LESLIE FAY, LI & FUNG IN DEAL/2 THE WORLD OF INDITEX/10

Women’s Wear Daily • The Retailers’ Daily Newspaper • July 30, 2002 Vol. 184, No. 21 $1.75

WWDTUESDAY

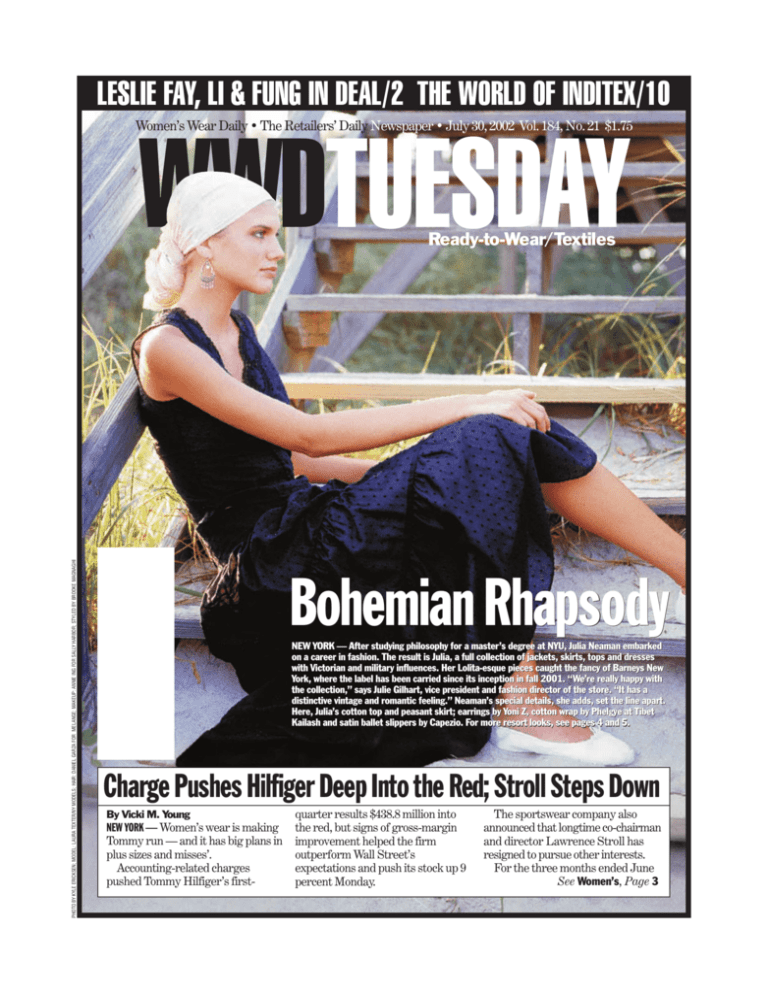

PHOTO BY KYLE ERICKSEN; MODEL: LAURA TEXTER/NY MODELS; HAIR: DANIEL GARZA FOR MELANGE; MAKEUP: ANNIE ING FOR SALLY HARBOR; STYLED BY BROOKE MAGNAGHI

Ready-to-Wear/Textiles

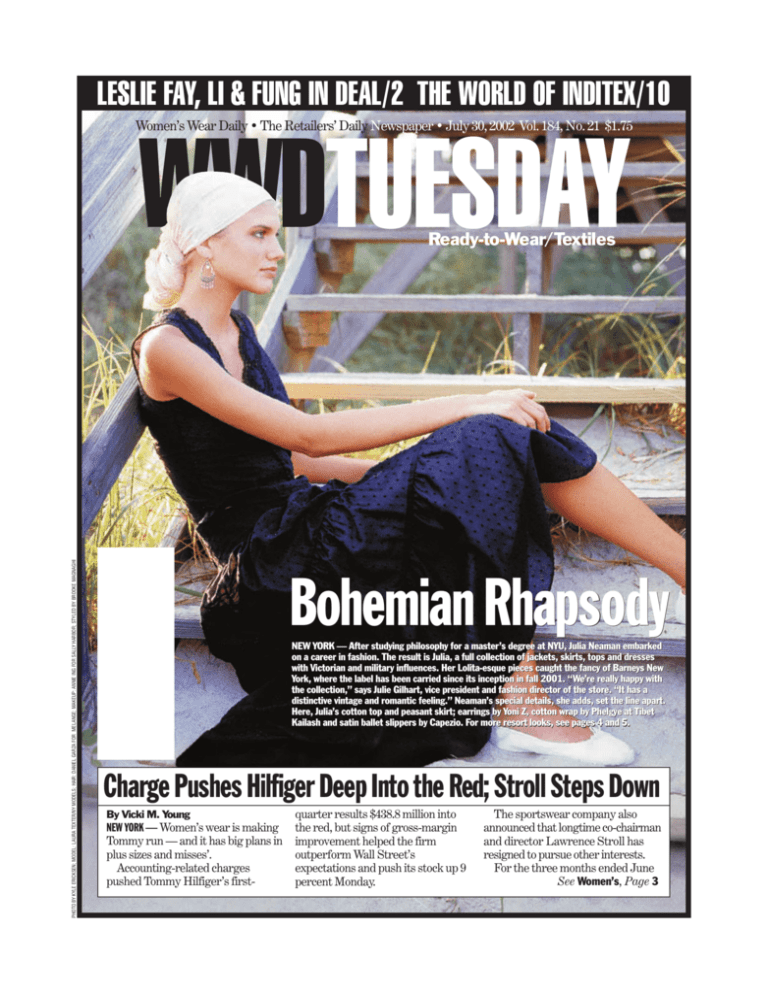

Bohemian Rhapsody

NEW YORK — After studying philosophy for a master’s degree at NYU, Julia Neaman embarked

on a career in fashion. The result is Julia, a full collection of jackets, skirts, tops and dresses

with Victorian and military influences. Her Lolita-esque pieces caught the fancy of Barneys New

York, where the label has been carried since its inception in fall 2001. “We’re really happy with

the collection,” says Julie Gilhart, vice president and fashion director of the store. “It has a

distinctive vintage and romantic feeling.” Neaman’s special details, she adds, set the line apart.

Here, Julia’s cotton top and peasant skirt; earrings by Yoni Z, cotton wrap by Phelgye at Tibet

Kailash and satin ballet slippers by Capezio. For more resort looks, see pages 4 and 5.

Charge Pushes Hilfiger Deep Into the Red; Stroll Steps Down

By Vicki M. Young

NEW YORK — Women’s wear is making

Tommy run — and it has big plans in

plus sizes and misses’.

Accounting-related charges

pushed Tommy Hilfiger’s first-

quarter results $438.8 million into

the red, but signs of gross-margin

improvement helped the firm

outperform Wall Street’s

expectations and push its stock up 9

percent Monday.

The sportswear company also

announced that longtime co-chairman

and director Lawrence Stroll has

resigned to pursue other interests.

For the three months ended June

See Women’s, Page 3

WWD, TUESDAY, JULY 30, 2002

2

Fashion Issues Continue Climb

By Evan Clark

NEW YORK — Buying just may

be coming back into fashion.

Apparel retailers and manufacturers were part of the markets’ stampede Monday, even

though Wal-Mart and Target reported below-plan sales for last

week. The Dow Jones Industrial

Average, posting the third-largest

point gain in its history, shot up

447.49 points, or 5.4 percent, to

8.711.88. Last Wednesday the

Dow jumped 488.95 points, or 6.4

percent. Since last Tuesday’s

close of 7,702.34, the Blue Chips

have rebounded 13.1 percent.

Still, the index is off 5.7 percent

so far this month.

The Standard & Poor’s retail

index advanced 12.84 points, or 4.6

percent, to end the day at 289.78.

Specialty stores posted the

most impressive gains, outshining

the overall markets and other retailers. Those seeing more robust

advances in their share prices included Urban Outfitters charging

up, $3.53, or 13.8 percent, to

$29.10; Ann Taylor, $2.75, or 11.2

percent, to $27.30; Burlington Coat

Factory, $2.11, or 11.3 percent, to

$20.81; Chico’s, $3.59, or 11.1 percent, to $36.09; Pacific Sunwear,

$1.81, or 9.5 percent, to $20.90;

Gap, $1.05, or 8.6 percent, to

$13.25; Buckle, $1.89, or 8.1 percent, to $25.24; Talbots, $2.31, or

7.8 percent, to $31.82; American

Eagle, $1.31, or 7.5 percent, to

$18.76; and Abercrombie & Fitch,

$1.70, or 7.1 percent, to $25.60.

Department stores brightening during the week’s first trading session included Nordstrom,

up $1.44, or 7.8 percent, to $19.85;

Saks, 75 cents, or 7 percent, to

$11.42; Dillard’s $1.66, or 7 percent, to $25.41; May Co., $1.85, or

6.3 percent, to $31.11; and J.C.

