PRESENTED BY: Sponsored by

advertisement

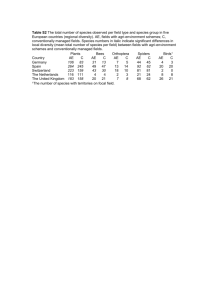

PRESENTED BY:! Sponsored by:! Employee Theft and Investigations Emp t f e h T e e y lo nd Sa curity a ., CFE rivate Se D . h P , ickmanCenter for P P . L n a ls, CPA l e Sus nted by the 4 W h ep Prese mber 11, 201 CFE and Jos Septe anks to the A With th fety – Occupational Fraud and Abuse ! Is clandestine, ! violates the employee’s fiduciary duties to the orgainzation, ! is committed for the purpose of direct or indirect financial benefit to the employee, and ! And costs the employing organization assets, revenues, or reserves.” The Fraud Triangle Skimming ! Removing cash from the victim prior to its entry into an accounting system. ! Unrecorded Sales – The employee sells goods to goods or services to a customer, collects the customer’s payment, but makes no record of the sale. Then the employee pockets the money rather than turning it over to his employer. (doc) ! Register manipulation (gas station, movie theater) ! Skimming during non-business hours (store managers and employees) ! Skimming off-site sales (parking lots, rental agents, insurance brokers) Skimming ! Understated Sales and Receivables – This is where the sales are recorded, but they are posted for less than what was collected from the customer. ! Employees can take the higher amount from the customer, but change the company copy of the receipt to reflect a lower amount on the sale. They also might record a sale of 100 units of an item as 50 units and keep the difference. ! False discounts – Employees with the authority to grant discounts by accepting full payment for an item but indicating on the register that a discount was given. Therefore, the employee can keep the difference. Skimming ! Theft of Checks Through the Mail – An employee (generally one person is in charge of opening the mail) takes checks from the mail, before they are recorded. (Mailroom theft of government checks or government grant funds) ! Kiting and Lapping – covering what is stolen with money from another source. ! Short-term skimming – The fraudster keeps the money only for a short while before eventually passing the payment on to the employer. In this way, the employee keeps the interest on the cash flow though they eventually deposit the money in the employer account. Converting Stolen Checks ! The employee can have an accomplice at a bank to convert checks made out to a business. ! Without an accomplice at the bank, a manager can be a “second endorser” on the check and can deposit it into his/ her own account. ! Laundering the funds – opening an account of similar name ! Altered payee – Add another name to the check. This may be detected, so it is not a preferred method. ! Inventory padding – “shrinkage” Cash Larceny ! Cash Larceny from Deposits - Banks ! Other Cash Larceny Schemes – Charitable & Non-profit Organizations Prevention – Segregation of Duties ! Cash Receipts ! Cash Counts ! Bank Deposits ! Deposit Receipt Reconciliation Check Tampering ! Forged Maker Schemes – Forgery includes not only the signing of another person’s name to a document with a fraudulent intent, but also fraudulent alteration of a genuine instrument. The person who signs the check is known as “the maker.” They must have access to blank checks (accounts payable clerks, office managers and bookkeepers). ! Intercepted Checks – Fraudsters usually make the checks to themselves, but they can make them to “cash,” “vendors (legitimate or otherwise), forgery, photocopied checks, automatic checksigning equipment, converting the check, forged endorsement schemes (checks intended for third parties), theft of returned checks (intercepting checks returned for bad addresses or other reasons. Rerouting delivery, etc. Register Disbursement Schemes ! False Refunds – Policy overrides in the refund log. Overstating refunds. Credit card refunds. ! False Voids ! Concealing Register Disbursements ! Prevention and Investigative efforts. Billing Schemes ! Cash-Generating Schemes ! Invoicing via Shell Companies – Fictitious entities created for the sole purpose of committing fraud. (company documents and state or local licenses can be presented to a bank with the fraudster as the signing authority). Sometimes the fraudster uses someone else’s name. Males may use their wife’s maiden name. P.O. Box addresses may be suspect. Sometimes the fraudster uses her/her street address. Vendor schemes have been uncovered by comparing the vendor address list against the employee address database. These are most successful if the fraudster is in a position to approve payments. Most shell company schemes involve services rather than goods. ! Pass through schemes. ! Invoicing via Non-complicit Vendors The fraudster takes a legitimate invoice, deletes the information on it and prints replicas and bills the victim company for much more work than originally invoiced. The fraudster files the phony invoices for authorization, transports the invoices and collect the payment checks. ! Personal Purchases with Company Funds Payroll and Expense Reimbursement Schemes ! Payroll Schemes – Overcharges to the victim organization. ! Ghost employees – People in payroll accounting can add fictitious names to the payroll. Fraudsters create a name that sounds similar to someone already on the payroll. ! Issuing and delivery of the check. Payroll and Expense ! Rates of pay and commission schemes. ! Expense Reimbursement, overstated expenses and Worker’s Comp. ! Altered receipts ! Multiple Reimbursements Inventory and Other Assets ! Misuse of Inventory and other assets –Borrowed or stolen. ! Theft of Inventory and other assets Corruption ! Bribery ! Economic Extortion ! Illegal Gratuities Conflicts of Interest ! Purchases Schemes ! Sales Schemes ! Other Schemes Fraudulent Statements ! Fraud in Financial Statements ! Generally Accepted Accounting Principles ! Users of Financial Statements ! Types of Financial Statements ! The Sarbanes-Oxley Act or the Public Company Accounting Reform Act. SOX was passed by Congress to protect shareholders and the public from fraudulent practices and to improve the accuracy of corporate disclosures. Fraudulent Financial Statement Schemes ! Fictitious Revenues ! Timing Differences ! Concealed Liabilities and Expenses ! Improper Disclosures Fraud Deterence ! Hiring Well ! Connections with Employees ! Company-wide Ethics ! Ethics Hotlines ! More Ideas