Expansion into Toronto

advertisement

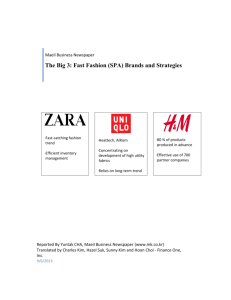

Expansion into Toronto Adrian Iwankewich Daniel Juhasz Daniel Sherrington Eastern Yoo Sunny Dey Vipi Thevathas Wednesday December 3, 2014 Prepared for Paul Gillespie MKTG 5007 Table of Contents Contents Company Overview 1 Executive Summary 2 Market Overview 2 Product & Channel Strategy4 Situation Analysis 6 PEST Analysis 7 Porter’s Five Forces Model 8 The Plan9 Marketing Strategy 10 Communications Strategy 14 Market Analysis 17 Sales Forecast 17 Contingency Plan 18 Works Cited 19 i Company Overview Founded by Tadashi Yanai, the first Uniqlo retail store opened in Hiroshima, Japan in 1984 (Uniqlo, 2014). Initially, Uniqlo started off as a “suburban roadside clothing store network” but in 1998 the company opened its first urban store in the super trendy Harajuku area, Shibuya ward and became very popular in major downtown cities such as Tokyo and Osaka (Uniqlo, 2014). By 2005, the company had over 700 stores in Japan. The success of Uniqlo’s ability to provide superior quality at low prices is due to their “creative” control of the planning, design, manufacturing, distribution and sales (Uniqlo, 2014). of the Soho district in Manhattan, but, once again, sales were not up to standard. Through communication with employees and customers, mid-management discovered that the low sales were due to the unpopularity of the loose fitting apparel. Typically at the time, apparel brands like The Gap, J-Crew and Banana Republic catered to a universal fit, “with a looser, relaxed-in-the-middle fit” (Urstadt, 2010). Uniqlo decided to experiment by introducing slimmer Japanese sizes. As a result, brand equity and location sales rose. Downtown consumers quickly converted into loyal Uniqlo customers (Urstadt, 2010). Usually the company is not concerned with changing their brand line for fads or short-term trends, but the demand for skinnier and slimmer fits in apparel has now become a new universal fashion norm. In 2001, Uniqlo opened their first store in London England. In 2002, they opened their first store in China. And in 2005, they opened their first store in South Korea partnering in a joint venture with Korea’s largest distributor Lotte Shopping Co. LTD. Also in 2005, Uniqlo’s timeless, functional apparel, with its combithe company launches in the United States, opening nation of superior quality and low prices, has prov3 stores in New Jersey shopping malls (Uniqlo, 2014). en recession proof on two major occasions. During In 2006, the company was forced to rebrand their the decade long recession in Japan throughout the American stores due to dwindling sales (Urstadt, 1990s, Uniqlo succeeded in dominating the market 2010). The stores in the New Jersey shopping malls as the go to apparel store for price sensitive shopwere not profitable, and as a result, Uniqlo decided pers. During the global recession in 2009, Uniqlo saw to shift their target from the suburban to the urban their profits rise 17% (Durisin, 2013). As of today, Uniqmarket. Thus, a flagship store was placed in the heart lo now has 1400 stores worldwide and 40 stores in the United States. Retrieved from Google 1 Executive Summary Globally, Uniqlo is the fourth largest Specialty Store Retailer of Private Label Apparel, behind INDITEX (Zara), H&M, and the Gap (Fast Retailing, 2011). Furthermore, in Uniqlo’s 2013 fiscal year, their sales grew 23.1%. Established as the largest apparel retailer in Asia, Uniqlo began expanding into the global market during the early 2000s (Passport, 2014). The apparel market in Canada contains Uniqlo’s main competitors. The competitive landscape is extensive and congested with no brand holding more than 1.9 percent market share (Passport, 2014). It is essential that Uniqlo pursues the proper marketing objectives and strategy to leverage their core competencies of a high quality product, low price, and Japanese identity. Uniqlo’s Canadian marketing objectives are to raise brand awareness, position the company as Canada’s number one casual wear retailer, and to increase market share in the Canadian apparel market to 1.0% by 2022. The marketing strategy to fulfill these objectives will include unveiling Uniqlo’s first Canadian flagship location at Yonge and Dundas Square - a high profile, high traffic location surrounded by clothing retailers. This brick and mortar location will also be accompanied by an extensive e-commerce channel to serve the rest of Canada. Uniqlo will highlight their unique high quality, low-price strategy through informative outof-home advertisements and the introduction of a HEATTECH Parka Jacket retailing for just $150. Utilizing promotional strategies, Uniqlo will aim to increase sales through the Toronto location and online store with the goal of expanding to other Canadian markets. According to Fast Retailer Inc.’s annual report, the average Uniqlo location produces 933,000 yen per square metre, or $830 per square foot. Therefore, Uniqlo’s Toronto flagship location will be striving to attain yearly sales of $33, 200,000. Market Overview Uniqlo will be entering the Canadian menswear and womenswear markets, markets