Auditing

& Attestation

Simulation Ver.3

Final Review Notes

BECKER

C PA R E V I E W

Becker Professional Review CPA Course Development Team

Timothy F. Gearty, CPA, MBA, JD ............ Editor in Chief, FARE National Editor, Regulation (Tax) Editor

Lisa M. Thayer, CPA ................................................. Business Environment & Concepts National Editor

Tom Cox, CPA, CMA, CHFP .......................................................... FARE (GASB & NFP) National Editor

Steve Levin, BA, JD .............................................................................. Regulation (Law) National Editor

Peter Olinto, JD, CPA ........................................................................... Regulation (Law) National Editor

Cindy Lawrence, CPA, MBA .................................................................................... Audit National Editor

Richard A. Sykes ................................................................................. Director of Education Technology

Anson Miyashiro .................................................................................... Multimedia Production Manager

Al Glodan ............................................................................................ Audio / Video Production Manager

Jay Garrett ................................................................................................................ Publishing Manager

Pete Console ................................................................................................... System Support Manager

Contributing Editors

Eric J. Brunner, PhD

Robert A. DeFilippis, CPA, MBA

Mike Farrell, JD

Dennis J.Green, CPA,MBA

Liliana Hickman-Riggs, CPA, CITP, CMA, CIA, DABFA, MS

Edward McTague, CPA, MBA

Michael Meriwether, CPA, MBA

Mike Potenza, JD

Ray Rigoli, CPA, MBA

Karen Tarbet, CPA, JD

Jennifer B. Deutsch, CPA, MS

Chris Cocozza, CPA, JD, LLM

Angeline S.Brown, CPA, MAC

Permissions

Material from Uniform CPA Examination Questions and Unofficial Answers, 1989, 1990, 1991, 1992,

1993, 1994, 1995, 1996, 1997, 1998, 1999, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007 and 2008

copyright © by American Institute of Certified Public Accountants, Inc. is reprinted (or adapted) with

permission.

Copyright © 2009 by DeVry/Becker Educational Development Corp. All rights reserved.

Printed in the United States.

Reproduction or translation of any part of this work beyond that permitted by Sections 107 and 108 of

the United States Copyright Act without the permission of the copyright owner is unlawful. Request for

permission or further information should be addressed to the Permissions Department, DeVry/Becker

Educational Development Corp.

DeVry/Becker Educational Development Corp. grants to you the one-time right to use the Becker CPA

Review materials as the original user. This license is granted only to you as a first-time user and is nontransferable to anyone else.

Becker CPA Review

Auditing

AUDITING TABLE OF CONTENTS

厳選 Simulations(講義

解説付き)

1.

Financial statements audits のまとめ .............................................................................................

1

2.

Simulation 1 (2005 AICPA Release) ..............................................................................................

3

3.

Simulation 2 (2006 AICPA Release)

.............................................................................................

11

4.

Simulation 3 (2007 AICPA Release)

.............................................................................................

23

5.

Simulation 4 (2008 AICPA Release) ................................................................................................

37

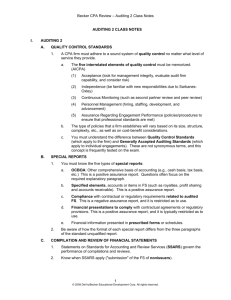

TOPIC 1: BEFORE THE FIELDWORK

1.

Purpose of an Audit ........................................................................................................................

1-3

2.

The Audit Process ..........................................................................................................................

1-3

3.

Management Assertions .................................................................................................................

1-4

4.

Ten Generally Accepted Auditing Standards ..................................................................................

1-5

5.

Planning the Audit ..........................................................................................................................

1-6

6.

Supervision ....................................................................................................................................

1-8

7.

Audit Documentation ......................................................................................................................

1-8

8.

Related Party Transaction ..............................................................................................................

1-8

9.

Multiple Choice ...............................................................................................................................