Penney, $1.07, or 6.1 percent, to

$18.62. In the discount world,

shares of Target climbed $2.29, or

6.9 percent, to $35.29, while WalMart saw a $1.35, or 2.8 percent,

increase, to close at $49.53.

Vendors seeing the strongest

gains in the price of their shares

were LVMH, up 92 cents, or 11.3

percent, to $9.10; Coach, $2.82,

or 12.9 percent, to $24.72; Jones

Apparel, $2.26, or 7.1 percent, to

$34.26; and Polo Ralph Lauren,

$1, or 5 percent, to $20.90.

The S&P 500 jumped 46.12

points, or 5.4 percent, to 898.96,

while the Nasdaq pushed ahead

73.13 points, or 5.8 percent, to

1,335.25. European financial markets were also strong Monday,

posting across-the-board increases. Shares in the UK FTSE 100

jumped a collective 4.6 percent, or

Continued on page 7

Watch Woes Hit Bulgari Shares

By Amanda Kaiser

MILAN — Many luxury stocks

have been having a tough time

of late, but Bulgari seems to be

especially hard hit.

Once a high-flying market star

with sought-after multiples,

Bulgari has hit a stall. Slumping

demand for watches, compounded by Bulgari’s reliance on flashy,

fashion-driven collections —

which have shorter shelf life than

those of its competitors — have

also sliced into sales at the family

jeweler, some analysts said.

“It looks like Bulgari is lagging

the rest,” said Melanie Flouquet,

an analyst with JPMorgan. “They

have more stock in the pipeline

at third-party retailers.”

Unsold watches could mean a

disappointing 2002 for the company. Chief executive Francesco

Trapani said it is reasonable to

expect net profit growth of 10 to

11 percent, falling short of some

analysts’ projections of almost 20

percent over 2001 net profit of

$69 million. Trapani said revenue this year should advance 5

percent on 2001’s $775.6 million.

(Dollar figures have been converted from the euro at current

exchange rates.)

A poor showing in watches

contributed to Bulgari’s worsethan-expected first-quarter results. The company’s watch sales

plunged 29 percent, compared to

a slide of 15.6 percent for lowerpriced Gucci-brand watches.

Watch sales, which made up

34 percent of revenue in the

first quarter, pushed overall volume down 5 percent to $167 million and net profit down 60 percent to $9.1 million.

“The watch market, compared with the past, is in a bit of

a crisis,” acknowledged Trapani.

Back in the days of the free-

spending Internet boom, “there

were people who loved watches

and came into the store and

bought six or seven at a time.

These people are not there anymore,” he said.

Bulgari shares have lost more

than half of their value over the

past year and are reaching new

lows on concerns about the

watch business, along with eurodollar parity worries and fears

that Bulgari will slip out of

Milan’s blue-chip stock index,

the MIB30, come September.

The stock market recalculates

the 30 biggest companies on the

Milan Bourse in terms of market

capitalization twice a year.

Bulgari has suffered more

than some other competitors because its watch collection is tootrend driven, some analysts said.

“They have to replace style on a

regular basis,” as one put it.

Continued on page 9

Leslie Fay, Li & Fung Strike Deal

By Joshua Greene

NEW YORK — Yet another dramatic chapter is being written in

the storied history of the 55year-old Leslie Fay Co.

Looking to revitalize itself

under its new executive team,

Leslie Fay has signed an exclusive sourcing deal with global

trading giant Li & Fung (Trading)

INTRODUCING

Ltd., while it prepares for a

spring relaunch of its signature

sportswear line and a fall 2003

revival of its Outlander label.

With a new chief executive

officer at the helm since March,

Leslie Fay is plotting a return to

the Seventh Avenue spotlight.

Over the past few months, ceo W.

John Short — aided by president and chief merchandising

DIRECTION

AN INTERNATIONAL TEXTILE DESIGN SHOW

Formerly

English Accents

and merging with

Fall 2003 Collections

August 6, 7 & 8, 2002 | 9am to 6:00pm

Closing 4pm on August 8

INPRINTS NY,

DIRECTION's

Penn Plaza Pavilion at Hotel Pennsylvania

401 7th Avenue (adjacent to hotel)

global exhibitor

base includes over

50 companies

SURFACE – A seminar series covering diverse fashion

trends and industry-related topics will run August 6 & 7

at DIRECTION.

& 100 collections.

T: 973-761-5598

E: DIRECTIONSHOW@aol.com

officer Linda Larsen German

and chairman John Pomerantz

— has reorganized the newly

private company’s operations

and divisions, shifted executives

and finalized plans to relaunch

hibernating brands.

In a group interview at the

firm’s offices at 1412 Broadway

here, the three executives said

retailer’s low inventory levels

coupled with the current state

of the economy make for an appropriate time to remain cautious, as well as for the rest of

the year. But Short assured that

the company’s prudence is not

permanent. Now is the time to

set people up liking the product,

he said, and the company will

catch up on sales down the road.

Leslie Fay’s volume bottomed out at $125 million after

it emerged from a four-year stint

in Chapter 11 bankruptcy in

1997. It has grown to an industry

estimate of $212 million today,

but has a long way to go from an

almost $850 million peak during

the early Nineties. But Pomerantz

and Leslie Fay survived its infamous accounting scandal that

rocked the company in 1993, and

the affable chairman remains

Continued on page 6

WWDTUESDAY

Ready-to-Wear/Textiles

GENERAL

4

10

2

8

16

FASHION: Resort’s bare sundresses cast a romantic spell from dawn to

dusk, in cotton or silk prints and solids, trimmed in ribbons, ruffles or lace.

Spain’s Inditex, which owns Zara and five other specialty chains, plans to

open 275 stores worldwide this year and launch a home line next year.

RTW: Leslie Fay has signed an exclusive sourcing deal with trading giant Li

& Fung, while setting plans to relaunch its signature sportswear line.

Diversification was a key theme among vendors at last week’s Yarn Fair

International in New York, which attracted more foreign exhibitors.

EYE: Nina Griscom makes a grand entrance at the Watermill Center

benefit...eyeing Malick Sidibé’s photos...postcard from Cap d’Antibes.

Obituaries ..................................................................................................9

Classified Advertisements ..................................................................14-15

To e-mail reporters and editors at WWD, the address is firstname.lastname@fairchildpub.com, using the individual's name.

SUBSCRIPTION RATES

U.S. and possessions, Retailer, daily one year, $99; Manufacturer, daily one year, $135. All others U.S.,

daily one year $195. Canada/Mexico, daily one year, $295. All other foreign (Air Speed), daily one year $595.

Please allow 6-8 weeks for service to start. Individual subscription information: (800) 289-0273;

outside U.S. (856) 786-2140; group subscription information (856) 786-0963.

Postmaster: Send address changes to WWD, P.O. Box 10531, Riverton, N.J. 08076-0531.

WWD® (ISSN#0149-5380) is published daily except Saturdays, Sundays and holidays with additional issues

every first Friday of every month and one Saturday edition in April and November by Fairchild Publications Inc.,

a subsidiary of Advance Publications Inc., 7 West 34th Street, New York, NY 10001-8191.

WWD is a registered trademark of Fairchild Publications Inc.© 2002 by Fairchild Publications Inc.,

a subsidiary of Advance Publications Inc. All rights reserved.

No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical,

including photocopying or recording, or by any information storage or retrieval system, except as may be

expressly permitted in writing by the copyright owner. Editorial Reprints: (212) 221-9595

Periodicals postage paid at New York, NY and other offices.

Mailed under Publications Mail Sales Agreement No. 517054. Canada Post Returns to: P.O.Box 1632, Windsor, ON N9A 7C9

GST # 88654-9096-RM 0001

Printed in the U.S.A.

All signed articles published in the paper represent solely the individual opinion of the writer and not those of

WOMEN’S WEAR DAILY.

For Web site access, log on to www.WWD.com

In Brief

ELLEN TRACY UPDATE: Is Liz Claiborne Inc. the frontrunner to buy Ellen Tracy? According to sources, negotiations are

continuing for Claiborne to buy the privately held bridge

sportswear firm headed by Herb Gallen, and a deal could be

imminent. “We don’t comment on r umors,” said a Liz

Claiborne spokeswoman. Gallen couldn’t be reached for comment. Sources said Claiborne’s Dana Buchman division and

Ellen Tracy would certainly give the firm a one-two punch in

the bridge sportswear arena.

●

● BEAUTY PILL: The European Commission cleared Swiss Food

group Nestle SA’s business partnership with French cosmetics

giant L’Oréal to develop a line of “cosmeceuticals,” dietary supplements for hair, nail and beauty care. As reported, L’Oréal and

Nestle are to form a new company called Laboratoires Inneov,

based in France, to create and market the products globally next

year. Avon entered the cosmeceuticals category in May 2001,

joining such manufacturers as Aveda.

