MASTER MINDS

No.1 for CA/CWA & MEC/CEC

2. CAPITAL BUDGETING

SOLUTIONS TO ASSIGNMENT PROBLEMS

Problem No.1

Payback reciprocal =

4,000 X100

= 20%

20,000

The above payback reciprocal provides a reasonable approximation of the internal rate of return, i.e.

19%.

Problem No.2

W.N.-1: Calculation of depreciation per annum

Cost - Scrap Value 80,000 − 10,000

= Rs.14,000 p.a.

Depreciation p.a. =

=

5

Life

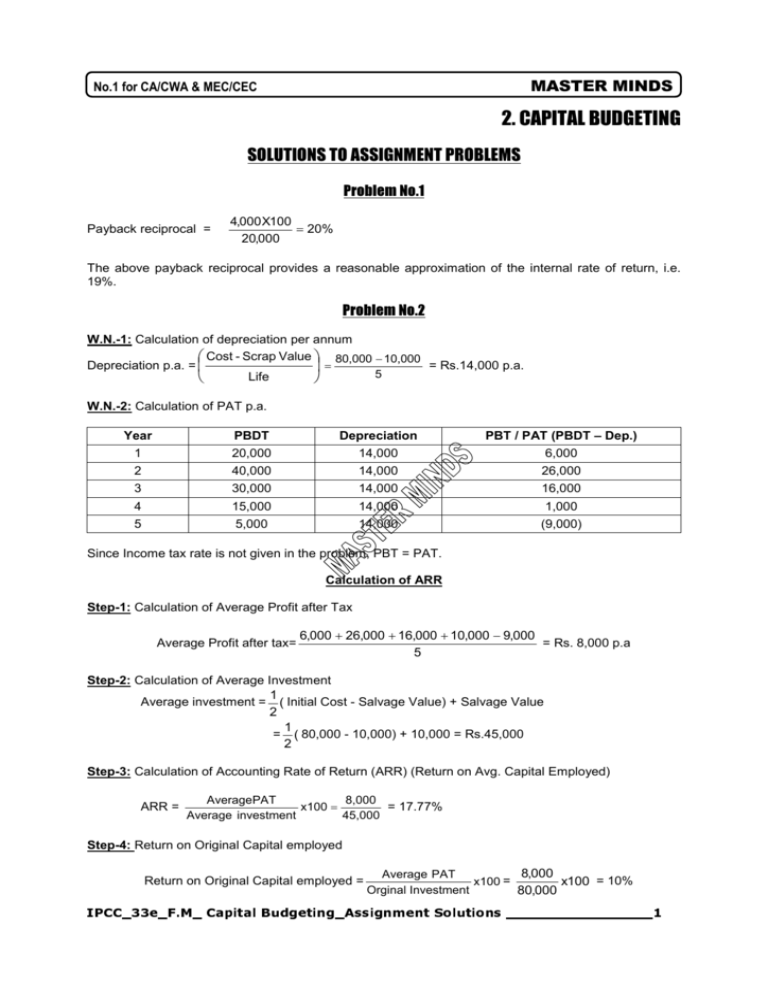

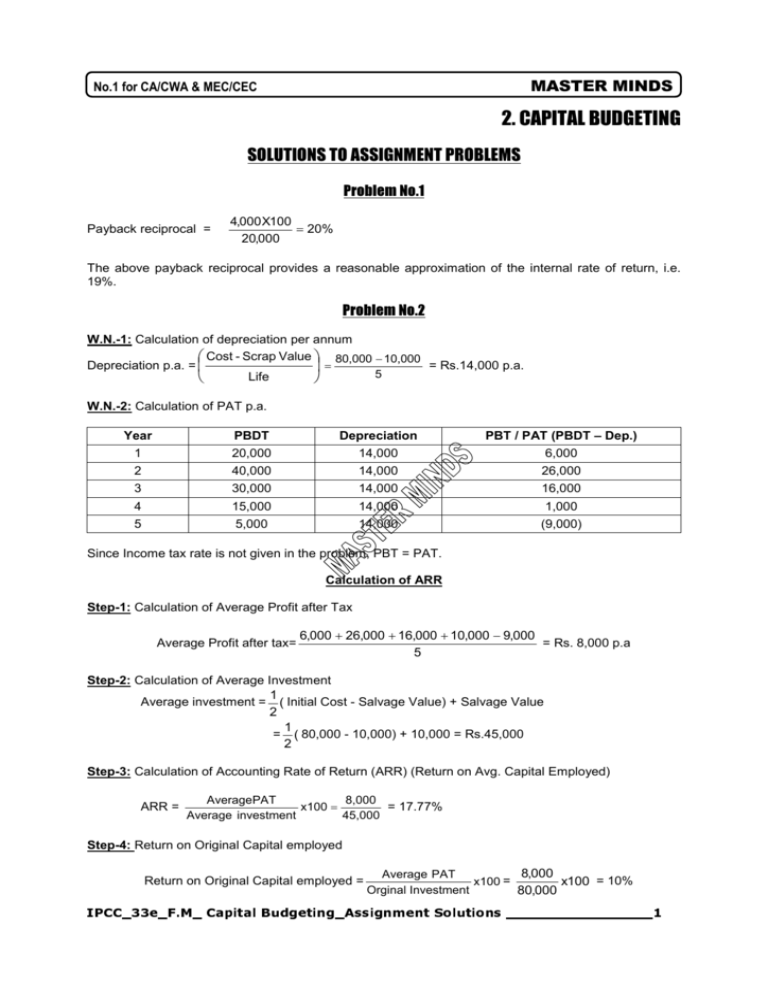

W.N.-2: Calculation of PAT p.a.

