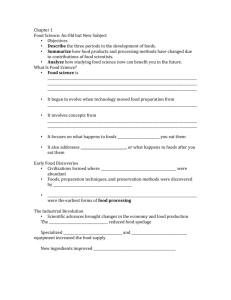

Research Question

advertisement

Mandatory Labeling and Aversion to GM foods Experimental evidence from India Sangeeta Bansal Centre for International Trade & Development School of International Studies Jawaharlal Nehru University New Delhi 110067, India sangeeta@mail.jnu.ac.in Sujoy Chakravarty Department of Humanities and Social Sciences Indian Institute of Technology Hauz Khas, New Delhi-110016 sujoy@hss.iitd.ac.in Bharat Ramaswami Planning Unit Indian Statistical Institute 7, S.J.S. Sansanwal Marg New Delhi 110016, India bharat@isid.ac.in April 2008 The authors gratefully acknowledge research funding from the South Asia Biosafety Program, an IFPRI managed program funded by the United States Agency for International Development. Mandatory Labeling and Aversion to GM foods Experimental evidence from India Abstract A recent recommendation from the Ministry of Health of the Government of India has proposed mandatory labeling of all GM food in the country. Internationally, countries have pursued different approaches to the labeling of genetically modified foods. The great divide has been between the policies in the European Union, that have favored mandatory labeling and the United States, which has chosen not to impose such requirements. The advocates of mandatory labeling argue that consumers need this information to make informed choices. The groups opposing mandatory labels think that if the demand for GM food is sufficiently high, the market on its own would provide this information through voluntary labeling. While implementation of mandatory labeling policy involves significant costs, the benefits of such a policy depend on consumer attitudes towards GM foods. Some theoretical papers argue that voluntary labeling policies achieve the same outcome as mandatory labeling, thus making the latter redundant. The two policies have a different impact only if a significant proportion of population is weakly GM averse. These are consumers who do not react to information unless it comes in the form of a label. The paper has two-fold objectives; first - to elicit willingness-to-pay for similar food products that differ only in their content of GMOs. More importantly, this paper attempts to test presence of weakly GM averse consumers. We use experimental auctions for our purpose and our subjects are from India. Our work is the first attempt to capture weak GM aversion among consumers. Key words: Experimental methods, genetically modified foods, willingness to pay, label sensitive consumers 1 1. Introduction Policies towards labeling of genetically modified or GM foods have varied between countries. The great divide has been between the policies in the European Union that has favored mandatory labeling and the United States, which has chosen not to impose such requirements. Developing countries have also been confronted with this issue. While Brazil and China have adopted mandatory labeling laws, Philippines and South Africa have pursued approaches based on voluntary labeling. In India, a recent recommendation from the Ministry of Health has proposed mandatory labeling of all GM foods. The trans-Atlantic divide over labeling policy is matched by corresponding differences in other areas of policy as well as consumer acceptability of GM products. Since 1999, the EU has followed a moratorium on growing GM crops. The EU opposition to GM crops is strongly supported by lobbying efforts, including the Green Party, Greenpeace, Friends of the Earth, and organic farmers (Schmitz 2004). Consumer resistance to GM foods is also much greater in Europe and Japan than it is in the United States. This was confirmed by the study of Lusk et. al (2006) in an experimental setting where they showed that the level of compensation required to induce consumers to accept GM food was much higher for European compared to US consumers. Whether as a result of mandatory labeling or consumer resistance, most EU retailers have stopped selling GM food altogether (Gruere, 2006; Lusk et.al, 2006). A conventional analysis of consumer preferences towards GM foods is, however, difficult because of unavailability of market data. As GM foods are not commonly sold in Europe, consumer demands cannot be estimated. In the US, where GM foods are 2 available, market data cannot be used because the GM content is not labelled on the foods. An alternative is to elicit valuations via hypothetical surveys. However, it is questionable to what extent such hypothetical valuations match observed purchase behaviour. To simulate real world purchase decisions, some researchers have designed experiments where subjects can bid for foods with money. In a typical experiment study, valuations are elicited for a GM and a non-GM food. As it is not possible by visual inspection to ascertain whether a product is GM, the foods used in the study are appropriately labelled. Huffman, et. al (2003, 2004), Lusk et. al (2006) and Noussair et.al (2002, 2004) are some of the studies that have utilized such experimental data to analyse consumer demand for GM food. European and US consumers are the subject of these studies. To our knowledge, there is no study that investigates consumer preferences towards GM foods in a developing country context. This paper is a contribution to this small and growing literature on consumer preferences and perceptions of GM foods. Like the literature cited above, we too use experimental methods to study attitudes towards GM foods. Our paper is, however, a departure from the literature in two important ways. First, we use subjects from New Delhi, India outside the usual developed country context. Second, while our study throws light on aversion to GM foods (like the literature), our experiment is also designed to answer questions about the impacts of mandatory labelling policies on GM foods. Below, we elaborate on both of these feature. The Indian context for GM products is different from both the US and the EU scenarios. While there has been a vocal debate about GM products in India, food safety 3 has been secondary to issues about impacts on growers and the environment. NGOs have typically opposed GM plants because of fears that it would damage biodiversity and because they believe that it would facilitate corporate control of the seed sector. 