Corrections

David Au remains international communication director at

Céline. The company is seeking a Paris-based public relations

manager, a position previously held by Blandine Viry, who has

left the company and who reported to Au. These points were

misstated in a story on page 5, Monday.

● ● ●

The retail workers’ union in Germany is Ver.di, which launched

a two-day strike at several dozen Wal-Mart stores in that country

on Friday and Saturday. The union was attempting to get WalMart to join the German Employer’s Federation, so employees

would be covered by all aspects of the union’s salary negotiations with the German retail industry. The information was misstated in a story that ran on page 28, Monday.

● ● ●

A story on page 8, July 25, incorrectly reported that In Style will

be down about 8 percent in September, with between 560 and

565 pages of ads. For September, the magazine actually has 360

pages of ads, a drop of 8.9 percent from last year’s 395 ad pages.

WWDStock Market Index for July 29

Apparel Mfg.: 171.34

Retailers: 260.44

Textiles: 13.61

7.27

8.76

0.26

Department Stores

Off-Pricers

Discounters

Specialty Stores

217.34

330.06

330.73

113.05

11.25

18.18

9.16

1.01

Index base of 100 is keyed to closing prices of Dec. 31, 1993.

Continued from page one

30, income before the cumulative effect of a change in accounting principle and a onetime deferred tax charge was

$2.6 million, or 3 cents a diluted

share, compared with $9 million, or 10 cents, in the same

year-ago quarter. Excluding the

accounting change, analysts had

expected a break-even performance by Tommy. Including the

change in accounting for goodwill and intangible assets and

the noncash tax charge, the

company lost $438.8 million, or

$4.88 a share, in the quarter.

A substantial improvement in

gross margins, which rose 194

basis points to 44.6 percent,

improved the quarter’s profile

dramatically and offset declines

in its men’s wear business,

which is now smaller than its

women’s wear wholesaling operation. Tommy’s stock closed at

$13.30, up $1.10, in New York

Joel Horowitz, chief executive officer, said during a conference call with analysts that the

company will be paying about $6

million to $7 million more in

taxes because of an increase in

New Jersey’s state tax. In spite

of the increase, the company is

still projecting earnings per

share of 61 cents for the second

quarter ending on Sept. 30. Fullyear guidance was upped to

$1.67, 3 cents above earlier estimates, to reflect higher than

expected first-quarter earnings

over the earlier estimate.

According to Lamer, “Tommy’s

guidance of $1.67, including the

N.J. tax hit, is both cautious and

conservative and does not

account for any improvement in

men’s wear. Men’s wear wholesale sales were down 21.9 percent, in line with expectations. As

long as Tommy plans that part of

the business to be down, and

gross margin improvement stays

Tommy had a very good quarter, with

“improvement

on their gross margins. I

am encouraged that the gross margins

will continue to improve.

”

— David Lamer, Ferris, Baker Watts

Stock Exchange trading Monday.

The accounting change, the

result of Statement of Financial

Accounting Standards No. 142,

affects how the company amortizes goodwill or intangible assets

having indefinite lives. The

impairment of goodwill in the

quarter was $430 million, or $4.78

per share. The deferred tax liability, also relating to the accounting

change, totaled $11.4 million for

the quarter. The quarter’s results

also reflect an expected seasonal

operating loss for the quarter for

the Tommy Hilfiger Europe operations, which the fashion firm

acquired on July 5, 2001.

Lehman Brothers analyst Robert Drbul said that the charge was

in line with expectations and is

comparable to what other fashion

firms have been doing to adjust to

the new accounting protocol.

While the analyst said that the

charge was for a number of different items, including trademarks,

one financial source specifically

pointed to the 1998 Pepe Jeans

acquisition and its goodwill

implications.

Despite a double-digit dip in

its men’s wear business, sales in

the quarter were up 3 percent to

$366.3 million from $355.7 million last year.

David Lamer, an analyst at Ferris, Baker Watts, said, “Tommy had

a very good quarter, with improvement on their gross margins. I am

encouraged that the gross margins

will continue to improve another

250 to 350 basis points over the

next three quarters.”

The analyst said that the

quarter was a good one for the

firm, which was busy “tightly

controlling its top line to control

its inventory, which in turn is

boosting its bottom-line results.”

Also contributing to the gross

margin increase, according to

Lehman’s Drbul, was the significant reduction in the amount of

goods sold in the off-price channels in the United States.

on track, the $1.67 assumes that

the men’s sector will remain

challenging at wholesale.”

Horowitz said during the call

that wholesale revenues in the

misses and juniors business

increased in the quarter by 28

percent to $107 million from

$83.4 million, while men’s revenues dropped 21.9 percent to

$100.8 million from $129 million.

Men’s wear wholesale categories

contribute 28 percent to the

company’s total revenues, analysts said. Sales in children’s

wear were up 3 percent to $58.8

million from $57 million.

Licensing revenue was down

6.9 percent to $13.1 million from

$14 million due to consolidation

and the acquisition of Tommy

Europe. In retail, revenue was

up 20 percent to $86.7 million

from $72.3 million. At the end of

June 30, the total store count

including Tommy Europe stores

was 172, consisting of 111 outlet

stores and 61 specialty licensing

sites. Comparable-store sales at

outlet company-owned stores

declined in the mid-single digits,

but margins were slightly better

due to more full-priced selling

and leaner inventory.

According to the ceo, the

addition of TH Woman, its plussize line, contributed significantly in the quarter. “In plus

sizes, we continue to expand our

footprints. The initial strategy

when we entered this business a

year ago was to establish ourself

as a denim resource. We continue to expand our offerings to

include sports. In the fall [we

will be in] more than 700 doors

compared with 250 doors when

we launched a year ago.”

Horowitz said that the company will grow the misses business by increasing the sportswear element and introducing

an activewear component. “This

includes the creation of lifestyle

shops in approximately 120

select doors where we will mer-

chandise our comprehensive

offering of denim, sportswear

and active product,” Horowitz

noted. “Approximately half of

these shops will be updated with

new fixturing to display the

newest assortment of merchandise and product, which will

reach the floors in early August.”

As for juniors, the ceo said that

starting with the back-to-school

season the company will introduce a new jean delivery every

month that will update a denim

wash or fit for the customer.

However, if the misses and

juniors categories were bright

spots at retail, men’s wear was

Tommy’s albatross in the quarter.

Horowitz disclosed, “The

men’s sportswear business continues to be challenging, and

largely promotion-driven. In

conjunction with the category

weakness, we have experienced

our own product issues in the

spring-summer season.” He

noted that the company took

aggressive measures to clear

inventory and get the sales floor

ready for fall product offerings.

The ceo quipped, “I never

thought I’d see the day when

men’s wear has a higher markdown rate than women’s wear, and

here we are and that’s the reality.”

Horowitz was optimistic about

the company’s future, but not

necessarily as positive about the

retail climate on a near-term

basis. “While the economic environment is quite challenging, can

we foresee a continuation of the

highly promotional retail climate? We expect the momentum

in our women’s businesses to continue, and we are encouraged by

some recent positive trends in

men’s jeans and children’s wear.

We are eager to see the results of

our initiatives and the redesign

of our men’s sportswear and remerchandising of our retail specialty stores beginning in the fall,

although the initiatives will come

against the backdrop of some

uncertainty and sagging consumer confidence,” he said.

As for Stroll’s resignation,

Lamer observed, “Stroll has been

working on Asprey & Garrard for

the last 18 months. Now he will

focus on that entirely. It will have

no operational impact on the

Tommy whatsoever.”

According to Tommy’s latest

annual report filed in May with

the Securities and Exchange Commission, Stroll retains a 1.1 percent ownership stake in Tommy.

Lamer didn’t rule out the possibility that Stroll, now without

any potential conflict of interest,

might want to take a closer look at

Calvin Klein Inc. should that business be put back on the market.

Lehman’s Drbul didn’t think that

was likely anytime soon, as long as

Stroll was still heavily focused on

Asprey. However, Drbul advised,

“I would keep a close eye on what

Silas Chou does because, if Stroll

was keen on acquiring CKI, he

would likely do it in partnership

with Chou.”

Both Stroll and Chou bought

Asprey in July 2000 from the

Brunei Investment Agency for

an undisclosed sum — although

industry observers estimated it

at less than $152 million. The

two, until Monday’s announcement, were co-chairman of

Tommy. Chou also retains a 1.1

percent stake in Tommy.

By Lisa Lockwood

NEW YORK — Lawrence Stroll

stepped down as co-chairman and

director of Tommy Hilfiger Corp. to

concentrate on his new babies,

Asprey and Garrard.

“It’s been a wonderful 13 and a

half years since acquiring Tommy. I

feel I’ve done all I can do,” said

Stroll, 43, who was reached in

London. “I want to move into different pastures. I bought Asprey &

Garrard two years ago and am enjoying it tremendously. I thought it was

the right time.”