within an industry which contain extensive competition. However, both the womenswear and menswear markets in Canada are projected to experience growth between 2013 and 2018. As far as the menswear category is concerned, it is projected that it will grow 6.5% in volume and 10.1% in value in the next 5 years (Passport, 2014). Moreover, it is projected that the womenswear category will have a 6.2% growth in volume and a 8.4% growth in value within the same time period (Passport, 2014). Next five years Menswear growing at 10.1% Womenswear growing at 8.4% 2 Competitors Uniqlo’s primary competitors in the United States are H&M & Zara (Fast Retailing, 2011). Each of these businesses posted sales increases in Canada during 2013 (Passport, 2014). Furthermore, both are large players in the Canadian menswear and womenswear categories. In regards to womenswear, H&M and Zara hold 1.8% and 0.6% of the market, respectively, with H&M having the largest market share of any brand (Passport, 2014). In the menswear category, on the other hand H&M and Zara hold 1.1% and 0.6% of the market, respectively, with Nike having the largest share of the market at 3.2% (Passport, 2014). Although the competitive landscape is vast, Uniqlo is the largest clothing retailer in Asia and commands a certain brand awareness that has created demand for the clothing in countries in which Uniqlo has not typically serviced. The growth of the Canadian menswear and womenswear markets signifies an opportunity for an established brand to enter the landscape with the ability to gain a profitable share of the market. Share of Market in Canada Menswear 1.8% Womenswear 1.1% 56 Stores Target Market A vital aspect of Uniqlo’s corporate mission statement focuses on providing clothing that, “anybody can wear whenever and wherever,” however, when expanding into Canada, it is essential that a segment of the market is selected as a target (Uniqlo, 2014). Moreover, as per the lifestyle and attitude data sheets available from Print Measurement Bureau, the individuals who have the largest purchasing index of Uniqlo’s direct competitors’ products are men and women between 18 and 34 (PMB, 2014). In addition, within this target, the largest buying index typically correlates to professionals and individuals with some form of post-secondary education (PMB, 2014). Therefore, the target market for expansion into the Canadian market, particularly in Toronto, will be the same target market as those of its competitors. The preparation of marketing communications for the expansion will focus on men and women between the ages of 18 and 34 who are professionals and have attained or are seeking a post-secondary education. Menswear 0.6% Womenswear 0.6% 25 Stores The location of Canada’s first flagship location will be in Toronto, Ontario. Toronto has the largest population of any Canadian city, and the most comprehensive retail options in the country (Retail Insider, 2014). Furthermore, as per Stats Canada’s 2011 Census, 25% of Toronto’s population are of Asian descent (Statistics Canada, 2013). It is documented that those of Asian descent in the United States possess a higher likelihood of brand awareness (Retail Insider, 2014). Toronto is, therefore, an ideal geographic and demographic location to place Canada’s first Uniqlo flagship location. 3 Product & Channel Strategy Uniqlo aims to be the largest clothing company in the world. They aim to achieve this goal by maintaining low prices, high quality products, and the strategic placement of retail locations. Uniqlo’s products are low in price, and designed for everyone. Their clothing is functional, meeting the needs and wants of a large scope of consumers. Their product is differentiated by their focus on high quality, simplicity, comfort and functionality (Fast Retailing, 2014). Uniqlo sets themselves apart from clothing companies that focus strictly on fashion by specifying the importance of the following statement: "More than trends, consumers need functionality. The product should be tough. It should be convenient to wear for daily life” (Chu, 2014). Uniqlo’s strength is in volume. For example, if you enter a store to purchase a t-shirt, you can choose from a large display showcasing over fifty colours. The clothing styles are generally simple, but allow consumers to customize their own wardrobe, with the large selection of colours made available. This characteristic of Uniqlo’s clothing make it suitable for any type of person, ignoring fads and trends (Chu, 2014). By focusing on function, selection and timeless deisgn, Uniqlo reduces risk of losses through fading fashion trends. HEATTECH AIRism Uniqlo has partnered with a materials manufacturer Toray Industries to produce clothing made with their HEATTECH fibres. This unique blend of materials allows Uniqlo to produce thin and very comfortable inner wear that is also very warm. Airism is Uniqlo’s functional line of clothing designed for active people. Its special blend of microfibres absorbs and dries perspiration. AIRsim, alongside HEATTECH, give a special aspect of functionality to Uniqlo’s clothing. Retrieved from Google “More than trends, consumers