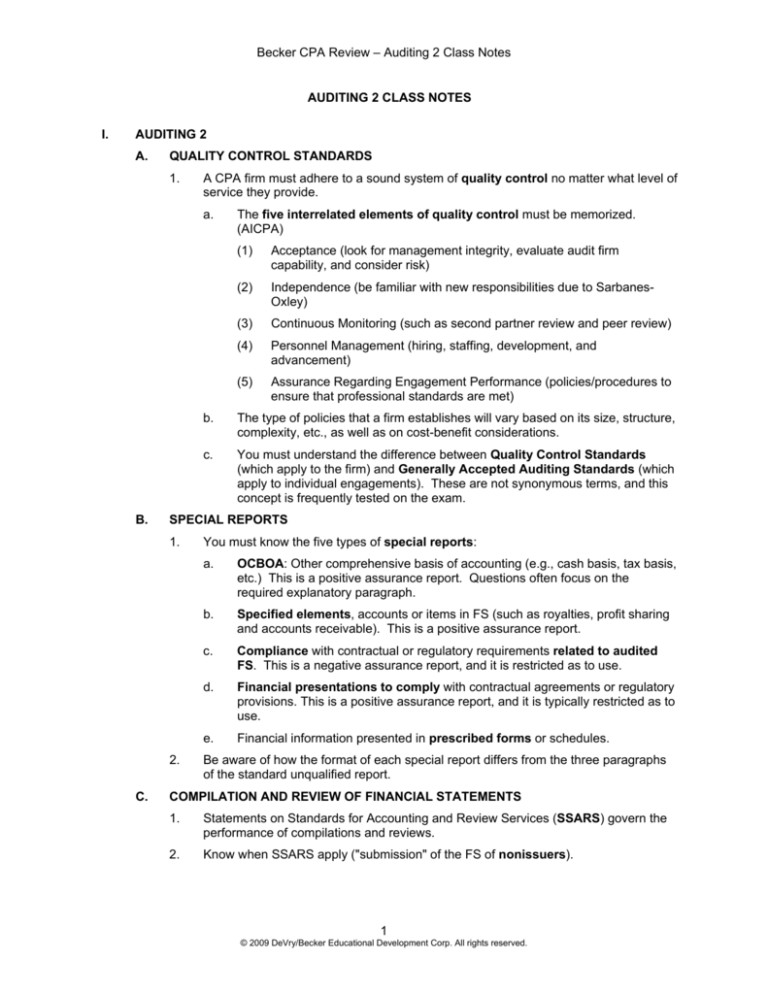

Becker CPA Review – Auditing 2 Class Notes

AUDITING 2 CLASS NOTES

I.

AUDITING 2

A.

QUALITY CONTROL STANDARDS

1.

A CPA firm must adhere to a sound system of quality control no matter what level of

service they provide.

a.

B.

(1)

Acceptance (look for management integrity, evaluate audit firm

capability, and consider risk)

(2)

Independence (be familiar with new responsibilities due to SarbanesOxley)

(3)

Continuous Monitoring (such as second partner review and peer review)

(4)

Personnel Management (hiring, staffing, development, and

advancement)

(5)

Assurance Regarding Engagement Performance (policies/procedures to

ensure that professional standards are met)

b.

The type of policies that a firm establishes will vary based on its size, structure,

complexity, etc., as well as on cost-benefit considerations.

c.

You must understand the difference between Quality Control Standards

(which apply to the firm) and Generally Accepted Auditing Standards (which

apply to individual engagements). These are not synonymous terms, and this

concept is frequently tested on the exam.

SPECIAL REPORTS

1.

2.

C.

The five interrelated elements of quality control must be memorized.

(AICPA)

You must know the five types of special reports:

a.

OCBOA: Other comprehensive basis of accounting (e.g., cash basis, tax basis,

etc.) This is a positive assurance report. Questions often focus on the

required explanatory paragraph.

b.