Year

PBDT

Depreciation

PBT / PAT (PBDT – Dep.)

1

2

3

20,000

40,000

30,000

14,000

14,000

14,000

6,000

26,000

16,000

4

5

15,000

5,000

14,000

14,000

1,000

(9,000)

Since Income tax rate is not given in the problem, PBT = PAT.

Calculation of ARR

Step-1: Calculation of Average Profit after Tax

Average Profit after tax=

6,000 + 26,000 + 16,000 + 10,000 − 9,000

= Rs. 8,000 p.a

5

Step-2: Calculation of Average Investment

1

Average investment = ( Initial Cost - Salvage Value) + Salvage Value

2

1

= ( 80,000 - 10,000) + 10,000 = Rs.45,000

2

Step-3: Calculation of Accounting Rate of Return (ARR) (Return on Avg. Capital Employed)

ARR =

AveragePAT

8,000

= 17.77%

x100 =

Average investment

45,000

Step-4: Return on Original Capital employed

Return on Original Capital employed =

8,000

Average PAT

x100 =

x100 = 10%

Orginal Investment

80,000

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________1

Ph:

98851 25025/26

www.gntmasterminds.com

Problem No.3

W.N. 1: Calculation of depreciation per annum

Cost - Scrap Value

80,000 − 0

= Rs.16,000 p.a.

=

5

Life

Depreciation p.a. =

Calculation of NPV using Incremental approach

Step-1: Calculation of Present Value of Cash Outflows:

Particulars

Amount

Investment in new equipment

80,000

Additional working capital

1,50,000

Total

2,30,000

Step-2: Calculation of Present Value of Operating Cash Inflows:

Particulars

Amount Rs.

Amount Rs.

1,00,000

Incremental net cash in flow

Less: additional wages

Depreciation(w.n.1)

Incremental PBT

Less: Tax @ 40 %

Incremental PAT

Add: depreciation

Incremental CFAT p.a

40,000

16,000

56,000

44,000

17,600

26,400

16,000

42,400

Therefore, Present Value of Operating Cash Inflows = 42,000 X PVAF(13%,5)

= 42,400 X 3.517

= 1,49,120

Step 3: Present Value of Terminal Cash Inflows

=

Gsp or Nsp on sale of initial equipment

=

0

Recovery of additional working capital

=

1,50,000

1,50,000

PV there off

=

1,50,000 * PVF (13%, 5)

= 1,50,000 X 0.543

=

Copy Rights Reserved

81,450

To

MASTER MINDS, Guntur

Step 4: Calculation of NPV

NPV

= PV of cash inflows – PV of cash outflows

= PV of Operating Cash Inflows +PV of Terminal Cash Inflows – PV of cash outflows.

= 1,49,120 + 81,450-2,30,000

= Rs.570

Conclusion: Since NPV is positive it is advisable to accept.

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________2

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Problem No.4

W.N – 1: Calculation of depreciation p.a.

Depreciation p.a. =

(Rs. in Lakhs)

Cost - Scrap Value 140 − 0

= Rs. 17.5 lakhs p.a.

=

8

Life

On supplementary equipment =

10 − 1

= 1.5 lakhs pa

6

Calculation of NPV using Incremental approach

Step-1: Calculation of Present Value of Cash Outflows:

Particulars

Amount

140

15

155

20

135

Cost of initial equipment

Cost of additional working capital

Less: tax free subsidy from government

Add: cost of supplementary equipment

- 10

Present value there off - 10* pvf ( 12% , 2 )

- 10* 0.797

Present value of cash out flows

7.97

142.97

Step-2: Calculation of Present Value of Operating Cash Inflows

Selling price per unit

a.

b.

c.

d.

e.

f.

g.

h.

i.

j.

k.

=

100

Less: - variable cost @ 40% =

40

Contribution per unit

60

=

Particulars

Sales volume (lakhs of unit)

Total contribution ( a * Rs. 60 per unit)

Fixed cost

Advertisement cost

Depreciation (WN – 1)

PBF (b-c-d-e) (loss)

Tax @ 50%

PAT (f-g)

CFAT (h+e)

PVF @ 12 %

Present value

Y1

0.8

48

16

30

17.5

(15.5)

(7.75)

(7.75)

9.75

0.893

8.706

Y2

1.2

72

16

15

17.5

23.5

11.75

11.75

29.25

0.797

23.31

Y3 to 5

3.0

180

16

10

19(17.5+1.5)

135

67.5

67.5

86.5

1.915

165.64

Y6 to 8

2.0

120

16

4

19

81

40.5

40.5

59.5

1.363

278.765

Therefore, Present Value of Operating Cash Inflows = Rs.278.765

Present value factor for years 3 to 5 = PVF (12% , 3) + PVF (12%, 4) + PVF (12%, 5)

= 0.712+0.636+0.567

= 1.915

Copy Rights Reserved

(or)

To

MASTER

MINDS, Guntur

PVAF (12%, 5) - PVAF (12%, 2)

= 3.605 - 1.690

= 1.915

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________3

Ph:

98851 25025/26

www.gntmasterminds.com

Present value factor for years 6 to 8 = PVF ( 12% , 6) + PVF (12%, 7) + PVF (12%, 8)

= 0.507+0.452+0.404

= 1.363

(or)

PVAF(12% , 8) - PVAF (12%, 5)

= 4.968 - 3.605

= 1.363

Step-3: Present Value of Terminal Cash Inflows =

Gsp or Nsp on sale of initial equipment

-0

Gsp or Nsp on sale of supplementary equipment - 1

Recovery of working capital

- 15

16

Pv there off

= 16 * PVF (12%, 8)

Copy Rights Reserved

To

MASTER MINDS, Guntur

= 16 * 0.404

=

6.464

Step-4: Calculation of NPV

NPV

= PV of cash inflows – PV of cash outflows

= PV of Operating Cash Inflows +PV of Terminal Cash Inflows – PV of cash outflows.