1 Indian policy towards plant biotechnology has neither been fully accepting or fully rejecting. After a long drawn out process challenged repeatedly by NGOs, the government approved commercial release of three Bt cotton varieties in 2002. Since then, however, the regulatory process has speeded up approvals. In the last 3 years, the government has approved more than a hundred different varieties of Bt cotton. At the end of 2007, Bt cotton was grown on 6.2 million hectares accounting for two-thirds of the area under cotton. In some parts of India, cottonseed oil is used in cooking. There are no restrictions on its sale or use because of GM origin. Cotton is, however, the only GM plant that has been commercialised. No GM food crop has yet been approved for planting. While the government has allowed genetic engineering experiments on plants such as mustard, rice and eggplant, future regulatory approval is uncertain. The GM foods in the Indian market (other than cottonseed oil) come from imports. Because of Indian patterns of consumption, India is not a large consumer of either GM corn or GM soybeans. India is a large importer of soya oil (including from primarily GM soybean producing countries). 2 In sum, official policies towards GM foods are still evolving and there is as yet no fully coherent policy towards this sector. 3 The proposal of mandatory labelling of GM foods must be seen in this context. Is it then possible that consumer attitudes could shape government policy towards one direction or the other? 1 This could possibly change if GM foods were introduced on a large scale. SPS barriers restrict the import of soybeans. 3 See Ramaswami (2007) for an analysis of the political economy that underlies official policies. 2 4 The second aspect of this study is that it is motivated by the debate about the pros and cons of mandatory labelling. Bansal and Ramaswami (2007), argue that in terms of provision of useful information, the mandatory labelling of GM foods is equivalent to voluntary labelling. Then why is labeling of GM products such a contentious issue internationally? One possible answer could be the presence of weakly GM averse consumers i.e., consumers who switch their preferences from GM to GM-free products only on seeing a label. Bansal and Ramaswami show that if there are enough such consumers, then mandatory labelling will adversely affect the market shares of GM food suppliers in equilibrium. On the other hand, if consumers with such preferences do not exist or not in large numbers, then mandatory labelling policies would have no impact. The experiment in this study aims to estimate the incidence of weakly GM averse labelsensitive consumers. Like the other studies, we too use an experimental approach because there is no alternative. As mentioned earlier, domestically produced cottonseed oil and imported soya oil are the primary examples of GM foods. However, GM content or origin is not labelled and so market data, even if available, would not be of use. The rest of the paper is organized as follows. Theoretical issues pertaining to voluntary vs mandatory labeling are analyzed in the next section. Section 3 describes the methodology of the experiment. The results are discussed in Section 4. Finally, Section 5 contains the conclusions. 5 2. Theoretical Issues Bansal and Ramaswami (2007) argues that voluntary labeling renders mandatory labeling redundant in the sense that mandatory labeling would not result in greater information or product choice to consumers. There is, however, a special set of circumstances where mandatory labeling can alter outcomes. Most studies on consumer preferences assume these preferences to be stable. What that means is that consumer preferences between GM and GM-free food does not depend on the label. The label provides information and consumers make choices according to their preferences. However, the label itself does not alter preferences. With stable preferences, mandatory labeling is redundant. But suppose this assumption were not true. Suppose there are consumers who are indifferent between GM and GM-free food but who shift their preference to GM-free food when they see a label on GM food possibly because they interpret the label as a signal of low quality. These are the weakly GM averse consumers. In addition, suppose that there are fixed costs (due to the infrastructure for segregation and identity preservation) that are incurred in establishing a GM-free marketing channel. If fixed costs are large enough, then it might happen that GM-free foods are not labeled differently from GM foods under voluntary labeling but that such distinction does take place under mandatory labeling. Consider the following example to clarify the logic. An economy consists of three types of consumers. When GM-free and GM products are priced identically, α consumers purchase GM products, γ consumers purchase only GM-free food (`strongly GM averse’) while β consumers are weakly GM averse consumers and consume GM 6 products as long as there is no labeling, but switch to GM-free products when there is labeling. Note that it is not assumed that these consumers are ignorant about the products they buy. In particular, consumers are fully aware that foods can be made with or without GM ingredients and they have preferences over these foods. Suppose also there is a single firm in the industry. Net of variable costs, the firm receives a profit r per unit of quantity from the sale of food which is the same whether the product is GM or GM-free. However, the provision of GM-free food requires a fixed cost k . Consider first the case where there is no mandatory labeling requirement. The firm has the choice of either supplying only GM food, or only GM free food or both types of foods. If the firm were to supply GM free food, then it would be in the firm’s interest to label the food as such. Unlabeled products would necessarily be GM products. It is assumed that the consumers can make this inference correctly. If the firm were to supply only unlabeled food (i.e., GM products), its profit is (α+β)r. The γ consumers who are strongly GM averse decline to consume the product. If the firm decides to label its food and supply GM-free food as well, then its profit becomes (α+β+γ)r – k. Clearly then, it would not be profitable for the firm to supply GM-free food if k ≥ γr . Now suppose mandatory labeling is in place that identifies GM food with a label. Now it is the unlabeled food that is, by implication, GM free. Once again, profits from supplying both GM and GM-free food are (α+β+γ)r – k. However, profits from supplying only GM food fall to αr because β consumers switch to GM-free foods because of labeling. Hence, the firm would supply both products as long as (β+γ)r > k. Thus, for given distribution of consumers, if fixed costs are such that (β+γ)r > k ≥ γr , then GM-free foods would not be supplied without mandatory labeling. 