He said the A&G Group, which

he bought with Silas Chou, was taking more time than he originally

thought. “It’s London-based and it’s

a lot easier for me,” said Stroll, who

resides with his family there.

Stroll said he made the decision

to leave about nine months ago and

apprised his partners. He said there

were no disagreements, the parting

is amicable, and he remains friendly

with them. Sources said Stroll has

been less involved with the Hilfiger

business as A&G has started to take

up an increasing amount of his time.

Asked if he believes there’s

growth left in Hilfiger, Stroll said,

“There’s absolutely opportunity in

Tommy. You won’t see the growth

levels of five to six years ago, it’s too

large a company. You can only have

a certain amount of distribution

without lowering one’s standards.”

Stroll said he will retain his

shares in Hilfiger. He and Chou each

own 1.1 percent of the company.

“I think we put together a fantastic team. All four partners made

an equal contribution to our enormous success,” said Stroll, referring to Tommy Hilfiger, honorary

chairman, Joel Horowitz, chief executive officer, and Chou, who continues to serve as co-chairman.

Although sources consider Chou

the genius and innovator behind

Hilfiger’s remarkable growth, they

credit Stroll with making some

major contributions to the company.

With a product design and marketing bent, Stroll spearheaded many

of Hilfiger’s ventures, including international distribution, in which he

was well versed, having had a previous partnership with Polo/Ralph

Lauren in Canada and Europe.

Sources said Stroll has a difficult

personality, but the back-and-forth

banter between he and Chou allowed

great ideas to come out of the

Hilfiger business. They said Stroll

was very aggressive when it came to

product offerings, which was a boon

to the growth of the business.

Stroll brought Polo to Canada in

the late 1970s, and in the early

1980s, became the Polo licensee

for all of Europe. He and Chou,

whose fathers were friendly, became

partners in Polo in Europe in the

mid-1980s. In 1989, an affiliate of

Novel Enterprises, owned by Chou

and Stroll, acquired the majority

ownership of Tommy Hilfiger Inc.

and the licensing agreement with

Mojan Murjani was terminated.

They took Hilfiger public in 1992,

followed by three secondary offerings. These offerings paid off handsomely for the partners. At one

point, the partners had netted a

combined $325 million on an original investment of $206,000.

While building Hilfiger, Stroll and

Chou engineered some key moves,

such as the $1.15 billion acquisition

in 1998 of two of its sister companies: Pepe Jeans USA Inc. and

Lawrence

Stroll

Tommy Hilfiger Canada Inc. Stroll’s

family owned 100 percent of Hilfiger

Canada, and Pepe Jeans was held by

associates of Stroll and Chou,

Hilfiger and Horowitz.

In 2001, Hilfiger Corp. also completed the acquisition of its former

European licensee, T.H. International

NV for $200 million in cash. Based

in Amsterdam, its principal operating

subsidiary was Tommy Hilfiger

Europe BV (and its subsidiary,

Tommy Europe). Tommy Europe was

controlled by Apparel International

Holdings Ltd., whose owners were

Chou, Stroll, Hilfiger and Horowitz.

Independent of Hilfiger, Stroll

and Chou bought Asprey & Garrard in

July 2000 from previous owner

Prince Jefri Bolkiah, the younger

brother of the Sultan of Brunei. They

aim to transform the A&G Group to

compete with such luxury firms as

Hermés, Louis Vuitton, Bulgari,

Gucci and Tiffany, and eventually go

for an initial public offering. “Our

plan is to build a business. If going

public down the road is sensible,

we’ll entertain that, but it’s not in the

cards today,” said Stroll on Monday.

Although Stroll kept a low profile

and preferred to keep his name out

of the press, he has been busy on

many fronts. Over the past several

years, he and Chou have been actively seeking acquisitions, both for

Hilfiger and themselves, and have

made unsuccessful bids for various

companies, namely Calvin Klein

Inc., Brooks Brothers and Valentino.

Asked if he’s looking to make any

more acquisitions, Stroll told WWD,

“I’m not looking, but if the right opportunity crossed my plate, I wouldn’t say no.” He said he could make

an acquisition with Chou, or “it

could be myself alone.”

Stroll said that currently he is

more involved than Chou in the

A&G Group, which generates $75

million in volume.

“Silas is not as heavily involved in

A&G as I am. Now I’m involved in

the design of product and the marketing function. That’s my side of the

contribution to our partnership. Silas

is more involved in the financial, distribution and accounting” said Stroll.

Executives were surprised

Monday with the news that Stroll

was departing Hilfiger. Some

sources said Stroll’s role at Hilfiger

was unclear and that he could be

disruptive, late for meetings and

unfocused. Others called him

shrewd, and someone who “lucked

out” by partnering with Chou.

“As co-chairman and in looking

at the big picture, Lawrence was

very instrumental and very important,” said John Koroukas, president

of sportswear at Warnaco Group, who

previously worked with Stroll at Pepe

Jeans and Hilfiger. “He was extremely involved, particularly in the

earlier years. He had great eye and a

great opinion of trends. He was very

strong, very aggressive and very opinionated. He’s a real cornerstone of

the organization.”

WWD, TUESDAY, JULY 30, 2002

Women’s Strong at Tommy Asprey and Garrard Are

As Quarter Sees $439M Loss Stroll’s Post-Hilfiger Focus

3

WWD, TUESDAY, JULY 30, 2002

4

Sunny

Diane Von

Furstenberg’s

gray polkadot

silk wrap

over August

Silk’s slip.

Nanette Lepore’s black

and white, ruffle-edged

dress; monarch

butterfly sunglasses

from MorgenthalFrederics; cotton wrap

by Phelgye at Tibet

Kailash; leather ballet

slippers by Capezio.

5

WWD, TUESDAY, JULY 30, 2002

y Side Up

Miguelina

Honeymoon’s

white linen

dress; necklace

by Yoni Z.

NEW YORK — Resort’s bare little sundresses cast a spell of romance

from dawn to dusk. They turn up in cotton or silk, prints or solids, but

always with the requisite flirty details: ribbons, panels, ruffles or lace.

David Meister’s

brown-toned

paisley silk

dress.

PHOTOS BY KYLE ERICKSEN; MODELS: LAURA TEXTER AND JESSICA K /NY MODELS; HAIR: DANIEL GARZA FOR MELANGE; MAKEUP: ANNIE ING FOR SALLY HARBOR; STYLED BY BROOKE MAGNAGHI; FASHION ASSISTANT: CHRISTINA CHINLOY

Jiwon Park’s

panel dress in

blush cotton

gauze, with

ribbons and

lace details, at

Showroom

Seven;

earrings

by Yoni Z.

Ready-to-Wear Report

Short’s Long Plan at Leslie Fay

Continued from page 2

focused on maintaining and rebuilding retail relationships.

As for whether the firm would ever regain its lofty

volume, Pomerantz’s reply was, “That would be nice.”

Leslie Fay’s global sourcing structure was another

area of the company that took a hard hit from its financial woes. As part of its reorganization plan five years

ago, Leslie Fay closed its long-time production facilities

in the Wilkes-Barre area of Pennsylvania. It has moved

most of its production offshore, but maintains some

local manufacturing, which Short said is important in

chasing trends.

To reduce cost by taking the sourcing operations outof-house, Leslie Fay executives told WWD that the company has entered into an exclusive agreement with Hong

Kong-based Li & Fung, the $4.2 billion global sourcing

and supply chain management company. In the new

agreement — which was finalized at the end of June —

Li & Fung is now fully responsible for all of Leslie Fay’s

fabric and manufacturing sourcing worldwide.

Li & Fung also absorbed Leslie Fay’s Guatemala

sourcing office, it’s only remaining sourcing bureau.

Short said Li & Fung’s knowledge of the Far East combined with its sound reputation made for an ideal

sourcing partnership.

“Cash is best deployed working on product, price

value and marketing,” Short said. “By partnering with Li

& Fung, we allow ourselves to redirect our funds into the

front-end of the business and we significantly enhance

our negotiating power with the mills, which will result in

full margins for our retailers and for us. Li & Fung has

tremendous weight in markets around the world.”

Li & Fung appointed Debora Vinson as division manager for the Leslie Fay account, along with a team of

five product managers to work directly with the firm in

New York. Additionally, there are about 50 to 60 other

people that will work on the Leslie Fay account in its

network of 68 sourcing offices in 40 countries. Currently,

areas where Leslie Fay teams have been placed include: Hong Kong, The Philippines, Indonesia, Korea

and India.

On the Leslie Fay side, Lee Polsky was hired as senior

vice president and is the new head of global sourcing.

Polsky has been involved in the implementation of Li &

Fung as it becomes the company’s exclusive buying agent

outside the U.S., which is to be fully implemented this week.

Short said apparel sourced by Li & Fung will start hitting the market in spring 2003 for the Leslie Fay Dress

and David Warren brands, as well as knitwear and

sweaters for the entire company. Li & Fung will source

for the rest of Leslie Fay’s divisions starting in fall 2003.