Specified elements, accounts or items in FS (such as royalties, profit sharing

and accounts receivable). This is a positive assurance report.

c.

Compliance with contractual or regulatory requirements related to audited

FS. This is a negative assurance report, and it is restricted as to use.

d.

Financial presentations to comply with contractual agreements or regulatory

provisions. This is a positive assurance report, and it is typically restricted as to

use.

e.

Financial information presented in prescribed forms or schedules.

Be aware of how the format of each special report differs from the three paragraphs

of the standard unqualified report.

COMPILATION AND REVIEW OF FINANCIAL STATEMENTS

1.

Statements on Standards for Accounting and Review Services (SSARS) govern the

performance of compilations and reviews.

2.

Know when SSARS apply ("submission" of the FS of nonissuers).

1

© 2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review – Auditing 2 Class Notes

3.

The auditor is required to have an understanding with the client regarding the service

being provided, and this understanding should be documented. An engagement

letter is the best way to document the understanding.

4.

Compilation – the accountant prepares financial statements without expressing any

assurance.

a.

b.

5.

6.

The accountant must perform the following procedures for this type of

engagement:

(1)

Establish an understanding with the client.

(2)

Obtain knowledge of the industry and the business.

(3)

Read the financial statements.

(4)

If fraud/illegal acts come to the accountant's attention, consider the effect

on the financial statements.

(5)

Draft the compilation report – you must commit to memory the standard

report for a compilation, and you must know how to modify the standard

report if disclosures are omitted or if there are departures from GAAP.

A report is not required if FS are not expected to be used by a third party (but

an engagement letter must be used instead).

Review – accountant uses inquiry and analytical procedures as a basis for

expressing limited assurance on the financial statements.

a.

The accountant must be independent in order to perform a review.

b.

The accountant must perform the following procedures for this type of

engagement:

(1)

Establish an understanding with the client.

(2)

Obtain knowledge of the industry and the business.

(3)

Make inquiries of appropriate individuals.

(4)

Perform analytical procedures.

5)

Read the financial statements.

(6)

If fraud/illegal acts come to the accountant's attention, consider the effect

on the financial statements.

(7)

Obtain a client representation letter from management.

(8)

Draft the review report – you must commit to memory the standard report

for a review, and you must know how to modify the standard report if

there are departures from GAAP.

c.

During a review of a nonissuer, the auditor is not responsible for testing internal

control, performing audit tests, or assessing fraud risk.

d.

Reporting on only one FS is okay.

e.

A change in the type of engagement is okay if it is for the right reasons (e.g.,

change in client requirements).

Reporting on Comparative Financial Statements

a.

Know how to report when there is a service upgrade or a service downgrade.

b.

Know how to handle situations in which a previously issued report needs to be

revised.

2

© 2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review – Auditing 2 Class Notes

D.

E.

c.

Be aware of the issues that arise when a predecessor auditor is involved.

d.

Know how to report when one period is audited and the other period is not.

REVIEW OF INTERIM FINANCIAL INFORMATION

1.

Note that this typically applies to public companies (issuers) and falls under auditing

standards (PCAOB standards), not SSARS.

2.

The accountant must perform the following procedures for this type of engagement:

a.

Establish an understanding with the client.

b.

Obtain sufficient knowledge of the entity's business and its internal control

(note this is different than a review under SSARS).

c.

Make inquiries of appropriate individuals.

d.

Perform analytical procedures.

e.

Read financial information, board minutes, etc.

f.

Obtain a client representation letter from management.

g.

Communicate results to management and the audit committee.

h.

Draft the review report - You must commit to memory the standard report for a

review (note that it is different than the review report under SSARS).

3.

Know how to modify the standard report if there are departures from GAAP.

4.

Comfort Letter

a.

A comfort letter is typically addressed to an underwriter, and covers the period

from the last audit to the registration date.

b.

The auditor is required to perform a review of the interim financial information.

c.

