credit analysis of seasonal businesses

advertisement

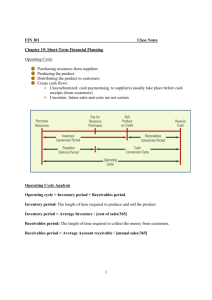

Cash Conversion Cycle 1 Jewelry retailers, bookstores, and toy distributors increase sales markedly just before the holiday season. Retail department stores and candy retailers follow the same pattern. Garden outlets, sporting goods stores and home lumber dealers experience peak sales during warm spring and summer months. Retail businesses use seasonal loans to support swings in sales activity. Clothing stores anticipate increases in volume in the spring and again in the fall as new lines arrive. Retail firms borrow heavily during the Christmas and Easter seasons to carry increased inventories and accounts receivable. Steel operations on the Great Lakes usually build iron ore inventories during summer months to supply their needs during winter when lake freighters cannot transport raw materials because of inclement weather. 2 Swimsuit manufacturers start producing bathing suits in fall for spring distribution to retailers. During the manufacturing phase, inventories build along with labor, overhead, other product costs. In the spring swimsuits are sold. Shortly thereafter, receivables fall due with proceeds providing the annual (loan) cleanup. Building contractors achieve higher levels of production when weather is favorable. Forest products producers build substantial log inventories to keep manufacturing plants supplied with raw materials during seasons when logging operations make little headway. 3 Coal and fuel oil dealers build inventories in during summer months, running them off steadily in fall and winter to a low point by early spring. Food processors use short-term lines to finance crops grown and shipped at distinctive seasons. Short term financing supports fertilizer and other production costs and the harvesting season for distribution and marketing of the crop (see Chapter 5). Fish canneries must do their processing as the fish are caught, which often results in the accumulation of substantial inventories 4 Buildup Period During the buildup period, demand deposits drop whereas loan balances, trade payables and inventory increase. At this point, the balance sheet begins to expand. High Point As a company reaches its high point, inventory, bank debt, and trade payables reach a peak. The need for liquidity bottoms out, and receivables remain low. The balance sheet reaches expansion limits. 5 Conversion Cycle Begins Inventory decreases and receivables increase as demand strengthens. Payables and bank debt remain steady or decline slightly. The balance sheet moves in tandem with the reduction in liabilities. Conversion Cycle Intensifies Shipments accelerate causing inventory to decline quickly and receivables to build further. Demand deposits rise, but at a slower rate as some receivables convert to cash. Payables and short-term loans begin to fall faster as collections are converted into cash. Balance sheet contraction moves in tandem with cash conversion. 6 Conversion Cycle Subsides The low point approaches. Firms ship very little merchandise. Inventory is already at low levels and receivables decline quickly, since the conversion process causes deposits to swell. The balance sheet fully contracts to its low point as trade payables and bank debt are retired or cleaned up. After the “traditional 30 days” have passed, renewed debt replenishes the account in preparation for next season. 7 8 Sometimes things go wrong – inventories haven’t been sold. At season’s end these obligors may not have cash available to zero out credit lines. The process generally follows a repetitive pattern 9 10 Seasonal Ratio Analysis Cash + Receivables/STD + Payables Returns/Gross Sales Cash Budgets Open cash budget link Trial Balance Analysis Break Even Shipments Break Even Inventory 11 One of the most effective tools used to derive peak short term financing requirements are cash budgets. Cash budgets usually span short periods - monthly, quarterly, semiannually, annually Short-term budgets pinpoint both borrowings required and timing of repayments. 12 Provide lenders with a way to monitor seasonal activity. For example, if actual cash receipts fall below planned receipts, bankers may assume that management either missed revenue targets, or goals were unrealistic to begin with. Help determine appropriate credit lines or loan ceilings. 13 Spot months bankers can reasonably expect loan reductions. If additional drawdowns replace loan repayments – watch out – inventory likely did not sell. Identify wayward deployment of seasonal advances. 14 Work as quasi-marketing tools. For instance, capital expenditures normally call for considerable cash outlays during the budget period. If the bank spots these anticipated outlays early enough, they can sponsor term loans or other facilities before the client approaches another bank or leasing company. 