KAR Auction Services - University of Oregon Investment Group

advertisement

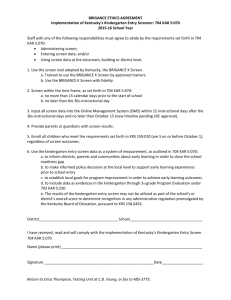

UNIVERSITY OF OREGON INVESTMENT GROUP 10-29-2010 CONSUMER GOODS KAR Auction Services HOLD Stock Data Price (52 weeks) Symbol/Exchange Beta Shares Outstanding Average daily volume (3 month average) Current market cap Current Price Dividend Valuation (per share) DCF Analysis Comparables Analysis Target Price Current Price 11.03 – 15.84 KAR / NYSE 1.51 134.6 M 158,409 1.744 B $12.96 N/A 10.3 (60%) 17.9 (40%) $13.31 $12.96 Summary Financials Revenue Net Income Operating Cash Flow 2009A 1,730M 23M 312M BUSINESS OVERVIEW KAR Auction Services was organized on November 9, 2006 in the state of Delaware for the sole purpose of consummating a purchase of ADESA, Inc. and combining Insurance Auto Auctions, Inc (IAAI) with ADESA. These are two secondary vehicle auction companies. With these two companies, KAR is the only corporation with significant market share in both the whole car auction and salvage car auction segments in North America. The Covering Analyst: Bryceson Charlton Email: bcharlto@uoregon.edu The University of Oregon Investment Group (UOIG) is a student run organization whose purpose is strictly educational. Member students are not certified or licensed to give investment advice or analyze securities, nor do they purport to be. Members of UOIG may have clerked, interned or held various employment positions with firms held in UOIG’s portfolio. In addition, members of UOIG may attempt to obtain employment positions with firms held in UOIG’s portfolio. KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu company completed its IPO on December 11, 2009 at $12 per share while this was below the expected $15-$17 range. KAR operates in three business segments; ADESA, IAAI, and AFC. Business Segments ADESA - (63% of Revenue) ADESA is the second largest provider of whole car auctions in North America. They run auctions both live at their auction sites and online through their website. They have 62 auction facilities, which are located to draw professional sellers and buyers together and allow the buyers to inspect their targeted vehicles. The online auction allows even more buyers to look at the car which is a benefit to the seller as more demand is generated. The type of vehicles sold through ADESA auctions are from institutional customers, which include off-lease vehicles, repossessed vehicles, rental vehicles, and others. Revenue generated from this segment is a fee basis on each car sold. This fee is usually around 330$ being split by the buyer and seller. ADESA also supplies ancillary services which account for around 200$ per transaction if the customer decides to use it. Insurance Auto Auctions, Inc - IAAI (32% of Revenue) This is the salvage vehicle auctions segment for KAR where they currently have 152 auction facilities. These include damaged vehicles designated as a total loss by its insurance company, stolen vehicles where an insurance claim has already been settled, and older model vehicles which car dealers no longer want. The buyers of these cars include body shops, rebuilders, used car dealers, automotive wholesalers, dismantlers, and others. Auctions are usually held weekly and vehicles are marketed at each auction site as well as online. The competitive market allows the vehicle to raise its auction price which gives KAR more revenue as fees increase. The revenue generated from this segment is by fixed fee and percentage of sale. Usually larger insurance companies obtain a fixed fee for each car sold while individuals or dealers use a percentage of sales. Other fees KAR collects on include towing, title processing, and other administrative services (ancillary services). Automotive Finance Corporation - AFC (5% of Revenue) AFC is a provider of floorplan financing to independent used vehicle dealers. This provides customers of both ADESA and IAAI direct short term inventory-secured financing to independent used vehicle dealers. AFC has 87 branches all located either in the auction facilities or close by. In 2009, AFC arranged 799,421 loan transactions at 110$ per transaction. The number of loans was down from the previous year however rates were up. 2 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu Initial Public Offering ADESA entered the vehicle redistribution industry in 1989 and first became a public company in 1992. In 1994, ADESA acquired Automotive Finance Corporation. Between 1995 and 2000, ADESA acquired Impact Auto Auctions, Ltd., a salvage auction chain in Canada. ADESA remained a public company until 1996 when ADESA was acquired by ALLETE, Inc. (“ALLETE”). Since then, ADESA has grown the business, organically and through acquisitions, into a leading vehicle redistribution company in North America. In 2004 ADESA completed another initial public offering and remained a public company until its merger with KAR Holdings in 2007. – 10k IAAI was originally organized as a California corporation in 1982 under the name Los Angeles Auto Salvage, Inc. In 1990 all of the outstanding capital stock of the company was acquired in a leveraged buyout. In 1991 the company’s name was changed to Insurance Auto Auctions, Inc. and the company completed an initial public offering. Since then, IAAI has grown the business, organically and through acquisitions, into a leading provider of salvage vehicle auctions and related services in North America. In 2005, IAAI was purchased by a group of private equity investors, some of whom consummated the merger with ADESA, Inc. in 2007. – 10k ADESA was taken private in 2007 by investors’ Kelso & Co, GS Capital Partners (affiliate of Goldman Sachs), ValueACT Capital and Parthenon