World Islamic Finance Summit 2011

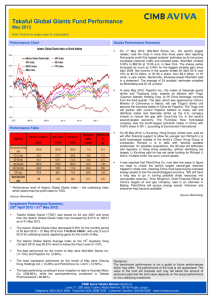

advertisement

World Islamic Finance Summit 2011 Session 1: Islamic Retail Banking and Takaful Session chair: Pervaiz Ahmed - CEO, Pak Qatar Family Takaful Limited. Presenter: Najmul Hassan - Former CEO, Gulf African Bank, Kenya Moderator: Fouad Farrukh – Head of Islamic banking, Faysal bank Limited. Panelists: Dr Imran Usmani – Shariah Advisor, Meezan Bank Limited, Imtiaz Bhatti – CEO & MD, Pak Kuwait Takaful Company Limited, Muhammad Imran - Head of Retail and consumer banking, Bank Islami Pakistan Limited and Najmullah Khan – Chief Operating Officer, Pak Qatar General Takaful Limited. The session commenced with a presentation by Najmul Hassan on ‘the growth of Islamic banking in Africa’. Fouad Farrukh to Dr Imran Usmani: Thank you Najmul Hassan and congratulations on setting up from the scratch a sizeable Islamic bank in Kenya, I have been associated with it so I can really vouch on it. To take on from the presentation, I would ask Dr Imran who is one of the pioneers in Shariah advisory in Pakistan, that we have seen the Shariah Advisors play a role in product development, we have seen them imparting knowledge to various schools, what do you think the Shariah scholars’ role should be in creating awareness in potential customers who are yet to come to Islamic banking? Dr Imran Usmani: (Prayers) HR development as you have mentioned, brother Najmul Hassan has also mentioned in his very informative speech regarding Africa. Although he has also experience of Meezan Bank, he should have mentioned something about Meezan also but nevertheless, he has mentioned great information about Africa so I think we should also go to Africa for these things. Regarding HR development, I think scholars have played a vital role for that purpose Alhamdulillah. My father as you have mentioned yesterday has given a very good and informative speech and I was just thinking that Alhamdulillah in Dar ul Uloom Karachi, we have initiated role for bringing Islamic banking in Pakistan as Muhammad Imran, would remember that we previously had 2 or 3 conferences about 10 years back held by Centre for Islamic Economics and then we started some programs like short modules for development of HR and for training the people working for Islamic banking so Alhamdulillah we have developed different modules and we together with Muhammad Imran and others started the program for IBA as well and now Alhamdulillah these programs of training are running in different universities so I think Shariah scholars are playing a very good role. And now the difference which I see here in Pakistan and outside Pakistan is that outside Pakistan there are very few scholars who are working with Islamic banks and just they are the trainers and there are only few trainers to train the people but what happened Alhamdullilah here is that when Islamic banking started in Pakistan in 2002 and Islamic banking windows, Islamic banking licenses started to be given so at that point in time, Dr Ishrat Hussain was the governor and we decided that we should have a rule that one Shariah Advisor should work only for one bank and at that point in time we were thinking that it might be difficult to find the Shariah Advisor but as we say that necessity is the mother of invention, so Alhamdulillah now many scholars have come. So all the scholars are coming Masha Allah and one scholar working for one bank and that Publicitas Conferences | 1 World Islamic Finance Summit 2011 particular Shariah Advisor is working for the development of that team. Now for example, here in Meezan, Alhamdulillah we have developed about 40-50 people, we have the biggest Shariah department, we don’t have all the Muftis, only one Mufti but others for example, lawyers, MBAs, CAs but all of them I can say that Masha Allah they have so much knowledge about these Islamic banking transactions that even it might not be wrong to say that some Shariah scholars might not have that particular knowledge of practicing transactions because for example we study in our books, for example, Hidayat - we read that book, we study that book and there are some very good examples and some very good rules have been mentioned but those rules, those examples were basically from very ancient days but nowadays, how to implement that and how they are practiced in the current environment, it is something else. So now Masha Allah people who are working in these Islamic banks, I think it is a very good thing that they are developing and I think that we should work for further grooming them and to create some awareness programs like some other conferences and you know that we have very few conferences in Pakistan. Dr Anis Sahib Masha Allah they have taken initiative in Riphah University and they are working for that and also NIBAF and also others but still we have some need to develop these things. Thank you. Fouad Farrukh to Pervaiz Ahmed: Thank you Dr Imran, Pervaiz Sahib you had good success in terms of family Takaful. Can you share your experience with the