Note to Firms

advertisement

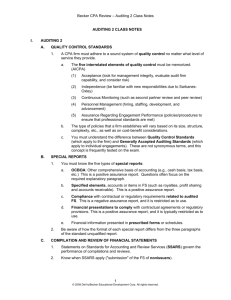

Insert Your Firm’s Logo Here Exploring SSARS 21: A Look at Preparation, Compilation and Review Services An Overview of the Changes and Impacts for Our Clients and Our Practice Instructions To Firms Below are some suggestions when using this PowerPoint to update your team members on SSARS 21. • This PowerPoint is an overview of significant changes to compilation and review engagements and an introduction to the preparation service. It should be used to augment your understanding of SSARS 21. Reviewing this is not a substitute for reading and understanding the actual guidance. • Several slides have a comment note for you to consider the application based on your current practices (and consider incorporating relevant examples), and there are likely others throughout the PowerPoint Once you have tailored this PowerPoint to your firm’s current practices, delete this slide Private Companies Practice Section 2 Objective To provide an overview of changes resulting from SSARS 21 • • • • • Overview Effective Dates AR-C 70 - Preparation AR-C 80 - Compilation AR-C 90 - Review Private Companies Practice Section 3 General Overview of SSARS 21 Private Companies Practice Section 4 SSARS 21 Supersedes all existing AR sections except for AR Section 120, Compilation of Pro Forma Financial Information • Prospective financial information is currently codified in Attest Standards Private Companies Practice Section 5 General Overview of SSARS 21 SSARS No. 21 is formatted into four separate sections: • Section 60, General Principles for Engagements Performed in Accordance With Statements on Standards for Accounting and Review Services • Section 70, Preparation of Financial Statements • Section 80, Compilation Engagements • Section 90, Review of Financial Statements These sections have been codified with the prefix “AR- C” to denote them from the extant AR sections. Private Companies Practice Section 6 Effective Date Effective for financial statement periods ending on or after December 31, 2015 Early implementation is permitted Interim engagements can be performed in accordance with SSARS 21 or SSARS 19 Private Companies Practice Section 7 Section 60 – General Principles Private Companies Practice Section 8 Section 60 – General principles for SSARS Engagements Replaces AR Section 60, Framework for Performing and Reporting on Compilation and Review Engagements Comply with the general principles in Section 60 in addition to the relevant sections based on whether the engagement is a preparation, compilation or review Not expected to result in changes to existing practice Private Companies Practice Section 9 Section 60 – General principles for SSARS Engagements AR-C Section 60 includes requirements with guidance on: • • • • • Ethical requirements Professional judgment Conduct of the engagement Engagement level quality control Acceptance and continuance of client relationships and engagements • Note to firms: Additional details about each of these requirements is included in the speaker notes. Firms may choose to add these details as additional slides Private Companies Practice Section 10 Section 70 – Financial Statement Preparation Private Companies Practice Section 11 Section 70 – Overview New non-attest financial statement preparation service Bright line between accounting services (preparation) and reporting services (compilation or review) Financial statements may be provided to third parties Private Companies Practice Section 12 Section 70 – Overview Applies when engaged to prepare financial statements but not engaged to perform an audit, review, or compilation on those financial statements. Does not apply when • engaged to merely assist in preparing financial statements • the financial statements are prepared as a by-product of another engagement The understanding with the client as to what the engagement entails is important. Private Companies Practice Section 13 Section 70 – Overview Examples of when AR-C 70 may apply • Preparation of financial statements prior to audit or review by another accountant • Preparation of financial statements to be presented alongside the tax return • Preparation of personal financial statements for presentation alongside a financial plan • Preparation of a single financial statement • Using the information in a general ledger to prepare financial statements outside of an accounting software system Private Companies Practice Section 14 Section 70 – Overview Examples of when AR-C 70 does not apply • Preparation of financial statements when the accountant is engaged to perform an audit, review, or compilation of such financial statements • Preparation of financial statements with a tax return solely for submission to taxing authorities • Personal financial statements that are prepared for inclusion in written personal financial plans prepared by the accountant • Financial statements prepared in conjunction with litigation services that involve pending or potential legal or regulatory proceedings Private Companies Practice Section 15 Section 70 – Planning An engagement letter signed by both the accountant and management or those charged with governance is required • Note to Firms: Add reference to location of preparation engagement letters for SSARS 21 No determination about independence is required • The firm may want to maintain independence in case attest services are requested in future • Note to Firms: Add reference to location of independence policies or person to whom questions should be directed Identify clients who may be interested in engaging us to perform preparation engagements. • SSARS 8 engagements • Accounting assistance Private Companies Practice Section 16 Section 70 – Fieldwork Obtain an understanding of the financial reporting framework and significant accounting policies Discuss significant estimates and judgments with clients • Client needs to understand • Client needs to accept responsibility Prepare the statements using the records and explanations provided by management • Not required to verify the completeness or accuracy of information Private Companies Practice Section 17 Section 70 – Financial Statements Financial statements can be prepared with or without disclosures • Disclose that substantially all disclosures are omitted If using a special purpose framework include a description Financial statements can be prepared with a known departure but must be disclosed Private Companies Practice Section 18 Section 70 – Legend/Disclaimer No report is required, even if the financial statements are expected to be used by a third party A legend is required on each page of the financial statements indicating, at a minimum, “no assurance is provided.” Examples: • No assurance is