Flavors are where the action is these days. As line extensions add

advertisement

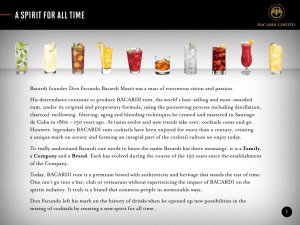

BY J. HERBERT SILVERMAN RUM RUNNING Flavors are where the action is these days. As line extensions add volume, rum category leaders and newcomers alike are rushing to invent even more. Last year, rum sold an estimated 50,000 gallons more than it had five years ago and its share of the U.S. distilled market reached almost 12 percent. An examination of the category reveals that in 2001, non-flavored products accounted for 63 percent of sales while flavored rums were 37 percent. Bacardi jumped full measure into the flavored rum market last year with the label simply known as “O”. Allied Domecq’s Malibu coconut-flavored rum skyrocketed while Diageo’s Captain Morgan is expected to report further gains under its new parentage. New high-end producers are also seeking to tap into the expanding market and a signature drink, the trendy Mojito, is entering the mainstream. The cocktail marketing approach is similar to the symbiotic relationship between vodka, gin and the martini. National chains like Host Marriott and Applebees have been aggressively promoting Mojitos further enhancing its profile. “ Last year rum was the fastest growing segment of the spirits category. We have a flourishing market in the echo boom generation – the offspring of the baby boomers who achieved legal drinking age about five years ago. – John Gomez, VP, Bacardi Last year, Chatham Imports launched the successful Marti Authentico, a rum that is infused with mint and lime. “Marti Authentico has been doing great,” reports Joe Magliocco, president of Chatham Imports. “Now that our Mojito-flavored rum has been out for a year in several major markets we are seeing strong repeat sales and excellent turn at retail.” Capitalizing on this trend, Pernod Ricard USA recently released Mojito Club. “Besides making a perfect Mojito, you can mix Mojito Club with exotic juices like passionfruit or guava nectar, traditional mixers, or drink it on its own,” says Christine Williamson, director of new products. According to Angelo Vassallo, vice president marketing, communications/brand development; “In the rum category, flavored rums are fueling growth. Consumers are constantly looking for something new and interesting to drink. Mojito Club, falls square into this category.” Speaking on behalf of the success of Admiral Nelson's Spiced Rum and Coconut Rum, Donn Lux, president of David Sherman Corp, agrees that: “The flavored rum category is an exciting category with a great deal of opportunity for expansion.” David Sherman has had success with creative cocktail programs, promoting the addition of more flavors into already flavored rums. A relative newcomer is the Marimba Rum Co., a division of Oregon’s Hood River Distillers. With exotic names such as Tropical Tease, Spiced Breeze, Orange S’cream and Lemon Squeeze, all of the products are imported from the U. S. Virgin Islands. “The rum category is strong and we believe that our new flavors and packaging will appeal to drinkers who are looking for a new twist,” says Ken Kossler, vice president of sales for the rum division. Why is rum so hot right now? An undisputed authority, John Gomez, vice president and group marketing director of the rum category, Bacardi, asserts, “Last year rum was the fastest growing segment of the spirits category. We have a flourishing market in the echo boom generation – the offspring of the baby boomers who achieved legal drinking age about five years ago. That’s a huge wave of new consumers coming into the market place in the next 15 years. These new drinkers like rum because of its mixability. It has a fun party image, not a serious drink like whisky.” A top brand producer in the category Bacardi accounts for an estimated 46 percent of all domestic rum sales and a production of 20 million cases worldwide. Gomez attributes much of this to flavors, “Bacardi is also taking advantage of its highly visible Bat logo promoting it as a signature for rum and coke to these younger consumers vis-a-vis the Cuba libre.” In the ready-todrink (RTD) category, Bacardi recently teamed up with The Minute Maid Company to launch Bacardi mixers, two shelf stable cocktail mixers. The new product is available in Strawberry Daiquiri and Pina Colada, today’s most popular frozen cocktail drinks today. Bacardi has also consummated an alliance with Anheuser Busch to develop a high-end maltflavored alcohol beverage, Bacardi Silver . According to John Kunz, a principal in Palmer Plaza Fine Wine & Liquors, a successful family owned business in Sarasota, says that flavored rums and RDT products are indeed breathing new life into the category. “While standards such as Bacardi Límon, Captain