industry? How you have benefited more by associating with the banks and using that channel for sales? Pervaiz Ahmed: Bismillah hir Rehman hir Raheem. In Family Takaful we go to retail customers most of the time where we have products of investment and risk based products and in General Takaful we go for asset and property. As far as associations with the bank and partnership with the banks are concerned, in General Takaful specially, Takaful industry when came in the beginning was relying heavily on banks because banks were the ones who were creating Islamic assets. And initially need of Takaful was sensed by Islamic banks, Islamic banks came and assets started building then they felt there was a need, for instance, Ijara or housing finance and they need Takaful contracts. So in the beginning it was felt that it was a bit slow, the banks had some reservations in terms of whether Takaful companies will be able to provide same services which conventional insurance companies were giving but now Alhamdulillah, it is picking up. There are still certain issues as far as service levels are concerned which I think the bankers will be able to share better. As far as Family Takaful is concerned, one of the major channel which we are using now is distributing our products through the counters of the bank and currently 60% of our sales is coming through the banks’ channel like the banking distribution channel and where Family Takaful growth is concerned, year and year we are growing by 100%, obviously the base is small but in the retail customer, there is a huge demand of the product. But I think there are very few players in the market right now and this is major challenge which the industry is facing. There is a need for more players in the market. Fouad Farrukh to Najmullah Khan: Thank you very much. Building on Takaful industry, now how do you see attracting the large customers who are not really coming towards Takaful and how do you create its awareness among them to have its acceptability? Publicitas Conferences | 2 World Islamic Finance Summit 2011 Najmullah Khan: (prayers) first of all I would like to thank you to the organizers for providing us an opportunity to present our Takaful point of view over here. There is one main hurdle in promoting of Takaful is lack of awareness for which Takaful companies must form strategic alliances among them to promote it and create awareness among the masses and for this we have a forum among Takaful companies but that is not enough because the presence of one forum is not sufficient to create awareness we should introduce Takaful as a subject in universities across the country. And in this respect, Takaful companies should come forward and promote it so that when students graduate from the universities they would be the ambassadors for us and they will work in companies and in this way help with the promotion. And Alhamdulillah Pakistan has 97% of the Muslim population and majority believes that conventional insurance, interest based insurance is impermissible and that is why this is untapped market so we should concentrate on this market and also in Islamic banking this should be our main focus and Islamic banking requires that the front end personnel be trained so that they are able to understand it properly and support us in promoting Takaful in the industry. Fouad Farrukh to Imtiaz Bhatti: Imtiaz Sahib you have your experiences, I would like you to share how Takaful industry is keeping pace with the retail banking growth of Islamic banking industry. We have seen 800 branches now almost in Islamic banking industry, how are you planning to keep pace with it? Imtiaz Bhatti: Thank you Fouad. Let me confess that Takaful has really drawn huge attention from the economic world during the past decades and it is witnessed from the fact that Takaful has grown over 35% during the past 5 years in countries like Malaysia and GCC countries. In Pakistan and countries like Malaysia, it is a fact that even a lot of non Muslims are opting for Takaful especially for economic reasons not for religious reasons including the transparency of the business. In Pakistan, Takaful is still at the embryonic stage, the first Takaful company came into being in 2005 – the Pak Kuwait Takaful company and currently there are three Takaful companies. The combined capacity of the three Takaful companies are over 2 billion per risk and let me tell you that over 90% of the single risk can be covered through this capacity. The problem in Takaful is not really the awareness in Takaful but the insurance penetration itself in Pakistan is just over 0.7% of the GDP which is one of the lowest not in the region but, I would say, in the world as well which translates into less than 1 billion US dollar which is nothing, which the middle size companies even a single company can earn this premium in countries like Malaysia or UAE. Here as I said that currently, we, the three Takaful companies, we can cater to the needs of Islamic banks as well but I think it’s a matter of confidence while comparing with the