Capital. The purchase price from these investors was 3.7 billion which included the contribution of IAAI and 700 million dollars of debt from these companies. As of June 2010 Goldman Sachs still owns 20% of shares outstanding for KAR auction services. BUSINESS AND GROWTH STRATEGIES Dealer Consignment - The car auction industry is very mature. Therefore KAR Auction Services’ main goal is to acquire market share. They hope to do this by first growing their dealer consignment business which is to obtain more vehicles from car dealerships. KAR is having local auction representatives who are familiar and skilled in communicating with local car dealers communicating to them the technology and live advantages you receive at ADESA. They feel these services will be adequate to receive their business. Increase Number of Salvage Vehicles - 12 million vehicles are de-registered every year, usually this means they are not useable any longer. Only 3.5 million of these are run through the salvage auctions. IAAI is pursuing more of these vehicles from the non insurance side (rental car, captive finance, and fleet companies). ADESA already has a good client base of these companies and good relations. This can hopefully give IAAI the edge needed to receive some of their business. Revenue growth - ADESA and IAAI grew revenue annually by 5.1% and 3.1% respectively from 2004 through 2009. This is mainly due to the increased use of ancillary services, fee increases, and new product offerings. The ADESA segment uses more of the ancillary services than IAAI because of the clientele. They plan to continue growing revenue by increasing customer utilization of the existing ancillary products. They also plan to increase the number of vehicles offered online and at their current physical auctions. IAAI is the only national salvage auction company that offers its customers both live and online car auctions. International – KAR feels they are in a good position to grow internationally, already having two ADESA auction sites in Mexico City and Guadalajara. They have international customers already in their online bidding system which is provided in multiple foreign languages. Buyers of KAR’s auctioned cars range from over 100 countries. The company has only said they “will continue to assess acquisition and Greenfield expansion opportunities in selective markets” for exploring the international market. I have not heard or read anything on them looking to expand outside the North America market. 3 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu ADESA – tends to be more cyclical with new car sales. This is due to if new cars are not being bought, there will be less used car sales and leasing which is the main driver for ADESA. For the last two quarters, they are down 7% in number of transactions; however because of the lack of supply, demand for these used cars rise. This leads to an increase of 4% for company revenue since vehicles generate a higher sales price, giving ADESA higher margins. This partially offsets the decrease of transactions. Floorplanning loans - AFC intends to selectively grow by using ADESA and IAAI to capitalize on cross-selling opportunities. They plan to tailor their services to individual car dealer’s needs. ADESA and IAAI locations provide the expanding opportunities that AFC is looking for. There are currently 87 AFC branches, of that 55 are physically located at auction sites while the rest are in close proximity. An addition of branches could be added to current auction sites with no AFC services close by. Services (KAR’s 10k) The following are the extra service KAR is able to provide their customers at their auctions. ADESA Ancillary services Marketing and advertising for vehicles to be auctioned Vehicle registration Condition report and detailing/body work Provide inbound and outbound transportation of vehicles Provide value-added market analysis to customers IAAI Ancillary services Hybrid auction model which allows both live and online buyers to bid on a vehicle If a totaled vehicle is received by IAAI it will remain at their facility but cannot be auctioned until the title has been submitted for transfer and processed by IAAI Provide inbound and outbound logistics Maintain vehicle inspection centers at most facilities which store and inspect vehicles Ability to streamline title process for vehicles, reducing processing time Technology services ADESA LiveBlock – Allows registered buyers to participate in live auctions online against buyers at the auction site. ADESA Market Guide - Provides wholesale auction prices, auction sales results, market data and vehicle condition information. i-Bid LIVE – live auction internet bidding for salvage vehicles. Provides buyer with real-time streaming audio from live auction and images of salvage vehicles. CSA Today – enables insurance company suppliers to enter vehicle data electronically and then track and manage progress of salvage vehicles in terms of both time and recovery dollars. This provides them their current total-loss data. Risk Factors Debt – KAR Auction Services has debt fair valued at 1.95 billion as of June 30, 2010. With a market cap of under 1.8 billion, this debt is a very substantial amount of this company. Management has already stated that reducing this debt is one of their main priorities. Since 2008, they have paid off close to 500 million of it. Nonetheless, with their current portion this can limit their ability to borrow additional funds for any reason including future acquisitions or capital 4 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu expenditures. Also, free cash flow is reduced in paying off this debt. Some of their senior secured credit facilities are at