“Li & Fung will find the best areas in the world to

manufacture and strive to minimize lead times,” Short

said, adding that another key objective is to focus on design details and embellishment in the product. “We

want to make sure that the price-value equation in

every item in every line represents great value to the

final consumer.”

The agreement with Li & Fung and the announcement last week to sell Trio New York are the first major

marks that Short has made on the company since he

began working there in March. In keeping with its current plan to remain cautious and streamline operations,

Leslie Fay announced after a board meeting Thursday

the decision to sell Trio, the ready-to-wear line it acquired only eight months ago, as reported.

Short said Trio — a nine-year-old company designed

by husband-and-wife team Steven and Judy Garfield —

has too similar of a market to David Warren and the licensed Liz Claiborne Dresses and Evening lines. In an

MARKET BASKET

MICHEL KLEIN’S NEW LINE: Paris-based designer Michel Klein,

who has a flourishing business in the Far East with his

Japanese partner of 12 years, Itokin, is out to beef up his

business elsewhere in the world. Klein will launch a new

secondary line, MK Michel Klein, this September at the Who’s

Next trade show in Paris.

“It’s a collection geared to vacations and sunny weather,”

explained Klein. “There are a lot of colorful prints and

embroidered pieces.”

Wholesale prices will range from $25 for a top to $60 for a

dress. Meantime, Klein’s signature collection is carried in

about 50 doors, including Le Bon Marché in Paris and Barneys

New York. Klein said he had $60 million in sales last year.

“In Asia, our business continues to grow, with 20 to 30

percent increases every season,” added Klein. “So I told

myself it’s about time to start concentrating on other

markets, too.”

PHOTO BY KYLE ERICKSEN

WWD, TUESDAY, JULY 30, 2002

6

From left, Linda Larsen German, John Pomerantz and W. John Short.

interview last week, Short said Trio was not a strategic

fit in terms of remapping.

“When you look at the power of the Liz Claiborne

and David Warren names, Liz is the top of the heap and

David Warren is a strong second,” Short said. “Trio is a

faraway third in our stable of brands.”

Short questioned whether or not a company starts to

cannibalize itself by having too much investment in the

same distribution channel, but cited no plans to sell other

areas of the business. He also said the company is always

on the lookout for new brands, as long as they don’t overlap with other labels in Leslie Fay’s current group.

In another result of the cautious attitude at Leslie

Fay, the company’s planned relaunch of the Outlander

label for fall 2003 still has a green light, though the project has been postponed for one year. Outlander, which

Short said was a $50 million brand in the early Nineties,

was known for its novelty knitwear. But Short said it’s

necessary to focus on squaring away the core business

before relaunching other labels. Short said he hopes

Outlander will offer a more diversified portfolio of

brands through the line’s sportswear and knitwear.

Further, Short said labels that carry high brand

recognition with consumers and retailers — such as the

dormant Breckenridge and Personal Sportswear labels

— are projects that he would like to see relaunched in

the future, though executives at the company have

made similar claims since 2000.

Leslie Fay Sportswear, however, which has not been

produced for the past three years, will relaunch at the

beginning of August during market week here with a

new spring 2003 collection.

The sportswear line has been designed alongside

Leslie Fay Dress, in terms of fabric and color themes, in

an overall goal to weave Leslie Fay Dress and

NINA NEWS: Lynda Galayda has been appointed executive vice

president of new business development at moderate dress line

Nina Leonard. Galayda was most recently with Foley’s, a

division of May Co. She will be involved in merchandising and

marketing the Nina Leonard line.

SAO NICE: A Brazilian hospital honored the Council of Fashion

Designers of America +by dedicating its ambulatory wing to

the group for its Fashion Target Breast Cancer initiative.

CFDA president Stan Herman and executive director Peter

Arnold, along with Tony Saffieri, FTBC executive producer,

made a trip to São Paolo, Brazil, this month for the city’s

fashion week and to tour the Instituto Brasileiro de Controle do

Cancer, which FTBC supports. The cancer treatment facility

has been expanded over the past seven years thanks to FTBC

support and has raised nearly $8 million for the cause.

More than 300 cancer patients joined hospital employees

in surprising Herman, Arnold and Saffieri with the dedication

of the ambulatory wing during their visit. Founded in 1994,

FTBC is now offered in eight countries.

Sportswear into a more unified brand. Leslie Fay Dress

is headed by Cate Bandel, who has held the post of president for the past year.

Frank Spina, a former Maggie London executive,

joined Leslie Fay on July 1 as design director of the dress

division. Spina will report to Bandel, as well as collaborate with the designer of Leslie Fay Sportswear — a vacant position that the company said it’s looking to fill.

Spina is also coordinating design with the company’s

shoe and handbag licensees, with the goal of updating

the style to match that of the overall Leslie Fay image.

Pat Kinney was hired in June as president of the entire sportswear group, which includes Joan Leslie,

Haberdashery and Leslie Fay Sportswear. It will also

include Outlander when it launches. Lynn Olsen was

hired last month as the director of merchandising for

the sportswear group.

“The Leslie Fay customer is really 55 years old and

above,” said Larsen. “We want to bring clarity to the

brand and tie sportswear [and the main collection] with

an aesthetic that is unified. We don’t want to walk away

from our customer, but we need to adjust the product to

be from 44 to 59 years old.”

Larsen, who’s primary responsibility is to oversee

product development, said there will be changes to the

clothes starting in spring 2003 in terms of a more youthful fit and by being more trend oriented.

“The product will be appropriate,” she said. “We’re

implementing these changes subtly, in ways that aren’t

scary to the consumer. Change will be obvious and what

we really tried to do is honor the existing consumer and

not disappoint her, yet bring the line subtlety forward to

a more updated and youthful look.”

Annette Mathieu was promoted to president of David

Warren Dress, where she was previously the head of

merchandising for the division.

Brands under the Leslie Fay umbrella will also see

what Short calls an “image audit” and will receive new

labels and hang tags, starting with the Leslie Fay brands

this spring. Jennifer Crawford was hired in June as director of marketing and creative services to oversee the

new image at retail. Changes to the other brands will be

rolled out as soon they are finalized, though Larsen did

not disclose dates or descriptions of the changes.

Image-oriented Web sites for each brand, with information about retail partners and store locations, are also

planned, but dates are yet to be determined.

As for which brand under its umbrella had the most potential, the executives pointed to Cynthia Steffe, the contemporary sportswear line acquired by Leslie Fay in 2000.

Leslie Fay, founded by Pomerantz’s father, Fred, in

1947, was one of the first to go public, and has since

been taken private and public several times over the

years. As for taking the company public once again,

Short said there are no current plans. However, he said

the company’s primary investor, Three Cities Research,

has a track record of investing with companies that

eventually go public and that a stock offering of some

sort is a possibility down the road.

Continued from page 2

186.10 points, to close at 4,202.70.

Workers struck several WalMart stores in Germany last

Friday and Saturday, though no

stores were closed. The strike

was instigated by Ver.di, Germany’s service union, which is

trying to pressure Wal-Mart to

join the German Employer’s

Federation, which the union negotiates with on salaries and

other issues on behalf of retail

workers. Ver.di said Monday

that it would continue to call for

strikes at Wal-Mart stores in

Germany, at as of yet unspecified dates, until Wal-Mart joins

the Federation. There are 95

Wal-Marts in Germany.

Sales for the overall company

slid below plan last week, though

Wal-Mart said it would still hit

Gilson and Turner

Planning to Exit

From Swiss Army

NEW YORK — Swiss Army Brands

Inc., a division of Victorinox AG,

said Monday that chairman Peter

Gilson and president A. Jeffrey

Turner plan to resign “in the immediate future,” although the

company did not specify when.

This follows news last week

that Swiss firm Victorinox AG

has agreed to purchase the remaining outstanding shares —

about 33 percent — of Swiss

Army that it doesn’t already own.

Swiss Army makes pocket

knives, watches, sunglasses and

a variety of other products.

On Monday, Victorinox said

that Susanne Rechner, senior vice

president of global watches at

SABI, was to be designated president of Swiss Army Brands if and

when the tender offer is completed. Both Gilson and Turner have

indicated their intention to tender all the shares they hold.

As part of the agreement, Victorinox will pay $9 a share in cash

for the approximate 2.7 million

outstanding shares of SABI held

by other holders. The deal is slated to be completed in mid-August,

according to a firm spokesman.

The two companies have engaged in legal rankling in recent

months regarding the sale. In

June, both companies issued

statements announcing the tender

offer, but later in the month a

number of lawsuits were filed on

behalf of shareholders of SABI asserting that Victorinox’s offer was

“unfair” and “grossly inadequate.”

In regard to the latest deal, a

special outside committee determined that the tender offer is

“fair and in the best interest of

stockholders of Swiss Army

Brands,” Victorinox stated. Most

of the lawsuits are still pending,

according to the spokesman.