conventional, we need to realize the fact that the conventional companies, the big players they are in the market for over 60 years, 70 years and specially in the insurance sector, the policy holder’s confidence is very important. Alhamdulillah as far as we are concerned, though the base is small but still we are growing at a rate of over 35% per annum and currently the Takaful share in Pakistan is about 3% as compared to 7% in the Islamic banking but the Islamic banking as we know has completed almost 10 years whereas for us its 5 years. So I am sure with the passage of time, specially with support from Islamic banks, we will be able to keep pace with Islamic banks and will be able to cater to the needs of the Islamic banks and of course the other users, the people who are opting for Takaful . Thanks. Fouad Farrukh to Imtiaz Bhatti: Well, then we establish that we have very low penetration, even in the insurance industry and Takaful share is only 3% so what steps you would take in terms of not only Publicitas Conferences | 3 World Islamic Finance Summit 2011 increasing your market share but making the pie bigger in terms of this industry i.e. product innovation or service delivery or going to the people who don’t actually come to it at all because of reservations? Imtiaz Bhatti: You are absolutely right. The Takaful as Pervaiz Sahib said, this can be segregated into Life and General Takaful. The product innovation in General Takaful is very simple. I mean the products offered by General Takaful like fire, marine, property, house owners, these are very simple products and it’s not a rocket science. Basically the current products offered by the conventional insurance companies are already being offered by the General Takaful companies but in the Life side of course there is lot of innovation required in the Takaful as well whereby we can offer we can offer something new to the potential customers and to the people who are opting for Takaful. Penetration as I said is just 3%, I think that the major reason for this 3% is the life of the Takaful companies itself because as I said, the first company started its operation in 2005 that too in December, so effectively it was 2006 and after that the 2 companies came into being 2 years later somewhere in 2007 and 2008 and I think as far as the awareness is concerned, it’s not only important for Takaful but for insurance penetration. There are 40 players in Pakistan providing the general insurance and you can imagine that you know a market of less than USD 1 billion is nothing for 40 players . The efforts are required for general insurance as well and once that penetration increases, I am sure that Takaful would also benefit in the process. Najmullah Khan: I would like to add something that basically we have to penetrate to the retail business like personal accident, housing finance and we should take the advantage of modern technology, these are the broad based and large volume business and use of technology makes this cost effective and we can penetrate more in the masses with retail business like Banka Takaful and these types of businesses. Alhamdulillah in Pak Qatar, we have purchased IT solutions from Malaysia and we have SAP and ERP solutions which would be beneficial in future as well and also we do not have facility of terrorism cover across the world. Among Takaful companies, we should create a Takaful terrorism pool because most of the business is related to Islamic banks and other banks need terrorism cover so a pool in this regard and utilization of this pool to move forward can be a wide scope for promoting it and other thing is that Islamic banks and Takaful industry are the partners so in Islamic banking industry, we have banks’ limit problem, so Islamic banks should understand our problems and for promoting Takaful industry, they should support us because we have enough capacity in Re-Takaful and we have foreign partners. So Alhamdulillah we have enough capacity so they can trust us to underwrite the business in a better way and watch their interests. So Islamic banking industry should support the promotion of Takaful. Thank you. Fouad Farrukh to Dr Imran Usmani: Dr Sahib, is there something you would like to add? Dr Imran Usmani: I would like to add something on that Takaful thing. As we know that interest is prohibited and conventional banking system is not allowed by Shariah because of two elements: one is Riba which is interest and the element of Gharar and Meysir. So we should try our best to develop that particular industry as we could do but unfortunately there are certain reasons, I don’t know, how they could be resolved but there some facts that Takaful companies not growing at the pace as Islamic banking is growing Alhamdulillah. I think there are some factors and we can work out on those things or factors. First of all I think that SECP, Security and Exchange Commission of Pakistan, they should play an Publicitas Conferences | 4 World Islamic Finance Summit 2011 important role for developing Takaful industry and they should play an aggressive