7 This example has been deliberately constructed to be simple. It can be generalized in several respects. The critical assumptions are the existence of labelsensitive weakly GM averse consumers and the presence of fixed costs. Without either of these features, mandatory labeling will not result in outcomes any different from voluntary labeling. When mandatory labeling with weakly GM averse consumers results in a different outcome (from that with without weak GM aversion), the outcomes with and without labeling cannot be ranked in terms of conventional welfare criteria because such criteria assume stable preferences. The outcomes can be ranked only in terms of the government’s own objective function. If the government wishes to shift consumer preferences and hence food purchases from GM to GM-free products, then it can justify mandatory labeling. 4 But if it wishes labeling to be neutral between these products, then mandatory labeling is not justified. Given the importance of weakly GM averse consumers, we wish to test their presence through experimental methods. 3. Methodology The experiment is designed to study the extent that consumers value the absence of GMOs in food products by measuring changes in willingness to pay in response to new information about GMO content. The protocol we use is similar in spirit to several other experimental protocols in the literature that use Vickrey auction type techniques like Noussair et al (2002, 2004). Below we describe our subject pool and design. 3.1 Subject Pool 4 Health warnings such as cigarettes or alcohol clearly fall in the category where it is clear that government would like to shift consumer preferences through labeling. 8 We ran three separate experimental sessions. Two of these used students, Masters and Bachelors degree students (from the Indian Statistical Institute (ISI) and the Indian Institute of Technology (IIT) both in Delhi). The other session consisted of university teachers from all parts of India (participants at a staff college refresher course at the Jawaharlal Nehru University (JNU)). Of the total pool of 136 subjects, 86 were students and the rest 50 were older university teachers (table 1). As a result, close to 65% of the subject pool is less than the age of 25 (table 2). Most of the cohort of college teachers are in the early stages of their career – only about 8% of the subject pool is 36 or greater. About 32% of the subject pool is female (table 3). In terms of parental background, most of the pool comes from family with high levels of educational attainment (tables 4 and 5). Nearly 80% of the pool have fathers who studied beyond high school. The corresponding % for mothers is 56%. Most annual family incomes (68%) are in the range of Rs. 100,000 to Rs. 500,000 which spans the range of what is known as the middle class in India (table 6). Note, however, that these incomes are well above median incomes (or more accurately household expenditures) in India. Tables 7 to 9 summarize information about lifestyle characteristics of the subject pool. By no means is our sample representative. In particular, compared to a representative sample, our study sample is biased towards urban consumers with higher than average family incomes and educational attainment. However, it can be argued that even such a limited group is worthy of study because (a) their attitudes and lifestyles are aspired to by other socio-economic groups and more importantly (b) they are the primary consumers of packaged foods that will be subject to mandatory labeling laws. 9 3.2 Subject decisions and protocol The experiments were conducted in large classrooms with the subjects seated away from each other. They were trained in the bidding protocol using a quiz and were not allowed to communicate during the session. In our experiment, subjects bid for real consumer goods using the Becker-De-Groot -Marschak (BDM) mechanism (Becker et al, 1964). The subjects have an endowment of 200 units of lab currency (deemed Francs) which convert to Indian Rupees at the rate of 4 Francs to a Rupee). In each round of the four rounds of auctions, they provide in writing the price that they would be willing to pay for a unit of both the products (the GM and the non-GM). After all the four rounds, one round is randomly picked and a valuation for each of the two products is picked from the uniform distribution [1, 100]. If a participant’s valuation is above this he or she purchases a unit at the drawn price, otherwise he or she keeps her endowment to take home in Rupees. In the BDM, a type of auction, bidders have a dominant strategy in bidding an amount equal to their true valuations for the good. There are several advantages to using demand-revealing mechanisms to elicit willingness to pay information. Firstly, the use of money as a metric allows for comparisons of intensity of preferences between subjects, as well as goods. Secondly in an auction, the subject is committing himself to an actual purchase, unlike in a poll where there is no commitment. Thirdly, in a demand-revealing mechanism, there is a dominant strategy to indicate one’s true valuation. In principle this allows willingness to pay be directly measured, rather than inferred. Fourthly, notice that though we deem it an “auction” there is no strategic (in the standard game theoretic sense) incentive as in a usual sealed bid auction as every participant whose valuation lies 10 above the drawn price wins a unit Note that when bidding for the products, we do not make the bids public