variable rates of interest which can negatively affect the company if there is an increase in interest rates. Moody’s has currently upgraded the company’s credit rating to B2 which is in the junk bond rating. If economic downturn continues this may affect KAR’s cash flow which could cause them trouble in making their debt payments. Used Vehicles - During the recent economic downturn, demand for used and new vehicles was lessened by a substantial amount. This caused the number of vehicles at an auction to decrease affecting their revenue. With lack of availability of consumer credit, this minimizes the number of buyers and decreases the demand for used vehicles. Salvage vehicles – If numbers of miles driven per car decreases this could also decrease the amount of salvage vehicles for IAAI. Another factor is when commodities such as steel and platinum decrease, it can also decrease vehicle values lowering KAR’s commission and the demand for these vehicles. Peer to Peer – KAR Auction Services competes with Mayhem and Copart directly; however, other sources of auctions including SmartAuction, OpenLane, and Ebay Motors also take away business. While they do not have any meaningful physical presence, they are still a threat to KAR’s future business. Although these companies haven’t grasped a sufficient market share of the type of vehicles sold in KAR’s auction; it is still a concern for investors going forward. MANAGEMENT AND EMPLOYEE RELATIONS KAR – James Hallet is the CEO and director. Mr. Hallet started at the company in 1993 as president of ADESA Canada. He served various roles included President and CEO in multiple terms. Except for a two year period he has been with ADESA or KAR since 1993. Previously he was CEO for ADESA from 2007 to 2009. ADESA – Thomas J. Caruso has been the President and CEO of ADESA since September of 2009. He has been with the company since 1992 and was Chief Operating Officer of ADESA before he became the CEO. IAAI – Thomas O’Brian has been the President and CEO since 2005. O’Brian recently sold around 250,000 shares in September at 11.8 a share. He is also a director of First American Corp, a separate title insurance company. AFC – Donald Gottwald is the current President and CEO of AFC. He was hired on December 10, 2008. Prior to this he was the vice president at HSBC Auto Finance and before that he worked at GMAC Financial Services for 12 years. RECENT NEWS 10-21-2010 – KAR Auction Services, to announce third quarter 2010 Earnings. The earnings will be released on Wednesday, November 3rd. It will host its conference call the next day. 10-20-2010 - Moody’s Lifts KAR Auction outlook on expected debt reduction. Moody’s Investor Services lifted its outlook on KAR to positive from negative, moving away from a possible downgrade because of “considerable improvement” in key credit metrics and an expectation that the company will continue to lower debt near-term. Since 2008 KAR has cut outstanding debt by about 500 million. 9-1-2010 – KAR Auction Services, Inc. Announces Participation in Upcoming Investor Conference. KAR gave a brief presentation on their company and how they generate revenue. They also informed investors of the market share alignment and where their industry is compared to the past. A replay of this will be on their website. 5 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu INDUSTRY Auto Wholesaling/Leasing - The online and live car auction industry is a small and mature industry. KAR already has 22% of the whole car market share and its 2009 sales were around 1 billion to give you a scope on the total market size. The two main factors for these companies are automobile wholesaling and auto leasing. When more new cars are bought it means more used cars are also sold which increases the vehicles ADESA has an opportunity to sell. As for auto leasing, leasers will get rid of a certain vehicle when it reaches a general mileage. If leasing is up streaming then KAR looks to have more business from these auto leasers. Positive Trends include: increase in number of households with more than one vehicle, car manufacturing improvements which allow vehicle lifespan to be longer, giving auction services a larger market. Affordability of used vehicles related to new vehicles. IBISWorld projects the wholesaling industry to increase 3.5% annually until 2015. It also projects auto leasing to increase 3% annually in the same time period. Salvage Auction Industry – Has increased at an estimated annual growth rate of 2%. New vehicles are becoming more complex (airbags and electrical components) this causes them to be more costly when repairing. Therefore, insurance companies should deem them a total loss and IAAI’s services should be in higher demand. Market Share - The market share for used car auctions is consolidated. Manheim, a private competitor to ADESA, represents 50% of the whole car auctions in North America. ADESA is second with 22% while no other competitor is over 3%. ADESA has increased from 18% in 2006 to its current portion in 2010. The salvage industry is just as compacted with Copart leading with 37% and IAAI having 35%. No other company represents more than 10% of the market. IAAI has increased its market share by 2% since 2006. Number of Vehicles (Image below) - There are currently around 270 million vehicles in operation in the US and Canada. Of these, 10-15 million new vehicles are registered into the countries each year. Around 12 million lose registration and around 3-4 million units are taken to salvage auctions from this 12 million. There are also around 40 million used vehicle transactions per year. Of these, 9 million units are auctioned off; however, this number does not include online transactions (online auction). 