role for developing that. Secondly they have previously issued the rule that they would not allow the window operation for Takaful companies and they would only allow full fledged Takaful companies but if I see from the Islamic banking point of view, for example, as a Shariah Advisor of a particular bank, of a large bank, for example Meezan Bank, I always try to urge them to insist them that you should try to find out good Takaful company but there are several problems, there are several issues which we have to face. You know that there are two sides of products, one is the corporate and the other one is for example, consumers. And the both things, for example the corporate side we have Murabaha, Ijara so on and so forth and even for the consumers we have car financing or house financing or some other things. So, if I say for the banks’ owned assets that you should go for Takaful and even we have some share holding , for example in Pak Kuwait Takaful company and some others but the problem is that we have to face two or three things simultaneously. Firstly the problem of infrastructure, previously there were some companies EFU, Adamjee and others, they are very large and very big companies and they have developed their infrastructure, they have their human resource system and everything is developed. So in these newly established Takaful companies, they don’t have so strong infrastructure that even the management is hesitant or reluctant to go with them and for example, if it is the case of the management of the Islamic banks so we can consider, we can expect that how could be the reaction of the other corporate when we ask them to do Takaful operations for their assets. For example, if Islamic banks have done leasing and we ask them to do Islamic Shariah compliant Takaful operation or for example to do Murabaha, so they say there are several issues. First issue is that the service issue and the infrastructure issue and the second issue is diversification of risk. It is another important issue because these are tiny companies, they are not big companies, they do not want to get the coverage through these companies. So now after seeing all these things and very frequently we get request for exemption to get the permission to get conventional insurance. So now I would say that SECP should consider that to allow to open window operation for Takaful companies so they can utilize their infrastructure, their system they have already developed and even the current Takaful company do not have as such that particular strength to cover all the risk of the businesses. So we should not have the target market for Islamic banks as such. If we have that particular target market, still I say that we cannot cover that particular market through these Takaful companies because of these problems but we should have in our mind, the bigger problems. We should serve for the conventional banking industry as well; we should serve other corporate who are not dealing with Islamic banks. So for these bigger market or larger market, we need to have more Takaful companies, more windows, so that the risk could be diversified, better services can be achieved and competition of the prices would develop so that way I think the Takaful operations can develop in the country. Pervaiz Ahmed: I think as far as the regulation is concerned, yes, there is issue because SECP doesn’t has resources to regulate even the conventional insurance industry so there is no interest at SECP level for Takaful so we don’t have any hopes. In Islamic banking we are seeing that State Bank is playing very vital role and they are leading the industry but it is not happening in SECP, they don’t have the resources even to regulate conventional insurance so we all know that. As far as Takaful companies capacity is concerned and the issue that they are not very well established that was even too for the Islamic banks when they came. I as a user of some of the Islamic banks, they were services we could not get even we Publicitas Conferences | 5 World Islamic Finance Summit 2011 tried so hard but still we stick to the Islamic banks because we feel that this is the industry that needs to be developed. And I think there is more like a perception issue, Islamic banks have been traditionally giving most of the time a leasing business which is giving more than 100% loss ratios. I think currently even a large insurance company cannot insure all the assets. They normally go with arrangement of coinsurance or co-Takaful. This is how it happens. Yes, there is a need in the Takaful industry that they should take more and more assets on the basis they do not enter into a price war between the Takaful companies which was happening unfortunately lately and there is a need for banks to understand that as well. I think there is a perception issue rather than real issues in banks. There are now capacities available in Takaful companies, there were shortage earlier. As far as windows are concerned the problem was this that SECP said that there will not be a window and immediately