= 278 + 65 – 6.464 = Rs. 142.97

Conclusion: Since NPV is positive it is advisable to accept the project.

Note: It is given that the company has other profitable businesses and the loss from one business can

be set off against profit of other business. Alternatively it can also be assumed that the loss is carried

forward and setoff against future profit.

Problem No.5

Calculation of NPV

a.

Step 1: Calculation of Present Value of Cash Outflows:

Particulars

Cost of machinery

Present Value of Cash Outflows

Amount

4,00,000

4,00,000

Step 2: Calculation of Present Value of Operating Cash Inflows:

Particulars

a.

b.

c.

d.

e.

Sales volume

Contribution per unit (10-6)

Total contribution (axb)

Fixed cost

CFAT (c-d)

Amount

40,000 units

Rs.4

1,60,000

20,000

1,40,000 p.a

PV thereof = 1,40,000 X PVAF(15%,6)

= 1,40,000 X 3.784 = 5,29,760

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________4

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Step-3: Present Value of Terminal Cash Inflows

G.S.P/N.S.P on sale of machinery = 20,000

PV thereof = 20,000 X PVF(15%,6)

= 20,000 X 0.432

= 8,640

Step-4: Calculation of NPV

NPV

= PV of cash inflows – PV of cash outflows

= PV of Operating Cash Inflows +PV of Terminal Cash Inflows – PV of cash outflows.

= 5,29,760+8,640-4,00,000

= 1,38,400

Conclusion: Since NPV is positive it is advisable to accept the project.

b. Let, x represents the sale volume required to justify the project. The project is acceptable if NPV is

at least equal to zero

Step-1: same as above – 4,00,000.

Step-2: present value of operating cash inflows

Particulars

Amount (Rs.)

a. Sales volume

X unit

b. Contribution per unit (10 – 6)

4

c. Total contribution

4X

d. Fixed cost

20,000

e. CFAT (c-d)

Present value there of

4X-20,000

= (4X – 20,000) * PVAF (15%, 6 years)

= (4X – 20,000) *3.784

Copy Rights Reserved

Step-3: same as above – 8,640

To

MASTER MINDS, Guntur

Step-4: Finding the value of X

Since NPV is ‘0’ then present value of cash inflows = present value of cash outflows present value

of operating cash inflows + present value of terminal cash inflows = present value of cash out flows

(4X – 20,000) * 3.784 + 8,640

= 4,00,000

(4X – 20,000)

= 1,03,424

4X

= 1,23,424

X

= 30,856 units pa

Problem No.6

Given information:

Project

A

B

A&B

C

Investment

1,00,000

1,50,000

2,50,000

1,50,000

NPV

1,25.000

45,000

2,00,000

90,000

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________5

Ph:

98851 25025/26

www.gntmasterminds.com

a. Selection of the projects if the firm has no budget constraint:

Given that all the projects have positive NPV therefore it is beneficial to select all the projects I.e

A,B & C.

b. Selection of projects if there is a budget constraint of 2,50,000:

Combination

A&B

A&C

NPV

2,00,000

2,15,000(1,25,000+90,000)

Since NPV is more in case of projects A&C, it is beneficial to invest in project A&C.

Problem No.7

W.N - 1: Calculation of depreciation per annum

Cost of Machinery

2,50,000

Less: Salvage value

30,000

Depreciable amount

2,20,000

Copy Rights Reserved

To

MASTER MINDS, Guntur

Sum of the years digits = 1 + 2 + 3 + …….. + 10 = 55.

st

Dep. for 1 year =

rd

3 year =

th

5 year =

2, 20, 000

x 10 = Rs.40,000

55

2, 20, 000

x 8 = Rs. 32,000

55

2, 20, 000

x 6 = Rs.24,000

55

nd

2

year

th

4 year =

2, 20, 000

x 9 = Rs.36,000

55

2, 20, 000

x 7 = Rs. 8,000

55

=

W.D.V at the end of 5th year = Cost – depreciation

= 2,50,000 – 1,60,000

= Rs. 90,000

Book value of machine after capital expenditure

= 90,000 + 60,000

= Rs. 1,50,000

Depreciable amount from 6th to 10th year

= 1,50,000 – 30,000

= Rs. 1,20,000

Sum of the years digits = 1 + 2 + 3 + 4 + 5 = 15

th

Dep. for 6 year =

th

8 year =

th

10 year =

1, 20, 000

x 5 = Rs. 40,000

15

th

7 year =

1, 20, 000

x 3 = Rs. 24,000

15

th

1, 20, 000

x 4 = Rs. 32,000

15

9 year =

1, 20, 000

x 2 = Rs. 16,000

15

1, 20, 000

x 1 = Rs. 8,000

15

Calculation of NPV

Step-1: Calculation of Present Value of Cash Outflows

Particulars

Cost of Machinery

Add: Working capital

Add: Cost of Additional equipment [60,000 x PVF (20%, 5y)]

Present value of Cash Outflows

Amount

2,50,000

50,000

24,120

3,24,120

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________6

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Step-2: Calculation of Present Value of Operating Cash Inflows.