information at any time, so that privacy of the valuations is safeguarded and subjects cannot use others’ bids to update their own valuations. The time line for the procedures is given in table 10. We auctioned two products, which we called A and B during the session. In the session using students from ISI they were Tortilla chips, one of which contained GM soy (imported product) and a domestic substitute that was GM free. For the sessions in IIT and JNU, the products were chocolate chips cookies that are available in stores in Delhi. The products were close substitutes; very similar in taste and appearance. The experiment consisted of four rounds, as outlined in Table 10. At the beginning of the experiment, subjects received a sample of both products without its packaging or labeling. Before bidding in the first period, subjects were required to taste each product. Then they marked down how much they liked the product on a scale where “I like it very much” and “I don’t like it at all” were at the extremes of the rating scale. Then the auction for period 1 took place. The two products were auctioned simultaneously. Each of the following periods consisted of the revelation of some information about some or all of the products, followed by a simultaneous auction for both products. The sale price was not drawn for any period until the end of period 4 and no information was given to participants about other players’ bids. At the beginning of period 2, we distributed a handout containing background information about GMOs. The information consisted of a) What are genetically modified foods? b) Why are they produced? 11 c) Why is there opposition to their consumption? d) What is government policy regarding GM foods in India? The information was an unbiased characterization so as not to affect consumer preferences towards GMO. The information handout is given in Appendix. At the beginning of third period, we revealed the information regarding the GM status of the product. The products were still in the packaging done by us and the label prepared by us. The label of product A read “Chocolate Chip Cookies,” and the label of product B had an additional information “This product may have been subject to genetic modification”. The label matched the proposed stipulation regarding GM labeling in India. Thus we revealed it to the participants that product A is GM free and product B could be subject to genetic modification. Finally in the last period, we revealed the brands of two products. 3.3 The products used The greatest challenge we faced was to identify two products that are similar in all attributes such as appearance, taste etc., except that one is GM and the other non-GM. As already mentioned, there are no domestically produced GM foods in India, therefore, a domestically produced product had to be compared with an imported product. For the imported product also there are no labels that say it is genetically modified. We checked with various testing labs in India if they could test the GM product. But even these labs were not well equipped to test GM content in highly processed food items. We tried to find a product from the US, containing soya or corn ingredients. Since US has adopted voluntary labeling policy for GM products, unlabelled soya or corn products from the US 12 are highly likely to be GM. We tried several products, potato chips, tortilla chips, cookies etc. For most products, there was a vast difference in taste in the Indian product and its imported counterpart. When there is a vast difference in taste, preferences for taste could outweigh preferences for non-GM attribute. Finally we could identify two brands of chocolate chip cookies, a domestic brand and an imported brand, that were close in appearance and taste. Additionally, we used an imported (containing GM) and an Indian (GM free) brand of tortilla chips for one of the experimental sessions. 3.4 Prior Information and weak GM aversion As discussed in the introduction, one of the objectives of our study was to identify subjects that exhibit weak GM aversion. We define these consumers as those who switch preferences to GM-free products when they see a label. Labels can affect demand for two reasons. First, consumers may be unaware about the properties of unlabeled foods on offer. For instance, they may believe that a food has a lower fat content or a different type of preservative than what they actually contain. In this case, by providing accurate information and correcting mistakes, labels can affect demand. The other case is when consumers have accurate estimates of the properties of unlabeled foods that enter their utility function. An example is that of preference for vegetarian foods which is common in India. While in many cases what is vegetarian can be visually ascertained, this is not always so. Consider for instance, fried foods. If eating places do not advertise that they use only vegetable oils (and not animal fat) in cooking, we assume that consumers will assume that the probability that animal fats are used is 13 high and accordingly determine demands. Consumers with strongly vegetarian preferences may decline to consume such products. On the other hand, this will not be a consideration for those who do not have a preference for vegetarian foods. In this case, a mandatory label (on what oils are used) does not provide new information. This is the sort of case considered in Bansal and Ramaswami (2007). In this scenario, any change in demand due to labels must be due to change in preferences which we call weak GM aversion. In our experiment, the challenge is to design it in such a way as to reduce and eliminate the information effect. This is particularly important in the Indian context because the notion of GM foods is still very new and not many subjects would have imagined that possibility. That’s the reason why we provide in round 2 (after the blind tasting) ample hints to consumers in this regard. First, we provide a one page handout containing background information about GM foods. After the subjects have read it, we ask them to report their subjective probability that the products on offer are genetically modified. With nothing more than taste and appearance to guide them, their subjective probabilities are nothing but guesses. But we would expect that those who are strongly GM averse will react to their subjective probabilities. On the other hand, those who are weakly GM averse would not react to the possibilities implied by the information distributed in round 2. It would take a label (shown in round 3) to affect their responses. This is the identification strategy used in the experiment. 