Third Avenue International Value Fund

advertisement

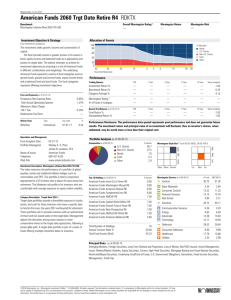

International Investment Opportunities FundSource Adviser Day 2011 Henry Ford 23 October 2009 PAGE 1 Disclaimer The information contained in this presentation has been prepared solely for informational purposes. It is not an offer to buy or sell or a solicitation of an offer to buy or sell units in the Fund/s managed by Elevation Capital Management Limited, to participate in any trading strategy or a recommendation to invest. If any offer of units in the Fund/s is made, it shall be pursuant to a definitive Investment Statement and Prospectus prepared by or on behalf of the Fund/s which will supersede this information in its entirety. Any decision to invest in the Fund/s should be made only after reviewing the definitive Investment Statement and Prospectus, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal and tax advisors in order to make an independent determination of the suitability and consequences of an investment in the securities. Any portfolio data, performance and risk targets contained in this presentation are subject to revision by the Portfolio Manager and are provided solely as a guide to current expectations. There can be no assurance that the Fund/s will achieve any targets or that there will be any return on or of capital. Historical returns are not predictive of future results. PAGE 2 PAGE 3 “In 1969, I wound up my partnership and I had to help people find someone to manage their money. I recommended Bill Ruane of Sequoia Fund…” – Warren Buffett Return Since Inception (July 1970 to June 2011) = 24,552% Robert Goldfarb and David Poppe Sequoia Fund Morningstar Managers of the Year Winner 2010, Runner-up 2008 “These managers had more than just the wind at their backs.” – Morningstar PAGE 4 PAGE 5 “Incisive, imaginative and smart, de Vaulx is highly regarded by fellow value investors and foreign-stock specialists.” – BARRON’S Charles de Vaulx Chief Investment Officer and Portfolio Manager International Value Advisers, LLC (IVA) Morningstar International Stock Manager of the Year Winner 2001, Runner-up 2006 Absolute Return Award Fund of the Year (Global Equity) Sofire Fund Ltd – 2005, 2006 PAGE 6 PAGE 7 “We’ve also spotlighted a top-performing international-only stock picker, Amit Wadhwaney of Third Avenue Funds.” The World’s Greatest Investors – SmartMoney “Amit doesn’t just look for cheap companies; he almost has to steal them,” – Jean-Marie Eveillard First Eagle Funds Amit Wadhwaney Portfolio Manager Third Avenue International Value Fund PAGE 8 B EST CA LL ZINIFEX (ZFX.AX, $9) The Australian zinc and lead miner took off in the commodities boom. Wadhwaney’s 2004 investment multiplied sevenfold, and he sold before falling zinc prices hurt the stock last year. WORST CA LL AIFUL (AIFLY.PK, $4) This consumer finance firm turned out to be, well, awful. The stock has fallen 70 percent in two years, due in part to Japan’s credit crunch. WHAT’S N EX T Wadhwaney sees surprising promise in the newsprint industry, which keeps growing even as the world goes digital. He likes Catalyst Paper (CTL.TO, $1), a Canadian firm headed for a turnaround. PAGE 9 For the FIRST TIME… New Zealand retail investors will have access to these “World Class” fund managers via… Fund Structure PAGE 10 * As at 31 July 2011 Portfolio Composition PAGE 11 * As at 31 July 2011 Fund X-Ray – World Regions PAGE 12 Fund X-Ray – Top Stock Holdings PAGE 13 Valeant Pharmaceuticals Berkshire Hathaway WBL TJX Fastenal Company Idexx Laboratories Netia Viterra Mohawk Industries Advance Auto Parts Precision Castparts Resolution Total Rolls-Royce Allianz Weyerhaeuser Sampo Astellas Pharma Leucadia National Andritz Genting Malaysia Bhd Nestle Nexans SSECOM Sodexo Genting Malaysia PAGE 14 Weyerhaeuser PAGE 15 “What to Buy? For those with a long horizon, I am sure wellmanaged forestry and farmland will outperform the average of all global assets.” - Jeremy Grantham’s 2011Q2 letter Part 2 PAGE 16 PAGE 17 Fee Structure PAGE 18 Management Fees: Sequoia Third Avenue IVA 1.00% 1.00% 1.25% ECGVFoF 0.95% ECGVFoF Management Fee will decrease as FUM grows. No Performance Fees for Managers or Elevation Capital. Conclusion Unique product offering for NZ retail investors; Value oriented investing style; Unhedged, globally diversified portfolio; World class fund managers with solid long-term performance track records; PAGE 19 Contact Us Elevation Capital Management Limited Website: www.elevationcapital.co.nz Email: info@elevationcapital.co.nz Phone: 09 307 6741 Address: 77 Parnell Road, Parnell, Auckland 1052. PAGE 20