PEER REVIEW - CPE Conferences

advertisement

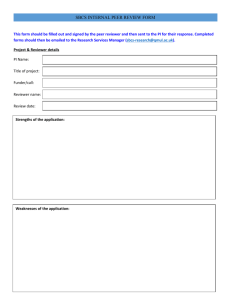

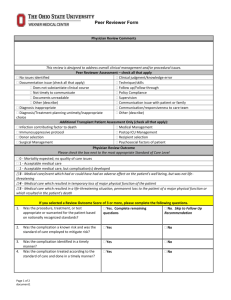

“Survival Tips” For Firms Undergoing Peer Review Debra Seefeld, CPA, CFE Seefeld Lawson Moeller LLP The Woodlands, Texas June 11, 2014 Primary goal of firms every three years…. To pass their PEER REVIEW! 1 Todays discussion to include: • Selecting a reviewer • What to expect during the peer review • Understanding the peer reviewer’s procedures AND… • Common peer review deficiencies • Reducing the cost of the peer review • Dealing with disagreements Quality Control Standards • SQCS No. 8, A Firm’s System of Quality Control, (which superseded and replaced all of the quality control standards that existed at the time) was applicable to a CPA firm’s system of QC for it’s A&A practice as of January 1, 2012 2 SQCS No. 8 identifies the following six elements of QC to be included in a firm’s QC system and addressed in its policies: 1. Leadership Responsibilities for Quality Within the Firm (“Tone at the Top) 2. Relevant Ethical Requirements 3. Acceptance and Continuance of Client Relationships and Specific Engagements 4. Human Resources 5. Engagement Performance 6. Monitoring Overview of Standards • What are the types of peer reviews? – System – Engagement • How does a firm know which review type is necessary? 3 System Review • For firms that perform engagements under– – Statement on Auditing Standards (SASs) – Government Auditing Standards (Yellow Book) – Examinations of prospective financial information under Statement on Standards for Attestation Engagements (SSAEs) System Review Cont. • Purpose of a system review – is to provide the reviewer with a reasonable basis for expressing an opinion on whether the firm: – Has designed its system of QC for its A&A practice in accordance with AICPA QC standards – Is complying with its QC policies & procedures in a way that will provide the firm with reasonable assurance of conforming with professional standards Engagement Review For firms that – – Are not required to have a system review. 4 Engagement Review Cont. • Purpose of an engagement review – is to provide the reviewer with a reasonable basis for expressing limited assurance that: – The financial statements and the related accountant’s report the firm submits for review, conform with professional standards – The reviewed firm’s documentation conforms with the requirements of SSARs or the SSAEs Reporting Model Changes One of the most significant changes is to the reporting model. Old Standards New Standards Unmodified – No LOC (Matter – MFC) -orUnmodified – LOC (Finding – in LOC) Pass (Matter – MFC) (Finding – FFC) Modified – LOC (Deficiency – in report) (Finding – in LOC) Pass with Deficiency (Deficiency – in report) Adverse (Deficiency – in report) Fail (Significant deficiency – in report) Elimination of Letter of Comments & Expanded Use of “Forms” to Communicate Findings to the Reviewed Firm • Matter for Further Consideration (MFC) form – the matter is documented on the MFC form and discussed with the firm or cleared. However, a matter may develop into a finding. • Finding for Further Consideration (FFC) form – finding documented here “only if the finding is not elevated to a deficiency or significant deficiency”. 5 Situation Noted Documented in/on Effect Matter MFC Form Discussed with firm or cleared Finding FFC form* Implementation plan*^ Deficiency “Pass w/ Deficiency(ies)” Peer Review Report Corrective action plan^ Significant deficiency “Fail” Peer Review Report Corrective action plan^ * Only if the finding is not elevated to a deficiency or significant deficiency ^ Only if requested by the administering entity’s peer review committee Selecting a Reviewer • Choose Method for Selecting Reviewer – Firm-on-Firm – Associations of CPA Firms – CART (engagement reviews only) Relationship with the Peer Reviewer • How do I set the appropriate tone? – Focus on the firm’s dedication to continual improvement – Establish an atmosphere of trust and cooperation • Surprises can be good, but not in a peer review – open communication is key! 6 Scheduling Your Review • For firm-on-firm review – – Interview potential reviewers – Consider the cost – TSCPA approves reviewer – Arrange date/lodging Scheduling Your Review Cont. • Note due date of review • Complete background information • Estimate A&A hours (system review) – Note: Each compilation counts as 1 engagement (For example, 1 yr of monthly compilation engagements = 12 engagements on statistics) Before Your Peer Review Begins • System & Engagement Reviews: – TSCPA scheduling form (Tip: email notification… watch your “junk mail”) – Inform AICPA/TSCPA firm name or structure change – Engagement letter 7 Before Your Peer Review Begins Cont. • System Review: – An engagement list (A&A list) – Completed Quality Control Policies & Procedures Questionnaire (and QCD, if applicable) – Monitoring