Wolseley Overview - Wolseley Private Equity

advertisement

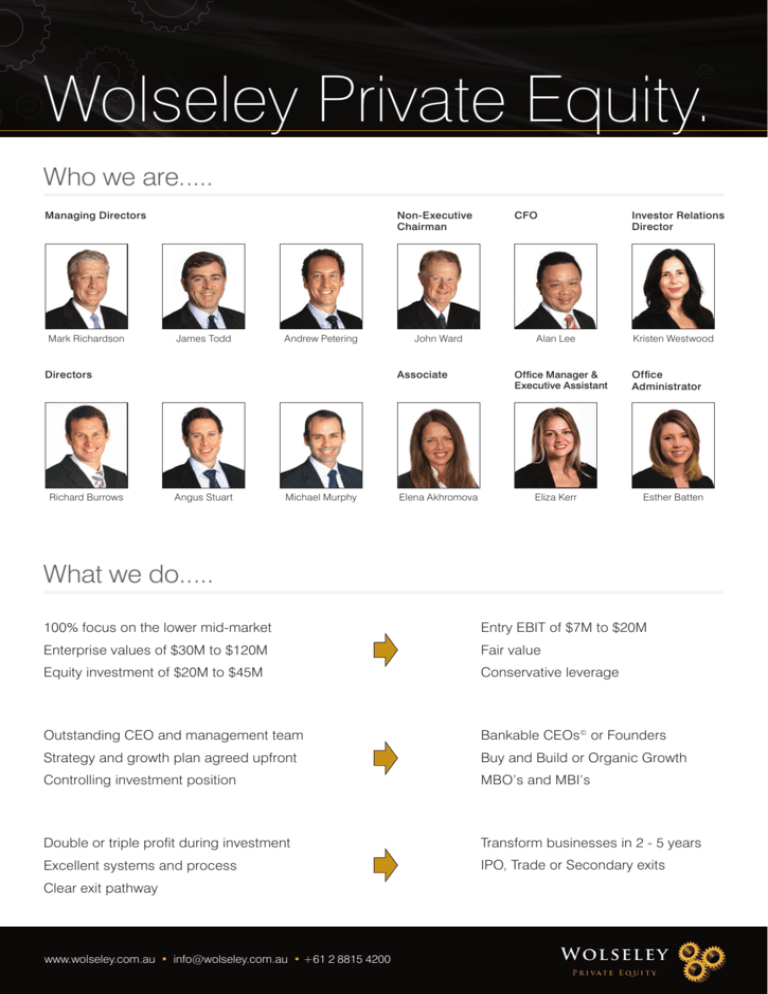

Wolseley Private Equity. Who we are..... Managing Directors Mark Richardson Non-Executive Chairman James Todd Andrew Petering Directors Richard Burrows John Ward Associate Angus Stuart Michael Murphy Elena Akhromova CFO Alan Lee Office Manager & Executive Assistant Eliza Kerr Investor Relations Director Kristen Westwood Office Administrator Esther Batten What we do..... 100% focus on the lower mid-market Entry EBIT of $7M to $20M Enterprise values of $30M to $120M Fair value Equity investment of $20M to $45M Conservative leverage Outstanding CEO and management team Bankable CEOs© or Founders Strategy and growth plan agreed upfront Buy and Build or Organic Growth Controlling investment position MBO’s and MBI’s Double or triple profit during investment Transform businesses in 2 - 5 years Excellent systems and process IPO, Trade or Secondary exits Clear exit pathway www.wolseley.com.au • info@wolseley.com.au • +61 2 8815 4200 Current investments Aggregation of independent Australian day hospitals Buy and Build - Bankable CEO©- Geoff Thompson - 2013 #1 in key segments of Australian print industry including web offset, sheetfed and digital Grown from $280M to $340M - Organic Growth - Bankable CEO©s- Geoff & Paul Selig - 2012 Each investment made on an exclusive basis 3 succession solutions with 5 Bankable CEOs© Leading wholesale freight forwarder (NVOCC) operating in Australia and Asia Grown from $70M to $146M - Organic Growth - Bankable CEO© - Humphrey Nolan - 2011 Leader in complex infrastructure and mining services solutions Grown from $70M to $95M - Organic Growth - Founder - Mick Boyle - 2010 Australia’s #1 designer, manufacturer and exporter of ambulances Grown from $50M to $55M - Organic Growth - Bankable CEO© - Bill Pike - 2010 Control position in all investments with conservative leverage 5 Organic Growth and 3 Buy and Build investments Global #1 franchise and brand in remanufactured printer cartridges Grown from $250M to $300M retail sales - Organic Growth - Rod Young - 2007 Global #1 in facade access and height safety equipment Grown from $30M to $60M - Buy and Build - 3 bolt ons - Bankable CEO© - Tony Combe - 2007 #1 private Australian electrical and communications services provider PACIFIC SERVICES GROUP Grown from $50M to $315M revenue - Buy and Build - 6 bolt ons - Jeff Bretz - 2006 Realised investments #1 independent Australian childcare and early education provider Grown from $38M to $65M - Buy and Build (11) - Founder - Tom Hardwick - 2011 to 2013 #1 special interest digital and print media publisher in Australia Grown from $15M to $30M - Buy and Build (7) - Bankable CEO© - David Gardiner - 2008 to 2013 Leading Australasian fresh produce, marketing and distribution business Grown from $120M to $350M - Organic Growth - 5 bolt ons - Tony Mahoney - 2006 to 2011 Australia’s leading print management company Grown from $10M to $120M revenue - Organic Growth - Andrew Price - 2000 to 2007 Market leader in air ticket consolidation, leisure and airline representation $900M to $1.1B sales - Buy and Build - 5 bolt ons - Peter Lacaze - 2002 to 2006 We support www.wolseley.com.au • info@wolseley.com.au • +61 2 8815 4200 Outstanding CEOs with small boards and aligned incentives All investments are on strategy and well positioned for exit Secondary Trade Sale Secondary Trade Sale IPO