15 Preparing a Cash Budget (Refer to Acme’s Cash Budget) 16 Trial Balance Analysis Qualitative Analysis ▪ Storm Signal Analysis Quantitative Analysis ▪ (Cash + Accounts Receivable)/(Short term Bank Debt + Trade Payables) ▪ Returns and Allowances/Gross Sales ▪ Purchases/Sales 17 Slow in-house orders in comparison to corresponding periods in previous years. Factory operating well below capacity. Changes in the manner payables are paid. Owners no longer take pride in their business. Frequent visits to the customer’s place of business reveals deteriorating general appearance of the premises. Example, rolling stock and equipment has not been properly maintained. Loans to or from officers and affiliates. 18 Management does not know what condition the company is in and the direction in which it is headed. The lender did not examine the obligor’s cash budget and as a result overestimated seasonal peaks and valleys thereby approving an excessive loan. Inability to clean up bank debt or clean ups effected by rotating bank debt. Unusual items in the financial statements 19 Negative trends – losses, weak gross margins, slowness in accounts receivable, and decrease in sales volume. Intercompany payables/receivables are not adequately explained. Cash balances reduce substantially or are overdrawn and uncollected during normally liquid periods. Management fails to take trade discounts because of poor inventory turnover. Cash flow problems – very low probabilities operating cash flows cover debt service. 20 Withholding tax liability builds as taxes are used to pay other debt. Frequent “downtiering “ of financial reporting sparked in an effort to bring on a more “liberal” accountant. Changes in financial management. Totals on receivables and payables aging schedules do not agree with amounts shown on the balance sheet of the same date. 21 At the end of the cycle, creditors are not completely paid out. Sharp reduction in officers’ salaries The bank sometimes can be paid out when the borrower leans on the trade. (This often gives bankers a false sense of security, but the company may be unable to borrow from the trade for the next buildup of inventory). Brings a lower standard of living home, and might suggest a last ditch effort to save a distressed business. Reduced salaries might signal a concerted effort to make headway. Erratic interim results signaling a departure from normal and historical seasonal patterns 22 The lender does not allow enough cushion for error. If the seasonal loan is not repaid and there is no other way out but liquidation of the collateral, the lender is taking possession of collateral at the worst possible time. It is the end of the season, and if the obligor cannot sell, how will the bank? Financials are submitted late in an attempt by management or their accountants to postpone unfavorable news. Unwillingness to provide budgets, projections or interim information. Suppliers cut back terms or request COD. 23 Changes in inventory, followed by an excessive inventory buildup or the retention of obsolete merchandise. The borrower changes suppliers frequently, or transient buying results in higher raw material costs. Increased inventory to one customer or perilous reliance on one account. Changing concentration from a major well-known customer to one of lesser stature pointing to problem inventory. A good mix of customers is the best defense against “seasonal shock therapy”. 24 The lender permits advances on the seasonal loan to fund other purposes, notably payments on the banks own term debt. Indeed, the term debt is handled as agreed, but the seasonal loan goes up and stays up. Company loses an important supplier or customer. Concentrations in receivables and payables. Failure to get satisfactory explanations on these concentrations. Failure to conduct investigations on the credit worthiness of larger receivables 25 The lender finances highly speculative inventory whereby the borrower is trying for a “home run.” Intangible signals such as failure to look the banker in the eye, letting the condition of the business deteriorate, or taking longer to return calls. Management orders three-pound lobsters during a banker’s lunch because the bank is picking up the check. This weekend they won’t be able to afford this dish - the firm has just gone off the cliff. 26 Prudently structured credits fall back on a second way out, or, as the literature defines it – a good exit strategy. T Temporary problems usually are not serious: the bank simply waives the annual cleanup. If conditions are precarious, the bank may decide to restructure the credit, that is, extend a term loan or revolver to be repaid over the next few years out of operating cash flows. A loan agreement, by virtue of its covenants and events of default, will give the bank greater control over the credit. Consider these important factors: 27 Cash Flow. Equity Injection. Formula Based Advances Credit Insurance. . 28