Engineering Economy Chapter 12 Income Taxes

advertisement

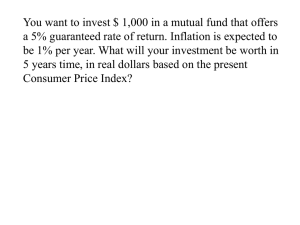

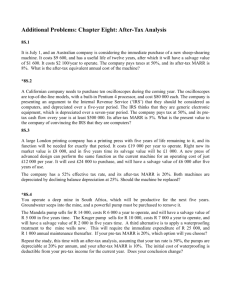

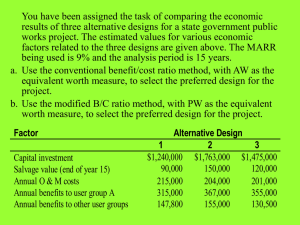

Engineering Economy Chapter 12 Income Taxes 1. Taxable Income of Individuals • We will not cover this material. • It is suggested reading, however, for personal knowledge. 2. Taxable Income of Business Firms • Taxable Income = Gross Income – all expenditures except capital expenditures (i.e., depreciable and non-depreciable assets) – depreciation and depletion charges • See pages 407-408 for a detailed explanation of these categories. 3. Notations Utilized • GI = ________________ • EXP = expenses except ________________________________________ – Note, as mentioned earlier, that the purchase of depreciable and non-depreciable assets are not expenses. • NCFBT = Net Cash Flow Before Taxes = __________________________ • TI = Taxable Income = _______________________________ • Tax = ______________________________ • NCFAT = Net Cash Flow After Taxes = __________________________ 4. Interest on Business Loans • The interest on business loans is also a _________________________. • We will discuss this later in the notes. 5. Cash Flow Tables • It is often beneficial to use a cash flow table when working problems to solve for after tax cash flows. • An example follows; however, please note that the number of columns varies based on the problem (i.e., the type and number of tax deductions, etc.). EOY NCFBT 0 1 2 … n n (s.v.) Dt TI 34% Tax NCFAT 6. Salvage Value (s.v.) Row in the Cash Flow Table • It is often beneficial to separate the last year of the cash flow table into two portions. • The first portion is devoted to the regular transactions that occur in the year. • The second portion (i.e., the s.v. row) is devoted to the salvage value of the asset. • By separating the salvage portion, it is easier to determine whether a _________________ _______________________ occurs (these are discussed next) on the salvage of the asset. This is important for tax purposes. 7. Capital and Ordinary Gains • A capital gain occurs when a non-depreciated asset is sold for more than the _________________________. • See page 417 for the tax treatment of capital gains. • An ordinary gain (a.k.a. depreciation recapture) occurs when an asset is sold for more than the ______________________. • The amount above the book value (i.e., the ordinary gain) is taxed at the current tax rate. 8. Capital and Ordinary Losses • A capital loss occurs when a non-depreciated asset is sold for less than the original cost basis. • See page 417 for the tax treatment of capital losses. • An ordinary loss occurs when less than the book value is received on the sale of a depreciated asset. 9. An Example • Four years ago, Dawgs Inc. purchased a piece of equipment for _______________. The equipment was depreciated using the MACRS 3-year property class. For years 1-4, the equipment generated a gross income of $25,000; $30,000; $40,000; and $40,000 respectively. The operating expenses in years 1-4 were ______________________________ ________________________, respectively. In addition to the above figures, Dawgs, Inc. sold the equipment after year 4 for $10,000. Given a tax rate of 34%, determine the after-tax cash flows. MACRS Calculations Cash Flow Table EOY 0 1 2 3 4 4 (s.v.) NCFBT Dt TI 34% Tax NCFAT 10. Analysis Techniques Using After Tax Cash Flows • It is quite obvious that after tax cash flows are the more realistic situation; therefore, we should realize the difference between Before-Tax Analysis Technique Calculations and After-Tax Analysis Technique Calculations. • For example, consider the ROR calculations for the example in note #9. Here we see that the before-tax ROR = __________ and the after-tax ROR = __________. • Because of the impact of taxes, it is needful to understand the difference in a Before-Tax MARR and an After Tax MARR. Obviously, an after-tax MARR should be lower than a before-tax MARR. 11. Interest on Loans • In addition to depletion and depreciation, interest on loans is another type of business tax deduction. 12. Example • A local company is considering purchasing a piece of equipment for $125,000. Of the $125,000, they will pay $25,000 out of pocket and use a 4-year, $100,000 loan to pay the remaining balance. The terms of the loan call for equal yearly payments based on a rate of 7% per year. The equipment will be depreciated using SOYD, a depreciable life of 5 years, and an estimated salvage value of $20,000. Given the following estimated before-tax cash flows, an incremental tax rate of 34%, and an after-tax MARR of 15%, should the company purchase the equipment? EOY BTCF 0 1 2 SOYD Calculations SUM = (5*6)/2 = 15 D1 = (5/15)(125,000 – 20000) = $35,000 D2 = (4/15)(125,000 – 20000) = $28,000 D3 = (3/15)(125,000 – 20000) = $21,000 D4 = (2/15)(125,000 – 20000) = $14,000 D5 = (1/15)(125,000 – 20000) = $ 7,000 3 4 5 6 6(s.v.) Loan Payment = Loan Table Year Amount Owed Beginning of Year Interest Amount Paid on Principal 1 2 3 4 • For the last year of the loan, the Amount Paid on Principle should equal the Amount Owed at the Beginning of the Year. The reason it did not in our example is because the A/P factor we used came from the back of the book (which rounds). Had we used the formula for A/P, the numbers would have matched! BTCF Loan C.F. Interest Given the above ATCF’s, the after-tax ROR = ___________. Depr. Based on the company’ s a fter -ta x MARR of _____, they ______________________. • Taxable Income for 6 (s.v.) • TI = Salvage – Book Value at Year of Sale 6 (s.v.) 6 5 4 3 2 1 0 EOY T.I. Tax (34%) ATCF