after that they said that they will allow window. In 2005 when rule came, 7 to 8 players came in the market, they wanted to take license but when SECP said they are allowing window, everybody shied away that ok we will wait for window and for 5 years, they have not allowed window. So if they would have allowed windows at that time or if they would have said no windows, so these big players would have come as dedicated players. So keeping things hanging around actually went against the industry and new players could not come. So more new players would mean more competition, more investment into infrastructure. Fouad Farrukh to Muhammad Imran: Very rightly said. I think media should project these issues to SECP for resolution at its earliest. In very simplest statement I would say Takaful industry is here to grow. There is lot of untapped market even which insurance couldn’t capture and its growth is correlated to Islamic banking itself because it should go hand in hand to prosper the growth. Moving on, we have already consumed lots of time I think, Imran could you please elaborate as far as Bank Islami or the industry is concerned, we have seen investment in unrestricted accounts and Modaraba and Musharaka business, we have seen consumer finance in terms of home, we have seen car and we have also seen lots of new development in terms of laptop financing and all those things from Meezan Bank. What is next? Where do we go from here? Muhammad Imran: Bismillah hir Rehman hir Raheem. I think it’s a very pertinent question, where to go from now. First of all Najam Sahib it was a pleasure listening to you after a short break in Pakistan, so welcome back to Pakistan. It’s always a pleasure to listen to your presentations. I was just thinking when Najam Sahib was presenting about Africa; there are so many similarities between our market in Pakistan and Africa. Both are in the stage where we are developing right now. Yes, we have developed Ijara as far as the auto financing is concerned, we have developed Diminishing Musharka as far as house financing is concerned, Meezan is doing house financing. Now when we go and meet customers, the common man, the mass market, they ask what’s in it for me? Now if are offering similar rates as the conventional banks are offering, we are offering similar products as the conventional banks are offering, what’s further in terms of Islamic banking that we have in our pocket to offer to them? I have just returned yesterday from the flood affected areas in internal Sindh and it has a very strong impact on my mind that what has happened to our brothers within our country in the same province is that we should do something as an industry. That can be a starting point. Now the pity is that the way to the mind to the people is through the heart and we must admit that as an industry that although we have been here for the last 10 years but one thing that we have missed is working as one industry in terms of Islamic Publicitas Conferences | 6 World Islamic Finance Summit 2011 banking. We haven’t got a platform yet. Now let’s say if we at Bank Islami want to initiate a charity program that we done in our bank, I am sure Meezan would be doing a similar thing and so would Faysal and other banks but have we done anything as far as the industry is concerned? As one Islamic banking industry? Now charity work as Najam Sahib has pointed out, it creates a lot of good will, it creates a lot of special place in the heart s of people. Now if someone comes over and ask us what sort of charity thing have we done? The earthquake has come over and it has gone by. Last year, there was huge flood, this year again our brothers are asking for help. Have we done anything as an industry for them? We have not. So I think one of the key points that I pick up from this conference can be lets join our hands together, this will create a goodwill for us and lets do something for our brothers and sisters who are right now desperate for help. And then even if we can not share some of the money from the profits, we do, all banks have charity accounts and we have a very good system being governed by Shariah scholars like Dr Imran Usmani and we can have an independent body that can govern for that and all the banks if they join the pool for the charity I think it can create a huge impact in terms of contribution that the Islamic banks have made towards the economy of the country and it will also give us the goodwill that we always want in terms of segregating and differentiating ourselves from the conventional banking. Fouad Farrukh to Muhammad Imran: Very well said. Imran you just talked about in the beginning that people are looking for something different so do you believe that there is a higher possibility of success if we are able to become distributors of venture capital for the consumers because consumers are willing to take risk for ventures and we don’t see any venture capital in Pakistan at all? Muhammad Imran: There were a couple of venture capital companies, I know of one, which was TMT ventures, my friend