need functionality. The product should be tough. It should be convenient to wear for daily life.” Uniqlo- Design Director (Chu, 2014) 4 “The company offers clothing basics, but basics that are current, that respond to what's going on today in art and design. Kino-bi means function and beauty, joined together: the clothing is presented in an organized, rational manner, and that very organization and rationality creates an artistic pattern and rhythm. All these qualities reflect the defining characteristics of modern Japanese culture, modern ‘Japaneseness,’ he said.” Nobuo Domae (Chief Executive Officer of Uniqlo USA) The Japanese identity associated with Uniqlo’s origins can be considered as valuable brand equity (Fast Retailing, 2013, p. 22). Although priced very low, the quality of Uniqlo’s fabrics are a cut above. Mastering economies of scale, Uniqlo is able to negotiate low prices from their material manufacturers due to their mass volume demand. This results in Uniqlo’s peculiar position of selling high quality for low prices. Retrieved from Uniqlo.com Uniqlo is a specialty store retailer of private label apparel, or also known as an SPA. The companyretails their clothing exclusively through their own brick and mortar retail locations, as well as through their online store. Store locations in the United States are currently in high traffic urban areas and major shopping malls in the core of large cities. Uniqlo often positions their flagship locations nearby competing flagship clothing stores. By operating flagship stores, Uniqlo is able to gain brand exposure, and showcase their low price, high quality apparel amongst other top clothing retailers around the world. The majority of their stores are of a large scale with multiple floors, facilitating the display of Uniqlo’s product variety. Their flagship stores are lavish in design and aesthetics. Their aim is to open the majority of their stores at a minimum size of 17,750 square feet (Annual Report, 2013, p.41). 5 Situation Analysis Strengths High-end Quality at Low Cost Mass volume retail Highly specialized in fabric technology and quality Innovative fabric technology: HEATTECH & AIRism Advanced Research and Development Centers Japanese Identity Excellent relations with manufacturers to “secure stable high volume supply of top quality materials” Largest Apparel-retail Market Share in Asia Opportunities Large Asian population in the GTA Positive brand awareness among conscious fashion-heads Huge winter market. HeatTech line perfect for Canadian winter. Weaknesses No logo on clothing unrecognizable. Smaller selection of fabrics and clothing styles than competitors. There is very little brand awareness in Canada to the general public. Not a lifestyle Brand. Purposely non-referential. Sizes and fit do not cater universally to the clothing retail market (due to slim fits). Threats Already established competitors in the Canadian Market including Zara, H & M and American Apparel. Canadian consumers are stepping away from outsourcing and favoring “made in Canada” manufacturing. Lack of trend adaptability. 6 PEST Analysis Political Canada and Japan continue to grow and share their political, economic and cultural values which has resulted in continual and positive bilateral relations. International groups and organizations that include the G8, Youth 8 summit, G20, APEC and ASEAN Regional Forum, provide space for negotiations where both nations partner in opportunities to share their common goals (Government of Canada, 2012). Economic Japan and Canada share strong trade and economic relations that have been “steadily expanding” (Urstadt, 2010). For one, Japan is Canada’s largest bilateral direct investment partner in Asia. Furthermore, both countries have strong export and import relations. According to Canada International, “Canada is deeply committed to pursuing new opportunities to deepen trade and economic cooperation with Japan” (Urstadt, 2010). In two-way merchandise trade, Japan is the fifth largest partner with Canada. To illustrate the strength of Canada and Japan’s export-import relations, Canada’s export of goods reached $10.7 Billion Canadian dollars while Japanese imports reached $13 billion Canadian in 2011 (Urstadt, 2010). In March of 2012, both Prime Ministers met in Japan to deepen trade and economic cooperation by launching negotiations toward a bilateral free trade agreement. A study was released afterwards known as the “Report of the Joint Study on the Possibility of a Canada-Japan Economic Partnership Agreement”. According to the report, estimated GDP gains from a bilateral free trade agreement would reach billions in U.S. dollars (Urstadt, 2010). Socio-Cultural The Japan culture is highly valued and it is a respected source of media and pop-culture. North Americans are well aware of Japan providing excellent brands and products from Sony and Panasonic electronics to Honda and Toyota vehicles. Japan and Canada cultures have enjoyed each other through arts, films, music, literature and comic books/manga (Government of Canada, 2012). Furthermore, not only is Toronto Canada’s largest city but it also possesses the