To calculate Present Values, you need three things:

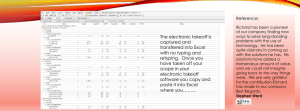

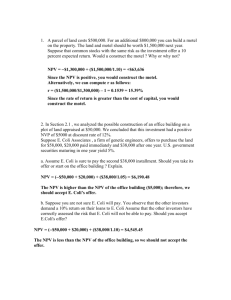

advertisement

To calculate Present Values, you need three things: Amount of Payments - How much will be received in future? Time Periods - At what time in the future will the payments be received? Interest Rate - What is the risk and opportunity cost associated with the future values? The Time Value of Money and Net Present Value • Having a dollar today is worth more than having the right to receive a dollar in the future • Calculating Present Values will tell you how much less that dollar in the future is worth than the dollar today. How to Calculate! • You can use the present value tables. • Multiply the payment to be received by the factor for the time period and the rate given. • PV = Payment x PVIF(rate, # of periods) Present Value of a Single Payment Present Value of an Annuity Net Present Value Method Open Imaging Company is considering the purchase of a magnetic resonance imaging (MRI) machine to improve the efficiency of its Radiology Department. Management must decide between Model M and Model N. The company’s minimum rate of return is 16 percent • Model M – Cost of $17,500 – Estimated residual value of $2,000 after 5 years – Projected cash inflows of $6,000, $5,500, $5,000, $4,500, and $4,000 during its five-year life • Model N – Cost of $21,000 – Estimated residual value of $2,000 after 5 years – Projected cash inflows of $6,000 per year for 5 years Net Present Value Method • Determine the net present value for Model M – Must use Table for Present Value of a Single Payment because of unequal cash flows Year 1 2 3 4 5 Residual value Total present value of cash inflows Less purchase price of Model M Net present value The cash outflow for the purchase is not discounted because it occurs at time zero Model M Net Cash Inflows $6,000 5,500 5,000 4,500 4,000 2,000 16% Factor .862 .743 .641 .552 .476 .476 Present Value $ 5,172.00 4,086.50 3,205.00 2,484.00 1,904.00 952.00 $17,803.50 17,500.00 $ 303.50 The residual value is discounted because it represents a cash inflow that will take place at the end of year 5 Net Present Value Method • Determine the net present value for Model N – Table for Present Value of an Annuity is used because the cash inflows are expected to be equal amounts in each year – However, Table 3 must still be used to determine the present value of the machine’s residual value Year 1-5 Residual value Total present value of cash inflows Less purchase price of Model N Net present value Model N Net Cash Inflows $6,000 2,000 16% Factor 3.247 .476 Present Value $19,644.00 952.00 $20,596.00 21,000.00 ( $ 404.00 ) Net Present Value Method • Results of the two analyses – Net present value of Model M is $303.50 – Net present value of Model N is ($404.00) • Model M should be chosen because it – Has a positive net present value – Is expected to exceed the company’s minimum rate of return • Model N should be rejected because it has a negative net present value Use Excel to Calculate NPV • Open a new workbook. Set up rows and columns to reflect time periods and future payments. Use Excel to Calculate NPV Insert the NPV function into the cell Use Excel to Calculate NPV Select Function from Category and Menu Use Excel to Calculate NPV Use Dialog box to enter interest rate Use Excel to Calculate NPV Select range of values for payments Use Excel to Calculate NPV • Click OK • Excel calculates NPV and displays formula in Formula Bar Use Excel to Calculate NPV Subtract Present Value of Cost to acquire asset to determine NPV Slight difference between Excel and tables is due to rounding Use Excel to Calculate NPV • Excel is more accurate than tables. • Can easily perform “what-if” calculations by changing variables, such as rate, payment, etc. • Avoid confusion over which table to use! • Easy to copy and paste calculations into other docs for presentation.