UK Café Society: Current Market Trends

UK Café Society: Current Market Trends

Market Snapshot

Table of Contents

The Evolution of Café Society

Current Consumer Behavior

Current Market Share

Market Size

Number of Branded Coffee Shops

Current Market Dynamics

Hot Trends

Bibliography

7

8

5

6

9

10

3

4

2

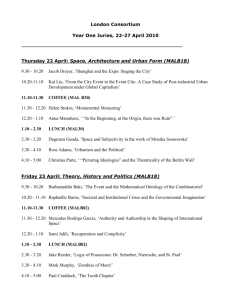

The Evolution of Café Society

Coffee was first introduced to the UK in 1610.

The first coffee houses appeared in Oxford in 1650 and their popularity soon spread.

By 1663, there were 82 coffee houses in London, rising to more than 500 by 1700. Entry cost was a penny and they became popular with writers, businessmen, politicians and scientists.

Through the centuries that followed, coffee houses lost favor to public houses or “pubs” which became the mainstay for UK society as “watering holes” and places to socialize.

By the twentieth century, popular chains such as Lyons' Corner Houses (1909-1977) grew and then thrived in London during the inter-war period. They were large buildings on several floors with a food hall, hairdressing salons, telephone booths, theatre booking agencies and several restaurants including the forerunner of todays coffee shops. They were smarter and grander than the local tea shops before them and offered patrons a degree of escapist relaxation.

The coffee revolution picked up pace in 1978 when Italian brothers Sergio and Bruno

Costa opened their first shop on Vauxhall Bridge Road. Costa Coffee is currently the established market leader (owned by multinational hotel, coffee shop and restaurant chain Whitbread plc).

Other coffee shop chains were quick to follow the increased thirst for coffee shops. New brands that evolved included:

1997: Café Nero opening it first store in London.

1998: Starbucks entered the UK market with London stores.

A painting from c1668 showing patrons of a

London coffee house

Lyons’ Corner House

3

Current Consumer Behavior

British consumers are very engaged with the coffee shop market – drinking coffee is intertwined in their daily routine. 20% of adults now visit a coffee shop on a daily basis compared to 1 in 9 in 2009; 1 in 3 Londoners go to a coffee shop daily.

Coffee shop visitors drink, on average, three cups of coffee per week at coffee shops. However they also drink a further 10 cups per week at home and a further 6 cups at work. Clearly, this indicates a significant scope for additional growth for coffee shops sales in the future.

1 in 5 adults

Average of 3 cups of coffee consumed at a coffee shop each week

34% of adults never make coffee at home

x

Visit a coffee shop everyday

4

Current Market Share

Branded coffee shop sales grew 10% in 2012 to £2.3bn and is now 10 times the size it was 15 years ago. The branded coffee shop market is estimated to be £3.7bn by 2017.

The Top 3 branded coffee shop chains dominate the market. Home grown brands Costa Coffee and Café Nero continue to thrive. Starbucks celebrates 15 years of trading in the UK in 2013 but has struggled in recent years.

Last year, Starbucks volunteered to pay £20m in back corporate taxes as it attempted to win back customers following revelations that it has paid no corporation tax in the UK in the previous three years.

2011

Fiscal Year

Revenue

2011

Outlet

Numbers

Market Share of Outlets

31%

Non-specialist coffee shops (e.g. supermarket cafés )

36%

33%

Branded coffee shops (e.g. Costa

Coffee)

Independent coffee shops

Top 3 coffee shops brands

= 54%

branded sales

£542m 1552

£398m 757

£ 166m 530

5

Market Size

The UK coffee shop market is growing and is forecast to generate £8bn of sales by 2017.

£5.8bn (+7.5%) £7bn £8bn

2012 2015 2017

The number of UK coffee shops is growing and is forecast to continue to expand over the next 5 years. The branded coffee chains (led by Costa Coffee, Starbucks and Café Nero) account for the majority of new coffee shop openings.

Branded coffee chains are opening 1,000 outlets each year collectively.

15,000 15,723 (+4%) 20,000 (+27%)

2011 2012 2017 6

Number of Branded Coffee Shops

The recession has benefited branded coffee chains as consumers have generally moved towards brands they trust (namely branded chains). This has added to the pressure on weak mid-sized chains and low quality independent coffee shops who are slowly fading out of the market.

Number of Shops

2,600 5,225 7,000

The number of

Branded Coffee

Shops has

DOUBLED

since 2005.

Nearly 30% of branded coffee shops are in London (1522 outlets).

2005 2012 2017

7

Current Market Dynamics

Smaller coffee shop players threaten to steal market share from established branded coffee shops chains :

Greggs moment has opened 5 pilot coffee shops since last year (Staines, Stevenage,

Middlesbrough and two sites in Newcastle). This marks a new brand from the Greggs plc., the largest bakery chain in the UK. The ex-regional operations director of Costa Coffee, Mr

Rolson, was hired in 2012 to ramp up the development of the format.