Sohaib Umar was the CEO of the company. They did start some interesting projects. One of our majority shareholders JS, they still have a private equity wing, they were also willing to go into venture capital but for the venture capital most important thing is you have to have a regulatory framework for that and number two, the economy of the country should be working at a level where there is one trust of the government and then trust among the people to invest in the venture capital investments. So unfortunately, overall the industry environment is not very conducive to that however I think venture capital comes naturally to Islamic banking because it is very much related to the Musharaka mode of financing that we promote and secondly the returns that venture capitalists do promote are pretty huge. They start at a very small scale and I will just quote one example, there is this one company by the name of Zappos.com, they sell shoes. They started through a venture capital company; their total sale of shoes across the globe is more than the export of Pakistan. Now a shoe is something that you cannot even imagine buying online because once you haven’t tried it, you cannot even buy it. But they have such a strong marketing strategy, the venture capital has gone huge and if you go to their website, you will be amazed to see what sort of offering they are offering. Yes, so of course the opportunity is there but then the industry and the regulation should be conducive for that. Fouad Farrukh to Najmul Hassan: Najm Sahib, to wrap it up since we started with you, how do you see your experience in Africa versus in Pakistan in Islamic banking industry? You have been there in both the places at the time of beginning. Publicitas Conferences | 7 World Islamic Finance Summit 2011 Najmul Hassan: I would like to begin by first mentioning something that I missed out and that is what Shaitan does to you. My learning of Islamic banking and my knowledge of what experience I gained is really the product of Meezan. I think Meezan has set a pace. I was part of the original team. I remember Dr Sahib, your father, I have learned so much from him. He is one of the most imminent people that I really now and it’s a great honor for us and I think that’s what I really applied when I went to Africa. It was nothing new than what we were doing in Meezan. It was exactly the same thing so my apologies for first not being grateful and thankful. One has to be grateful to people first and then one can be grateful to your Almighty also. What I really feel different in Pakistan as compared to Africa, in Africa you can’t sell Islam, you can’t use Islamic card to sell a product because of the fact that one, the number of Muslims are less, particularly in Kenya there are about 15% or so. So you have to put in an angle that there is something good in it for you and therefore you build your whole model around a service network or a service mindset of your people that we have to go out of the way to satisfy a customer. When a customer walks into an Islamic bank, he must get an experience of something different from what he is getting in a conventional bank. There must be some way in which we are able to project what we really believe in. that’s one thing we did. We had a really strong service culture within the Gulf African Bank and continued to project that. In fact Gulf African bank in the very first year of operation, we were the runner up of the best service provider in Kenya. There were 40 banks in Kenya and the Central Bank gave us an award to the Gulf Bank as the second best customer service provider and they do this mystery shopping through their own companies and then they come in and they measure everyone. What is their experience, how was the banking, how long it took for a person to greet? We also went in with a very standard program of teaching our people in the branch, 6 or 7 things that they must do: when someone walks in, how will you greet him? When you do or conclude a business, what would you say? Very small things which basically must reflect our service culture, you know Islam has a huge service culture to it. So that’s what I found different in Pakistan, we try and sell more in an Islamic way. This is Shariah compliant, this is this but at the end of the day, frankly speaking, there’s much you can do to sell your product for a Muslim. I had this great friend of ours of Sitara, Mian Idrees Sahib, he used to say there’s a cost of being a Muslim, now that cost is both in terms of return as well as the kind of bad service that you get. So if we want our Takafuls to grow, if we want our Islamic finance to grow, I think yes at the backend we are doing everything in a Shariah compliant way because that’s what we stand for but at the front end, we must be able to compete with the rest of the world. If the Citibank, the standard chartered and all the top banks are able to give you a next level of service, we must be able to give them next plus one. Now if you are able to do that, you will be able to sell. It’s like a Halal