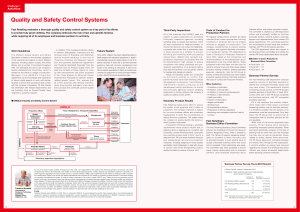

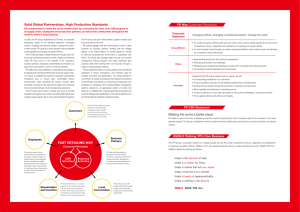

UNIQLO AR05(E)_pdf.p

advertisement