Coffee#1 is a fast growing coffee shop chain established in 2001. With 28 stores in South

Wales and the South West England (owned by brewer S. A. Brain & Company).

Harris+Hoole dates from 2006 and has 9 stores in London and the South East. Press coverage has highlighted customer criticism of the brand’s ‘fake indie' image (since it was revealed that Tesco, UK’s leading grocery chain, has a 49% stake in the company).

An increased interest in food with Brits aspiring to be “foodies,” has led to explosion of food-focused branded coffee shops.

Pret A Manger was founded in 1986 in London and has 244 stores nationwide (176 stores in London). The company is founded on fresh, healthy food (every shop has its own kitchen and there is no sell-by date on anything) as well as friendly and speedy service. It is now an international food retailer, with 41 shops in the US, 12 in Hong Kong and 1 in Paris.

EAT was founded in 1996 in London and has 119 stores (91 stores in London) nationwide.

The company is committed to providing the best food, soup and coffee at reasonable prices. Every shop has its own kitchen.

PAUL is a French chain of bakery/café restaurants established in 1889 and opened its first

UK store in 2000. There are now 31 stores all located in London.

8

Hot Trends

Increased emphasis on new specialty coffees and drinks

Cortado coffee, flat white coffee, caffe caramella

Growing interest in the source and quality of coffee (due to consumer demand for corporate ethics and social responsibility)

Customers look for Fair Trade, Organic – AMT Coffee was the first UK coffee shop to go 100% Fairtrade with its coffee, and offer 100% organic milk.

Consumers seek out the baristas coffee experience – coffee brewed by coffee masters

Consumers look for new ways to tailor their coffee experience to meet their own personal tastes:

From choice of coffee brewing machine to the supplier of beans

More emphasis on the coffee shop ambiance, environment and experience as consumers switch their social setting from pubs to coffee shops and as coffee shops continue to transcend all day parts:

High end independent coffee shops offer customers evening courses in coffee brewing and latte art (www.kaffeine.co.uk/Coffee.html)

More varied seating and spatial design allows socializing for different social settings .

9

Bibliography

It makes the heart lightsome, cures wind... and prevents mis-carryings': Coffee house advert from 1650s London praises the

“grain that growth only in the deserts of Arabia”- Daily Mail, July 18, 2012. http://www.dailymail.co.uk/news/article-2175231/Coffee-house-advert-1650s-London-praises-grain-groweth-deserts-

Arabia.html

Coffee shop revolution continues to stimulate the high street . Guardian, Friday 22 June 2012

http://www.guardian.co.uk/business/2012/jun/22/coffee-shop-revolution-continues

Lyons’ Corner House - Wikipedia

http://en.wikipedia.org/wiki/J._Lyons_and_Co.

Corporate websites for Café Nero, Costa Coffee, Whitbread plc .

Britain's love of coffee is fuelling industry growth- FoodBev.com. December 19, 2012

http://www.foodbev.com/news/britains-love-of-coffee-is-fuelling-indu#.URQ1mKXoR1E

Starbucks to pay £20m in tax over next two years after customer revolt – The Guardian – December 6, 2012

http://www.guardian.co.uk/business/2012/dec/06/starbucks-to-pay-10m-corporation-tax

Coffee shop growth shows no sign of slowing - Bakeryinfo.co.uk, December 20, 2012

http://www.bakeryinfo.co.uk/news/fullstory.php/aid/11078/Coffee_shop_growth_shows_no_sign_of_slowing_.html

Project Café 2012 - Allegra Strategies

Greggs takes a Moment for coffee – The Independent. March 15, 2012

http://www.independent.co.uk/news/business/news/greggs-takes-a-moment-for-coffee-7571362.html

Customers criticise 'indie' image of the coffee shops part-owned by Tesco

http://www.guardian.co.uk/business/2013/jan/02/harris-hoole-coffee-ownership-tesco

Smiley culture: Pret A Manger's secret ingredients . Daily Telegraph, March 9, 2012

http://www.telegraph.co.uk/foodanddrink/9129410/Smiley-culture-Pret-A-Mangers-secret-ingredients.html

10

Bibliography

Store Wars: Pret a Manger and Eat- Guardian, June 22, 2012

http://www.guardian.co.uk/money/2012/jun/22/store-wars-pret-a-manger-eat

Coffee Loving Britain- Kantar Media, January 3, 2013

http://www.kantar.com/consumer/leisure/coffee-shop-statistics-uk-2013

Greggs Moment headed for Midlands Bakeryinfo.co.uk, February 13, 2013

http://www.bakeryinfo.co.uk/news/fullstory.php/aid/11240/Greggs_Moment_headed_for_Midlands.html

11

![저기요[jeo-gi-yo] - WordPress.com](http://s2.studylib.net/store/data/005572742_1-676dcc06fe6d6aaa8f3ba5da35df9fe7-300x300.png)