restaurant, a non Muslim will not go there just because there’s a Halal food. He goes there because there is a value for money, he gets great service. So they become popular wherever they are opened and there’s a small Muslim population. I think that’s where we must turn our attention in Pakistan, not just to sell a product because of Shariah, that’s our belief, that’s our core value. It has to be Shariah compliant but at the front, we must be able to be better than what the conventional banks are doing. Now the day we become better than them as far as service is concerned, you can rest be assured, you will always grab the market, whether it’s Takaful or whether it is your Islamic banking products or retail or whatever products that are there. Publicitas Conferences | 8 World Islamic Finance Summit 2011 Dr Imran Usmani to Fouad Farrukh: Masha Allah while Fouad is moderator of this session and he has asked question many from all of us. Now I will be moderator for him. I want to ask some question from you that you have been working for Faysal bank and Faysal bank was the starter of Islamic banking in Pakistan and my father has worked Alhamdulillah 20 or 25 years back for Faysal bank and then there was some gap in Faysal bank Islamic banking and my contact with you was in BMI bank in Bahrain Alhamdulillah and I have experienced with you very good Masha Allah commitment in yourself. So what is your planning and how do you see that how would you take Faysal bank Islamic wing towards Islamic banking? May I ask that question from you? Fouad Farrukh: By all means you are very right. I understand that Faysal bank started as an Islamic bank when there was no licensing at that point in time. At that time, Al Baraka Bank was also there, I think AlTaufeeq investment bank used to be an Islamic based banking system. I understand that since 2007, the conventional banking license was granted by State Bank of Pakistan. I wasn’t part of the team at that point of time in this country, so really can’t speak what was the deciding factor behind that but as Islamic banking was separately started, the working was started in 2007, we got the license and we opened our first branch in 2009. As far as Islamic banking is concerned for Faysal bank Islamic banking wing, I can proudly say that we in terms of Shariah, we have made no compromise. We have compromised business on the basis where Shariah restrictions apply or where there is a grey area, we have taken a conservative route. As far as Islamic banking of Faysal bank is concerned, one branch almost 2 years back, today we are 43 branches and we should be closing we 46 Islamic dedicated branches across Pakistan in about 20 cities. Najm Sahib has very rightly said, we provide best services without compromise and we provide online and all banking services across other branches except selling any product or opening an account or anything because that is where the Shariah education has to be there. So slowly and steadily we expect to be a significant part of the bank, operating, obviously we are use something in synergy which is the back end. We train the back end people for our products, we don’t need to spend because those people have enough skill set and enough skill set has been developed to share resources but all funds, all selling channels, are segregated as per the regulation as per our Shariah advisor requirement. Thank you very much, that was a very unexpected question. We summarize here that Islamic banking is Masha Allah doing very well and we had experience shared from Africa, and we had experience shared from the Takaful and the retail banking industry. Once again, thank you very much everybody. Publicitas Conferences | 9 World Islamic Finance Summit 2011 Question from the audience 1. One question from Najmullah sahib. My name is Javed Aziz from Albaraka. You said that you provide Takaful to many people but simultaneously you have very good contacts abroad for reinsurance. So is it a mix of conventional or you get reinsurance from Takaful? Najmullah Khan: Alhamdulillah we have the arrangements with 100% Re-Takaful partners across the globe in Malaysia, Bahrain and now you know major reinsurer like Munich Re, Swiss Re and Hanoa Re have their Re-Takaful windows in the world and assisting us in managing the business. 2. Assalam o Alaikum. My name is Sadaqat. I want to give one suggestion, it is now concluded that Takaful is not progressing as well as Meezan bank and other banks have progressed in the past. Now I think there are two main reasons behind that one is that of lack of public awareness perhaps due to lack of proper campaigns from insurance companies. Secondly some of the scholars in Pakistan, they are totally against the Takaful, they are not accepting Takaful as an Islamic solution of conventional insurance. So in two different sectors what should be done in order to generate and establish properly Takaful insurance. So are there some Shariah scholars helping in the matter? Pervaiz Ahmed: It’s not. Takaful you have rightly mentioned progressing that well but the