4. Results 4.1 Blind Tasting 14 In the blind tasting, subjects are asked to rank each of the products on a taste scale of 1 to 7 (higher is the number, greater is the liking) with 0.5 increments. Therefore, a choice is made from 14 possible values. Figure 1 plots the empirical cumulative density function of rankings for both these products. If one ignores, the crossing of the distributions at low taste levels, rankings for the non-GM product dominate that of the GM product by first order stochastic dominance (the figure excludes the ISI subjects as they were faced with different products than the other subjects). The sample mean of the taste rankings of product A is 4.96 and that of product B is 4.44. The Spearman’s rank correlation between the two taste rankings is –0.1664 and the null that the rankings are independent is not rejected at the 8% level of significance. 4.2 Prior Probabilities of likelihood of products being GM In round 2, subjects were asked to evaluate the likelihood of either product being GM on a scale of 1 to 5. Figure 2 plots the empirical cumulative density of this evaluation. As can be seen, the proportion of consumers who regard product A (the non-GM product) as GM is higher than the similar proportion for product B at any likelihood level between 1 to 5. Thus, the sample mean of the likelihood that product B is GM is higher than that of product A (2.96 for B as against 2.63 for A). Both sample means indicate that the average probability that either product is GM is greater than 0.5. Out of the 114 subjects who report these prior probabilities, 94 of them have a prior probability of at least 0.5 on either or both products. Thus, with such high subjective probabilities, it is expected that that it will affect the price bids of those who are GM averse. If both probabilities are high, then we would expect the average bid 15 across these two products to fall for those who are GM averse. However, if consumer perceptions are such that they put much greater probability on one product, then the average bid may not fall. Figure 3 plots the scatter between the consumer perceptions that either product is GM. The scatter suggests that there is not much of a relation between the perceptions of the two products. However, the Spearman rank correlation is 0.22 and is significant at the 2% level. Thus, there is a small, positive and significant correlation between the perceptions of both products. 4.3 Normalized Prices Across Rounds Figure 4 plots the average price bids (normalized with respect to round 1 bids) across the four rounds. As can be seen, the average bids of both products increases over the rounds. It is surprising that the average bid for the GM product increases (especially in the early rounds) although the bids for the GM free product increase at a faster rate than the bid for the GM product. Consistent with GM aversion, the relative price of the GM free product (the ratio of the price bid for product A to the price of product B) rises throughout (also in figure 4). It is particularly interesting to note the increase in the relative price of the GM free product from round 1 to round 2. In round 2, the label has not yet been revealed but because there is greater suspicion that product B is GM, the rise in relative price of product A (the GM free product) is consistent with GM food aversion. 16 4.4 The Determinants of Round 2 Bids and GM free price premiums Subjects place their bids in round 2 after reading the GM background information sheet and after evaluating the probability that either product is GM. Table 11 presents the results of a regression of round two bids on the variables that constitute the information set at that time – round one bids, taste rankings of the two products and the prior probabilities that either product is GM. As might be expected, the second round bids are highly (and positively) correlated with first round bids. Furthermore, the prior probabilities are significant in the regression. The probability that product A is GM reduces the expected bid for product A in round 2 and its impact on the expected bid for product B is negligible and insignificant. For instance, if the prior probability is 0.5 (i.e., 2.5 on the likelihood scale), the price of product A drops on average by nearly Rs. 11. Similarly, the expected bid for product B is negatively affected by the perception that it could be GM. At a prior probability of 0.5, the negative impact is Rs. 8. Both of these results are evidence of GM aversion on average. From these results, we can calculate the average discounts for GM product by evaluating the impact on price bids when the prior probability is 1. The results are summarized in Table 12. They indicate high discounts for GM food. This result is surprising because of the following. Out of the 114 subjects, 36 did not alter their price bids from round 1 to round 2. Of the subjects who altered their price bids, some of them did so by small amounts. It is possible that faced with a second round, these subjects may have thought that the “correct” response was to alter the price bid. Hence, suppose we consider the subjects who did not either alter the price bids or they did so by Rs. 5 or less on both the 17 products. Let’s call them “information inert” subjects. Then we find that there are 56 of them – almost half of the sample. Therefore the negative relation between second round bids and the prior probability must come from only one half of the sample. In Table 13, we tabulate the averages of the prior probabilities of informationinert (ii) and non-ii subjects. There is no statistical difference in the prior probability of product A. There is a greater difference in the prior probability of product B but even this is not significant at the 10% level. It seems therefore that the difference in price bids between the ii and non-ii subjects comes not so much from differences in processing of prior information but from preferences. Whether this conclusion is warranted needs more investigation because the last two rows of the table indicate that the differences in prior probabilities is mirrored in differences in price bids between the ii and non-ii subjects. 