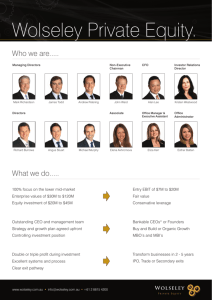

Wolseley Private Equity.

advertisement

Wolseley Private Equity. Who we are..... Managing Directors Mark Richardson Non-Executive Chairman James Todd Peter Hasko Directors Richard Burrows Andrew Petering Associate Angus Stuart Michael Murphy Elena Akhromova CFO John Ward Commercial Director Investor Relations Director Alan Lee Kristen Westwood Office Manager & Office Executive Assistant Administrator Peter White Alison Ensor Eliza Kerr What we do..... 100% focus on the lower mid-market Entry EBIT of $5M to $20M Enterprise values of $20M to $120M Fair value Equity investment of $10M to $35M Conservative leverage Outstanding CEO and management team Bankable CEOs© or Founders Strategy and growth plan agreed upfront Buy and Build or Organic Growth Controlling investment position MBO’s and MBI’s Double or triple profit during investment Transform businesses in 2 - 5 years Excellent systems and process IPO, Trade or Secondary exits Clear exit pathway Targeting 20 - 30%+ IRR and 2 - 3X www.wolseley.com.au • info@wolseley.com.au • +61 2 8815 4200 Our business community #1 in key segments of Australian print industry including web offset, sheetfed and digital Grown from $280M to $320M - Organic Growth - Bankable CEO©s- Geoff Selig & Paul Selig - 2012 Each investment made on an exclusive basis Leading Wholesale Freight Forwarder (NVOCC) operating in Australia and Asia Grown from $70M to $135M - Organic Growth - Bankable CEO© - Humphrey Nolan - 2011 #1 independent Australian childcare and early education provider 4 succession solutions with 5 Bankable CEOs© Grown from $25M to $70M - Buy and Build - 11 bolt ons - Founder - Tom Hardwick - 2011 Leader in complex infrastructure and mining services solutions Grown from $70M to $110M - Organic Growth - Founder - Mick Boyle - 2010 Australia’s #1 designer, manufacturer and exporter of ambulances Grown from $50M to $55M - Organic Growth - Bankable CEO© - Bill Pike - 2010 Global #1 franchise and brand in remanufactured printer cartridges Grown from $250M to $300M retail sales - Organic Growth - Restructure - Rod Young - 2007 Global #1 in facade access and height safety equipment Grown from $30M to $60M - Buy and Build - 3 bolt ons - Bankable CEO© - Tony Combe - 2007 #1 special interest digital and print media publisher in Australia Grown from $15M to $30M - Buy and Build - 7 bolt ons - Bankable CEO© - David Gardiner - 2008 PACIFIC SERVICES GROUP #1 private Australian electrical and communications services provider Grown from $50M to $315M revenue - Buy and Build - 6 bolt ons - Peter White - 2006 Control position in all investments with conservative leverage 5 Organic Growth and 4 Buy and Build investments Outstanding CEOs with small boards and aligned incentives All investments are on strategy and well positioned for exit Realised investments Leading Australasian fresh produce, marketing and distribution business Grown from $100M to $350M - Buy and Build - 5 bolt ons - Tony Mahoney - 2006 to 2011 Australia’s leading print management company $10M to $120M revenue - Growth - Andrew Price - 2000 to 2007 Market leader in air ticket consolidation, leisure and airline representation $900M to $1.1B sales - Buy and Build - 5 bolt ons - Peter Lacaze - 2002 to 2006 We support www.wolseley.com.au • info@wolseley.com.au • +61 2 8815 4200 Secondary Trade Sale IPO