improper management of working capital. These corporations have good financial status in the long run, but because of incompetent working capital, are not able to compete with other corporations’ and they expelled. Profit units are able to affect corporations’ rate of cash by applying various policies in relation to working capital management. These strategies can affect rate of risk and their return. Studied the affect of policies of corporations’ working capital over the rare of Companies risk. The results of this research reveal that, there is a significant and positive relationship between the policies of working capital and corporations’ risk. Other findings of the research show that there is a significant and positive relationship between corporations’ size and risk. (Ding et al,2013), with use a panel of over 116,000 Chinese firms over the period 2000–2007 to analyze the extent to which firms owned by differentagents are able to use working capital to 174 Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org mitigate the effects of financing constraints on their fixed capital investment. These findings indicate that, in the presence of fluctuations in cash flow, firms tend to adjust both their fixed and working capital investment. Yet, when we differentiate firms into those with a relatively high and a relatively low working capital to fixed capital ratio, and in the presence of cash flow shocks, it is only those firms with a high ratio that are able to adjust their working capital investment. Furthermore, for all but foreign firms, the sensitivity of fixed capital investment to cash flow is much lower for those firms with high working capital: these may therefore use their working capital to alleviate the effects of cash flow shocks on their fixed capital investment.To fully take into account the. Bei & Wijewardana (2012) to investigates working capital policy (WCP) practices in Sri Lankan context. For this aim Sample of this investigation consist 155 companies listed in Colombo Stock Exchange (CSC) from 2002 -2006. The study finding explore the impact of different types of working capital policy practises are differently affect the firm liquidity, efficiency, profitability and capacity usage Nazir & Afza (2007), ) to investigates the traditional relationship between working capital management policies and a firm’sprofitability. Using the panel data set for the period 1998-2005, the impact of aggressive working capital investment and financing policies has been evaluated using return on assets as well as Tobin’s q. The study finds a negative relationship between the profitability measures of firms and degree of aggressiveness of working capital investment and financing policies. Theseresults were further validated by examining the impact of aggressive working capital policieson market measures of profitability, which was not tested before. The results of Tobin’s q werein line of the accounting measures of profitability and produced almost similar results for working capital investment policy. Liquid assets management decisions are very complex. On the one hand, when too much money is tied up in working capital, the business face higher costs of managing liquid assets with additional high alternative costs. On the other hand, the higher liquidity assets policy could help enlarge income from sales. (Michalski 2008). 175 Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org ALShubiri (2011), to investigates the Effect of Working Capital Practices on Risk Management The sample includes 59 industrial firms and 14 banks listed on the Amman Stock Exchange for the period of 2004-2008. The results indicate a negative relationship between profitability measures and working capital aggressiveness, investment and financing policy. Firms have negative returns if they follow an aggressive working capital policy. In general, there is no statistically significant relationship between the level of current assets and current liabilities on operating and financial risk in industrial firms. There is some statistically significant evidence to indicate a relationship between standard deviation of return on investments and working capital practices in banks. Pirashanthini et al,(2013), to investigates the relationship between the aggressive working capital policies and profitability and to identify the impact of working capital policies on profitability with the samples of twenty Manufacturing companies listed under Colombo stock exchange (CSE) in Sri Lanka The study found that there is no relationship between the profitability measures of firms and working capital investment and financing policies. Further, the working capital aggressive investment and financing policies have no impact on profitability measures of ROA and ROE. 3.Research Hypotheses: H1: There is a significant relationship between the Aggressive Investment Policy (of working capital and profitability. H2: There is a significant relationship between the Aggressive Financing Policy of working capital and profitability H3: There is a significant relationship between Aggressive investment Policy and aggressive Financing Policy. 