4.5 Identifying GM Averse Subjects The identification of GM averse subjects comes from comparing the price bids in round 1 (blind tasting) with the price bids in round 3 when the labels are revealed. We define the label-inert (li) subjects as those for whom the price bids on both products in round three is either identical to the bids in round one or is within Rs. 5 of the round one bids (on both products). Table 14 shows that out of the 56 information-inert subjects, 33 or 29% of the sample continue to be label-inert. Neither the information nor the label makes a difference to their bids. GM aversion must therefore be sought in the remainder of the sample. 23 of the information-inert subjects react to the label while almost all of the subjects who are not information inert are also not label-inert. 18 Excluding the label-inert subjects, we have 78 subjects. We divide this pool into 6 cells as in Table 15. We define a subject is GM averse if either (1) product A price bid in round three is greater than the price bid in round one and the product B price bid is either unchanged or lower in round three compared to round 1 or (2) product A price bid is the same as in round one and product B price bid is lower in round three. From the table, these subjects (marked in yellow) number 35 which is about 30% of the sample. By a similar logic, a subject is GM loving if either (1) product B price bid in round three is greater than the price bid in round one and the product A price bid is either unchanged or lower in round three compared to round 1 or (2) product B price bid is the same as in round one and product A price bid is lower in round three. There are 16 such subjects. These are marked in green in table 15. The diagonal terms cannot be classified into either of these categories – these are subjects who increase the bids for both products or decrease the bids for both products. We define the weakly GM averse subjects as those who are GM averse and who are information-inert. Table 16 divides the information-inert subjects into the 6 cells as in Table 15. From here it can be seen that 13 subjects satisfy the weak GM averse condition. Unlike the other GM averse subjects, these individuals react only to the label and not to the background information. Table 17 summarizes the findings from this discussion. Tables 14-17 exclude data from the ISI experiment where different products were used. The corresponding tables for the entire sample are in tables 18-21. Note the percentages of different categories is quite robust to whether we use the entire sample or whether we exclude the ISI sub-sample. 19 Finally table 22 reports the correlates of GM aversion (for the entire sample). The probability of being GM averse is negatively and significantly correlated with being a student and with those who report frequent exercise. With students, higher is the evaluation of the taste for the GM- free product, lower is the probability of being GM averse. Surprisingly, this relation does not hold for non-students. Some of the other variables (smoker dummy, frequency of snacking junk food and mother’s education) also have the “expected” signs but are not significant at the 5% level. These results reassure that our identification of the GM averse subject pool is not off the mark. 5. Conclusions: This paper aims at studying consumer attitudes towards GM foods in the context of a developing country, India. The motivation came from the proposed law in India to have mandatory labeling of all GM products in India. The data set is obtained by assigning labeling and information treatments to subjects who participated in lab experiments of food items that might be genetically modified. We obtain a number of interesting results. First, we find that, on average, consumers are willing to pay a high price premium for GM free products. Alternatively, they are willing to buy GM products at a discount. The individual as well as relative price of the two products is negatively related to consumers’ perception of the products being GM. Further, the relative price of the GM free product rises consistently in each round. These results are evidence of GM food aversion and are consistent with the earlier literature on experimental evidence of consumer attitudes towards GM foods. 20 Second, the GM averse subjects correlated with variables in an expected way. Students are less likely to be GM averse. For students, GM aversion is negatively correlated with taste ranking. Similarly higher is the frequency of exercise, higher is GM aversion. The aversion to GM foods comes, however, from only 30% of the sample. In fact, about 50% of the sample do not alter their bids after receiving background information, and about 30% of the sample do not revise their bids even after the label is revealed. These latter subjects do not care about GM status of the product. We also find that about 13% of the subjects are GM lovers. Most interestingly, we identify consumers who do not react to the background information but react negatively to the GM label. We term these as weakly GM averse. Recall that in Section 2, we argued that existence of such label sensitive weakly GM averse consumers can alter market outcomes with mandatory labeling. In our experiment we find that there is a significant number (about 11% ) of such subjects. This is a robust result. Presence of such consumers means that mandatory labeling can change market shares of GM foods in equilibrium. 