country’s most comprehensive retail (Retail Insider, 2014). As a highly urbanized city, Toronto is populated with fashion conscious individuals who are well aware of high end international brands such as Uniqlo. Technology The research and development department of Uniqlo heightens their focus on research and experimentation of materials to continuously improve the quality and functionality of their clothes. Uniqlo also collaborates with companies like Toray Industries to develop technological innovations in fabric such as HEATTECH, an advanced combination of threading that creates a “renowned soft, silky feel” (Fast Retailing, 2013, p. 32). Retrieved from Google 7 Porter’s Five Forces Model Threat of Substitute Products: Low to Moderate »» Easy to substitute non-referential plains clothes. »» -Difficult to match Uniqlo’s superior quality combined with low price. Determinant of Supplier Power Buyer Power: High »» Over saturated market. »» Competition is very high. »» Most notable rivals are H&M, Zara and The Gap. RIvalry »» Over saturated market. »» Competition is very high. »» Most notable rivals are H&M, Zara and The Gap. »» Because the apparel market is saturated, consumers can easily switch to other brands at no cost. »» Apparel consumer’s are generally price sensitive and moderately to highly knowledgeable of clothing which partly explains Uniqlo’s success during the 2009 recession, committing to low prices (Fast Retailing, 2013). Threat of New Entrants: Low to Moderate »» High rate of new entrants »» Economies of scale is a factor that makes it difficult to threaten already established corporations like Uniqlo who have mastered mass volume, superior quality at low prices. »» Although visually Uniqlo may appear to be undifferentiated, its superior quality at low prices maintains substantial difference from other brands. Retrieved from Uniqlo.com 8 The Plan To continuously provide fashionable, high quality lifewear at the lowest prices in the market. Uniqlo’s essence is of pure functionality woven with innovative Japanese technology, refined by culture. Uniqlo is stylish apparel for everyone, for every occasion. ‘‘ ‘‘ Mission Statement New Marketing Objectives Raise brand awareness in steps to dominate apparel market Position Uniqlo as the number one Canadian retailer for casualwear, emphasizing highquality products and low prices Increase Uniqlo’s market share in the Canadian apparel market to 1.0% in Canada by 2022 9 Marketing Strategy Product Uniqlo is a brand that focuses on casual wear with an influence of Japanese fashion. Their primary products are for men, women, kids, and infants. Uniqlo’s product lineup consists of t-shirts, sweaters and pants and other clothing in a wide variety of colours. They are truly representing their products to the masses giving them the option to customize their wardrobes. For Uniqlo’s expansion into Canada, a focus will be placed on the HEATTECH lineup, adapting to the needs and wants of the Canadian consumer by producing sweaters, fleeces and winter outerwear using the innovative technology. HEATTECH uses rayon and milk proteins to trap the moisture of the body to generate and retain heat (Fast Retailing, 2014). The Canadian climate allows Uniqlo to increase its utilize of the HEATTECH line and technology in Canada. Therefore, we will introduce a brand new product line of parka jackets made specifically to withstand the Canadian winter. The Jackets will be exclusively sold in Canada and will be the frontier product for the new HeatTech lineup Retrieved from Google for Canada. The jacket will utilize HEATTECH technology to infuse a comfortable, warm liner with Uniqlo’s down jacket technology to provide layers of warmth during the cold months. The Parka Jacket is a new development for Uniqlo’s product line. The introduction of the product will allow Canadian consumers to feel entitled to the product that identify with their needs and wants. The Parka Jacket will be priced low, at $150.00, which will be positioned competitively alongside other parka jackets in the market. Uniqlo chooses functionality over fashion as their selling point, which has excelled their success in expanding with low-cost products. Uniqlo’s minimalist design retains high quality standards without following fads and trends of its competitors. Uniqlo places its importance on craftsmanship for the masses, which includes specializing in textile, sewing and dyeing (Urstadt, 2010). An example of Uniqlo’s craftsmanship is their premium jeans that are made of Japanese selvedge denim. The jeans are made from a weave, that continuously stitches a thread from the top to the bottom of the jeans, ending with a red stitching on the cuff (Urstadt, 2010). Uniqlo’s emphasis on quality will allow them to differentiate its products from the competition. The unique approach of emphasizing quality and low cost is an opportunity that can allow Uniqlo to reach its market share goal of 1% in apparel by 2022. 