6 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu S.W.O.T. ANALYSIS Strengths Only vehicle auction company with large presence in both the whole car auction and salvage vehicle market Leader of industry technology with its hybrid auction program Weaknesses Large amount of debt lessens the chance of expansion They are in a mature industry which does not have high growth in future revenue Opportunities Opening two auction sites in Mexico could create an undiscovered market for KAR Only 30% of de-registered vehicles are sold in auctions Threats If debt payments are not met, possible bankruptcy could occur Peer to peer vehicle sales such as EBay Motors or Craigslist could lessen their transactions. Auto industry could continue to decline PORTER’S 5 FORCES ANALYSIS Supplier Power – Low Supplier power is limited as KAR does not have any one supplier who provides more than 5% of its vehicles. Barriers to Entry - High Investment in technology and infrastructure are the main barrier to industry. Companies must comply with regulatory requirements that make it difficult for new entrants to build their operation. Larger companies also have existing relationships with many of the suppliers and buyers. Buyer Power – Low No current customer provides more than 4% of KAR’s revenue. They have a very diverse base of buyers as previous mentioned in the business segment. When lower numbers of vehicles are supplied, demand will go up giving KAR increased margins. 7 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu Threat of Substitutes – Medium ADESA must provide a set of services or ease through their auctions to receive business from Auto Dealers who could just continue to keep a vehicle on their lot. During the current economic downturn many car dealerships were keeping older vehicles (usually the one’s they send to ADESA) and trying to sell them on their own. The reason for this was the low vehicle turnover during the downturn made them try to get a commission on these cars where in a normal economy they are not worried about them. EBay Motors and Craigslist could potentially become a substitute. Degree of Rivalry – Medium Manheim currently has a 50% market share in the whole car auction industry. Management feels that the customers would like to see this gap shortened and have a more equal ratio. IAAI as has been stated is the only salvage auction to provide live and online auctions of the same vehicle to customers. They feel this puts them ahead of their rival Copart for the future. CATALYSTS Upside Demand for New Cars and Leasing Vehicles goes up If company continues to pay off outstanding debt credit rating will rise Downside New vehicle sales decrease, supply of vehicles at auctions will decrease If company doesn’t continue to deleverage itself it could leave investors afraid of the stock COMPARABLE ANALYSIS Finding comparable companies for KAR was difficult as a result of its unique debt structure, future growth, and only one true competitor that is public. I selected companies with a variety of traits I felt were comparable to KAR. All but one of these companies are in the auto industry as they have equivalent risks and market exposure as KAR. The metrics I used were EV/Revenue, EV/EBITDA, and EV/FCF. These metrics will proficiently measure KAR’s ability to generate sales, margins, and free cash flow compared to that of the comparables. I took out GPI’s multiple for FCF because I felt it was an outlier. With that said I decided to weight my Comparable Analysis only 40% because of the difficulty of finding good comparables with similar growth outlook as KAR. Copart, Inc – CPRT (25%) Copart is a provider of online auctions and vehicle remarketing services in the United States, Canada and the United Kingdom. It provides vehicle sellers with a range of services to process and sell vehicles over the Internet through its Virtual Bidding Second. - Reuters Copart is IAAI’s main competitor with a 37% market share in the salvage vehicle business. They are similar in market cap with KAR; however, they do not have any long term debt. This is why they have a similar weighting to the other comparable companies, because of their difference in equity structure to KAR. 8 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu AutoZone Inc – AZO (25%) AutoZone is a retailer and distributor of automotive replacement parts and accessories. The Company also has a commercial sales program that provides commercial credit and prompt delivery of parts and other products to local, regional and national repair garages, dealers, service stations and public sector accounts. The Company also sells the ALLDATA brand automotive diagnostic and repair software. Additionally, it sells automotive hard parts, maintenance items, accessories and non-automotive products. – Reuters AutoZone has the most similar future growth estimates as KAR, which is why they are rated so high. Its business also targets technology for its products on its websites, which is a current and future focus of KAR. Penske Automotive Group Inc – PAG (15%) Penske Automotive Group is an automotive retailer. Each of its dealerships offers a range of new and used vehicles for sale. In addition to selling new and used vehicles, the Company generates revenue at each of its dealerships, through maintenance and repair services, and the sale and placement of products, such as third party finance and insurance products, third-party extended service contracts and replacement and aftermarket automotive products. – Reuters PAG experiences the supply effects of used vehicles much like KAR. If credit is hard to obtain their business is likely to suffer a lack of demand. They have a very similar