Course Website

advertisement

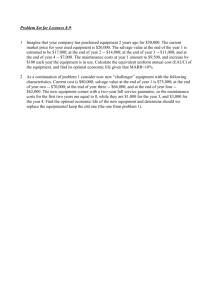

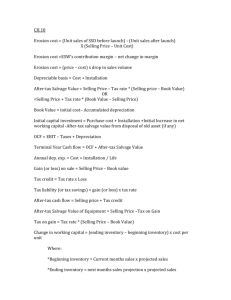

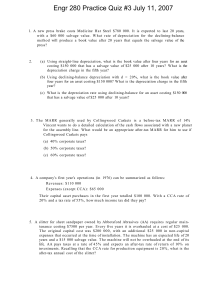

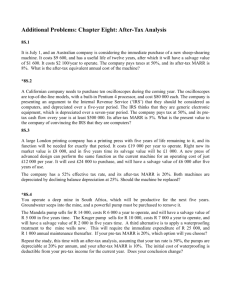

You want to invest $ 1,000 in a mutual fund that offers a 5% guaranteed rate of return. Inflation is expected to be 1% per year. What will your investment be worth in 5 years time, in real dollars based on the present Consumer Price Index? An engineering project requires $20 000 as first cost and has a planning horizon of five years. Operating costs are $2 000 (actual) per year, and expected annual revenue is $8 000 (actual). Calculate the project's present worth if the real interest rate is 5%, the expected annual inflation is 2% and the salvage value is $5 000 (actual). Your company buys a piece of capital equipment for $100,000. It depreciates at 20% per year, declining balance. The company is taxed at 40%. The physical life of the equipment is 5 years, after which it has no salvage value. Using the equipment, you expect to incur annual costs of $15,000 and to receive an annual income of $50,000. Your real after-tax MARR is 10%. What is the after-tax present worth of this investment if there is no inflation over the next five years? What is the expected after-tax present worth of the investment if there is a 50% chance that there will be 5% inflation over the next five years, given that the annual costs and annual income are in actual dollars? Park Iseul has just completed a Masters degree in Library Science. She has had four job offers, but is finding it difficult to choose between them. She discusses the problem with her room-mate, Lee Kyung Sook, who is currently taking a course in Engineering Economics. “What factors are you considering?” asks Lee. “The salary is one factor, of course,” says Park, “Megacorp has offered me $9 000 a month, and none of the others come close to that. And they also have the best prospects for promotion. But really, the most important thing to me is the atmosphere at work. Megacorp seems very cold and unfriendly. And the next most important thing is the distance I have to commute – Megacorp is sixty minutes travel away, I don't want to spend all my time travelling.” “I can help you make the decision,” says Lee, “All we need to do is to construct a decision matrix. You give me all the details, and I'll enter them on a spreadsheet right now.” Professional Engineering Exam Dec 2007, Q. 2 You plan to manufacture plastic containers for six years in a factory in Ontario. This requires capital equipment costing $4,200,000. You will finance the purchase of the equipment by a $3,200,000 loan from the National Bank. The loan interest is 12%, and the amortization period is 10 years with 10 end-of-year payments. The CCA rate for the capital equipment is 20%. At the end of the six years the equipment will be sold for $260,000 and the loan principal remaining after the sixth loan payment will be repaid to the bank. The anticipated yearly revenue minus all costs (except loan interest) is $2,860,000. Your tax rate is 40%. Determine a) the CCA in the final year and the terminal loss or recaptured CCA b) the interest portion of the final loan payment and the remaining principal c) the pre-tax cash flow in year 6 d) the taxable income in year 6 e) the after-tax cashflow in year 6 Professional Engineering Exam, Dec 2006, #4 A company requires computing equipment for a new project that will last 3 years. They can either purchase the equipment for $X, or lease it for $850,000 per year, payable yearly in advance. The (after-tax) MARR is 15%, and the Capital Cost Allowance for computing equipment is 50%. The company makes $1,000,000 per year and pays tax at 30%. The salvage value of the equipment is zero. Determine: a) The present value (after tax) of leasing b) The after-tax cashflow in year 2 of the purchasing option if X is $2.4M c) The preferred alternative if X = $3M d) The value of X that would make the two alternatives economically equivalent Question 5, Dec 2009 A CNC lathe used in a production process requires major repair. It can either be completely overhauled for $X, or replaced by a new machine for $1,100,000. Your MARR is 10%. The lathe is needed for five more years. The O/M costs and salvage values for both the old and new machines are as follows (all values in thousands of dollars). The old machine has zero salvage value. Determine: Year 1 2 3 4 5 Old O/M 140 140 140 320 140 New O/M 55 55 115 55 55 New salvage 900 760 430 200 65 a) the EUAC of keeping the old machine if X=$470K b) the range of values for X for which repair is the preferred option c) the annual saving if X=$710K and we replace the machine d) the IRR of replacing the machine if X=$750K