10 Price One of the key contributors to Uniqlo’s success is their low pricing strategy. This strategy makes their high quality products affordable and widely accessible to the general public. Customers can purchase t-shirts for $6 US and cashmere sweaters for $30 with the guarantee of a high quality product (Bhasin, 2014). It is crucial that the low prices Uniqlo is known for are reflected in the Canadian market, ensuring consumers develop trust towards the brand and its brand equity. Prices will not be marked up strategically to increase profits, but will be priced according to the market ensuring consistent profit margins per unit of clothing to Uniqlo locations globally. This sort of pricing strategy and product offering allows Uniqlo the opportunity to compete with and absorb market share from its major Canadian competitors. Offering high quality clothing products at subsantially lower prices is a core differentiator of Uniqlo’s positioning Price lower than competitors High quality uncompromised When introducing the flagship store at Yonge-Dundas Square, selective discounts will be utilized to attract prospects to test-drive specific products, such as a cashmere sweater, with the goal that they will enjoy the product, promote it through word-of-mouth and ultimately convert into a loyal customer. Examples of Pricing HEATTECH Parka Jacket: $150 High Quality Denim Jeans : $29-49 AIRism breathable athletic shirt: $12 11 Place The Uniqlo flagship store will be opened at Yonge and Dundas Square in Toronto on the first weekend of December, 2015. We have decided not to open Uniqlo stores in shopping malls due to initial limited exposure. The objective is to visibly expose Uniqlo to as many Torontonians as possible. Like the overwhelming lights, billboards and giant screens that pervade downtown Tokyo, Yonge and Dundas Square is similarly situated as a high traffic spot that attracts attention through its billboards, lights, street performances and other attractions. Furthermore, by placing our flagship store in the heart of Yonge And Dundas Square we are approaching a frontal attack against our competitor H&M which is also situated in the area. Anticipating the success of the Toronto flagship store, the next phase will focus on store expansion throughout other major Canadian cities to increase Uniqlo’s market share. The outdoor presence of Uniqlo’s brand is crucial as logos are absent on the actual clothing. The the location is also ideal for having easy subway accessibility as the square is directly above Dundas station. The flagship store will have multiple levels Proposed Location:Yonge-Dundas Square Area Retrieved from Google with different categories of products on each floor. The universal layout organization of Uniqlo stores will continue in the Toronto flagship store. The long-term goal of Uniqlo in Canada will be to open warehouses and distribution centers near the retail stores. However, in the early stages of the Toronto expansion, Uniqlo will temporarily partner with a pre-established distribution channel like Tiger Distribution. The plan is to maintain partnership just for the first two years of Uniqlo’s presence in Canada. If the flagship store meets our sales forecasts and solid growth is apparent, then we will confidently build our own warehouse distribution channel for Canadian locations in the country. The warehouse should not be built until we see growth and success within the Canadian apparel market. Moreover, it is of high importance that we include a viable and ready ecommerce service for all Canadians across the country, to accompany the launch of the Toronto flagship store. The e-commerce service will increase Uniqlo’s market share to meet the objective of a 1% share of the Canadian apparel market by 2022. Yonge-Dundas Square Facts: »»Over 28 Million people pass through the square each year »»Growing in popularity as a central downtown hub »»Canada’s busiest pedestrian intersection »»Host of many community festivals and events 12 Promotion Uniqlo’s promotional strategies for Canadian expansion will be catered to the masses - deploying extensive advertisements through billboards, posters, digital and social media campaigns. Through our promotional push and pull strategies, the goal is to contribute to an increase of our market share to 1% by 2022. Some promotional tactics that will be utilized are placing a pop-up store as a teaser before opening the grand opening of the flagship. This tactic is designed to create buzz and awareness towards Uniqlo as a brand. Out of home advertising such as billboards and TTC media buys will be utilized in order to showcase Uniqlo to the people of Toronto. Identifying the brand with secondary sources such as celebrities is a valuable strategy to appeal to our target market. Our target market consists of men and women between 18 and 34, we will plan and execute a free concert with the Grammy Award winning artist Pharrell to coincide with the opening day of the Uniqlo flagship store. By placing advertisements at TTC subway stations, Uniqlo’s brand will gain a large amount of exposure by daily commuters and passengers. This proposed media buy at Dundas station would be seen by over 60,000 people daily. (Statistics from 2012-2013 ridership,TTC) Incorporating local bloggers and blogs to write about Uniqlo’s expansion in Toronto will allow communication with the target groups through influencers and opinion leaders. Social media outlets such as Instagram and Facebook are direct outlets to the target group and their interaction and reaction to the product. We can inform potential customers about the qualities and technological developments that Uniqlo has to offer. This media will include poster campaigns highlighting variety of colours, quality fabrics, dyeing and sewing. 