MONTHLY FUND F A CTS

advertisement

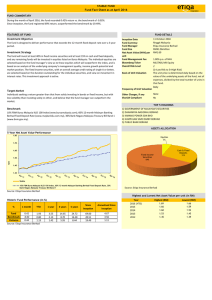

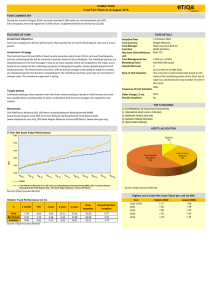

1 HONG LEONG STRATEGIC FUND Fund Objective NOVEMBER| 2015 Investment Strategy To provide investors with an investment that strives for stable returns as well as consistency in performance and income. The Fund is able to re-weight its asset classes strategically according to changes in fundamentals of the economy and monetary policies. For the equity portion, the Fund will generally invest in companies with good income and growth potential, i.e. companies that are projected to achieve earnings growth over the next 12 to 24 months. The Fund may also invest in undervalued companies that have longer term upside i.e. over the next 12 to 24 months. For the fixed income portion, the Fund will not invest in any fixed income securities that are rated “BBB" and below, and will only invest in fixed income securities that are rated at least “A3” as rated by RAM or its equivalent ratings by MARC. The Fund may invest a minimum 0% and maximum 98% in equities. The Fund may also invest a minimum 2% and maximum 100% in fixed income securities. MONTHLY FUND FACTS Investment Manager Mr. Hoo See Kheng – Hong Leong Asset Management Bhd (HLAM) Mr. Hoo obtained a Bachelor of Commerce from University of New South Wales Australia and a post-graduate diploma in System Analysis and Design from Japan-Singapore Institute of Software Technology. Before joining HLAM, Mr. Hoo has over sixteen (16) years of fund management experience with Aseambankers, Phileo Asset Management and Libra Invest Berhad. He obtained his Capital Markets Services Representative’s license from the SC on 16 April 2014. Mr. Hoo is also a member of the Malaysian Institute of Accountants. He holds the Certified Information System Auditor (U.S.A). Fund Performance Since Launch Fund Update November was a month of consolidation for Malaysia as the FTSE BM KLCI did not fluctuate wildly as it did in previous months and enjoyed some strength on the back of a stronger Wall Street and ringgit. The sale of Edra Global Energy Berhad to the Chinese and China’s commitment to buy Malaysian bonds also helped boost sentiment. Furthermore, the third quarter results season appeared to be rather decent with fewer than expected disappointments. Malaysia's gross domestic product (GDP) growth of 4.7% in the third quarter of 2015 (Q3 2015) was driven by capital spending in the manufacturing and services sectors. Malaysia’s exports had recorded 8.8% growth to the RM70.16 billion in September, the highest within the first nine months of this year. For the month, the FTSE BM KLCI edged up 6 points or 0.4% to close at 1,672 points. The Fund took profit on some stocks that have outperformed the index and switched into some laggards. CALCULATION: Percentage Growth, NAV Per Unit-toNAV Per Unit basis with gross income (if any) from HLSTF reinvested, since launch, in MYR terms. Source: Lipper For Investment Management Fund Performance Table Fund (%) Benchmark (%) 1 Month 0.77 0.35 3 Months 9.31 2.77 6 Months -0.35 -2.29 1 Year 2.33 -4.38 3 Years 22.27 6.10 5 Years 26.87 14.52 Since Launch 133.13 72.97 Past performance is not necessarily indicative of future performance and unit prices and investment returns may go down, as well as up. Source: Lipper For Investment Management Large Cap Investment Approach Medium Cap Small Cap Growth Blend Value HONG LEONG STRATEGIC FUND NOVEMBER| 2015 Income Distribution Fund Information Description Launch Date Launch Price NAV Per Unit as @ 30 November 2015 Fund Size Fund Category Fund Type Initial Sales Charge Annual Management Fee Minimum Initial Investment Subsequent Investment Financial Year End Details 8 March 2005 RM0.5000 Date Amount Details 18/09/2013 3.1 sen Gross 18/03/2014 3.1 sen Gross RM0.3785 18/09/2014 3.1 sen Gross 17/03/2015 1.75 sen Gross 15/09/2015 1.75 sen Gross RM51.61 million Mixed Assets Growth & Income 6.0% 1.50% RM1,000 RM100 30 September Historical NAV Per Unit as at 30 November 2015 MONTHLY FUND FACTS Risks Market risk, Liquidity risk, Fund management risk, Noncompliance risk, Loan financing risk/Financing risk, Inflation/ Purchasing power risk, Particular Security Risk, Credit/ Default Risk, Interest