documentation (since last peer review) – Other items requested (list of personnel, firm background information, etc) Survival Tips • Coach firm personnel on anticipated inquires from reviewer • Monitoring is required (you must document) -- even sole practitioners • Consider consulting an outside peer reviewer between reviews Selection of Engagements • System Reviews – No earlier than three weeks before review – Cross-selection of A&A practice – Surprise engagement (highest level – must be surprise) 8 Selection of Engagements Cont. • “Must Selects” – Governmental - Government Auditing Standards – Employee Benefit Plans – Depository Institutions (> $500 million assets) – Broker-Dealers – Service Organizations Selection of Engagements Cont. • “Must Cover” – HUD – School Districts – State and Local Government – Industries in which a firm’s auditing practice has 10% or more concentration or the firm’s three largest industry concentrations (if none represent more than 10%) Survival Tips • Submit all required documents on time to your reviewer & the TSCPA • By knowing the peer review standards, firms can anticipate the engagements to be selected for review & inspect those files before the review begins 9 Before Your Peer Review Begins • Engagement Review: – Financial statements/accountant’s reports – Engagement questionnaire – SSARS/SSAE documentation – Engagement letter SSARs 8 – Firm representation letter Selection of Engagements • Engagement Reviews – Generally two engagements selected What to Expect During the Review • Assemble remaining engagements • Have staff available • Remain open-minded • Ask reviewer for feedback (engagement & practice management areas) 10 What to Expect During the Review Cont. • Respond to reviewers questions promptly – Oral – MFC’s and/or FFC’s – E-mail • Have others attend exit conference Accessing MFCs Online... Understanding the Peer Reviewer’s Procedures, for example: • Review of firm’s planning & engagement profile • Read report & review financial statements • Review audit documentation for general audit procedures • Identify significant audit areas 11 • Review remaining audit documentation for significant audit areas • Provides explanation for all “no” answers for which Matters for Further Consideration (MFC) forms may be generated • Determine if matters noted are elevated to a finding and should be reported to the firm on the Findings for Further Consideration (FFC) form • Determine impact of findings on report to be issued Common Peer Review Deficiencies – Reports & Financial Statements • Report dating departures • Report wording • Failure to report on supplemental information • Report did not cover all periods covered by the financial statements Common Peer Review Deficiencies – Reports & Financial Statements Cont. • Failure to disclose lack of independence in a compilation report • Omitted or inadequate disclosures • Inappropriate F/S titles • Improper classification between current & long-term debt 12 Common Peer Review Deficiencies – Procedures & Documentation • Failure to document risk assessment • Using outdated third party practice aids • Dating discrepancies on management representation letter • Failure to sign off on all programs & checklists Common Peer Review Deficiencies – Procedures & Documentation Cont. • Failure to document risk of fraud • Failure to document analyticals (pre and post) • Failure to document 101-3 (for example when providing tax & compilation for same client) • Failure to document monitoring Survival Tips • 101-3 Are you in compliance? • CPE to match work performed – don’t just “count hours”? 13 Reducing Costs of the Peer Review • Firms that have a properly designed QC system tend to have fewer deficiencies, which means less time on the review • Have all files ready when reviewer arrives • Avoid interruptions • Deal with reviewer’s questions when the reviewer is in the field Dealing with Disagreements • Differences of opinion between reviewed firm & reviewer should be resolved before the “exit conference” • Ask the reviewer for support to his or her conclusion by providing section of the applicable professional standards • If you still disagree, note your reasons on the MFC and/or FFC form(s) Dealing with Disagreements Cont. • Reviewed firm may contact – – TSCPA administering the review – AICPA Technical Hotline – AICPA Ethics Hotline 14 Between Reviews • Notify AICPA if firm issues first audit • Read firm’s prior peer review report • Monitor your firm’s policies and procedures Between Reviews Cont. • Modify policies & procedures as necessary • Prepare written monitoring report • Communicate findings to firm Survival Tips The Best System of Quality Control is . . . one that provides the firm with reasonable assurance of conforming with professional standards and the standards of the firm. 15 Debra Seefeld, CPA, CFE 281.362.9732 Ext 106 Debra@SeefeldCPA.com The Woodlands, Texas 16