4.Measuring the research variables in this study Variables consists of three sections: Dependent variable= to calculate the Profitability ratios measure Has been used (ROA) and (ROE). 176 Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org Independent variables=in this research and based on the researches by Afza and Sajid Nazir (2008) To calculate Aggressive Investment Policy and Aggressive Investment Policy As have been considered independent variables. Controlling variables: Variables of firm size, sales growth, asset growth is considered as a control variable. Table 1: Calculation of dependent and independent variables Variable Symbol Explanation Aggressive Investment Policy AIP (Total Current Assets)/(Total Assets) Aggressive Investment Policy Return on Assets Return on Equity Size Sales growth AFP ROA ROE Size SG (Total Current Liabilities)/(Total Assets) Net Income / Assets Net Income/ Equity ln sale (current year sales -last year sales) / last year sales 5.Methodology: This study is of applied type as far as goal is concerned and the research method is experimental. The literature about the research was collected from the theoretical topics of library resources, scientific databases and local and international papers. In order to assess and analyze the data, regression method was used. In order to analyze data, EViews software was applied. 6.Sample & Data The statistical society of this study was selected among the admitted companies to Tehran Stock Exchange following systematic elimination of banks and insurance companies and financial mediation and eventually about 93 companies were selected in the cycle of 2005-2009. They had to possess the following characteristics: 1) The fiscal year of the company had to end on 20 March. 2) The companies should not have had financial changes from 2005 -2009. 3) The companies should have been admitted to Tehran Stock Exchange by the end of fiscal year 2009. 4) The desired data of the research should be available to calculate the test of hypotheses. 177 Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org 5) They should not have had a stop of transactions for more than 6 months during the study cycle. 7.Methodology To test hypotheses 1 and 2, the relationship between profitability and Aggressive Investment Policy, Aggressive Financing Policy, is used following pattern. ROA=α+β1 AIP+ β2 Size+β3 SG +ε Model(1) ROE =α+β1 AIP+ β2 Size+β3 SG +ε Model(2) ROA=α+β1 AFP+ β2 Size+β3 SG +ε Model(3) ROE =α+β1 AFP+ β2 Size+β3 SG +ε Model(4) The following model is estimated to test hypotheses 3 H0:β1=β2 Model(5) …….y=α+β1x H1:β1≠β2 8. Analysis hypotheses Variables Mean Table (2). Descriptive Statistics Median Minimum Maximum Standard Deviation ROA 0.333827 0.330128 0.111647 0.566351 0.132857 ROE 0.118991 0.122487 0.061065 0.155393 0.030331 AIP 0.5344 0.53408 0.49365 0.57982 0.0277 AFP 0.624752 0.623179 0.612289 0.643956 0.009678 Size 5.538787 5.546905 5.42491 5.611312 0.062639 SG 2.047422 1.937001 1.545595 3.043925 0.476472 178 Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org Table (3). Model(1) Variables β0 AIP SIZE SG D.W Coefficient 16.767 -0.96446 2.69775 33.437 2.28 t-Statistic 1.101816 -0.29299 1.28273 0.42257 Prob. 0.0092 0.8186 0.0000 0.0055 Table (4). Model(2) Variables β0 AIP SIZE SG D.W Coefficient 3.321776 -0.489465 0.51963 2.16378 2.28 t-Statistic 1.134603 -0.772869 1.284233 0.142135 Prob. 0.0099 0.5811 .0000 .0000 Table (5). Model(3) Variables β0 AFP SIZE SG (F) Adj.R D.W Coefficient 14.8559 -11.1647 -1.17901 -34.8457 0.039286 0.99 1.72 t-Statistic 22.88813 -13.5753 -9.42109 -8.78221 Prob. 0.0278 0.0468 0.0073 0.0022 Table (6). Model(4) Variables Coefficient t-Statistic Prob. β0 1.833145 3.014359 0.2039 AFP -2.49603 -3.23919 SIZE -0.04238 -0.36144 0.1906 .0000 SG 2.741551 1.72 0.73746 .0000 D.W 179 Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org Table (7). Model(5) Variables Coefficient t-Statistic Prob. β0 0.616976 5.729698 0.0106 AIP 0.014551 0.072332 0.9469 (F) 0.005232 D.W 1.52 9.Findings For the analysis was tested the first hypothesis models 1 and 2. In model (1) The results show that, is no significant relationship between Aggressive Investment Policy (of working capital) and profitability (ROA). that the amount of obtained statistics for AIP is more than 5%. Also, the statistics obtained for the size and sales growth of is less than 5%, This means ,there is a significant relationship between with profitability, And the 95% confidence level there is not