Rate Risk, Currency Risk, Country Risk, Emerging Markets Risk, Repatriation Risk, Risk Associated with Investments in Pre-Listed Securities and Dividend Policy Risk. High Low 1 Month RM0.3817 RM0.3745 12 Months RM0.4122 RM0.3561 Risk Characteristics as at 30 November 2015 6 Months 1 Year Ann. Std. Deviation 16.17% 11.98% Ann. Sharpe Ratio -0.20% -0.06% Portfolio Details as at 30 November 2015 * Asset Allocation Sector Exposure Country Exposure Top 5 Holdings Securities % of NAV Guinness Anchor Berhad - Malaysia 8.08% Hong Leong Industries Berhad - Malaysia 7.13% Yinson Holdings Berhad - Malaysia 6.49% MUI Properties Berhad - Malaysia 5.58% Engtex Group Berhad - Malaysia 5.36% * Percentage of NAV. All figures are subject to change on a frequent basis. Note:-(1) Based on the Fund’s portfolio returns as at 31 October 2015, the Volatility Factor (VF) for this Fund is 10.0 and is classified as “High” (Source: Lipper). “High” includes funds with VF that are above 7.975 but not more than 9.575 (Source: Lipper). The VF means there is a possibility for the Fund in generating an upside return or downside return around this VF. The Volatility Class (VC) is assigned by Lipper based on quintile ranks of VF for qualified funds. VF is subject to monthly revision and VC will be revised every six months. The Fund’s portfolio may have changed since this date and there is no guarantee that the Fund will continue to have the same VF or VC in the future. Presently, only funds launched in the market for at least 36 months will display the VF and VC. Disclaimer:- Investors are advised to read and understand the contents of the Hong Leong Master Prospectus Issue No. 2 dated 30 April 2015 and its First & Second Supplementary Master Prospectus dated 1 September 2015 & 2 November 2015 respectively (collectively known as the “ Prospectus”), before investing. The Prospectus has been registered and Product Highlights Sheet lodged with the Securities Commission Malaysia who takes no responsibility for the contents of the Prospectus and Product Highlights Sheet. A copy of the Prospectus can be obtained from any of HLAM offices and Maybank branches. The Product Highlights Sheet is also available and that investors have the right to request for it. You should also consider the fees and charges involved before investing. Prices of units and distributions payable, if any, may go down or up, and past performance of the Fund is not an indication of its future performance. Where a distribution/unit split is declared, investors are advised that the NAV per unit will be reduced from cum-distribution NAV/pre-unit split NAV to ex-distribution NAV/post-unit split NAV. Where a unit split is declared, the value of your investment in Malaysian Ringgit will remain unchanged after the distribution of the additional units. Where unit trust loan financing is available, investors are advised to read and understand the contents of the unit trust loan financing risk disclosure statement before deciding to borrow to purchase units. Investors should be aware of the risks for the Fund before investing: Market risk, Liquidity risk, Fund management risk, Non-compliance risk, Loan financing risk/Financing risk, Inflation/ Purchasing power risk, Particular security risk, Credit/Default risk, Interest rate risk, Currency risk, Country risk, Emerging markets risk, Repatriation risk, Risk associated with investments in pre-listed securities and Dividend policy risk. Please note that the NAV per unit, sales charge and fees displayed in this document are quoted exclusive of Goods and Services Tax. All fees and expenses incurred by the fund are subject to Goods and Services Tax at the prevailing rate. This document is prepared by Hong Leong Asset Management Bhd. It is not intended to be an offer or invitation to subscribe or purchase of funds. The information contained herein has been obtained from sources believed in good faith to be reliable; however, no guarantee is given in its accuracy or completeness. Applications must be made on the Account Opening Form, Pre-Investment Form and Investment Application Form referred to and accompanying the Prospectus. The Fund may not be suitable for all and if in doubt, investors should seek independent advice.