Particulars

Y1

(Rs. in Lakhs)

Y2

Y3

Y4

Y5

Y6

Y7

Y8

Y9

Y10

1.0

0.4

1.0

0.36

1.0

0.32

1.0

0.28

1.0

0.24

1.0

0.40

1.0

0.32

1.0

0.24

1.0

0.16

1.0

0.08

P.B.T

Less: Tax @ 40%

0.6 L

0.24 L

0.64

0.256

0.68

0.272

0.72

0.288

0.76

0.304

0.60

0.24

0.68

0.272

0.76 0.84

0.304 0.336

0.92

0.368

P.A.T

Add:Depreciation

0.36

0.4

0.384

0.36

0.408

0.32

0.432

0.28

0.456

0.24

0.36

0.40

0.408

0.32

0.456 0.504

0.24 0.16

0.552

0.08

C.F.A.T.

X P.V.F (20%, n)

0.76

0.833

0.744

0.694

0.728

0.579

0.712

0.482

0.696

0.76

0.402 0.335

0.728

0.279

0.696 0.664

0.233 0.194

0.632

0.162

P.Value

0.634

0.516

0.422

0.343

0.279 0.255

0.203

0.162 0.128

0.102

PBDT

Less: Dep.(W.N-1)

Therefore, Present Value of operating cash inflows = Rs.3,04,498

Step-3: Calculation of Present Value of Terminal Cash Inflows (At the end of the project)

Particulars

Amount

G.S.P/N.S.P on sale of machinery

Add: Recovery of working capital

30,000

50,000

Total of Terminal Cash Inflows

80,000

Present Value thereof = 80,000 X PVF (20%, 10y) = 80,000 X 0.162 = Rs.12,960

Step-4: Calculation of NPV

NPV = PV of cash inflows – PV of cash outflows

= PV of Operating Cash Inflows + PV of Terminal Cash Inflows – PV of Cash Outflows

= 3,04,498 + 12,960 – 3,24,120 = - Rs. 6662

Conclusion: Since NPV is negative it is not advisable for the company to accept the project.

Assumptions:

• Cash flows are assumed to accrue at the end of each year.

• Interim cash inflows at the end of each year are assumed to be reinvested at the rate of cost of

capital.

• Cash flows given in the problem are assumed to be certain.

Problem No.8

Copy Rights Reserved

To

MASTER MINDS,

Calculation of IRR:

(Single out flow & multiple even cash inflows)

From the given information,

PVA = 36,000

periodic payment = 11,200 term of annuity = 5 years

We know that, PVA

= P.P X PVAF (r%, 5 yrs)

36,000 = 11,200 X PVAF

PVAF

= 3.214

Trace the PVAF in the PVAF table against 5 years

Therefore IRR = 17% approximately

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________7

Ph:

98851 25025/26

www.gntmasterminds.com

Problem No. 9

(Rs. In Lakhs)

Step-1: Calculation of Pay Back Period

Machine – A

Year

Machine – B

CFAT

Accumulated CFAT

CFAT

Accumulated CFAT

1

2

3

4

5

1.5

2.0

2.5

1.5

1.0

1.5

3.5

6.0

7.5

8.5

0.5

1.5

2.0

3.0

2.0

0.5

2.0

4.0

7.0

9.0

Pay Back

Period

2+

= 2.6 Years

3+

5.0 − 3.5

2.5

5.0 − 4.0

3.0

= 3.33 years

Since Pay Back Period is less for Machine – A, it is beneficial to purchase Machine – A.

Step-2: Present Value of Cash Out flows

Particulars

Amount

Cost of Machinery

Present Value of Cash Outflows

5,00,000

5,00,000

Step-3: Present Value of Operating Cash Inflows

Year

Y1

CFAT

PVF @ 10%

PV

1.5

0.909

1.3635

Machine – A

Y2

Y3

Y4

Y5

Y1

2.5

0.751

1.8775

1.0

0.621

0.621

0.5

0.909

0.4545

2.0

0.826

1.652

1.5

0.683

1.0245

Machine – B

Y2

Y3

Y4

2.0

0.751

1.502

1.5

0.826

1.239

Y5

3.0

0.683

2.049

2.0

0.621

1.242

Present Value there of for Machine – A= 6.5385

Present Value there of for Machine – B= 6.4865

Step-4: Present Value of Terminal Cash Inflows - Nil

Step-5: Calculation of NPV and Profitability Index

Particulars

Machine A

Present Value of cash inflows

Present Value of cash outflows

NPV @ 10%

Profitability Index (P.V of Cash Inflows / Cash Outflows)

Machine B

6.5385

(5.0)

1.5385

1.31

6.4865

(5.0)

1.4865

1.30

Since NPV and P.I. are higher for Machine – A, it is beneficial to purchase Machine – A.

Step-6: Calculation of I.R.R for Machine – A

Year

Cash flow

0

1

2

5.0

1.5

2.0

NPV @ 20%

NPV @ 24%

PVF

PV

PVF

PV

1.0

0.833

0.694

(5.0)

1.25

1.39

1.0

0.806

0.650

(5.0)

1.21

1.30

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________8

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

3

4

5

2.5

1.5

1.0

NPV

0.579

0.482

0.402

1.45

0.72

0.40

0.21

0.524

0.423

0.341

1.31

0.63

0.34

(0.21)

Using Interpolation

IRR = Ll +

NPV@ L1

NPV@ L1 − NPV@ L 2

(L2 – L1)

=

20 +

0.21

(4) = 22%.

0.21 + 0.21

Step-7: Calculation of IRR for Machine – B

Year

NPV @ 18%

Cash flow

5.0

0.5

1.5

2.0

3.0

2.0

0

1

2

3

4

5

NPV @ 20%

PVF

PV

PVF

PV

1.0

0.847

0.718

0.609

0.516

0.437

(5.0)

0.42

1.08

1.22

1.55

0.87

1.0

0.833

0.694

0.579

0.482

0.402

(5.0)

0.42

1.04

1.16

1.45

0.80

0.14

(0.13)

Using Interpolation

IRR

NPV@ L1

=

Ll +

=

18 +

=

19.04%

NPV@ L1 − NPV@ L 2

(L2 – L1)

0.14

× 2 = 18 + 1.012 = 19.04%

0.14 + 0.13

Copy Rights Reserved

To

MASTER MINDS,

Since IRR is high for Machine – A, it is beneficial to purchase Machine – A.