Victorinox, headquartered in

Ibach-Schwyz, Switzerland, also

makes pocket knives and tools.

In the first quarter ended

March 31, SABI, based in Shelton,

Conn., reported a loss of $936,000,

an improvement over a loss of

$2.3 million in the previous year’s

quarter. Revenue gained 17.6 percent to $24.7 million.

In recent years, Swiss Army

has begun to add more categories

and promote itself as a lifestyle

brand.

— Melanie Kletter

the lower end of its July comparable-store sales plan for a 5 to 7

percent uptick. On a recorded

call, the firm attributed some of

the weakness to strong year-ago

sales driven by the distribution of

income tax rebate checks.

J.C. Penney said its department stores should comp down 2

to 4 percent in July, in line with

its original expectations. Last

week, Penney’s said it was tracking toward a 2 percent decline.

Federated Department Stores

Inc. continues to expect its samestore sales to be flat to slightly

down in July, and Target said

comps in its discount stores came

in below plan due to weakness in

its men’s wear and gardening

areas.

— With contributions from

David Moin

NEW YORK — Strong sales in

each of its divisions combined

with reduced expenses paved

the way for Steven Madden Ltd.

to report a 19 percent increase

in its second-quarter profits and

raise its outlook for the year.

For the quarter ended June

30, the Long Island City, N.Y.based maker of shoes and accessories yielded net income of

$5.3 million, or 38 cents a diluted share, beating Wall Street’s

consensus estimates by 3 cents.

Last year, the company reported income of $4.4 million, or 34

cents a diluted share. Sales skyrocketed to $88.1 million, registering 47.9 percent higher than

year-ago sales of $59.6 million.

“We are extremely encouraged by our performance yearto-date and are very excited

about the direction of our business,” Jamieson Karson, chief

executive, said in a statement.

“As we move forward into the

balance of the year and beyond,

we intend to focus not only on

further strengthening our core

brands, but also on identifying

new areas of growth and diversifying our business through additional licensing arrangements

and international expansion.”

Revenues from the wholesale business, comprising SM’s

five brands — Steve Madden

Women’s, Steve Madden Men’s,

Stevies, LEI and David Aaron —

significantly exceeded plan, increasing 66.5 percent to $65.7

percent from $39.5 million.

Results were driven by high

double-digit increases across

the board and the strong sales

of Madden Men’s, which grew

600 percent year-over-year.

Retail revenues were boosted 11.5 percent to $22.4 million

and up 5.1 percent on a comparable-store basis. The company

currently operates 74 stores, including its Internet site, and

plans to add eight more during

the rest of the year.

Based on the quarter’s results and current sales trends,

SM bumped its earnings target

for the year to between $1.33

and $1.38 a share, from the previous range of $1.28 to $1.33.

For the first half, income rose

15.9 percent to $9.4 million, or 68

cents a diluted share, compared

with income of $8.1 million, or 63

cents, in the corresponding period

last year. Sales grew 37 percent to

$154.7 million versus $113 million.

WWD, TUESDAY, JULY 30, 2002

Stocks Score Again Solid Madden Quarter Ups Outlook

7

The Fiber Price Sheet

Textile Report

Yarn Fair: Branching Out

On the last Tuesday of each month, WWD publishes the current,

month-ago and year-ago fiber prices. Prices listed reflect the cost

of one pound of fiber.

Fiber

Price on

7/26/02

Price on

6/25/02

Price on

7/31/01

Cotton

Polyester staple

Polyester filament

June Synthetic PPI

46.63 cents

53 cents

66 cents

105.4

N/A

50 cents

67 cents

106.4

44.15 cents

52 cents

67 cents

107.8

*THE CURRENT COTTON PRICE IS THE JUNE AVERAGE ON FIBER BEING DELIVERED TO SOUTHEASTERN

REGION MILLS, ACCORDING TO AGRICULTURAL MARKETING SERVICES/USDA. INFORMATION ON POLYESTER

PRICING IS PROVIDED BY THE CONSULTING FIRM DEWITT & CO. THE SYNTHETIC-FIBER PRODUCER PRICE

INDEX, OR PPI, IS COMPILED BY THE BUREAU OF LABOR STATISTICS, AND REFLECTS THE OVERALL CHANGE IN

ALL SYNTHETIC-FIBER PRICES. IT IS NOT A PRICE ON DOLLARS BUT A MEASUREMENT IN HOW PRICES HAVE

CHANGED SINCE 1982, WHICH HAD A PPI OF 100. WOOL PRICES FOR THE MONTH WERE NOT AVAILABLE

PHOTOS BY TALAYA CENTENO

WWD, TUESDAY, JULY 30, 2002

8

Editor’s Note: The Fiber Price Sheet resumes its normal monthly appearance today after a two-month break. The U.S.

Department of Agriculture suspended its tracking of landed cotton prices in May. It has since resumed tracking them.

Silk City Fibers’ multicolored rayon and nylon. Overfil’s green and multicolored cotton, wool, nylon, polyester and acrylic.

By Joshua Greene and Daniela Gilbert

NEW YORK — Diversification was a key theme among

vendors at last week’s Yarn Fair International, with

executives explaining that they’re trying to expand their

product offering beyond the sweater-and-sock trade,

which had been the core of the show.

But the changes at the three-day show, which

wrapped up at the Metropolitan Pavilion in here on

Wednesday, were not limited to vendors’ assortments.

More than half of this year’s exhibitors were first-time

participants — making for a pronounced increase in the

number of foreign yarn spinners and fibermakers participating. While U.S. firms represented the plurality of

exhibitors, 32 percent of the total, other exhibitors

hailed from nations including Italy, Spain, Canada, the

U.K., China, Japan and Mauritius.

Several vendors who specialize in apparel said home

furnishings is a market they would like to enter and

brought examples of yarns that could be used in both

knit apparel and upholstery.

At Kennett Square, Penn.-based Kennetex, which

specializes in nylon and polyester yarns, director of

sales and marketing Amy Seiler said attendees looked

to her yarns with high luster for end-use in apparel and

home furnishings. Microfiber chenille yarns were also

targeted by would-be clients for various end-use products, Seiler said.

The company also touted its new line of Kennetex

Express Yarns — an array of $1.88-a-pound polyesterolefin yarns that can be shipped within 24 hours.

Eric Nichols, director of sales at Montreal-based

CNS Yarns, said the company’s tricolor acrylic-nylon

yarn — dubbed “Ménage-à-trois by Nichols” — garnered

the most attention. He also said he expected bouclés

and acrylic-acetate blends to be strong for fall 2003.

Victoria’s Secret’s Paola Monje said she was looking

for tape yarns in different blends at the fair. Monje, a

production coordinator for sweaters at the retailer, said

she was interested in yarns that caught her attention

the moment she saw them. Flat ribbon yarns as well as

natural fibers, such as silk and mohair, mixed with synthetics were also an interest for Monje.

“I’m also looking at novelty yarns such as bouclés

and morels,” said Monje. “I’m always inspired by colors,

and my eye is going to pastels.”

Buyers are liking the smoother

“hand

and the better drape that

matte yarn offers.

”

— Peter Sagal, Silk City Fibers

Fancy yarns were also a popular interest at Loyal

Light International, a Guang Zhou, China-based company, in its sixth year of exhibiting at the Yarn Fair. Loyal

Light specializes in acrylic yarns priced at $4 a pound

and under.

“Chunky gages are popular,” said Joanna Lee, managing assistant. “We’re seeing a lot of interest with

acrylic-spandex blends and acrylic-mohair blends.”

For customers who were interested in full garment

packages, Lee said Loyal Light has partnerships with

apparel manufacturing plants in China.

The strongest trend at this year’s Yarn Fair was multicolored yarns. Many exhibitors showed them in a variety

of constructions, including bouclé, tweed and chenille.

At Grignasco, Italy-based spinner Grignasco Group,

export sales manager Andrea Rossi said that multicolored looks will be essential for fall 2003, citing that the

mixing of color gives a three-dimensional, textured effect. One example Rossi pointed out was a lofty beige

wool yarn, accented with flecks of color throughout.

At Prato, Italy-based Overfil SpA, soft and lightweight

chunky looks were key, according to export manager

Sissi Giulivi. The company emphasized texture in yarns,

including slubbed varieties. Color was also important.

“The general trend lately is to go simple,” Giulivi

said. “But we want to offer very distinct novelties to give

our customers something new.”

Vaiano, Italy-based Pratofilati Srl, meanwhile, featured a selection of rougher bouclé yarns with a multicolored effect that included mixtures of yellow, red, orange, brown and wine.

“People are not really looking for solids,” said Jen

Doyle Fischer, yarn sales representative at Fall River,

Mass.-based Nortex Yarns. “Anything multicolored is key.”

Fischer said Fireworks — Nortex’s new space-dyed

bouclé yarn in acrylic and polyester — caught the attention of show attendees.

