Macro Lecture 7: Money and the Federal Reserve Board

advertisement

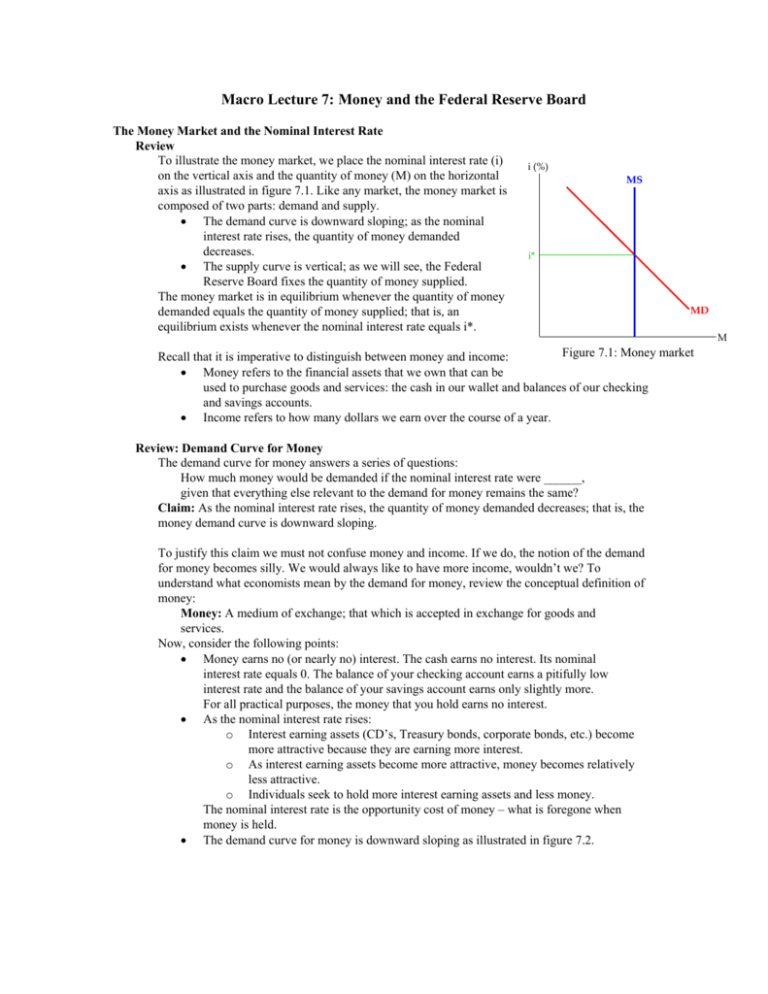

Macro Lecture 7: Money and the Federal Reserve Board The Money Market and the Nominal Interest Rate Review To illustrate the money market, we place the nominal interest rate (i) on the vertical axis and the quantity of money (M) on the horizontal axis as illustrated in figure 7.1. Like any market, the money market is composed of two parts: demand and supply. The demand curve is downward sloping; as the nominal interest rate rises, the quantity of money demanded decreases. The supply curve is vertical; as we will see, the Federal Reserve Board fixes the quantity of money supplied. The money market is in equilibrium whenever the quantity of money demanded equals the quantity of money supplied; that is, an equilibrium exists whenever the nominal interest rate equals i*. i (%) MS i* MD Figure 7.1: Money market Recall that it is imperative to distinguish between money and income: Money refers to the financial assets that we own that can be used to purchase goods and services: the cash in our wallet and balances of our checking and savings accounts. Income refers to how many dollars we earn over the course of a year. Review: Demand Curve for Money The demand curve for money answers a series of questions: How much money would be demanded if the nominal interest rate were ______, given that everything else relevant to the demand for money remains the same? Claim: As the nominal interest rate rises, the quantity of money demanded decreases; that is, the money demand curve is downward sloping. To justify this claim we must not confuse money and income. If we do, the notion of the demand for money becomes silly. We would always like to have more income, wouldn’t we? To understand what economists mean by the demand for money, review the conceptual definition of money: Money: A medium of exchange; that which is accepted in exchange for goods and services. Now, consider the following points: Money earns no (or nearly no) interest. The cash earns no interest. Its nominal interest rate equals 0. The balance of your checking account earns a pitifully low interest rate and the balance of your savings account earns only slightly more. For all practical purposes, the money that you hold earns no interest. As the nominal interest rate rises: o Interest earning assets (CD’s, Treasury bonds, corporate bonds, etc.) become more attractive because they are earning more interest. o As interest earning assets become more attractive, money becomes relatively less attractive. o Individuals seek to hold more interest earning assets and less money. The nominal interest rate is the opportunity cost of money – what is foregone when money is held. The demand curve for money is downward sloping as illustrated in figure 7.2. M 2 Supply Curve for Money The supply curve for money is vertical. To understand this we shall study the role that the Federal Reserve Board plays in the banking system. Recall our simplified bank balance sheet: Assets Reserves Vault Cash 30 Dep at Fed 20 Securities Loans Liabilities 50 Deposits 60 480 Borrowing 500 10 Question: Which balance sheet entry counts as money? That is, which entry can we use to purchase goods and services? Decreases Increases Answer: We use our checking deposits. We can purchase money supply money supply goods and services by writing checks, as long as our i (%) checking account balance is sufficient. Also, in the age of MS’ MS MS’ smart phones we can transfer funds from our saving accounts to our checking accounts in seconds. So, effectively our savings account deposits also constitute money. We will now see how the Federal Reserve Board uses its tools to affect the quantity of money in our economy. When the Fed decreases the money supply and the money supply (MS) curve shifts left; alternatively, when the Fed increases the money supply the money supply (MS) curve shifts right. See figure 7.2. M Figure 7.2: Monetary policy and the money supply curve Federal Reserve Board's Policy Tools Primarily, the Federal Reserve Board uses three policy tools to control the money supply: Open market operations; Discount rate; Required reserve ratio. The first tool, open