Chapter 13 Homework Solutions

advertisement

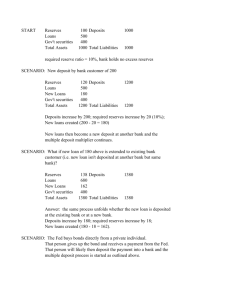

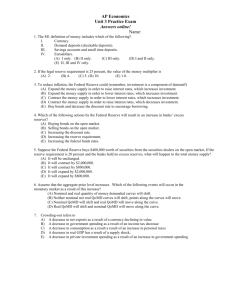

Chapter 13 Homework Solutions 1. If the Fed sells $2 million of bonds to the First National Bank, what happens to reserves and the monetary base? Use T-accounts to explain your answer. If we assume that First National Bank pays for the bonds out of reserves, then there will be a $2 million decrease in reserves at First National Bank and a $2 million increase in securities. At the Fed, there is a decline of $2 million in reserve liabilities and a $2 million decline in securities (assets). Reserves Securities First National Bank Assets -$2 million +$2 million Securities Assets -$2 million Liabilities Federal Reserve Reserves Liabilities -$2 million The monetary base is defined as currency in circulation plus reserves. The $2 million drop in reserves means that the monetary base fell by $2 million. 2. If the Fed sells $2 million of bonds to Irving the Investor, who pays for the bonds with a briefcase filled with currency, what happens to reserves and the monetary base? Use Taccounts to explain your answer. This transaction causes currency in circulation to fall by $2 million. Since the entire transaction was carried out in cash, there is no change in bank reserves. The monetary base still falls by $2 million, though. Irving the Investor Currency Securities Assets -$2 million +$2 million Securities Assets -$2 million Liabilities Federal Reserve Currency Liabilities -$2 million 7. Suppose that the Fed buys $1 million of bonds from the First National Bank. If the First National Bank and all other banks use the resulting increase in reserves to purchase securities only and not make loans, what will happen to checkable deposits? This is a somewhat tricky question in that you are not told who First National Bank purchases securities from. The Fed’s purchase causes reserves in the banking system to rise by $1 million. First National then uses this $1 million to purchase securities (presumably from someone other than the Fed!) Suppose they buy the security from an individual. This means that there is now $1 million more currency in circulation. Suppose that $1 million is deposited in the bank. The bank then places a required fraction of this $1 million in reserves (based on the reserve requirement) and uses the remainder to purchase a security. With a 10% reserve requirement, the bank will buy $900,000 worth of securities. The person who sold these securities will now have $900,000 to deposit in the bank. They do so and total deposits are now $1 million at the first bank and $900,000 at the second bank = $1,900,000. The second bank places 10% of the $900,000 in reserve and uses the remaining $810,000 to buy securities from another individual. That individual deposits the proceeds from her sale into her bank and the process continues. Evenutally through the process of multiple deposit creation, the total value of deposits created will be $1 million * (1/rr) = $1 million * (1/0.1) = $10 million. 8. If the Fed buys $1 million in bonds from the First National Bank, but an additional 10% of any deposit is held as excess reserves, what is the total increase in checkable deposits? Assuming that there is a 10% reserve ratio, then holding 10% excess reserves will lead to 20% of total deposits being held in reserve. The simple money multiplier becomes 1/0.2 = 5. As a result, multiple deposit creation will turn $1 million of reserves into $5 million of deposits. 12. If the required reserve ratio on checkable deposits increases to 20%, how much multiple deposit creation will take place when reserves are increased by $100? Recall that reserves are related to deposits by the following formula: ΔD = (1/rr)* ΔR, where rr is the reserve requirement. ΔD =(1/0.2)*100 = $500 15. If you decide to hold $100 less cash than usual and therefore deposit $100 in cash in the bank, what effect will this have on checkable deposits in the banking system if the rest of the public keeps its holdings of currency constant? According to the situation outlined above, there will be a $100 increase in reserves. Through the process of multiple deposit creation, we will see a $100/rr increase in deposits. If rr = 10%, then deposits will rise by $1000. If rr was 5%, deposits would rise by $2000. If rr was 20%, deposits would only rise by $500.