enterprise value as KAR and even more debt which shows in their beta of 1.98 the highest of the comparables. LKQ Corporation - LKQX (10%) LKQ provides replacement systems, components, and parts needed to repair vehicles (cars and trucks). The Company provides alternatives to original equipment manufacturers collision products, and provides mechanical replacement parts used by collision and mechanical automobile repair businesses. - Reuters I picked LKQ as a comparable because of its placement in the vehicle repair industry, especially with salvage parts and similar enterprise value to KAR. With its low debt and what seems to be a less risky investment I decided to only weight LKQX at 10%. Group 1 Automotive, Inc – GPI (10%) Group 1 Automotive, Inc. operates in the automotive retail industry. The Company owned and operated 124 franchises at 95 dealership locations and 22 collision service centers in the United States. Through its operating subsidiaries, the Company markets and sells a range of automotive products and services, including new and used vehicles and related financing, vehicle maintenance and repair services.” – Reuters. GPI was chosen because of its industry, similar debt to equity and enterprise value to KAR. It also deals with financing vehicle loans and repair services. HSN Inc – HSNI (10%) - is an interactive multi-channel retailer offering retail experiences on television (TV), online, in catalogs and in retail and outlet stores through its two operating segments, HSN and Cornerstone. HSN is a retailer and interactive lifestyle network offering an assortment of products through television home shopping programming on the HSN television network and through its business-to-consumer Internet commerce site HSN.com. Cornerstone comprises home and lifestyle brands, distributes over 200 million catalogs annually, operates seven separate Internet sites, and operates 23 retail and outlet stores.” - Reuters HSNI is the one comparable that is not in the same industry as KAR. With that said I felt they were a good comparable mostly because their products are bought via auction online as KAR’s are. Also it has the most comparable Gross and Net Margins to KAR. Its downside of course being that it’s not affected by the auto industry, although it is affected by disposal income not unlike KAR. America’s Car-Mart, INC – CRMT (5%) “America’s Car-Mart, Inc. is an automotive retailer in the United States focused exclusively on the Buy Here/Pay Here segment of the used car market. The Company’s operations are principally conducted through its two operating subsidiaries, America’s Car-Mart, Inc. (Car-Mart of Arkansas) and Colonial Auto 9 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu Finance, Inc. (Colonial). The Company primarily sells older model used vehicles and provides financing for substantially all of its customers. Each of the Company’s dealerships engage in the selling and financing of used vehicles.” – Reuters Car-Mart was chosen because of their exposure to both the auto dealership of older cars and auto financing much like KAR’s segment AFC. They are the smallest in enterprise value and do not have a sufficient amount of debt which is why I weighed them the least. DISCOUNTED CASH FLOW ANALYSIS For the discounted cash flow analysis I broke down revenue into the three business segments of KAR. I then projected cost of sales as a percentage of revenue. Breaking down revenue into these segments allowed me to attribute the different growth rates and gross margins each company has and was a more accurate assessment of revenue. Management did not forecast very many items and I had to rely on analysts’ estimates as a range for my estimates in the first few years. After 2010, I have year to year revenue growth at an average of 2%. This seems reasonable as industry revenues appearing to be growing at least 3%. I wanted to estimate revenue conservatively as ADESA and IAAI looked to be in a mature and slow growing market. I also used the 30-year Treasury bond for my risk-free rate as this is the policy our group has adopted. Revenue ADESA - is in the most mature market and can only hope to improve sales through gaining market share, and when the economy recovers they should have more vehicles to auction off. This will negatively affect their gross margins as currently used vehicles are selling for a higher value giving them higher commissions. Management has given estimates of single digit growth in the future. I have ADESA growing 2% in 2011 and then increasing that to 3% for two years when the used vehicle market should be back to strength before decreasing that growth to 1% in the terminal year. IAAI – this is the segment that KAR believes has growth potential as currently only 3.5 of the 12 deregistered vehicles are being taken to auction. Management gives forecasting growth of 2-4% which I scale down from 4% to 1% in the terminal year as there is no indication of how long this growth is sustainable. AFC – Revenue for AFC has increased by 59% comparing the first two quarters to 2009’s first two quarters. This is due to a 37% increase in revenue per loan transaction and 16% more loans processed. The company has stated a growth initiative to create or add on to factories more AFC’s stores. I have them growing 6% in 2011 and scale that down to 2% for 2018. While this may seem conservative, KAR has only stated a desire to offer AFC at all of their auctions and no potential growth figures. Cost of Services ADESA - Cost of services increases as revenue does since commission margins will not be as strong as used vehicle’s price should decrease when the market is normal unlike the present condition. Then I have it decreasing to 55% from the current 56% because of more efficient practices and technology being implemented in their auction services. IAAI – Increased their margin due to higher car prices. I have cost of services increasing to 62% in 2013 when the market looks to be fully recovered and used vehicle prices will be lower. I then have it decreasing to 60% as technology and more cohesion with ADESA should lower cost of services. 