Space-dyed yarns were also on view at Wattrelos,

France-based Groupe Saint Lievin. Sales director Alain

Vandenabeele highlighted multicolored yarns with

fluffy and hairy qualities that lend a graphic feel.

Peter Sagal, president of Paterson, N.J.-based Silk

City Fibers, said he saw an increased interest in multicolored, textured yarns at the fair. Sagal said Silk City

has moved away from shiny looks, offering matte rayon

yarns in a variety of colors.

“These styles have been surprisingly strong,” Sagal

said. “I think buyers are liking the smoother hand and

the better drape that matte yarn offers.”

Unifi Cuts Losses in 4th Quarter

TED

PRIN

&

S

LID

F SO WOVEN

O

S

H

M

C

r

A

a

T

e

OGR

TRE

rensw

K P R Y E D & S wear • Childessories

C

O

T

c

s

I N - S YA R N - D ear • Meniforms • Ac

ensw

• Un

Wom ngewear

Lou

CUSTOM DESIGN • PRINTING • DYEING

INTERNATIONAL SALES AND SHIPPING

129 WEST 132 STREET • LOS ANGELES CA 90061 • PHONE: 800-877-2066 • FAX: 800-788-5283

NEW YORK SHOWROOM: 110 WEST 4OTH STREET #1901 • NEW YORK NY 10018 • PHONE: 212-840-1266

NEW YORK — Unifi Inc. significantly reduced

the flow of red ink in the quarter and the year

and is hoping to cut it further by providing polyester to Western companies operating in Asia.

Fourth-quarter net losses narrowed to $1.6

million, or 3 cents a share, from the year-ago

deficit of $15.6 million, or 29 cents. Results for

the most recent quarter include a pretax loss of

$7.4 million, or 8 cents a share after taxes, from

the sale and write-down of excess real estate.

Excluding this loss, income for the quarter

reached $3 million, or 5 cents a share.

Sales for period ended June 30 slid 0.4 percent to $256.5 million from $257.6 million a year

ago. The just-ended quarter included an extra

week compared with the year-ago period.

Chief executive officer Brian Parke noted in

a statement: “Each of our businesses in Brazil,

Ireland and England were profitable in the

June quarter.

“We have made significant progress in upgrading our business systems to Web-based technology, allowing us to more effectively plan our

entire global supply chain.”

The Greensboro, N.C.-based textured yarns

producer also entered agreements with Tuntex

to help that firm’s Thailand manufacturing facility ramp up the quality and variety of its polyester filament yarns while using the Thai plant

as a base for sourcing in Asia.

Mike Delaney, senior vice president, noted:

“Asia represents the majority of global poly-

ester textured yarn consumption. The agreements with Tuntex will establish an effective

foothold in the market from which we can distribute high-quality textured polyester yarns,

particularly to supply the needs of Western

companies that have already shifted production to the region.”

Asia represents the

“majority

of global polyester

textured yarn consumption.

”

— Mike Delaney, Unifi

For the year, losses tapered slightly to $43.9

million, or 82 cents a share, from $44.7 million, or

83 cents, a year ago. Before a change in accounting standards, losses narrowed dramatically to

$6.1 million, or 11 cents a share. The period also

included a pretax loss of $1.7 million, or 2 cents a

share, from the sale and write-down of property

and equipment as well as a $33.8 million pretax

benefit from Unifi’s manufacturing alliance with

DuPont, which is currently in arbitration.

Sales were down 19.1 percent to $914.7 million from $1.13 billion a year ago.

— Evan Clark

Obituaries

Prominent in Fifties Fashion

NEW YORK — Jeanne S. Campbell, a designer who played a

role in the Fifties sportswear

movement in America that included more famous names like

Bonnie Cashin and Claire McCardell, died last Wednesday of

complications resulting from a

stroke. She was 82.

While her career, which

spanned more than 30 years, has

not had as visible an impact in

comparison to the continued

name recognition of some of her

peers, Campbell’s designs for

Sportwhirl, a New York manufacturer, were highly successful

on Seventh Avenue and had a

marked impact on the mid-century popularization of inexpensive separates. Her designs were

featured on the covers of Vogue,

Harper’s Bazaar and Glamour in

the Fifties; she received the

1955 Coty American Fashion

Critics’ Award; and, in 1970, she

was among 15 American designers included in a WWD ranking

of the “Women of the Year.”

That’s partly because Campbell’s theories of design often

placed the accent on timeless

and fairly nondescript styles

with a breezy slant, rather than

the trendy look of the moment.

As she once said, “It’s a no-age,

no-price look, and it’s up to the

nized with a Mademoiselle Merit Award in 1951, before being

recruited to Sportwhirl. She

continued to build collections

based on a separates philosophy, with fabrics particularly

suited for casual, ever yday

wear. Her clothes, sold under

the “Jeanne Campbell for Sportwhirl” label, turned up on Ava

Gardner, Lynda Bird Johnson

and Liza Minnelli.

“She always tried to make

things classic and timeless, so

they didn’t go out of style,” said

Petersen, who described Campbell as a stern, but nontraditional mother, whose success

was often based on sheer force

of will.

“She was strong and ambitious and filled with great

ideas,” Petersen said. “Whatever

idea she had, she made it happen. Nothing could stop her,

whether it was designing or

working in the garden, or even

putting up a ceiling herself. She

never wanted to grow old, and

even had her nails and hair

done to the end. She had to be

like the first Martha Stewart —

she always had unique ways of

doing things.”

Liesel Boose, who knew

Campbell since around 1950, had

a similar impression. Boose was

Campbell’s theories of design often

placed the accent on timeless and fairly

nondescript styles with a breezy slant,

rather than the trendy look of the

moment. As she once said, “It’s a noage, no-price look, and it’s up to the

person who wears it to make the look.”

person who wears it to make

the look.”

Campbell, who died at the

Oxford, N.Y., home of her

daughter, Jean E. Peterson, had

grown up in Pittsburgh and

wanted to be a fashion designer

since she was 10 years old. After

studying at the Pittsburgh Art

Institute, she opened a small

dress shop in Clearwater, Fla.,

where her family had a summer

home. It was there, during

World War II, while she worked

for the Civil Aeronautics Administration drawing charts and

maps, that she met her husband,

Edward A. Campbell, a lieutenant in the U.S. Air Force.

Af ter the war, the couple

moved to New York and Campbell got a job designing for

Loomtogs, where she worked for

about five years and was recog-

working as a fashion illustrator

for WWD and met the designer

through the paper’s art director,

who said Campbell could help

her find an apartment in the city.

Campbell rented her an apartment directly across from hers on

East 48th Street, which had been

redecorated when the former

tenant moved out.

“It was cold as anything, but

beautifully decorated,” Boose

said. “Jeanne would come over

and try things on me, then ask

me to take them into Women’s

Wear to promote them a little

bit. She once had me wear a

burlap outfit — burlap from

head to foot — because someone

from Paris had done it and it

was a big hit. She knew what she

wanted and she was determined

to get it.”

After divorcing her husband

fe, Bill Robinson, Victor Costa,

Cathy Hardwick, Jeffrey Banks,

David Minka and Chrystine Forti.

In the Seventies, when designers

were only beginning to rise as

celebrities, Lesser helped clients

protect the rights to their names

and designs.

“They were to a large extent,

I’ll use the term ‘abused,’ by the

trade,” at the time, said Harrison.

Andrew Gowen, an analyst with

Lehman Brothers, said Bulgari is

suffering more because it experienced such a boom in the past

and grew more than competitors.

He explained that back in the

go-go years of the Nineties,

Cartier’s sales grew in the single

digits while Bulgari’s ballooned

in the double digits. So when the

market turned, stores found

themselves with that many more

Bulgari watches.

Trapani said Bulgari struggled in the past as third-party retailers ordered fewer watches to

give them time to deplete unsold

stock in the back room. But he

said orders should pick up in

coming months and the flow of

watches between Bulgari and its

retailers should return to normal

starting in August. Backed-up inventory was a problem until 15

months ago, but slowly it is depleting, he said.

The situation is improving,

but a real rebound isn’t seen

until next year at the earliest,

said analysts with one forecasting a second-quarter slide in

Bulgari watch sales of 20 to 22

percent, although comparables

in the second half of the year

should improve, since sales in

the latter part of 2001 (after

Sept. 11) were especially weak.

“The question is whether these

third-party retailers have clean inventories,” said Flouquet, who

predicted that stores will probably

take a more conservative route to

avoid restocking the back room.

“In U.S. stores, it looks like it is

improving. Will they reorder? Yes,

but probably not en masse.”

Fashion Scoops

in 1964, Campbell moved to

Westhampton, N.Y., where the

couple had converted two neighboring shacks into a remarkable

house that she operated as a

bed-and-breakfast until recently.