1-9

10. Multiple Choice (Solutions) .............................................................................................................. 1-11

TOPIC 2: PLANNING

1.

Planning for Risk ...........................................................................................................................

2-3

2.

Internal Control ...............................................................................................................................

2-5

3.

Auditor's Risk Assessment .............................................................................................................

2-7

4.

Responding to Assessed Risk ........................................................................................................

2-8

5.

Multiple Choice ...............................................................................................................................

2-11

6.

Simulation

2-13

7.

Multiple Choice (Solutions) ............................................................................................................ 2-29

.....................................................................................................................................

TOPIC 3: TRANSACTION CYCLES

1.

Summary of Key Transaction Cycles .............................................................................................

© 2009 DeVry/Becker Educational Development Corp. All rights reserved.

3-3

iii

Auditing

Becker CPA Review

2.

Expenditure Cycle ..........................................................................................................................

3-3

3.

Payroll and Personnel Cycle ..........................................................................................................

3-4

4.

Revenue Cycle ...............................................................................................................................

3-5

5.

Multiple Choice ...............................................................................................................................

3-11

6.

Simulation

3-13

7.

Multiple Choice (Solutions) .............................................................................................................. 3-33

.....................................................................................................................................

TOPIC 4: EVIDENCE AND COMMUNICATION

1.

Audit Evidence

..............................................................................................................................

4-3

2.

Substantive Tests ...........................................................................................................................

4-3

3.

Auditing Receivables ......................................................................................................................

4-4

4.

Auditing Cash .................................................................................................................................

4-5

5.

Auditing Inventory ..........................................................................................................................

4-5

6.

Required Auditor Communications .................................................................................................

4-6

7.

Multiple Choice ...............................................................................................................................

4-11

8.

Simulation ......................................................................................................................................

4-13

9.

Multiple Choice (Solutions) .............................................................................................................. 4-27

TOPIC 5: EFFECT OF IT ON THE AUDIT

1.

The Effect of Information Technology (IT) on the Audit ..................................................................

5-3

2.

Quality Control Standards ..............................................................................................................

5-5

3.

Ratio Analysis – Analytical Procedures ..........................................................................................

5-5

4.

Multiple Choice ...............................................................................................................................

5-7

5.

Multiple Choice (Solutions) ..............................................................................................................

5-9

TOPIC 6: STATISTICAL SAMPLING

1.

Audit Sampling ...............................................................................................................................

6-3

2.

Statistical Sampling ........................................................................................................................

6-3

3.

Sampling Risk ................................................................................................................................

6-3

4.

Attribute Sampling ...........................................................................................................................

6-3

5.

Variables Sampling ........................................................................................................................

6-4

6.

PPS Sampling ................................................................................................................................

6-6

iv

© 2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Auditing

7.

Dual Purpose Samples ...................................................................................................................

6-7

8.

Multiple Choice ...............................................................................................................................

6-9

9.

Multiple Choice (Solutions) .............................................................................................................. 6-11

TOPIC 7: OPINIONS

1.

Opinion Types ................................................................................................................................

7-4

2.

Standard Unqualified Opinion ........................................................................................................

7-4

3.

Modified Unqualified Opinion .........................................................................................................

7-5

4.

Qualified Opinion ............................................................................................................................

7-6

5.

Adverse Opinion .............................................................................................................................

7-7

6.

Disclaimer of Opinion .....................................................................................................................

7-7

7.

Comparative Financial Statements ................................................................................................

7-7

8.

Subsequent Events ........................................................................................................................

7-8

9.

Subsequent Discovery of Facts ......................................................................................................

7-9

10. Omitted Audit Procedures ..............................................................................................................

7-9

11. Multiple Choice ...............................................................................................................................

7-11

12. Simulation

7-13

.....................................................................................................................................

13. Multiple Choice (Solutions) .............................................................................................................. 7-27

TOPIC 8: OTHER REPORTS & SERVICES

1.