10 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu AFC – Gross Profit for AFC increased 55% in the current 2010 quarters compared to the same time last year. This was due to a decrease in cost of services and the company has said that there are not a lot of variable costs associated with this segment. If revenue increases look for the gross margin to increase as well. I have these costs decreasing to 19% in the terminal year as guidance has said they should be fairly constant in a number basis and not a percentage of revenue. Selling, General and Administrative – I decided to project this out at 20% to the terminal year. In the past this percentage has been relatively stable and I saw no reason to change it. Depreciation and Amortization – Currently this is at the 9% to 10% range of revenue. However with capital expenditures at 4%, this will affect depreciation in time and is why I have it gradually lowering to 7% in 2018. Other Income Expense – This line item is mostly dominated by the currency rate fluctuation with Canada. However, this figure is not substantial to the total revenue. Interest Expense – This item has decreased to 8% in the 2010 quarters mainly because of prepayment of debt. While there is a good chance of management continuing to pay off debt and keep the rate here I projected it at 10% a more average of the past years and this current one. I have this gradually decreasing after 2013 when the maturity on the main portion of their debt is due. Tax Rate – Company guidance has said the tax rate will be 42% going forward. However, lower state taxes, international operations, and discrete items have changed this. For example, in the first two quarters of this year, the tax rate was 33.6% because of these items. Going forward, I start my projections at 42%. I forecast that this will eventually lower towards 35% the maximum corporation tax. This is due to the company continuing to pay off its Taxes Payable account. I have it at 37% in my terminal WACC as I felt this was a better representative of the future value than 42%. Net Working Capital – Projecting NWC was notably difficult as the line items varied over the history of KAR which only goes back until 2007. Two line items that are completely new for 2010 are Obligations collateralized by finance receivable and Finance receivables securitized, net of allowances. This is the result of a new guidance opposed by GAAP which requires finance receivables after January 1, 2010 under KAR’s revolving sale agreement be included in the balance sheet. With no future guidance on this subject I decided to use its current percentage of revenue and project this out to the terminal year. I see cash increasing after 2013 when most of their debt is paid off. Trade receivables have varied in the past and 19% seemed reasonable for the short term future. I have this decreasing as a more appropriate figure compared to the past two years. Accounts Payable was relatively constant from 2008 to 2009 with a jump in 2010 quarters and has no details given about it in any SEC filings. I decided to trend it down from the current quarter to be closer to its figure in the past. It is still above 08 and 09 because of the company’s plan to go after consignment vehicles which is the main source of this account. Capital Expenditures and Acquisitions – include investing in their core information technology capabilities and expanding capacity in their auctions. For 2010, the company’s guidance is that it will be 75 million with $50 million of this going to maintenance of facilities and the rest going to growth initiatives. Future CapEx will be used for improvement or new auction facilities, improvements in technology systems, and new auction facilities. I decided to trend Cap Ex and Acquisitions up to 7% in the terminal year as when they pay off their debt KAR will look to improve or branch out new auction sites. Beta – I first ran a weekly regression for less than a year (KAR went public last December) and received a beta of .77. While this was comparable with CPRT (main competitor) and LKQH it seemed like it did not take into account the 11 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu debt of KAR. I then used a Hamada to calculate my beta and found a beta of 1.51 which I was comfortable with. Companies used in the Hamada were in similar industry with a comparable market cap. I rated CPRT the highest because it is my main competitor. Cost of Debt – KAR has more debt than equity currently so this is a significant part of my implied price. In the most recent 10k it stated that the weighted average interest rate on all borrowings was 5.5% in 2009 compared to that of 7.2% in 2008. I decided to use 7.78% which is a slight premium to KAR’s current bond YTM. RECOMMENDATION KAR Auction Services is a debt laden company with strong current and future projections of free cash flow. It competes in a mature industry and has limited growth in the future. With that stated their high cost of debt brings my DCF valuation to being overvalued. I received an implied price of $13.31, which if reached would give us a gain of 3.1%. I do not feel my comparable analysis is strong enough to push this stock into a buy. All but one comparable company has faster growth than KAR. Although I see KAR deleveraging its debt as it has in the past year, the ability to predict beta, cost of debt, and the debt/equity ratio in the terminal year is an item I am not yet confident to estimate. I am recommending a HOLD for all portfolios. 