airtel - WordPress.com

advertisement

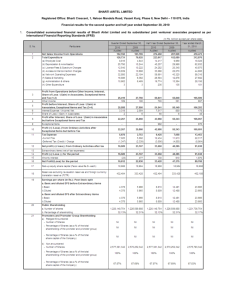

AIRTEL - A PRODUCT MANAGEMENT APPROACH Presented by Group 12/ G4 : Atul Kothiyal, Shipra Bansal, Shriman Kalyan, Vamsee Krishna Marketing Management 1 | 15 Jun 2009 | Great Lakes Institute of Management CASE OBJECTIVES The Airtel Promise: “We at Airtel always think in fresh and innovative ways about the needs of our customers and how we want them to feel. We deliver what we promise and go out of our way to delight the customer with a little bit more” In this case analysis, we will go through the • position of Airtel in Indian Telecom Industry • success factors of Airtel • repositioning strategies • competition : strategies and counter-strategies • suggestions and action plan for Airtel to improvise INDIAN MOBILE TELECOM SECTOR Market Share: GSM Caters to all segments Fastest growing telecom market Average of 6 mn new subscribers every month Service Provider Market Share Airtel 32.48% Vodafone 24.17% BSNL 15.72% Idea 14.84% (May 09) 391 mn mobile subscribers Teledensity: 36.98% in March 2009 Both GSM and CDMA Service Provider Market Share Big Four hold almost 74% of the mobile market Airtel 24.34% Reliance 17.74% Vodafone 17.21% BSNL 14.37% Market Share: Mobile (Mar08) BHARTI – BUSINESS PORTFOLIO Bharti has a diverse product mix Telecom Related: Airtel TeleSoft TeleTech Telecom Seychelles – 3G Comviva technologies – VAS Jersey Airtel – HSDPA, 3G Infratel Others: Del Monte India – processed foods and beverages Retail – Easyday, Walmart/ Best Price Modern Wholesale AXA Insurance and Investments Centum Learning Airtel – Product Line - It’s all about providing ‘Value’ Friendz (for youth) Free Voice and Data, extended validity, offers on VAS, etcE Ladies Special (billing flexibilities) Airtel Seniors (discount on specific numbers, health benefits) Youtopia (Postpaid/ Friends) Free devotional songs ( > 60 yrs) For Magic: •Free SMS •Special Night Rates •Free Talk Time MAGIC – TOTAL PRODUCT CONCEPT Future Product(s): 3G Applications Augmented Product(s): GPRS, GPS, VAS, Information content Formal Product(s): Network coverage, Portal, Payment options, Customer Service, Recharge Options, SMS Core Product(s): Voice service/ Mobile Telephony AIRTEL: ‘PORTER’S 5 FORCES’ APPROACH Threat from New Entrants Power of the Buyer Supplier Bargaining Power Rivalry among competitors • Supply: Decline in ARPU, Infrastructure tenancy costs • Demand: Brand Pull, Customer Switching • Government Policies: License, Spectrum, Mobile Number Portability • Lack of differentiation • Intense competition • Low switching costs • Shared towers • Large number of players • Lack of expertise • High exit barriers • High fixed cost • Big 4 in almost all segments • Less time for innovation – low response time • Price wars Threat of Substitutes • • • • VOIP Online Chat Satellite Phones EMail REASONS FOR AIRTEL’S SUCCESS Early Entrant Forecast the Boom Established in 1985, Bharti has been a pioneering force in the telecom sector with many firsts and innovations to its credit By 2004 Airtel deployed around 23,000 km of optical fibre cables across the country, coupled with approximately 1,500 nodes, and presence in around 200 locations Network Coverage Airtel’s high-speed optic fibre network currently spans over 101,337 kms covering all the major cities in the country The company has two international landing stations in Chennai that connects two submarine cable systems REASONS FOR AIRTEL’S SUCCESS Innovation and repositioning/ adapting 1995-1998 – ‘Power to keep in touch’ positioned in the premium category aimed at elite class. 1999-2001 – ‘Touch Tomorrow’ started to cater to new segments by positioning itself as a brand that improved quality of life. In 2002 - ‘Live Every Moment’ Airtel signed on music composer A.R. Rahman. 2003-2008 – ‘Express Yourself’ strengthens the emotional bond that Airtel enjoys with its existing customers Brand recollection Airtel is the most recognizable brand in Indian operator space. 40% of respondents able to identify it as a mobile brand. REPOSITIONING Need for repositioning in 2002: A look at what competitors did4 BPL and Hutch Idea Spice and Idea Spice • Waived airtime charges-Incoming Calls • Ad-spend Rs. 630 million • SMS 9 languages • Prepaid roaming • Contests and reward programs • VAS: Railway inf., Astrology, movie tickets etc. REPOSITIONING – AIRTEL’S WAY Third phase of network expansion Effective Brand Endorsers: A.R. Rahman’s -‘Live Every Moment’ campaign. Saurav Ganguly, Madhvan and Kareena for Magic Percept Advertising: TVC- Shah Rukh Khan and Kareena Kapoor Tag lines: You can do the magic (Magic hai to mumkin hai) Anything is possible Jahan Chaho Airtel Magic Pao Express Yourself (2003 