Morgan, Parrot Bay and Malibu continue to dominate our sales, we have noticed that the new six-pack Bacardi Silver, the malt-based drink, is getting off to a strong start.” For Allied Domecq, the acquisition of Malibu gives the company’s portfolio a highly sought after rum-based brand with a proven growth record. Last year, Malibu accounted for three million cases with net sales of $150 million. An outstanding success story over the past five years has been Todhunter Imports whose Cruzan Rum has grown during that period from three flavors (coconut, banana and pineapple) to a list that includes citrus flavored junkanu, rum cream and vanilla. “Together Cruzan represents 3.5 percent of flavored rums and growing,” says Tom Valdes, a founder of the company along with Jay Maltby, both high-ranking alumni of Bacardi. Valdes comments that, in fact, flavored rums have seen double-digit growth each of the past six years. Promotion of Mount Gay, imported from Barbados by Remy Amerique, is closely allied with sailing and includes sponsorship of about 50 regattas annually since it is a favorite drink of yachtsmen. “We will be sponsoring 109 events nationwide this year and speaking directly to about 65,000 sailors,” says Remy brand manager, Claire Jordan. “We will be sampling Extra Old, our hot ticket, premium line at every event as part of our strategy to introduce our existing Eclipse consumers to our premium, award winning product.” The Bermuda distiller, Gosling Bros., has made its reputation with the darkest of rums, albeit unflavored. The Black Seal label adheres to the original recipe, a closely guarded family secret that has been handed down since 1806, according to Michael Avitable, vice president, director of marketing for importer, Marie Brizard, USA. After World War 1, the cork was sealed with black sealing wax, hence the name. An exception to the flavored marketing trend is Don Q imported by Jim Beam Brands. JBB throws its marketing strength behind two classic versions, Cristal and Gold. “Focus of the rum’s promotion is New York and Florida along with New Jersey because of their ethnic composition and our high Puerto Rican visibility,” says Kathleen DiBenedetto, group product director. “We are continuing our Don Q sampling promotion which targets popular upscale bars encouraging consumers to trade up to Don Q.” While Bacardi, Allied Domecq and Diageo dominate the rum category, not to be overlooked are a growing group of niche marketers mostly aiming at the high end. One example is Rhum Barbancourt, distributed by self-styled maverick Michel Roux and his Crillon Imports. No longer bound by a Haitian trade embargo, it’s available in four variations; Three Star, Five Star Reserve Speciale, Estate Reserve dark rums and the more recent addition, Traditional White. Kunz notices many of his regular customers experimenting in the premium category. “Permanent residents tend to experiment at the high end and will try the specialty rums coming from Brazil, Mexico, Martinique and Bermuda. In the category ‘sipping rums’there are rums that are aged 12 to 15 years such Cadenheads from Barbados at 46 proof and certainly not inexpensive.” A relatively new rum from The House of Angostura, Angostura 1919 is a full-bodied, blended rum from Trinidad that is aged for eight years. The use of charred American oak bourbon barrels is designed to give the rum a darker hue, and molasses, caramel and toasty flavors. The 1919 has a suggested retail of $26. Appleton, the oldest sugar estate in Jamaica, has a serious presence in the premium category with their V/X, their Extra, and particularly their Estate 21-Year Old Jamaica Rum. The rums that make it up have been carefully selected by the Master Blender and are then aged for a minimum of 21 years in oaken vats for over two years to allow the blend to marry. Made by the same company that produces the world-famous cigars, Sidebar Spirits, LLC’s new Montecristo Rum is aiming for the same demographic. The recipe is developed from an ancient Guatemalan tradition, and the rum is aged in American oak barrels once used for Kentucky bourbons. From rums of 12 to 23 years old, Montecristo focuses on the blending component, much like a fine scotch or whiskey. “The rum category is growing at an above average rate. The majority of growth is in premium aged rums and flavored rums and consumers are looking for an alternative; a quality upsell. We have created rum that a conoisseur may enjoy on the rocks or up, yet is also great for mixing and not priced out of the mixing category” said Tim Haughinberry, President, Sidebar Spirits, LLC. J.Herbert Silverman is a veteran newspaper and magazine writer. His current assignments are U.S.correspondent for UK-based Drinks International, and contributing editor, ART News.