She continued to commute to

work for Sportwhirl until 1977

and remained active as an instructor and judge at Parsons

School of Design, which has established a scholarship fund

under her name. She also often

traveled to Barbados and Peru

with the International Executive

Service Corp. to consult with

fashion industries and instruct

young designers.

In addition to her daughter

and ex-husband, Campbell is

survived by a son, Edward A.

Campbell Jr., a graphic designer

in New York.

— Eric Wilson

Stanley Lesser, 72, Designer Attorney

NEW YORK — Stanley C. Lesser,

an attorney who was an early advocate of designers’ rights to

their names, died at his New

York home on Sunday. He was 72

and had a brain tumor, according

to David Harrison, his partner in

the firm of Lesser & Harrison.

During his 48-year law career,

Lesser represented designers

such as Perry Ellis, Cynthia Stef-

Continued from page 2

“[Consumers] aren’t still buying

watches as accessories that they

can do without. Instead, they are

buying a watch,” said one analyst.

And although Bulgari has been

making watches since the Seventies, some analysts noted that

Bulgari finds it hard to compete

with more established brands

steeped in technological innovation like Cartier or Patek Philippe.

“Bulgari is one of my favorite

stocks, but I would never buy a

Bulgari watch,” said one analyst. “It is seen more as a fashion product or jewelry than as a

real watch.”

Flouquet of JPMorgan said

Bulgari suffered in the United

States because its flashier fashion image attracted a younger

clientele. Those were among the

first consumers to curb spending

in the downturn after Sept. 11.

“The golden boys and golden

girls — they were hit pretty hard,”

she said.

Still, Trapani denied that Bulgari’s watch collections are overexposed to fashion’s whims, noting a wide variety of timepieces,

ranging from the intricate whitegold-and-diamond bangle Trika

watch to the sporty Diagono

made of matte yellow gold and

black rubber.

“What has always helped Bulgari’s watch results and will help

us a lot in the future is a big glamour component,” said Trapani,

who boasts of Bulgari’s latest

product placement: In “Minority

Report,” Tom Cruise sported a futuristic Bulgari timepiece that

was custom-crafted for the film.

“He brought a sagacious approach to these things that some

of these folks didn’t have.”

Lesser is survived by his wife,

Diana; two daughters, Karen and

Susan; a son, David and six

grandchildren.

Funeral services are scheduled for today at 11:45 a.m. at The

Riverside, West 76th Street and

Amsterdam Avenue, in Manhattan.

TOGA PARTY: After bowing out of

the gala-show hoopla this year, the

Metropolitan Museum of Art is

planning a dramatic return of its

Costume Institute Gala on April 28,

2003, with a title sponsor already

in place. Gucci has signed on to

host the “Party of the Year” and

the Met’s upcoming “Goddess”

exhibit, which explores how

classical dress has inspired and

influenced art and fashion

throughout the ages.

“Classical revivals in dress are a

mainstay not only of contemporary

fashion, but are also found

throughout costume history,” said

Harold Koda, curator of the Costume

Institute. “We’re going to track the

Greco-Roman authority back through

the Empire, Rococo and Baroque

periods.” The exhibit will even take a

look at Hollywood’s representation of

the classical past, as seen in Isadora

Duncan’s dance performances for

“Medea” and “Gladiator.”

MATTHEW’S MEMORIES: Matthew

Williamson is planning to look back

on his career as a fashion designer

— all five years of it — in a

retrospective scheduled to take

place in London. The designer has

asked Rankin to photograph

friends, including Jade Jagger,

Trudie Styler, Helena Christensen,

Sophie Dahl and Claudia Schiffer, in

looks from his past 10 seasons.

The photographic exhibition will

take place in September during

London Fashion Week in a venue

that’s still to be decided, and plans

are in the works to take it to other

fashion cities. A spokeswoman said

Williamson is entirely serious about

the flashback after such a brief

period in business — and there’s

no irony intended. “He really

wanted to document the past five

years of his career, and thank his

friends — like Jade, Helena and

Trudie — who’ve stuck with him

since the beginning,” she said.

FOOT FETISH: Gilles Bensimon’s fall

boots and sandals story in the

August issue of Elle has raised

several eyebrows with images of a

woman kissing another’s red

lacquered nails or another in an

Alexander McQueen corset on all

fours, rump to the camera. But one

of the less salacious images of a

Christian Louboutin satin mule on

page 152, shown as a still life of the

shoe propped against a photograph

of a woman wearing them, holds a

more subtle mystery. Turns out the

model in question is Diane Von

Whose legs are these?

Furstenberg, a close pal and frequent

collaborator of the footwear

designer, although her stems are not

credited in the caption.

“I thought it looked better with

no text,” said Bensimon,

publication director of Elle. “The

idea was to have Diane’s legs,

because, I thought, if her legs could

talk, they would have a lot to say.”

WWD, TUESDAY, JULY 30, 2002

Bulgari’s

Tough

Time

Designer Jeanne S. Campbell,

9

WWD, TUESDAY, JULY 30, 2002

10

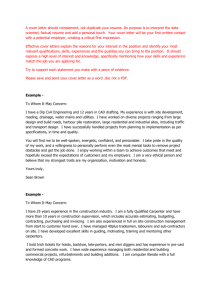

Zara’s store in Mexico.

Zara’s store on

Madrid’s Gran Via.

Inditex’s corporate headquarters in La Coruña, Spain.

Inside the Zara store in Nice, France.

Inside the Inditex Empire

By Barbara Barker

Amancio Ortega, Inditex

founder and chairman.

LA CORUNA, Spain — The Inditex juggernaut shows

no signs of slowing.

The industrial and retail behemoth based here,

which owns Zara and five other branded apparel

chains operating 1,377 stores in 41 countries, plans to

open up to 275 stores worldwide this year in its everincreasing expansion. It also expects to launch a home

line next year to go along with its women’s, men’s, children’s wear, accessories and beauty products.

The one market that remains off Inditex’s radar

for the time being, however, is the United States. The

company currently operates four Zara stores in

Manhattan; one each in Long Island and New Jersey;

two in Miami and one in Puerto Rico.

“The time is not right [to expand in the United

States],” Raul Estravera of Zara said in an interview.

“We are still concentrating on Europe. The U.S. requires an enormous effort, and we can’t work on both

markets at the same time.”

He did predict one U.S. opening by year’s end,

“probably,” (a word he used throughout the conversation) with follow-up outlets “probably” of two to

three per year.

“The events of Sept. 11 resulted, obviously in a

drop in U.S. sales,” Estravera added. “We even

closed stores for a few days. But today, sales are

good; they have recovered.”

In addition, the stock valuation was pushed down

to its lowest levels of $17.78 to $19.76. Currently, at

$20.75 to $22.72, it is trading higher than before the

attacks, Estravera said.

Elsewhere, though, Inditex continues to step on

the accelerator, and it remains one of the most-admired retailers in the world. Zara operates stores in

Canada, South America, Asia and the Middle East.

Europe, including Spain, accounts for roughly 77

percent of the group’s total sales.

“In Europe, our focus is on Germany — that’s the

key market — also France and the U.K., along with

smaller countries like Holland, Belgium and

Austria,” Estravera said. “We will still open stores in

Spain and Portugal, but not at a significant rate.”

“Normally, the retail operation is not a franchising system,” added his colleague Carmen Melón

(generally speaking, the company bypasses traditional management titles, but the duo oversee all the

group’s external communications). “There are three

joint ventures — in Japan and Germany (with the

Bigi and Otto Versand Groups respectively) and in

Italy (with Grupo Percassi) — but we have franchises

in the Middle East, because it’s the easiest way to do

business there.”

The once-secretive Inditex is beginning to provide more peeks into its operations following its

successful initial public offering in May 2001. The

IPO reportedly raised $2 billion for 26.1 percent of

the company and valued Inditex overall at $10 billion. Based on a solid performance, the stock was

admitted to the blue-chip IBEX 35 index six weeks

after its market debut. Earlier this month, company

founder and chairman Amancio Ortega sold 1.98

percent of his participation for $255.6 million to institutional investors. He retains majority ownership

with 59.3 percent. The remainder is owned by

15,000 company employees — out of a workforce of

almost 27,000.

And to think it all began with a pink quilted robe.

In the early Sixties, or so the story goes, Ortega decided to make that robe and other basic garments

like underwear and housecoats cheaper than any-

11

WWD, TUESDAY, JULY 30, 2002

Inditex’s newest chain, the Oysho lingerie and sleepwear store.

Zara’s multilevel store in Tokyo.

Who’s the Next Zara?

MADRID — While major industry leaders here say nobody does it better, there are some heirs apparent nipping at Zara’s heels. How close is the competition?

Mango: Spain’s second-largest apparel exporter

(women’s only) after Inditex, with 600 stores in 68

countries and forecast retail sales for fiscal 2002 of

$1.6 billion. The chain, which manufactures the majority of its merchandise like Inditex, is currently targeting the European market, especially the United