significant relationship between Aggressive Investment Policy (of working capital) and profitability (ROA).In model (1). In model 2 was tested the relation between Aggressive Investment Policy (of (working capital) and ROE . The results show that, is no significant relationship between Aggressive Investment Policy (of working capital) and profitability (ROE). To test hypotheses 3, model 4 and 4 are used. In Model 3 the results show, there is a significant relationship between Aggressive Financing Policy of working capital and profitability (ROA). amount of obtained statistics for AFP is less than 5%. And between company size and growth sales with profitability (ROA), is a positive a significant relationship. In Model 4, is no significant relationship between Aggressive Financing Policy (of working capital) and profitability (ROE). But, And between company size and growth sales with profitability (ROE), is a positive a significant relationship.That amount of obtained statistics for AFP is less than 5%. To test the third hypothesis is that the relationship between Aggressive Investment Policy and Aggressive Financing Policy ,the Model 5 is used. The results indicate that there is no relationship between(AFB) and (AIP). that the amount of obtained statistics for Aggressive 180 Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org Investment Policy of more than 5%. and obtained amount for Durbin-Watson statistic 1.52, is between 2.5 to 1.5, which indicate that there is no auto-correlation between each of the hypotheses. 10.Conclusions The working capital managers are divided into two categories: conservative and Aggressive. Conservative strategy in working capital management causes the increase of liquidity strength excessively. In implementing conservative policies, the risk of the inability of maturity debts refund has been tried to reach to the lowest level. Aggressive strategy manager, with the lowest current asset, try to take maximum advantage from current debts through daring strategy and manage the company in this way. In this study, Investigate the relationship between Aggressive Investment Policy , Aggressive Financing Policy and profitability of Tehran’s stock market were analyzed. For this purpose statistical society includes 93 firms and also, 1 period of 6 years (20042008).with systematic elimination method were selected. The results indicate that there is no relationship between(AFB) and (AIP). Also, there is no significant relationship between AIP with ROA and ROE . Further analysis showed that is no significant relationship between AFP with ROA and no significant relationship AFP with ROE. References 1-Mohamadi ,Mohamad,(2009), effect of working capital management on profitability of accepted companies in tse, Pajouheshgar (journal of management) , 6(14):91-80. 2-Malekiniya,Nahid,Asgari Alouj Hossein,Ghezelbash Azam,(2012), Study of reaationship between working capital strategy and profitabilitt measures the companies in automobile, pharmaceutical and mineral industries in tehran stock exchange ,journal of monetary & financial economics , 18(2):160-139. 3-Zohdi,Mohhamad, Valipour, Hadi, , Alireza Hashem,Shahabi, ,(2011), Working capital and corporations’risk policies, The financial accounting and auditing research ; 2(8):210-186. 4-Ding, Sai, Guariglia, Alessandra, Knight, John,(2013), Investment and financing constraints in China: Does working capital management make a difference?, Journal of Banking & Finance 37 (2013) 1490–1507. 181 Advanced Research in Economic and Management Sciences (AREMS) Volume 19, 2014 ISSN: 2322-2360 WWW.universalrg.org 5-Bei , Zhao, W. P Wijewardana,(2012), Working capital policy practice: Evidence from Sri Lankan companies, Procedia - Social and Behavioral Sciences 40 ( 2012 ) 695 – 700 6-Taghizadeh .V.,Akbari .khsroshahi M.,Ebrati M.R.(2012), An investigation of the association between working capital management and corporate performance, International journal of management and business research, 2(3):218-203 7-Nazir , Mian Sajid, Afza, Talat,(2009), Impact of Aggressive Working Capital Management Policy on Firms’ Profitability, Journal of Applied Finance, Vol. 15, No. 8, pp. 19-30, 8-Michalski ,Grzegorz Marek, (2008), Liquidity or Profitability: Financial Effectivness of Investments in Working Capita, l, International financial systems, http://ssrn.com/ abstract=1299586 9-Shabahang R,(2008), Financial Management, Audit Organization Publications, Volume I & II, 10 Rahnamay rood poshti ,Nikoomaram H.,. Rahnamay rood poshti.F, Heibati,F,(2010), Foundations Financial Management, Volume I & II, Termeh Publications,. 11-RaymondP.Neneu,(1986),Fundamentals of managerial finance,3rd ed,Cincinnati ohio:SouthWestern Publishing Co. 12- Jhankhany, Ali, Parsaeian, A., (2001), Financial Management, Volume II, issued position 182