21 References Bansal, S. and Ramaswami, B. (2007), “The economics of GM food labels: An evaluation of mandatory labeling proposals in India, IFPRI Discussion Paper 00704 Becker, G., DeGroot, M. and Marschak, J. (1964), “Measuring utility by a singleresponse sequential method,” Behavioral Science, vol 9 (July), 226-32. Caswell, Julie A. 200. “Labeling policy for GMOs: To each his own?” AgbioForum 3: 53-57. Gruere, G “A Preliminary Comparison of the Retail Level Effects of Genetically Modified Labelling Policies in Canada and France”, Food Policy, 31, 148-161. Gruere, G. and S. R. Rao. 2007. A review of international labeling policies of genetically modified food to evaluate India’s proposed rule. AgBioForum, 10 (1): 51-64. Huffman, W.E., J.F. Shogren, M.C. Rousu, and A. Tegene (2003). “Consumer Willingness to Pay for Genetically Modified Food Labels in a Market with Diverse Information: Evidence from Experimental Auctions.” Journal of Agricultural and Resource Economics. 28(2003):481–502. Huffman, W.E., J.F. Shogren, M.C. Rousu, and A. Tegene (2004). “Consumer’s Resistance to Genetically Modified Foods: The Role of Information in an Uncertain Environment”, Journal of Agricultural and Food Industrial Organization, 2, Article 8. Kalaitzandonakes, Nicholas, (2004), “Regulating Biotechnology: GM Food Labels”, in Biotechnology: Science & Society at a Crossroad, National Agricultural Biotechnology Consortium Proceedings, Cornell University. Jayson L. Lusk, W. B.Traill, L. O. House, C. Valli, S. R. Jaeger, M. Moore and B. Morrow (2006) “Comparative Advantage in Demand: Experimental Evidence of Preferences for Genetically Modified Food in the United States and European Union,” Journal of Agricultural Economics, Vol. 57, No. 1, 2006, 1–21 Noussair, C., Robin, S. and B. Ruffieux (2004), “Do consumers really refuse to buy genetically modified food?” The Economic Journal, 114, 102-120. Noussair, C., Robin, S. and Ruffieux, B. (2002), “Do consumers not care about biotech foods or do they just not read the labels?” Economic letters, 75, 47-53. Rousu, M., Huffman, W., Shogren, J., Tegene, A., (2003) “Should the United States regulate mandatory labeling for genetically modified foods?” Evidence from experimental auctions. Working paper Schmitz A., (2004), “Controversies over the Adoption of Genetically Modified Organisms”, Journal of Agricultural and Food Industrial Organization, 2, Article 1. 22 Vickrey, William (1961), “Counterspeculation, Auctions, and Competitive Sealed Tenders,” Journal of Finance, 16: 8-37. 23 Appendix I Background information about GMOs 1. What are genetically modified foods? Foods derived from plants that are genetically modified are called genetically modified (GM) foods. A plant is genetically modified if it contains genes that have been inserted using genetic engineering techniques. 2. How is genetic engineering different from traditional plant breeding? Genetic engineering makes it possible to insert a gene from another organism (such as another plant species, bacteria or animal) into the plant variety of interest. This is not possible with the traditional techniques of producing improved plant varieties. 3. Why are GM foods produced? GM foods are developed – and marketed – because there is some perceived advantage either to the producer or consumer of these foods. The first generation of GM plants have given more direct benefits to growers than to consumers although the latter have possibly gained from lower prices. 4. What are examples of genetically modified plants? The principal examples of genetically modified crops occur in soyabeans, maize (i.e., corn) and cotton. For instance, genes from a commonly found soil bacteria have been used to produce soybeans, maize and cotton that are naturally resistant to certain pests. 5. Why are GM foods regulated? There are two broad concerns with GM plants. First, because the foods are novel, the must be tested for toxicity and possible allergenicity. The second issue is whether the engineered gene can escape into wild populations and other unintended plants. For these reasons, GM crops must be assessed for food and environmental safety before they can be planted. 6. What is the status of GM foods in India? In India, no GM food crop has been approved for planting yet. Therefore, foods produced from domestically produced crops are not genetically modified. Foods that are imported could contain ingredients that are genetically modified. As of now, India does not have separate regulations for imports of GM food other than what applies to imported foods generally. 7. Why do some people oppose GM foods? 24 Several NGOs and individuals claim that GM plants pose unacceptable risks to food safety as well as environment safety. They argue that transferring genes between organisms creates new risks for human health that cannot be fully comprehended by our existing scientific knowledge. They would therefore recommend that GM foods should be banned or severely curtailed until risk assessments are more comprehensive in testing the adverse effects on human health. This is disputed by biotechnology advocates who point out that GM crops are extensively tested before they are approved. According to the World Health Organization (WHO), "GM foods currently available on the international market have passed risk assessments and are not likely to present risks for human health. In addition, no effects on human health have been shown as a result of the consumption of such foods by the general population in the countries where they have been approved." 25 Table 1: Distribution of Subject Pool Institution # % ISI 22 16 JNU 50 37 IIT 64 47 Table 2: Age Distribution Age Number Percentage <=25 87 64.93 26-30 17 12.69 31-35 20 14.93 36-40 8 5.97 41-45 1 0.75 >=46 1 0.75 Table 3: Sex Distribution Sex Number Percentage Female 43 31.62 Male 93 68.38 Total 136 100 Table 4: Father’s highest education Father's education Freq. Percent High school or less 28 20.59 Vocational Diploma 2 1.47 Bachelor’s degree 57 41.91 Post-Graduate Degree 49 36.03 Total 136 100 Table 5: Mother’s highest education Mother’s education Freq. Percent High school or less 60 44.12 Bachelor’s degree 49 36.03 Post-Graduate Degree 27 19.85 Total 136 100 26 Table 6: Family Income Annual Income Freq. Percent < Rs, 100,00 12 9.02 Rs 100,000-250,000 43 32.33 Rs. 250,000-500,000 48 36.09 Rs. 500,000-750,000 9 6.77 Rs. 750,0009 6.77 1,000,000 > Rs. 1,000,000 12 9.02 133 100 Table 7: Lifestyle characteristics: Smoking Do you smoke ? Freq. Percent yes 20 14.71 no 116 85.29 Total 136 100 Table 8: Lifestyle characteristics: Exercise How often do you exercise in a week? Freq. Percent never 36 31.58 once or twice 41 35.96 more than twice 19 