Step-8: Calculation of Average Rate of Return

1. Depreciation

Particulars

Machine– A

Machine – B

Cost − Scrap

Life

1,00,000

1,00,000

2,50,000

2,50,000

2. Average Investment =

1

2

(Initial Investment − Scrap ) + Scrap + Add.W/cap

3. Average PAT. p.a.

(Avg CFAT – Depreciation)

4. Average Rate of Return (3) / (2)

70,000

80,000

1.5 + 2 + 2.5 + 1.5 + 1

− 1

5

0.5 + 1.5 + 2 + 3 + 2

− 1

5

0.28 (70,000/2,50,000)

0.32 (80,000/2,50,000)

Since machines are mutually exclusive and A.R.R. is high for Machine – B, it is beneficial to purchase

Machine – B.

Conclusion: In all the above cases except in the case of A.R.R - purchase of Machine - A is beneficial.

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________9

Ph:

98851 25025/26

www.gntmasterminds.com

Assumptions:

1. For Pay back period: Cash flows are assumed to accrue evenly throughout the year.

2. For NPV

• Cash flows are assumed to accrue at the end of each year.

• Interim cash inflows at the end of each year are assumed to be reinvested at the rate of cost of

capital.

• Cash flows given in the problem are assumed to be certain.

Copy Rights Reserved

To

3. For IRR

MASTER MINDS,

• Cash flows are assumed to accrue at the end of each year.

• Interim cash inflows at the end of each year are assumed to be reinvested at the rate of IRR.

• Cash flows given in the problem are assumed to be certain.

Problem No. 10

Step-1: Calculation of CFAT p. a

Particulars

Machine X

Estimated savings in cost

Estimated savings in Wages

Less: Additional cost of maintenance

Additional cost of supervision

CFAT p.a

Machine Y

500

6,000

800

1,200

4,500

800

8,000

1,000

1,800

6,000

Step-2: Calculation of Pay back period

Particulars

Payback period =

Machine X

Initial Investment

9000

CFAT

4500

= 2yrs.

Machine Y

18000

= 3 yrs.

6000

Assumption: The two machines are mutually exclusive.

Conclusion: It is beneficial to select the machine with least pay back period i.e. Machine X.

Problem No.11

(a)

(i) Payback Period

Project A: 10,000/10,00

= 1 year

Project B: 10,000/7,500

= 1 1/3 years.

Project C: 2 years +

10,000 − 6,000

1

= 2 years

12,000

3

Project D: 1 year.

(ii) ARR

(10,000 − 10,000)1/ 2

=0

Project A:

(10,000)1/ 2

Copy Rights Reserved

To

MASTER MINDS, Guntur

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________10

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

(15,000 − 10,000)1/ 2 2,500

=

= 50%

(10,000)1/ 2

5,000

(18,000 − 10,000)1 / 3 2,667

=

= 53%

Project C:

(10,000)1 / 2

5,000

(16,000 − 10,000)1/ 3 2,000

=

= 40%

Project D:

(10,000)1/ 2

5,000

Project B:

Copy Rights Reserved

To

MASTER MINDS, Guntur

Note: This net cash proceed includes recovery of investment also. Therefore, net cash

earnings are found by deducting initial investment.

(iii) IRR

Project A:

The net cash proceeds in year 1 are just equal to investment.

Therefore, r = 0%

Project B:

This project produces an annuity of Rs.7,500 for two years.

Therefore, the required PVAF is: 10,000/7,500 = 1.33.

This factor is found under 32% column. Therefore, r = 32%

Project C:

Since cash flows are uneven, the trail and error method will be followed. Using

20% rate of discount the NPV is + Rs.1,389. At 30% rate of discount, the NPV

is –Rs.633. The true rate of return should be less than 30%. At 27% rate of

discount it is found that the NPV is –Rs.86 and at 26% + Rs.105. Through

interpolation, we find r = 26.5%

Project D:

In this case also by using the trail and error method, it is found that at 37.6%

rate of discount NPV becomes almost zero.

Therefore, r = 37.6%

(iv) NPV

Project A:

at 10%

at 30%

-10,000+10,000x0.909 = -910

-10,000+10,000x0.769 = -2,310

Project B:

at 10% -10,000+7,500(0.909+0.826) = 3,013

at 30%

-10,000+7,500(0.769+0.592) = +208

Project C:

at 10% -10,000+2,000x0.909+4,000x0.826+12,000x0.751 = +4,134

at 30%

-10,000+2,000x0.769+4,000x0.592+12,000x0.455 = -633

Project D:

at 10% -10,000+10,000x0.909+3,000x(0.826+0.751) = +3,821

at 30%

-10,000+10,000x0.769+3,000x(0.592+0.4555) = +831

The Project are ranked as follows according to the various methods:

Ranks

Projects

A

B

C

D

PB

1

2

3

1

ARR

4

2

1

3

IRR

4

2

3

1

NPV (10%)

4

3

1

2

NPV (30%

4

2

3

1

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________11

Ph:

98851 25025/26

www.gntmasterminds.com

(b) Payback and ARR are theoretically unsound method for choosing between the investment projects.