market operations, is the most important. Accordingly, we shall focus on it. 3 Open Market Operations The Fed performs an open market purchase whenever it buys or sells government bonds. Note that the Federal Reserve Board does not issue government bonds. Who issues them? The U.S. Treasury issues government bonds whenever the federal government runs a deficit. When the Fed performs an open market operation, it is buying or selling government bonds that have been issued previously by the U.S. Treasury. To understand how an open market operation affects the banking system we shall use our simplified illustration: Assets Liabilities Reserves 50 Deposits 500 Vault Cash 30 Dep at Fed 20 Securities 60 Loans 480 Borrowing 10 Required reserve Deposits ratio = 10% 500 = 50 Since (actual) reserves equal required reserves, banks cannot make any additional loans. The bank is loaned up. Required reserves = Open market purchase of $5: The Fed buys $5 worth of T-bills from Kate (a private individual). Do not make this more complicated than it is. Figure 7.3 T-Bill keeps it straightforward by following the movement of the T-bill and the Fed’s check. Fed Federal Reserve Board In exchange for the T-bill, the Fed gives Washington, DC Kate one of its checks, a Federal Reserve Pay to the order of Kate $5 Bank’s deposits at Board check made out for $5. Ben Bernanke Fed rise by $5. What will Kate do with this check? Kate Fed Check will deposit the check in her bank account by taking the check to her bank and handing it to a bank teller. Kate’s deposits rise by Kate’s deposits at Bank $5. the bank rise by $5. What will the bank do with the check? Just Figure 7.3: Open market purchase as you and I deposit the checks that we receive at our banks, a bank deposits the checks that it receives at its bank, the Fed. The bank’s deposits at the Fed will rise by $5. Summary: When the Fed performs an open market purchase of 5: Kate’s deposits rise by 5. The bank’s deposits at the Fed rise by 5. Assets Reserves Vault Cash Dep at Fed Securities Loans Liabilities 55 50 30 25 20 Deposits Kate 60 480 Borrowing 505 500 +5 10 Remember that deposits at the Fed are part of the bank’s reserves. Accordingly, actual reserves have risen by 5, from 50 to 55. 4 What has happened to required reserves? Reserves have risen by 5 and deposits have risen by 5 also from 500 to 505: Required Required reserve = Deposits reserves ratio = 10% 505 = 50.5 (Actual) reserves are 55 and required reserves are 50.5. The bank has excess reserves of 4.5. When a bank has excess reserves what will it do? It will issue more loans. How many additional loans? To address this recall the key questions: With actual reserves of 55 and a required reserve ratio of 10%, how many deposits can the bank be liable for? 550 because 10% 550 = 55. Since loans and deposits change by the same amount when a bank issues a new loan and reserves are unaffected, how many additional loans can the bank issue? 45 because 550 505 = 45. Assets Reserves Vault Cash 30 Dep at Fed 25 20 Securities Loans Others +45 Liabilities 55 50 Deposits Kate Others 550 505 500 +5 +45 60 525 480 Borrowing 10 Now, what are required reserves? Required Required = reserve Deposits reserves ratio = 10% 550 = 55 (Actual) reserves equal required reserves. Since there are no excess reserves, the bank cannot issue any additional new loans. The bank is loaned up. Summary: When the Fed performs an open market purchase of 5: (Actual) reserves increase by 5. Deposits increase by 50. Loans increase by 45. An open market purchase expands the money supply because deposits have increased. 