12 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu APPENDIX 1 – COMPARABLES ANALYSIS The University of Oregon Investment Group ($ in millions, except per share data) Stock Characteristics Current Price 50 Day Moving Avg. 200 Day Moving Avg. Beta Size ST Debt LT Debt Cash and Cash Equiv. Diluted Share Count Market Cap Enterprise Value Profitability Margins Gross Margin EBITDA Margin Net Margin Credit Metrics Interest Expense (LTM) Debt/Equity (MRQ) Debt/EBITDA (LTM) EBITDA/Interest Expense (LTM) Operating Results Revenue (LTM) Gross Profit (LTM) EBITDA (LTM) Free Cash Flow (LTM) Net Income (LTM) Valuation EV/Revenue EV/EBITDA EV/Free Cash Flow KAR Max Min Avg. Median 234.72 12.96 50.64 28.53 226.13 12.91 50.27 27.69 202.50 13.26 45.67 26.31 2.16 1 1.36 1.39 12.96 12.91 13.32 1.51 25% CPRT 25% AZO 15% PAG 10% LKQX 10% GPI 10% HSNI 5% Weighted Average CRMT 33.49 34.19 35.27 0.64 234.72 226.13 202.5 1.27 13.25 12.95 13.26 1.61 21.53 20.61 19.89 0.95 32.1 29.62 28.48 2.16 30.62 39.97 28.37 1.63 26.44 25.76 24.25 1.11 79 77 70 1.25 1398 838 6 92.07 1220 3449 27 567 190.5 143.16 3082 3486 647 421 32.2 23.64 759 1795 13 321 279.9 57.54 1762 1816 0.4 44 0.3 10.87 287 332 278.3 986.0 142.8 69 4117 5238 1398 2909 289 143 10588 13398 0 44 0.3 11 759 1795 417 1017 146 74 2786 3791 27 567 144 71 1753 3014 2019 289 134.60 1744 3474 268.2 85.03 2848 2579 2909 98.3 45.11 10588 13398 52% 37% 20% 16% 3% 1% 36% 14% 7% 39% 11% 5% 34.8% 23.0% 2.8% 45.0% 36.6% 19.6% 52.2% 22.3% 10.0% 15.5% 2.7% 0.9% 45.4% 14.1% 7.2% 16.1% 3.3% 0.7% 34.9% 8.3% 3.4% 43.3% 5.2% 8.8% 38.4% 18.0% 9.1% 157 183% 7.83 10 3 72.19 0% 65% 0 3.37 2.7 6.3 37.5 23% 2.31 6.0 150 116% 4.9 2.7 0% 0.0 157.2 27% 1.8 10.4 93.5 183% 7.8 3.1 30.4 19% 1.9 10.4 37.5 141% 6.4 4.5 34.1 19% 1.4 6.9 2.7 16% 2.7 6.0 63.7 0.5 2.7 5.5 10396 3842 1638 1627 738 314 136 16 14 28 2546 901 284 158 98 1776 618 409 374 51 773 348 283 152 152 7362.6 3842 1638 1627 738 10396 1616 285 285 98 2239 1016 316 165 161 5007 807 168 59 37 2853 995 236 111 98 314 136 16 14 28 4619 1578 596 521 268 1.96 x 8.49 x 9.29 x 3.34 x 9.11 x 17.00 x 1.82 x 8.18 x 8.24 x 0.33 x 12.09 x 12.10 x 1.56 x 11.04 x 21.19 x 0.36 x 10.70 x 30.60 x 0.64 x 7.71 x 16.42 x 1.06 x 20.35 x 23.94 x 1.6 10.1 14.3 Implied Price 8.89 17.86 26.99 Weight 33% 33% 33% 3840 1172 419 348 170 Metric EV/Revenue EV/EBITDA EV/FCF Price Target Current Price Under Valued 17.90 12.96 38% 13 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu APPENDIX 2 – DISCOUNTED CASH FLOWS ANALYSIS The University of Oregon Investment Group ($ in millions, except per share data) Total Company Revenue % Y/Y Growth Cost of Revenue % Revenue Gross Profit Gross Margin Operating Expenses SG&A % Revenue D&A % Revenue Total Operating Expenses % Revenue EBIT % Revenue Other (Expense) Income % Revenue Interest Expense % Revenue Pre-tax Income % Revenue Less Taxes (Benefit) Tax Rate Net Income Net Margin Add Back Depreciation and Ammortization % Revenue Add Back Interest Expense*(1-Tax Rate) % Revenue Operating Cash Flow % Revenue Current Assets % Revenue Current Liabilities % Revenue Net Working Capital % Revenue Change in Net Working Capital Capital Expenditures+Acquistions % Revenue Unlevered Free Cash Flow Discounted Unlevered Free Cash Flows 2007 1103 627 57% 475 43% 2008 1771 61% 1053 59% 718 41% 242 22% 127 11% 369 33% 106 10% 8 1% 162 15% -48 -4% -10 21% -38 -3% 127 11% 129 12% 217 20% 902 82% 444 40% 457.7 42% 384 22% 183 10% 731 41% -13 -1% -20 -1% 215 12% -248 -14% -31 13% -216 -12% 183 10% 188 11% 155 9% 753 42% 444 25% 309 17% 0% 217 129.6 7% 25 2009 2010AQ1-2 1730 928 -2% 997 508 58% 55% 732 421 42% 45% 365 21% 172 10% 537 31% 195 11% 12 1% 173 10% 34 2% 11 32% 23 1% 172 10% 117 7% 312 18% 942 54% 417 24% 525.1 30% 216.3 69 4% 27 0.5 2010Q3-4E 2010A+E 897 1825 6% 494 1002 55% 55% 403 823 45% 45% 186 20% 85 9% 271 29% 150 16% 2 0.2% 71 8% 55 6% 19 34% 37 4% 85 9% 47 5% 169 18% 1417 179 20% 81 9% 260 29% 143 16% 1 0.1% 72 8% 72 8% 30 42% 42 5% 81 9% 42 5% 164 18% 1512 942 1025 475 51% -50.1 24.6 3% 194 486.5 54% 11.5 48.7 2% 104 100 365 20% 166 9% 531 29% 292 16% 2 0.1% 143 8% 127 7% 49 38% 78 4% 166 9% 88 5% 332 18% 1512 83% 1025 56% 487 27% -39 75 4% 296 1.5 2011 E 1879 3% 1032 55% 847 45% 2.5 2012 E 1944 3% 1092 56% 852 44% 366 20% 180 10% 546 29% 301 16% 3 0.2% 188 10% 116 6% 48 41% 68 4% 180 10% 110 5% 358 19% 1625 87% 1074 57% 552 29% 65 87 4% 205 185 389 20% 185 10% 574 30% 278 14% 2 0.1% 194 10% 86 4% 35 41% 51 3% 185 10% 115 5% 350 18% 1722 89% 1087 56% 635 33% 83 97 5% 170 142 3.5 4.5 2013 E 2014 E 2005 2056 3% 3% 1119 1139 56% 55% 886 917 44% 45% 401 20% 180 9% 581 29% 304 15% 2 0.1% 200 10% 106 5% 50 40% 56 3% 180 9% 120 5% 357 18% 1746 87% 1120 56% 626 31% -9 108 5% 257 201 411 20% 185 9% 596 29% 321 16% 2 0.1% 164 8% 158 8% 67 39% 91 4% 185 9% 100 5% 377 18% 1832 89% 1126 55% 705 34% 79 111 5% 187 136 5.5 2015 E 2107 2% 1166 55% 940 45% 6.5 2016 E 2139 2% 1162 54% 977 46% 7.5 2017 E 2171 1% 1179 54% 992 46% 8.5 2018 E 2194 1% 1191 54% 1004 46% 421 20% 169 8% 590 28% 350 17% 2 0.1% 147 7% 205 10% 83 39% 122 6% 169 8% 90 5% 380 18% 1877 89% 1154 55% 723 34% 17 135 6% 228 155 428 20% 160 8% 588 28% 389 18% 2 0.1% 150 7% 241 11% 94 39% 147 7% 160 8% 91 5% 399 19% 1906 89% 1172 55% 734 34% 11 137 6% 251 158 426 20% 152 7% 578 27% 414 19% 2 0.1% 130 6% 286 13% 105 38% 181 8% 152 7% 80 5% 413 19% 1934 89% 1190 55% 745 34% 11 161 7% 241 142 442 20% 154 7% 596 27% 408 19% 2 0.1% 132 6% 278 13% 102 37% 177 8% 154 7% 84 5% 414 19% 1955 89% 1202 55% 753 34% 8 158 7% 248 