Between the two time-adjusted (DCF) investment criteria, NPV and IRR, NPV gives consistent

results. If the projects are independent (and there is no capital rationing), either IRR or NPV can be

used since the same set of projects will be accepted by any of the methods. In the present case,

except Project A all the three projects should be accepted if the discount rate is 10%. Only Projects

B and D should be undertaken if the discount rate is 30%.

If it is assumed that the projects are mutually exclusive, then under the assumption of 30% discount

rate, the choice is between B and D (A and C are unprofitable). Both criteria IRR and NPV give the

same results – D is the best. Under the assumption of 10% discount rate, ranking according to IRR

and NPV conflict (except for Project A). If the IRR rule is followed, Project D should be accepted.

But the NPV rule tells that Project C is the best. The NPV rule generally gives consistent results in

conformity with the wealth maximization principle. Therefore, Project C should be accepted

following the NPV rule.

Problem No.12

(a)

Payback Period Method:

A = 5 + (500/900)

= 5.5 years

B = 5 + (500/1200)

= 5.4 years

C = 2 + (1000/2000)

= 2.5 years

Net Present Value:

NPVA = (- 5000) + (900 - 6.145) = (5000) + 5530.5 = Rs.530.5

NPVB is calculated as follows:

Year

Cash flow (Rs.)

10% discount factor

Present value (Rs.)

0

(5,000)

1.000

(5,000)

1

700

0.909

636

2

800

0.826

661

3

900

0.751

676

4

1,000

0.683

683

5

1,100

0.621

683

6

1,200

0.564

677

7

1,300

0.513

667

8

1,400

0.467

654

9

1,500

0.424

636

10

1,600

0.386

618

1591

NPVC = (-5000) + (2000×2.487) + (1000×0.683) = Rs.657

Internal Rate of Return

If NPVA = 0, present value factor of IRR over 10 years = 5000/900 = 5.556

From tables, IRR A = 12 per cent.

Copy Rights Reserved

To

MASTER MINDS, Guntur

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________12

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

IRRB

Year

Cash flow

(Rs.)

10% discount

factor

Present

value (Rs.)

0

1

2

3

4

5

6

7

8

9

10

(5,000)

700

800

900

1,000

1,100

1,200

1,300

1,400

1,500

1,600

1.000

0.909

0.826

0.751

0.683

0.621

0.564

0.513

0.467

0.424

0.386

(5,000)

636

661

676

683

683

677

667

654

636

618

1,591

Interpolating: IRRB = 10 +

20%

discount

factor

1.000

0.833

0.694

0.579

0.482

0.402

0.335

0.279

0.233

0.194

0.162

Present

value (Rs.)

(5,000)

583

555

521

482

442

402

363

326

291

259

(776)

1,591x10

= 10+6.72 = 16.72 per cent

(1,591 + 776)

IRRC

15%

discount

factor

Present

value (Rs.)

18%

discount

factor

Present

value (Rs.)

(5,000)

1.000

2,000

0.870

(5,000)

1.000

(5,000)

1,740

0.847

1,694

2

2,000

0.756

1,512

0.718

1,436

3

2,000

0.658

1,316

0.609

1,218

4

1,000

0.572

572

0.516

516

Year

Cash flow

(Rs.)

0

1

140

136

140x3

= 15 + 1.52 = 16.52 per cent

(140 + 136)

Accounting Rate of Return

5,000

ARRA: Average capital employed =

= Rs.2,500

2

(9,000 − 5,000 )

Average accounting profit =

= Rs.400

10

( 400x100)

ARRA =

= 16 per cent

2,500

(11,500 − 5,000 )

= Rs.650

ARRB: Average accounting profit =

10

(650x100)

ARRB =

= 26 per cent

2,500

(7,000 − 5,000 )

= Rs.500

ARRC = Average accounting profit =

4

(500 x100)

ARRC =

= 20 per cent

2,500

Interpolating: IRRC = 15 +

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________13

Ph:

98851 25025/26

www.gntmasterminds.com

(b)

Summary of Results

Project

A

5.5

16

12.4

530.5

Payback (years)

ARR (%)

IRR (%)

NPV (Rs.)

B

5.4

26

16.7

1,591

C

2.5

20

16.5

657

Comparison of Rankings

Method

1

2

3

Payback

C

B

A

ARR

B

C

A

IRR

B

C

A

NPV

B

C

A

Problem No.13

Calculation of NPV & IRR:

Year

NPV at the rate of 12%

Cash flow

0

PVF @12%

PV

NPV at the rate of 13%

PVF @13%

PV

(35,00,000)

1

(35,00,000)

1

(35,00,000)

1-4

10,00,000

3.037

30,37,000

2.974

29,74,000

5

5,00,000

0.567

2,83,500

0.543

2,71,500

6

5,00,000

0.507

2,53,500

0.48

2,40,000

NPV

74,000

(14,500)

Using interpolation,

IRR = l1 +

NPV @ l1

(l2 − l1 )

NPV @ l1 − NPV @ l2

Copy Rights Reserved

74,000

(13% − 12%)

=12% +

88,500

= 12.836%

To

MASTER MINDS, Guntur

Since NPV is positive, it is beneficial for the company to accept the proposal.

Since IRR is > cost of capital, it is beneficial for the company to accept the proposal.

Problem No.14

1. Computation of Net Present Values of Projects:

Cash flows

Year

0

1

2

Project A

Rs. (1)

1,35,000

30,000

Project B

Rs. (2)

2,40,000

60,000

84,000

Discounting

Discounted

Factor @ 16%

Cash flow

Project A

Project B

(3)

Rs. (3) x (1)

Rs. (3) x (2)

1.000

1,35,000

2,40,000

0.862

51,720

0.743

22,290

62,412

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________14

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

3

4

5

Net present value

1,32,000

84,000

84,000

96,000

1,02,000

90,000

0.641

0.552

0.476

84,612

46,368

39,984

58,254

61,536

56,304

42,840

34,812

2. Computation of Cumulative Present Values of Projects Cash inflows:

Year

Project A

PV of cash

Cumulative

inflows

PV

Rs.