5 i (%) Recall that the money demand curve is downward sloping. Money earns no or virtually no interest. As the nominal interest rate increases, interest earning assets become more attractive; consequently, we hold more interest earning assets and less money. Figure 7.4 illustrates the benchmark case: Benchmark Case Money supply Nom interest rate (i) MS 5.0 500 5.0% MD We have just seen that an open market purchase of 5 increases deposits by 50 from 500 to 550. Since deposits are part of the money supply, the money supply increases and the money supply curve shifts right by 50 as illustrated in figure 7.5. When the Fed performs an open market purchase, the nominal interest rate falls. M 500 Figure 7.4: Money market - Benchmark case i (%) An open market purchase increases the money supply. The money supply curve shifts right reducing the nominal interest rate. Macro lab 7.1 allows us to check our logic: Macro Lab 7.1: Open Market Purchase MS MS 5.0 3.8 MD 500 550 M Figure 7.5: Money market – Open market purchase Next, instead of considering an open market purchase we will consider an open market sale. 6 Open market sale of $5: The Fed sells $5 worth of T-bills to Kate (a private individual). Again, do not make this more complicated than it is. Figure 7.6 keeps it straightforward by T-Bill following the movement of the T-bill and Kate’s check. Fed Kate In exchange for the T-bill, Kate Amherst, MA gives the Fed one of her checks, Pay to the order of the Fed $5 Bank’s deposits at a check made out for $5. Kate Fed fall by $5. Fed Check What will the Fed do with Kate’s check? The Fed returns Kate’s check to her bank. When it does so, it reduces the bank’s deposits Kate’s deposits at Bank at the Fed by 5. the bank fall by $5. What will the bank do with the Figure 7.6: Open market sale check? The bank reduces Kate’s balance by $5 and returns the check to Kate. Kate’s deposits at the bank fall by $5. So, what will happen to the balance sheet? Kate’s deposits will fall by 5 and the bank’s deposits at the Fed will fall by 5: Assets Liabilities Reserves 45 50 Deposits 495 500 Vault Cash 30 Kate 5 Dep at Fed 15 20 Securities 60 Loans 480 Borrowing 10 Remember that deposits at the Fed are part of the banks’ reserves. Accordingly, (actual) reserves have fallen by 5, from 50 to 45. What has happened to required reserves? Deposits have also fallen by 5 from 500 to 495: Required Required = reserve Deposits reserves ratio = 10% 495 = 49.5 (Actual) reserves are 45 and required reserves are 49.5. The bank has negative excess reserves of 4.5. The bank now must reduce its loans. How many fewer loans? To address this recall the key questions: With actual reserves of 45 and a required reserve ratio of 10%, how many deposits can the bank be liable for? 450 because 10% x 450 = 45. Since loans and deposits change by the same amount when a bank issues a new loan and reserves are unaffected, how many fewer loans will the bank issue? 45 because 495 450 = 45. Assets Reserves Vault Cash 30 Dep at Fed 15 20 Securities Loans Others 45 Liabilities 45 50 Deposits Kate Others 5 45 450 495 500 60 435 480 Borrowing 10 7 Now, what are required reserves? Required Required = reserve Deposits reserves ratio = 10% 450 = 45 (Actual) reserves equal required reserves. Excess reserves are 0 and the bank is now loaned up. Summary: An open market purchase of 5: (Actual) reserves decrease by 5; Deposits decrease by 50; Loans decrease by 45. An open market sale contracts the money supply because deposits have decreased. At first glance, it may appear that a reduction in loans would be disruptive to the banking system. In fact, it need not be for two reasons: First, some loans that banks issue are “callable” which means that at any point in time the bank can ask its customers to repay the loans immediately. Bank customers who have such loans should be prepared for this. Second, loans that are not callable are paid off over time. Home mortgages provide an important example. Banks cannot demand that a home owner repays the full amount of his/her mortgage immediately, home mortgages are not callable. Every month a homeowner pays off a portion of his/her mortgage, however. Consequently, unless a bank issues new loans, the loan component of the bank’s balance sheet will naturally decrease every month. We have just seen that an open market sale of 5 decreases deposits by 50 from 500 to 450. Consequently, the money supply decreases and the money supply curve shifts left by 50 as illustrated in figure 7.7. When the Fed performs an open market sale, the nominal interest rate rises. i (%) MS MS 6.3 5.0 An open market sale decreases the money supply. The money supply curve shifts left raising the nominal interest rate. Macro lab 7.2 allows us to check our logic. MD 450 500 M Figure 7.7: Money market – Open market sale Macro Lab 7.2: Open Market Sale