Special Reports ..............................................................................................................................

8-3

2.

SSARS ...........................................................................................................................................

8-3

3.

Review of Interim Financial Statements .........................................................................................

8-5

4.

Attestation Engagements ...............................................................................................................

8-6

5.

Assurance Services ........................................................................................................................

8-8

6.

Multiple Choice ...............................................................................................................................

8-9

7.

Multiple Choice (Solutions) .............................................................................................................. 8-11

TOPIC 9: GOVERNMENT AUDITING

1.

Government Auditing Standards ....................................................................................................

9-3

2.

Auditor Responsibilities ..................................................................................................................

9-3

3.

Reporting Requirements ................................................................................................................

9-4

© 2009 DeVry/Becker Educational Development Corp. All rights reserved.

v

Auditing

Becker CPA Review

4.

Sarbanes-Oxley Act .......................................................................................................................

9-6

5.

Multiple Choice ...............................................................................................................................

9-9

6.

Multiple Choice (Solutions) .............................................................................................................. 9-11

TOPIC 10: ADDITIONAL TOPICS

1.

Professional Standards ..................................................................................................................

10-3

2.

Service Organizations ....................................................................................................................

10-3

3.

Fair Values .....................................................................................................................................

10-3

4.

Reports on the Application of Accounting Principles ...................................................................... 10-3

5.

Reporting on Financials for Use in Other Countries ....................................................................... 10-3

6.

Long-Term Investments .................................................................................................................

10-4

7.

Condensed Financial Statements ..................................................................................................

10-4

8.

Selected Financial Data .................................................................................................................

10-4

9.

Information Accompanying the Basic Financials ............................................................................ 10-4

10. Required Supplementary Information .............................................................................................

10-4

11. Segment Information ......................................................................................................................

10-4

12. Auditor-Submitted Documents .......................................................................................................

10-4

13. Additional Examples of Fraud Risk Factors .................................................................................... 10-5

14. Additional Tests of Controls in the Expenditure Cycle ....................................................................

10-6

15. Auditing Other Areas ......................................................................................................................

10-8

16. Comparisons of SSARS and SAS Engagements ........................................................................... 10-9

17. Prospective Financial Statement Summary .................................................................................... 10-10

TOPIC 11: AUDIT COMMUNICATIONS

1.

vi

Examples of Audit Communications

Internal Control Communication .............................................................................................. 11-3

Letter of Audit Inquiry ..............................................................................................................

Management Representation Letter ........................................................................................ 11-5

Standard Unqualified Auditor Report ....................................................................................... 11-7

Standard Combined Audit Report : Issuers ............................................................................. 11-8

Auditor's Report that Refers to Another Auditor's Work .......................................................... 11-10

11-4

© 2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review

Auditing

Going Concern Paragraph ...................................................................................................... 11-11

Qualified Opinion: GAAP Problem .......................................................................................... 11-12

Qualified Opinion: GAAS Problem .......................................................................................... 11-13

Adverse Opinion ...................................................................................................................... 11-14

Disclaimer of Opinion .............................................................................................................. 11-15

Comparative Financial Statements: Change in Opinion .......................................................... 11-16

Comparative Financial Statements: Different Opinions ........................................................... 11-17

Special Report – OCBOA ........................................................................................................ 11-18

SSARS Review Report ........................................................................................................... 11-19

SSARS Compilation Report .................................................................................................... 11-20

Review of Interim Financial Statements .................................................................................. 11-21

Attestation Report on Internal Control ..................................................................................... 11-22

Compilation of Financial Forecast ........................................................................................... 11-23

Examination of Financial Forecast .......................................................................................... 11-24

© 2009 DeVry/Becker Educational Development Corp. All rights reserved.

vii

Auditing

viii

Becker CPA Review

© 2009 DeVry/Becker Educational Development Corp. All rights reserved.