16.67 everyday 18 15.79 Total 114 100 Table 9: Lifestyle characteristics: Snacking How often do you consumer read-to-eat snacks in a week? Freq. Percent never 14 12.39 once or twice 50 44.25 more than twice 38 33.63 everyday 11 9.73 Total 113 100 27 Table 10 Sequence of Events in the Experiment Session Period 1 - Information: blind tasting of two products - Recording of hedonic rating of the two products - Auction Period 2 - Additional information: General information about GM products - Recording of consumer perception about likelihood of each product being GM - Auction Period 3 - Additional information: Product A is non-GM and product B may be subject to genetic modification (Product Labeling) - Auction Period 4 - Additional information: Brand names of the two products - Auction Transactions - Random draw of the auction that counts towards final allocations - Random draw of sale price of two products - Implementation of the transaction for the period that counts 28 Figure 1: Cumulative density function of taste rankings 120 100 80 tastea tasteb 60 40 20 0 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5 6 6.5 7 Figure 2: Cumulative density function of GM likelihood rankings 120 100 80 gmproba 60 gmprobb 40 20 0 1 1.5 2 2.5 3 29 3.5 4 4.5 5 1 2 gmprobB 3 4 5 Figure 3: Scatter of subject perceptions of likelihood of product A is GM vs likelihood of product B is GM 1 2 3 gmprobA 30 4 5 Figure 4: Average bids for products across the 4 rounds (normalized by round 1 bid). 1.6 1.4 1.2 1 Non-GM 0.8 GM (labelled) Relative price of non-GM 0.6 0.4 0.2 0 1 2 3 31 4 Table 11: The determinants of second round bids (1) (2) Price bid Price bid for for Product A Product B First round price bid 0.8*** 0.08 for Product A (0.08) (0.09) First round price bid -0.001 0.8*** for Product B (0.05) (0.09) Probability that -4.4** -0.3 Product A is GM (1.8) (2.0) Probability that 1.2 -3.2* Product A is GM (1.8) (1.9) Taste Ranking of -0.7 -3.3* Product A (1.6) (1.9) Taste Ranking of -1.1 -1.5 Product B (1.1) (1.3) Constant 30** 37** (14) (16) Observations 101 101 R-squared 0.683 0.608 Robust standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1 COEFFICIENT Table 12: Price Discounts for GM product Discount for Product A if it were GM Rupees As % of Mean price Rs 22 37% Discount for Product B if it were GM Rupees As % of mean bid Rs. 16 32% 32 Table 13: Difference in Average Prior Probabilities and price bids between Inert and Non-Inert Subjects Inert Non-Inert Difference p-value of test that difference = 0 Prob that A is GM 2.616071 2.640351 0.024279 0.9 Prob that B is GM 2.705357 3.206897 0.501539 0.014 Price bid for A 58.58929 59.26456 0.675276 0.9063 Price Bid for B 55.91071 42.26893 -13.6418 0.0201 Table 14: Cross-tabulation of information-inert and label-inert subjects Not label-inert Label-inert Total Not information-inert 55 3 58 Information-inert 23 33 56 Total 78 36 114 Table 15: Counting the GM Averse: # of subjects satisfying the following condition Product A (GM-free) Price bid is higher in round 3 than in round 1 Price bid is the same in round 3 as in round 1 Price bid is lower in round 3 than in round 1 Total Product B (GM) Price bid is higher in Price bid is the same in Price bid is lower in round 3 than in round 1 round 3 as in round 1 round 3 than in round 1Total 14 5 21 40 9 0 9 18 7 30 0 5 13 43 20 78 Table 16: Counting the weakly GM Averse: # of information-inert subjects satisfying the following condition Product A (GM-free) Price bid is higher in round 3 than in round 1 Price bid is the same in round 3 as in round 1 Price bid is lower in round 3 than in round 1 Total Product B (GM) Price bid is higher in Price bid is the same in Price bid is lower in round 3 than in round 1 round 3 as in round 1 round 3 than in round 1Total 33 1 2 6 9 2 0 5 7 2 5 0 2 5 16 7 23 Table 17: Summary classification GM Averse Weakly GM averse (subset of GM averse) GM Loving Label-inert Not classifiable Total 35 13 16 36 27 114 % of sample 30 % 37 %(of GM averse) 14 % 31% 24 % Table 18: Cross-tabulation of information-inert and label-inert subjects: Entire sample Not information-inert Information-inert Total Not label-inert Label-inert Total 70 3 73 25 38 63 95 41 136 Table 19: Counting the GM Averse: # of subjects satisfying the following condition: Entire sample Product A (GM-free) Price bid is higher in round 3 than in round 1 Price bid is the same in round 3 as in round 1 Price bid is lower in round 3 than in round 1 Total Product B (GM) Price bid is higher in Price bid is the same in Price bid is lower in round 3 than in round 1 round 3 as in round 1 round 3 than in round 1Total 18 10 25 53 9 0 9 18 8 35 0 10 16 50 24 95 Table 20: Counting the weakly GM Averse: # of information-inert subjects satisfying the following condition: Entire sample Product A (GM-free) Price bid is higher in round 3 than in round 1 Price bid is the same in round 3 as in round 1 Price bid is lower in round 3 than in round 1 Total Product B (GM) Price bid is higher in Price bid is the same in Price bid is lower in round 3 than in round 1 round 3 as in round 1 round 3 than in round 1Total 34 1 3 7 11 2 0 5 7 2 5 0 3 5 17 7 25 Table21: Summary classification – Entire sample GM Averse Weakly GM averse (subset of GM averse) GM Loving Label-inert Not classifiable Total % of sample 32 % 34 %(of GM averse) 44 15 17 41 34 136 12.5 % 30 % 25 % Table 22: Correlates of GM Aversion COEFFICIENT Student dummy Taste ranking of GM-free product Taste ranking of GM product Interaction between student dummy and taste ranking of GM-free product Interaction between student dummy and taste ranking of GM-free product Dummy if exercise is more than twice a week Dummy if subject consumes read to eat snacks more than twice a week Dummy for smoker Dummy if Mother’s education > = Bachelors degree Constant Observations R-squared Robust standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1 35 (1) (2) Probit Marginal Effects -1.919 -0.659** (1.187) (0.309) -0.464*** -0.171*** (0.139) (0.0515) 0.0958 0.0353 (0.134) (0.0493) 0.498*** 0.183*** (0.169) -0.113 (0.0620) -0.0416 (0.170) 0.710*** (0.254) -0.403 (0.0624) 0.262*** (0.0908) -0.149 (0.271) -0.490 (0.331) 0.372 (0.275) 2.026* (1.201) 134 . (0.0989) -0.181 (0.122) 0.135 (0.0973) 134 .