1

2

3

4

5

Project B

PV of

Cumulative

cash inflows

PV

Rs.

Rs.

51,720

51,720

62,412

1,14,132

61,536

1,75,668

56,304

2,31,972

42,840

2,74,812

Rs.

22,290

84,612

46,368

39,984

22,290

1,06,902

1,53,270

1,93,254

(i) Discounted payback period: (Refer to Working note 2)

Cost of Project A = Rs.1,35,000

Cost of Project B = Rs.2,40,000

Cumulative PV of cash inflows of Project A after 4 years = Rs.1,53,270

Cumulative PV of cash inflows of Project B after 5 years = Rs.2,74,812

A comparison of projects cost with their cumulative PV clearly shows that the project A’s cost

will be recovered in less than 4 years and that of project B in less than 5 years. The exact

duration of discounted pay back period can be computed as follows:

Project A

Project B

18,270

34,812

(Rs.1,53,270 – Rs.1,35,000)

(Rs.1,53,270 – Rs.1,35,000)

period

0.39 year

0.81 years

To recover excess amount of

cumulative PV over project

cost

(Rs.18,270 / Rs.46,368)

(Rs.34,812 / Rs.42,840)

3.61 year

4.19 years

(4 – 0.39 years

(5 – 0.81) years

Excess PV of cash inflows

over the

Project cost (Rs.)

Computation

required

of

(Refer to Working note2)

Discounted payback period

(ii) Profitability Index : =

Sumofdisco untcash inf lows

initiancas houtlay

Profitability Index (for Project A)

=

Profitability Index (for Project B)

=

(iii) Net present value (for Project A)

(Refer to Working note 1)

Net present value (for Project B)

=

Rs.1,93,254

= 1.43

Rs.1,35,000

Rs.2,74,812

= 1.15

Rs.2,40,000

Rs.58,254

=

Rs.34,812

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________15

Ph:

98851 25025/26

www.gntmasterminds.com

Problem No.15

Advise to the Hospital Management:

Determination of Cash inflows

Amount

Sales Revenue

Less: Operating Cost

40,000

7,500

32,500

9,250

23,250

6,975

16,275

9,250

25,525

12,000

13,525

Less: Depreciation (80,000 – 6,000)/8

Net Income

Tax @ 30%

Earnings after Tax (EAT)

Add: Depreciation

Cash inflow after tax per annum

Less: Loss of Commission Income

Net Cash inflow after tax per annum

In 8th Year :

New Cash inflow after tax

Add: Salvage Value of Machine

Net Cash inflow in year 8

13,525

6,000

19,525

Calculation of Net Present Value (NPV):

Year

CFAT

13,525

19,525

1 to 7

8

Present Value of

Cash inflows

PV Factor @10%

4.867

0.467

Less: Cash Outflows

NPV

65,826.18

9,118.18

74,944.36

80,000.00

(5,055.64)

Sum of discounted cash inflows 74,944.36

=

=0.937

Present value of cash outflows

80,000

Advise: Since the net present value is negative and profitability index is also less than 1, therefore, the

hospital should not purchase the diagnostic machine.

Profitability Index =

Note: Since the tax rate is not mentioned in the question, therefore, it is assumed to be 30 percent in

the given solution.

Problem No.16

(i) Payback Period of Projects

Particulars

C0

C1

C2

C3

A

(10,000)

6,000

2,000

2,000

3 years

B

(10,000)

2,500

2,500

5,000

3 years

C

(3,500)

1,500

2,500

D

(3,000)

0

0

1 year and 9.6 months

3,000

3 years

12

x2,000

i.e.

2,500

(ii) If standard payback period is 2 years, Project C is the only acceptable project. But if standard

payback period is 3 years, all the four projects are acceptable.

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________16

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

(iii) Discounted Payback Period (Cash flows discounted at 10%)

A 10,000 + 5,454.6 + 1,652.8 + 1,502.6 + 8,196

3years +

12

x1,390 = 3 years and 2 months

8,196

B 10,000 + 2,272.75 + 2,066 + 3,756.5 + 5,122.50

3years +

12

x1,904.75 = 3 years and 4.6 months

5,122.55

C 3,500 + 1,363.65 + 2,066 + 375.65 + 3,415

2years +

12

x70.35 =2 years and 2.25 months

375.65

D 3,000 + 0 + 0 + 2,253.9 + 4,098

3years +

12

x746.10 =3 years and 2.18 months

4,098

If standard discounted payback period is 2 years, no project is acceptable on discounted payback

period criterion.

If standard discounted payback period is 3 years, Project ‘C’ is acceptable on discounted payback

period criterion.

Problem No.17

Recommendations regarding Two Alternative Proposals:

(i) Net Present Value Method:

Computation of Present Value

Project A = Rs.4,00,000 x 3.791 = Rs.15,16,400

Project B = Rs.5,80,000 x 3.791 = Rs.21,98,780

Computation of Net Present Value:

Project A = Rs.15,16,400 – 12,00,000 = Rs.3,16,400

Project B = Rs.21,98,780 – 18,00,000 = Rs.3,98,780

Advise: Since the net present value of Project B is higher than that of Project A, therefore, Project

B should be selected.

(ii) Present Value Index Method:

Present Value Index =

Pr esentValue ofCash inf low

InitialInv estment

15,16,400

= 1.264

12,00,000

21,98,780

= 1.222

Project B =

18,00,000

Copy Rights Reserved

Project A =

To

MASTER MINDS, Guntur

Advise: Since the present value index of Project A is higher than that of Project B, therefore,

Project A should be selected.