life of the Takaful companies are 2-4 years old. In 2005, SECP came with the rules and in 2007, Takaful companies started coming, then this issue of window came. There are only 5 companies right now, 3 General Takaful companies and 2 Family Takaful companies in the market. General Takaful companies are having more difficulties in the market because the conventional general insurance industry is not doing well; their growth is about half a percent a year and they are making underwriting losses. There are couple of big players who are not playing by the rules and SECP doesn’t have means to manage them. And SECP doesn’t treat Takaful and non Takaful companies differently and as far as Shariah scholars are concerned, there is an awareness issue in banking normally and whenever you go and talk to them they understand pretty well. Companies cannot spend so much money; the reason is there is poor capitalization in the market. A General Takaful company can start with 300 million rupees and 500 million rupees for a Family Takaful company , so it doesn’t allow a company to invest heavily in technology, in human resource development, in training and development and then to create awareness and then running some media campaigns. Even you see that you don’t have those ads coming in insurance as well. You see in India that every fourth ad will be from an insurance company, it doesn’t happen in Pakistan. So this is one of the major issues that insurance companies and Takaful they are poorly capitalized as compared to the banking industry. Imtiaz Bhatti: Let me add on that insurance market is just 1 billion US dollar and out of those 40 companies, 80% of the insurance rests with major five players for the simple reason that those five players are operating in Pakistan for over 60 years. So as far as the insurance industry or the general Takaful, the reinsurance capacity or the reTakaful capacity is very important which is given to the company as you grow. So even in the conventional insurance if you see, as I said that 35 companies those who have been in operation for over 10 years and 15 years, so their share in the insurance market is very minimal for the simple reasons that they are new companies as compared to big players who Publicitas Conferences | 10 World Islamic Finance Summit 2011 have been operating for 50 or 60 years. So as we grow with the passage of time, we gain our capacity and more companies even the windows are coming if the windows are allowed, I think we will be able to cater to the needs and this would certainly grow and the share33% I can safely say that Insha Allah in the next 3-4 years, the share should not be less than the Islamic banking share in the conventional banking. 3. This is Shahzad from Pak Qatar Takaful. I would to add a comment. Someone just said that Takaful industry has just been there for 5 years. If we talk about Islamic banking 5 years ago, it was at this growth stage. So I think Islamic banking has short term objectives, Islamic banks can play a major role for the penetration of Takaful products in the market. The 3 Takaful companies definitely can join hands to facilitate all the corporate customers. The only challenge we have is the Re-Takaful arrangement. Yes, that is the major thing; otherwise, we the three companies are capable enough to facilitate each and every asset of the corporate that is linked to any Islamic bank. Thank you. Pervaiz Ahmed: Thank you very much for the comment. Just to wrap it up, I think we have heard from Najm Sahib about the African market. It was quite heartening to note that one of our colleague was part of that success story. The topic which was given to panel was quite diversified. We had customer services and QA issues which we could not address. Yesterday it was mentioned by Saleem ullah Sahib as well that what is happening as far as customer care and services are concerned. What kind of quality control, what banking and Takaful companies are doing and then we had innovation and liability side product, which obviously due to the limited time, we could not address and on HR development when Imran bhai mentioned that yes, what is happening with the passage of time is more and more institutions are coming. We are seeing Riphah University, CIE took the lead, now Karachi university, NIBAF and so many other institutions and the theme of growth opportunity which was presented to us by let’s say in African market or Middle Eastern market, we could see there is a huge demand for human resource. Pakistan has already taken lead. We can export resources from here to abroad as well, this is the only area where I think we can do that and finally I think in Takaful, Takaful company needs to come up progressively to cater to the conventional industry need as well as Islamic banking and with this I think with the passage of time, it would take a while because normally there is a tipping point and then the industry would grow. So that point is yet to come but Alhamdulillah, the response from the market is pretty good. Thank you. Publicitas Conferences | 11