provided on these financial statements. • These financial statements have not been subjected to an audit, review, or compilation engagement, and no assurance is provided on them. • Other statements that convey that no assurance is provided on the financial statements are acceptable. Note to firm: see speaker notes for additional considerations. The legend can be shown as headers or footers. Private Companies Practice Section 19 Section 70 – Legend/Disclaimer The accountant or the accountant’s firm name is not required to be included, although it can be. • Note to Firms: Document firm policy if name will or will not be included Options if the legend is not included: • • • • Issue a disclaimer Perform a compilation engagement; or Resign. Note to Firms: Document which option the firm will pursue if a legend is not included Keep a copy of the statements in the workfiles Private Companies Practice Section 20 Peer Review Requirements Note to firms: determine whether you wish to review peer review requirements in your training session. Firms that only perform preparation engagements are not required to enroll in AICPA PRP A firm’s preparation engagements are included in the scope of a peer review when the firm either elects to enroll in the program or is already enrolled due to other engagements it performs Changes are effective for peer reviews commencing on or after February 1, 2015 Private Companies Practice Section 21 Section 80 – Compilation Engagements Private Companies Practice Section 22 Section 80 – Overview of Changes Applies when the accountant is engaged to perform a compilation engagement Some changes to the engagement letter A report is always required Independence is a required consideration Management use only financial statements (SSARS 8 engagements) are no longer an option. Private Companies Practice Section 23 Section 80 – Planning Requires an updated engagement letter • Signature by both the accountant and the client is required. • Note to Firms: Document location of engagement letters updated for SSARS 21 One change to engagement letter is that management’s responsibilities are clarified • Clients may be concerned that management’s responsibilities have changed, but they have not. • Talking points available to help frame the conversation Private Companies Practice Section 24 Section 80 – Fieldwork No changes to procedures Private Companies Practice Section 25 Section 80 – Financial Statements Supplementary information references, such as “See accountant’s compilation report” or “See independent accountant’s compilation report.” are allowed, but no longer required. • Note to Firms: Document firm’s policy regarding if the reference will be used and communicate in training Statements can be prepared with or without disclosures Private Companies Practice Section 26 Section 80 – Reporting A report is always required Management use only financial statements (SSARS 8 engagements) are no longer an option. • Preparation engagement under AR-C 70 is an option • Or keep as compilation but with a report • Note to firms: Document process for communicating with clients currently receiving SSARS 8 financial statements and discussing impact with them Streamlined report The city and state where the accountant practices is now required Private Companies Practice Section 27 Section 90 – Review Engagements Private Companies Practice Section 28 Section 90 – Overview of Changes Some changes to the engagement letter Some changes to the management representation letter Some changes to fieldwork requirements Review report has been updated Private Companies Practice Section 29 Section 90 – Planning Updated engagement letter • Signatures by both the accountant and the client are required. • Management’s responsibilities are clarified. • Language added regarding the form and content of the review report expected to be issued. • Statement added that management agrees to - Include the review report in any document containing the related financial statements - Ask the accountant’s permission to do so • Considerations with respect to using a special purpose framework • Note to Firms: Document location of engagement letters updated for SSARS 21 Private Companies Practice Section 30 Section 90 - Fieldwork Requirements regarding the performance of analytical procedures have been clarified. • Note to Firms: Add reference to updated policies for performing analytical procedures in a review engagement Inquiries are now presumptively required. Reconciling the financial statements to underlying accounting records is now specifically required. Management representation letter guidance is clarified. Private Companies Practice Section 31 Section 90 – Financial Statements Supplementary information references, such as “See independent accountant’s review report.” is allowed, but no longer required. • Note to Firms: Document the firm’s policy for including references to supplemental information The concept of required supplementary information is introduced • Defined as information that an accounting standard requires to accompany an entity’s basic financial statements Private Companies Practice Section 32 Section 90 – Reporting Updated report with heading and city and state of accountant’s practice location Modification to the standard report in certain situations Additional requirements for Emphasis of Matter or Other Matter paragraphs Expanded communications with management or those charged with governance Private Companies Practice Section 33 Financial Statement Users Private Companies Practice Section 34 Financial Statement Users Start communicating with users about the new report formats for compilations and reviews. • Provide examples of standard reports Users may be concerned that they are receiving something different. • Reports have been modified but there is no change to the level of service or assurance previously provided. Private Companies Practice Section 35 Next Steps Private Companies Practice Section Implementing The New Standards We will begin implementing SSARS 21 during the planning stage of year end engagements. • Start communicating management's responsibilities and changes to compilation and review reports during our planning meetings • Note to firms: Update these bullets with specific instructions you wish to give to your staff Additional materials and documentation provided by the AICPA at AICPA.org/SSARS21 Private Companies Practice Section Reminders Obtain signed updated engagement letters Ensure you’re using the updated reports for compilations and reviews Ensure you’re using the updated management letters for reviews Talk to SSARS 8 engagements clients now to determine level of engagement Private Companies Practice Section 38 Questions? Private Companies Practice Section 39