136 14 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu APPENDIX 3 – DISCOUNTED CASH FLOWS ANALYSIS ASSUMPTIONS The University of Oregon Investment Group Assumptions for Discounted Free Cash Flows Model Tax Rate 42% Terminal Growth Rate Terminal Tax Rate 37% Terminal Value Risk-Free Rate 2.6% PV of Terminal Value Terminal Risk-Free Rate 3.91% Sum of PV Free Cash Flows Beta 1.51 Firm Value Market Risk Premium 7% LT Debt % Equity 42% Cash % Debt 58% Equity Value Cost of Debt 7.78% Diluted Share Count CAPM 13.19% Terminal CAPM 14.48% Implied Price WACC 8.15% Current Price Terminal WACC 8.91% Under (Over) Valued 3% 4320 2091 1309 3400 2019 289.4 1381 135 10.3 12.96 -21% APPENDIX 4 – HAMADA BETA Auction Services Ticker Weighting 30% CPRT 15% LKQX 15.0% PAG 15.0% GPI 12.5% KMX 12.5% AN Mean Median Tax Rate KAR D/E Unlevered Business Beta KAR Levered Beta Beta SE 0.67 1.14 1.61 2.16 1.31 1.33 0.17 0.23 0.24 0.38 0.28 0.29 1.27 1.32 0.25 0.28 Price Shares Out. 33.49 21.53 13.25 32.10 29.54 23.82 85.03 143.16 92.07 23.84 224.85 146.39 Debt 0.00 594.40 2235.50 1068.30 4037.00 2855.70 D/E 2847.55 0% 3082.23 19% 1219.93 183% 765.26 140% 6642.07 61% 3487.01 82% 69% 71% 42% 116% 0.90 1.51 15 KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu APPENDIX 5 – BETA SENSITIVITY ANALYSIS The University of Oregon Investment Group Beta 2.01 1.88 1.76 1.63 1.51 1.39 1.26 1.14 1.01 St. Deviation Implied Price Under (Over) Valued 2.00 10.32 -20.10% 1.50 10.98 -15.00% 1.00 11.65 -9.80% 0.50 12.47 -3.50% 0.00 13.31 3.10% -0.50 14.27 10.40% -1.00 15.44 19.50% -1.50 16.67 29.20% -2.00 18.27 41.40% APPENDIX 6 – WORKING CAPITAL MODEL The University of Oregon Investment Group ($ in millions, except per share data) 2007 Net Revenues 1103 Current Assets Cash and Cash Equivalents 204.1 % of Revenues 19% Restricted cash 16.9 % of Revenues 1.5% Trade receivable 278 % of Revenues 25% Finance receivable 247 % of Revenues 22% Finance receivables securitized, net of allowances % of Revenues Retained interests in finance receivables sold 71.5 % of Revenues 6% Deferred income tax assets 29.3 % of Revenues 3% Other current assets 54.8 % of Revenues 5% Totla current assets 901.8 % of Revenues 82% Current Liabilities A/P 292.8 % of Revenues 27% Accrued employee benefits and compensation 55 % of Revenues 5% Accrued interest 16.4 % of Revenues 1% Other accrued expenses 80.1 % of Revenues 7% Income taxes payable % of Revenues Obligations collateralized by finance receivables % of Revenues Total Current Liabilities 444.1 % of Revenues 40% 2008 1771 2009 1730 2010 E 1825 2011 E 1879 2012 E 1944 2013 E 2005 2014 E 2056 2015 E 2107 2016 E 2139 2017 E 2171 2018 E 2194 158.4 9% 15.9 0.9% 286 16% 159 9% 363.9 21% 9.3 0.5% 250 14% 150 9% 43.4 2% 43.2 2% 47.2 3% 752.7 42% 89.8 5% 37.3 2% 40.9 2% 941.9 54% 289.4 16% 8.3 0.5% 346 19% 113 6% 571.2 31% 95 5% 42.6 2% 46.4 3% 1511.9 83% 346 18% 11 0.6% 357 19% 150 8% 582 31% 94 5% 38 2% 47 3% 1625 87% 398 20% 12 0.6% 369 19% 156 8% 603 31% 97 5% 39 2% 49 3% 1722 89% 401 20% 12 0.6% 361 18% 160 8% 621 31% 100 5% 40 2% 50 3% 1746 87% 452 22% 12 0.6% 370 18% 164 8% 637 31% 103 5% 41 2% 51 3% 1832 89% 463 22% 13 0.6% 379 18% 169 8% 653 31% 105 5% 42 2% 53 3% 1877 89% 492 23% 13 0.6% 364 17% 171 8% 663 31% 107 5% 43 2% 53 3% 1906 89% 499 23% 13 0.6% 369.07 17% 174 8% 673 31% 109 5% 43 2% 54 3% 1934 89% 505 23% 13 0.6% 373 17% 176 8% 680 31% 110 5% 44 2% 55 3% 1955 89% 283.4 16% 42 2% 15.4 1% 102.7 6% 262.7 15% 56 3% 14.8 1% 80.2 5% 2.7 0.2% 443.9 25% 417 24% 408.3 22% 51 3% 11.6 1% 77.6 4% 3.1 0.2% 473.4 26% 1025 56% 413 22% 75 4% 15 1% 79 4% 3 0.2% 488 26% 1074 57% 389 20% 78 4% 16 1% 97 5% 2 0.1% 505 26% 1087 56% 401 20% 80 4% 16 1% 100 5% 1 0.1% 521 26% 1120 56% 391 19% 82 4% 16 1% 103 5% 0 0% 534 26% 1126 55% 400 19% 84 4% 17 1% 105 5% 0 0% 548 26% 1154 55% 406 19% 86 4% 17 1% 107 5% 0 0% 556 26% 1172 55% 412 19% 87 4% 17 1% 109 5% 0 0% 564 26% 1190 1655% 417 19% 88 4% 18 1% 110 5% 0 0% 570 26% 1202 55% KAR Auction Services Inc university of oregon investment group http://uoig.uoregon.edu APPENDIX 7 – COST OF DEBT ANALYSIS Cost Cost of Debt 9.28% 9.03% 8.78% 8.53% 8.28% 8.03% 7.78% 7.66% 7.53% 7.28% 5.50% of Debt Sensitivity Price Under (Over) Valued 12.05 -6.8% 12.24 -5.2% 12.44 -3.7% 12.65 -2.1% 12.92 -0.4% 13.09 1.3% 13.31 3.1% 13.43 3.9% 13.55 4.9% 13.79 6.7% 15.77 22% APPENDIX 8– REVENUE MODEL The University of Oregon Investment Group ($ in millions, except per share data) 2007 2008 2009 2010Q1-2 2010 E 2010A+E 2011 E 2012 E 2013 E 2014 E 2015 E 2016 E 2017 E 2018 E Total Rev 1102.8 1771.4 1729.6 928.4 897.0 1825.4 1878.8 1943.9 2004.7 2055.6 2106.5 2139.2 2171.0 2194.2 Total Cost of services 627 ADESA Growth% Cost of services % of Revenue IAAI Growth% Cost of services % of Revenue AFC Growth% Cost of services % of Revenue 678 386 57% 330 219 66% 95 22.3 23% 61% 1053 59% 1123 66% 655 58% 550 67% 362.9 66% 97.7 3% 35.2 36% -2% 997 58% 1089 -3% 615 57% 553 1% 352.1 64% 88 -10% 29.8 34% 508 55% 554 494 55% 540 309 56% 316 -43% 185.3 59% 58.6 302 56% 305 179.95 59% 52 13.6 23% 11.96 23% 6% 1002 55% 1094 0% 611 56% 621 12% 365.25 59% 111 26% 26 23% 3% 1032 55% 1116 2% 625 56% 646 4% 381 59% 117 6% 26 22% 3% 1092 56% 1149 3% 655 57% 672 4% 410 61% 123 5% 27 22% 3% 1119 56% 1184 3% 663 56% 692 3% 429 62% 129 5% 27 21% 3% 1139 55% 1207 2% 676 56% 713 3% 435 61% 136 5% 28 21% 2% 1166 55% 1231 2% 690 56% 734 3% 448 61% 141 4% 29 21% 2% 1162 54% 1244 1% 684 55% 749 2% 449 60% 147 4% 29 20% 1% 1179 54% 1256 1% 691 55% 764 2% 458 60% 151 3% 30 20% APPENDIX 9 – SOURCES www.reuters.com www.sec.gov KAR Auction Services Inc 10k www.karauctionservices.com Ibisworld Google Fiannce Yahoo Finance Factset 17 1% 1191 54% 1269 1% 698 55% 771 1% 463 60% 154 2% 30 19%