Takaful Global Giants Fund Performance

advertisement

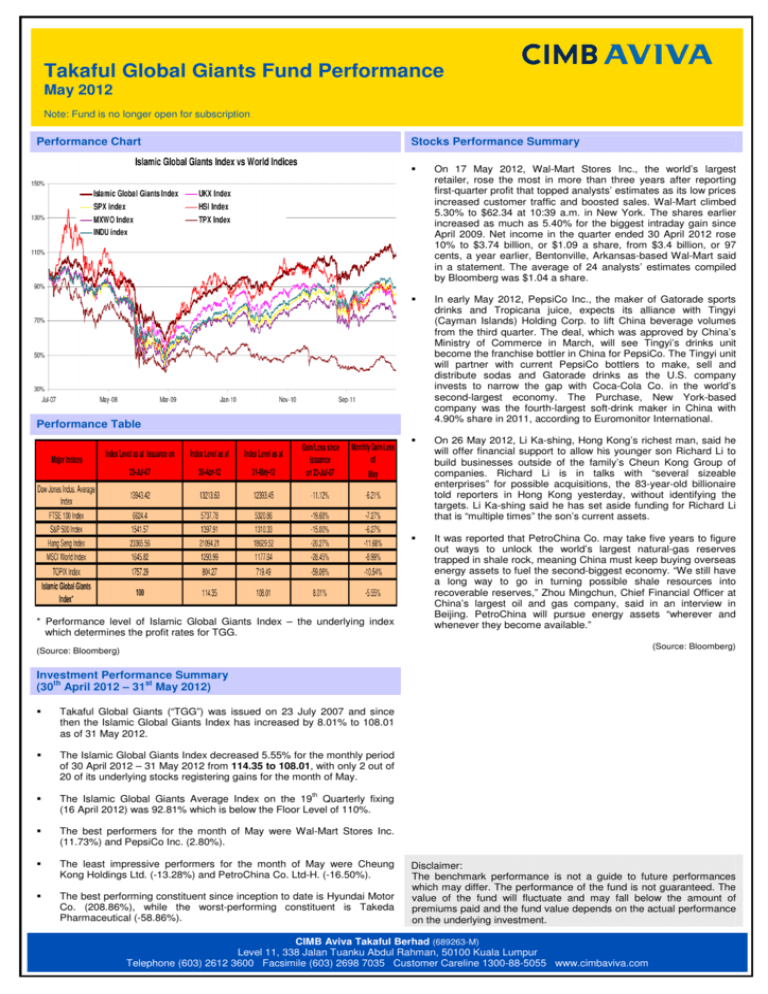

Takaful Global Giants Fund Performance May 2012 Note: Fund is no longer open for subscription Performance Chart Stocks Performance Summary On 17 May 2012, Wal-Mart Stores Inc., the world’s largest retailer, rose the most in more than three years after reporting first-quarter profit that topped analysts’ estimates as its low prices increased customer traffic and boosted sales. Wal-Mart climbed 5.30% to $62.34 at 10:39 a.m. in New York. The shares earlier increased as much as 5.40% for the biggest intraday gain since April 2009. Net income in the quarter ended 30 April 2012 rose 10% to $3.74 billion, or $1.09 a share, from $3.4 billion, or 97 cents, a year earlier, Bentonville, Arkansas-based Wal-Mart said in a statement. The average of 24 analysts’ estimates compiled by Bloomberg was $1.04 a share. In early May 2012, PepsiCo Inc., the maker of Gatorade sports drinks and Tropicana juice, expects its alliance with Tingyi (Cayman Islands) Holding Corp. to lift China beverage volumes from the third quarter. The deal, which was approved by China’s Ministry of Commerce in March, will see Tingyi’s drinks unit become the franchise bottler in China for PepsiCo. The Tingyi unit will partner with current PepsiCo bottlers to make, sell and distribute sodas and Gatorade drinks as the U.S. company invests to narrow the gap with Coca-Cola Co. in the world’s second-largest economy. The Purchase, New York-based company was the fourth-largest soft-drink maker in China with 4.90% share in 2011, according to Euromonitor International. On 26 May 2012, Li Ka-shing, Hong Kong’s richest man, said he will offer financial support to allow his younger son Richard Li to build businesses outside of the family’s Cheun Kong Group of companies. Richard Li is in talks with “several sizeable enterprises” for possible acquisitions, the 83-year-old billionaire told reporters in Hong Kong yesterday, without identifying the targets. Li Ka-shing said he has set aside funding for Richard Li that is “multiple times” the son’s current assets. It was reported that PetroChina Co. may take five years to figure out ways to unlock the world’s largest natural-gas reserves trapped in shale rock, meaning China must keep buying overseas energy assets to fuel the second-biggest economy. “We still have a long way to go in turning possible shale resources into recoverable reserves,” Zhou Mingchun, Chief Financial Officer at China’s largest oil and gas company, said in an interview in Beijing. PetroChina will pursue energy assets “wherever and whenever they become available.” Performance Table * Performance level of Islamic Global Giants Index – the underlying index which determines the profit rates for TGG. (Source: Bloomberg) (Source: Bloomberg) Investment Performance Summary th st (30 April 2012 – 31 May 2012) Takaful Global Giants (“TGG”) was issued on 23 July 2007 and since then the Islamic Global Giants Index has increased by 8.01% to 108.01 as of 31 May 2012. The Islamic Global Giants Index decreased 5.55% for the monthly period of 30 April 2012 – 31 May 2012 from 114.35 to 108.01, with only 2 out of 20 of its underlying stocks registering gains for the month of May. The Islamic Global Giants Average Index on the 19th Quarterly fixing (16 April 2012) was 92.81% which is below the Floor Level of 110%. The best performers for the month of May were Wal-Mart Stores Inc. (11.73%) and PepsiCo Inc. (2.80%). The least impressive performers for the month of May were Cheung Kong Holdings Ltd. (-13.28%) and PetroChina Co. Ltd-H. (-16.50%). The best performing constituent since inception to date is Hyundai Motor Co. (208.86%), while the worst-performing constituent is Takeda Pharmaceutical (-58.86%). Disclaimer: The benchmark performance is not a guide to future performances which may differ. The performance of the fund is not guaranteed. The value of the fund will fluctuate and may fall below the amount of premiums paid and the fund value depends on the actual performance on the underlying investment. CIMB Aviva Takaful Berhad (689263-M) Level 11, 338 Jalan Tuanku Abdul Rahman, 50100 Kuala Lumpur Telephone (603) 2612 3600 Facsimile (603) 2698 7035 Customer Careline 1300-88-5055 www.cimbaviva.com