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________17

Ph:

98851 25025/26

www.gntmasterminds.com

(iii) Internal Rate of Return (IRR):

Project A:

P.V. Factor =

InitialInvestment

12,00,000

=

=3

AnnualCashInflow

4,00,000

PV factor falls between 18% and 20%

Present Value of cash inflow at 18% and 20% will be:

Present Value at 18% = 3.127 x 4,00,000 = 12,50,800

Present Value at 20% = 2.991 x 4,00,000 = 11,96,400

12,50,800 − 12,00,000

x(20 − 18)

IRR

= 18 +

12,50,800 − 11,96,400

50,800

x2

54,400

= 18 + 1.8676 = 19.868%

= 18 +

Copy Rights Reserved

To

MASTER MINDS, Guntur

Project B:

P.V. Factor =

18,00,000

= 3.103

5,80,000

Present Value of cash inflow at 18% and 20% will be:

Present Value at 18% = 3.127 x 5,80,000 = 18,13,660

Present Value at 20% = 2.991 x 5,80,000 = 17,34,780

18,13,660 − 18,00,000

x(20 − 18)

IRR = 18 +

18,13,660 − 17,34,780

13,660

x2

= 18 +

78,880

= 18 + 0.3463 = 18.346%

Advise: Since the internal rate of return of Project A is higher than that of Project B, therefore,

Project A should be selected.

Problem No.18

Working notes:

Cost - Scrap Value

1,50,000

= Rs.30,000

=

5

Life

Depreciation on machine. X =

2,40,000

Cost - Scrap Value

= Rs.40,000

=

6

Life

Depreciation on machine. Y =

Particulars

Annual savings:

Wages

Scrap

Total savings(A)

Annual estimated cash cost:

Indirect material

Supervision

Maintenance

Total cash cost(B)

Machine X

Machine Y

90,000

10,000

1,00,000

1,20,000

15,000

1,35,000

6,000

12,000

7,000

25,000

8,000

16,000

11,000

35,000

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________18

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Annual cash savings(A-B)

Less: depreciation

Annual savings before tax

Less: tax @ 30 %

Annual profit after tax

Add: depreciation

Annual cash in flows

75,000

30,000

1,00,000

40,000

45,000

13,500

60,000

18,000

31,500

30,000

42,000

40,000

61,500

82,000

Evaluation of alternatives:

(i) ARR = average annual net savings

Average investment

31,500

x100 = 42%

Machine X =

75,000

42,000

x100 = 35%

Machine Y =

1,20,000

Copy Rights Reserved

To

MASTER MINDS, Guntur

Decision: Machine X is better.

[Note: ARR can be computed alternatively taking initial investment as the basis forcomputation (ARR =

Average Annual Net Income/Initial Investment). The value ofARR for Machines X and Y would then

change accordingly as 21% and 17.5%respectively]

(ii) Present Value Index Method

Present Value of Cash Inflow = Annual Cash Inflow x P.V. Factor @ 10%

Machine X

= 61,500 x 3.79

= Rs.2,33,085

Machine Y

= 82,000 x 4.354

= Rs.3,57,028

P.V index

= present value of cash inflow

Investment

Machine X

=

2,33,085

= 1.5539

1,50,000

Machine Y

=

3,57,028

= 1.4876

2,40,000

Decision: Machine X is better.

Problem No.19

PART – A

Project

Present Value of Cash Inflows

A

B

C

D

E

1,87,600 x PVAF (12%, 2y ) = 317044

66,000 x PVAF (12%, 5y ) = 2,37,930

1,00,000 x PVAF (12%, 3y) = 2,40,200

20,000 x PVAF (12%, 9y) = 1,06,560

66,000 x PVAF (12%, 10y) = 3,72,900

Initial

cash

outlay

3,00,000

2,00,000

2,00,000

1,00,000

3,00,000

NPV

P.I

17,044

37,930

40,200

6,560

72,900

1.057

1.19

1.201

1.066

1.243

Ranking

as per

NPV

IV

III

II

V

I

Ranking

as per

P.I

V

III

II

IV

I

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________19

Ph:

98851 25025/26

www.gntmasterminds.com

PART – B

All the projects have positive NPV. So, we can accept all the projects subject to availability of funds. It is

also given that the company is having limited funds of Rs.4,00,000 and we need Rs.11,00,000 to invest

in all the projects. So, it is required to do capital rationing.

Capital Rationing, assuming that the projects are divisible

Project

E

Cash Outflow

3,00,000

C

1,00,000

NPV

72,900

20,100

Total

Surplus funds

1,00,000

40,200

x 1,00,000

2,00,000

93,000

-

PART - C

All the projects have positive NPV. To accept all the projects we need initial investment of Rs.11,00,000.

But the available funds are just Rs.5,00,000. Therefore, it is necessary to do capital rationing.

Capital Rationing, assuming that the projects are divisible

Project

E

C

Cash outlay

3,00,000

2,00,000

NPV

72,900

40,200

1,13,100

Total

Surplus funds

2,00,000

---

Assumptions:

• Perfect linear relationship is assumed to exist between inflows and outflows. In other words, NPV

changes proportionately to changes in investment.

• It is assumed that there is scarcity of funds in the current year only. In other words, there is no

scarcity of funds in subsequent years.

• The given projects are mutually independent.

• A project can be accepted only once.

• A project can either be accepted now or rejected. In other words, there is no question of postponement.

THE END

IPCC_33e_F.M_ Capital Budgeting_Assignment Solutions ________________20