A comfort letter:

(1)

Provides negative assurance with respect to unaudited financial

statements.

(2)

Is restricted and not for the general public.

(3)

Provides positive assurance regarding the auditor's independence.

ATTEST ENGAGEMENTS

1.

An attest engagement is one in which a CPA is engaged to issue an examination,

review, or agreed-upon procedures report on subject matter, or on an assertion about

the subject matter, that is the responsibility of another party (typically management).

2.

The standards for attestation engagements are very similar to GAAS, but not

identical.

a.

There are five general standards: training and proficiency; independence,

performance/due professional care, professional knowledge of subject matter,

and judgment as to whether the assertion is capable of evaluation.

b.

There are two fieldwork standards: planning and supervision, and evidence.

c.

There are four reporting standards: identify the assertion/subject matter and

the type of service, express a conclusion, disclose any reservations about the

engagement, and (in certain circumstances) restrict use of the report.

3

© 2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review – Auditing 2 Class Notes

3.

4.

Statements on Standards for Attestation Engagements (SSAE) are applicable for

attestation engagements. Attestation services include those related to:

a.

Agreed-upon procedures

b.

Financial forecasts and projections

c.

Pro-forma financial statements (restricted use)

d.

Internal control over financial reporting (covered in A5)

e.

Compliance engagements

f.

Management's Discussion and Analysis

Trust Services

The following trust services are also considered attest engagements.

a.

WebTrust Engagement – assessing a website

b.

SysTrust Engagement – assessing a system

5.

Like GAAS audits, attest engagements require an understanding with the client,

appropriate documentation, and inquiry regarding subsequent events.

6.

A written assertion and a management representation letter are required for

examinations and reviews.

7.

Agreed-Upon Procedures Engagements

a.

b.

8.

The following conditions must exist for an auditor to accept this type of

engagement:

(1)

Independence of the accountant.

(2)

Agreement of the parties as to what procedures are going to be applied,

the criteria to be used, etc.

(3)

The subject matter must be capable of consistent measurement.

(4)

The specified party takes responsibility for the sufficiency of the

designated procedures.

(5)

Use of the report is restricted to the specified parties.

(6)

The client (or in some cases a third party) is responsible for the subject

matter.

(7)

A summary of significant assumptions is included if prospective FS are

involved.

There are various reporting requirements, including a list of procedures

performed and findings obtained, a statement that the specified party is

responsible for the sufficiency of the procedures performed, a disclaimer of

opinion, and a restriction on use.

Prospective Financial Statements

a.

Financial forecast – know the definition ("best guess") and that forecasts are

available for general (or restricted) use.

b.

Financial projection – know the definition ("what would happen if") and that

projections are restricted use.

4

© 2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review – Auditing 2 Class Notes

c.

The auditor can perform the following types of engagements with regard to

prospective financial statements.

(1)

Compilation engagement – disclaim an opinion, include caution about

achievability, and state that the accountant has no responsibility to

update.

(2)

Examination engagement – two parts to opinion: FS presented in

conformity with guidelines and assumptions provide a reasonable basis

for FS. Also, include caution about achievability, and state that the

accountant has no responsibility to update.

(3)

Agreed-upon procedures – see item 7b above. Also, include caution

about achievability and state that the accountant has no responsibility to

update.

Note that a review is not an option.

d.

9.

Partial presentations of prospective information exclude certain essential

elements and are not appropriate for general use.

Other Attest Engagements

a.

Pro-forma Financial Statements – show the effect a hypothetical transaction

would have had on past FS – these are not prospective FS.

(1)

These statements may either be examined or reviewed.

(2)

The report should reference the financial statements from which the

historical financial information was derived.

b.

Compliance Attestations – an agreed-upon procedures engagement or an

examination may be performed.

c.

Management's Discussion and Analysis (MD&A) – an examination or a

review may be performed.

5

© 2009 DeVry/Becker Educational Development Corp. All rights reserved.