till date) Customer Delight Innovative marketing Continuous technological up gradations New VAS (Value Added Services) offerings Efficient customer service REPOSITIONING – AIRTEL’S WAY First in: 32K SIM cards Roaming cellular services Smart mail, Fax Facility, Call hold, call waiting and web message Easy activation and recharge: Scratch System, ICICI ATM Distribution facilities: Company outlets Departmental stores, gift shops, retail outlets Telephone booths and even kirana stores Magic : Mass market and friendly; targeted the youth Portal Improvisation Pricing strategies: Free voice mail service Night differential prices Door step deliveries for magic cards CURRENT POSITION Improved Brand Image and recognition 85,650,733 customers as on 1st Jan 2009 Bharti Airtel : Business Week IT 100 list 2007 3 SBUs: Mobile services: GSM Telemedia services: Broadband and telephone Enterprise services: Telecom solutions – corporate and B2B. Airtel's HS optical fiber network : 101,337 kms PRODUCT MANAGEMENT ANALYSIS: MCKINSEY’S 7S MODEL APPROACH Shared Values Values of the company Structure System Strategy Skills Staff Style Integrated org structure and areas of business, ‘OneAirtel’, Better delivery Customer support (Airtel Connect) initiative, MIS, Internal processes Clear vision and able management Able to win competition, but can differentiate better Competency can be improved, more subject matter experts needed Aspirational and lifestyle brand, able leadership, COMPETITION & STRATEGIES “Where there is innovation, there is scope for competition; and vice-versa” Providing Value and not just products and services Portal experience: From Mega-Portals to customer-centric Portals. Vodafone and Airtel. Global Brands: Vodafone-Hutch Essar, Virgin Handset strategy: MVNO like Virgin Mobile Segmented targets: Value and Pricing for Youth and Corporates Marketing strategies: Mobile telecom - almost like FMCG! Technological upgradations: Matching the innovations in the handset industry Services for Mobile OS, Java applications and other VAS in the handset market Specific examples: Blackberry, Apple IPhone Substitutes: Low cost handsets for mass market High end Blackberry and Iphone for the Niche market VOIP, Internet – chat and email, satellite phones One positive aspect: Network sharing among the competitors PERPETUAL MAPPING - COMPETITORS High connectivity Airtel Virgin Reliance BSNL Low Connectivity Vodafone High Esteem Low Esteem Idea SUGGESTIONS & ACTION PLAN VAS - Saving grace for the operators!!! Bharti Telesoft – Software venture of Bharti Enterprises Examples: Mobile Music, ticketing, bill payments, phone backup, mobile banking, maps, internet At 14 cents per minute, some VAS services make much more money than the average 3-4 cents per minute that voice does. Typically, data sells at anywhere between 4-65 cents VAS constitutes 7% of total telecom revenue SMS constitutes 55% of VAS revenue At CAGR of 44% (2007 – 2010), VAS revenues will reach USD 2,744 mn Revenue share between telcos & content providers is 70:30 Architect and deploy operator’s VAS service delivery platform and collaborate with key players in the VAS value chain. Broadband 63 million urban Indians accessed Internet using their phone in February, 2009. 16 million urban Indians access Internet on their phone almost on a daily basis SUGGESTIONS & ACTION PLAN Continuous improvement - IT support/ technology Bharti Airtel entered into a comprehensive 10-year agreement with IBM to transform & manage its IT infrastructure. Exploit the technology expertise to provide better value. E.g. Tariff Check Up. This will help in customer retention. Rural Segment Near - saturation in the urban markets Rural markets will drive 35 to 38 % of the handset market growth A mix of economical handsets (simple, durable, longer batter life), lower voice call rate, flexible payment options can be formulated MVNO: Proactive strategic alliances so that market share is not eaten up Airtel has to further improve it’s network infrastructure 3G: Tap the market at the initial stages (New Products) Rural health care, education, Governance, END NOTESE “It took us 15 years to get our first 100 million subscribers... but we are looking at acquiring our next 100 million customers in India within the next three years.” — Sunil Bharti Mittal on May 15, 2009 Airtel has been successful in the long run by focusing on the customers’ needs rather than just being ‘just another’ service provider. The scenario is optimistic, market has potential for growth in specific segments and the company can achieve even greater heights by targeting value-addition to its products in strategic ways. ~ References: Official website of Airtel and other sources from the Internet.