13 Communications Strategy To expand into the Canadian apparel market, it is essential that Uniqlo executes a marketing communications strategy which reaches the target market to raise brand awareness. The marketing communications mix is designed to utilize various approaches and techniques to entice prospects in a variety of creative manners. Furthermore, the marketing communications strategy will initially inform potential customers in the market who are already aware of the brand while initiating curiosity to those who are not. Out-of-home advertising techniques will utilize promotional tools to raise brand awareness. Billboards and promotional posters will be placed strategically around the city to attract the attention of potential customers, raising brand awareness and informing them that a flagship store will be opening soon in downtown Toronto. Out of Home Guerilla / Non Traditional Public Relations Events & Experiences Large billboard advertisements will be simplistic, focusing on the emphasis of Uniqlo’s logo, a phrase such as “Coming Soon”, the inclusion of links to the company website and Uniqlo’s Canadian social media outlets. This technique will not only entice curiosity for our target market of being unaware of the brand, but also stimulate consumers with pre-existing brand awareness, pulling prospects to research the details of Uniqlo’s launch into the Canadian market. The inclusion of website and Canadian social media links are also able to educate consumers lacking brand awareness. Moreover, we will implement a full takeover of TTC’s advertising space within subways, buses and streetcars. The purpose of the posted ads in transit is to educate and inform the commuting target market of Uniqlo’s innovations in fabric technology as well as their brand line, according to season. To take advantage of commuter travel time, the target market will have sufficient time to read the posted informational ad on Uniqlo’s fabric technology. For the winter season, diagrams focusing on the science of Heattech technology will promote the company’s brand equity as the innovative provider of winter wear that best fights the winter cold. We will also accompany the science education with basic ads of models, including musician Pharrell Williams, wearing the season’s clothing line. Similarly, for the Summer season, the focus will steer towards the technology of AIRism for fighting sweat and moisture, accompanied with a set of ads with models wearing the Summer line. Furthermore as posters are placed side by side, dominating the entire ad space of a given subway, streetcar or bus, each poster will consist of a specific color theme, thus presenting an entire array of colors to the TTC commuter. This will also meet our objective of positioning our brand for having the widest selection of colors in the general apparel market. Lastly, Dundas station will be appointed as the sole station to accompany Uniqlo advertisement. Exclusively posting ads in Dundas station is a means to inform passing commuters that the location of the flagship store is indeed on Yonge and Dundas Square area. 14 Guerilla/Experiential Guerilla and word-of-mouth marketing techniques will be used as a teaser campaign to stimulate brand awareness and curiosity. Organized in co-operation with the City of Toronto, a red shipping container will be placed at Yonge and Dundas Square in August of 2015, three months prior to the opening of the flagship store. The shipping container will be decorated solely with a Uniqlo logo and a countdown number which will be re-painted each day. The shipping container will be left unattended for seven days. On the Goals »»Spark the curiosity of passers by »»Stimulate social media attention »»Get stunt featured in key blogs and media news outlets »»Increase awareness, and spark interest in learning about what Uniqlo is about Location of Shipping Container at Yonge-Dundas Square seventh day, the container will be opened up as a pop-up shop selling Uniqlo clothing for the entire Labour Day weekend. This tactic will create a buzz on social media, news outlets, and the blogosphere. Once the pop up store opens, the official date for the Yonge-Dundas square location will be announced making Uniqlo’s official presence in the Canadian market known to the general public. Timeline »»Place container at Yonge-Dundas Square »»Repaint numbering on side of container, counting down from seven days »»On final day, container will be opened and transformed into a one day pop up store for Uniqlo »»During event, announce official opening of flagship store at YongeDundas Square area 15 Public Relations In relation to the strategic execution of the pop-up store and flagship locations, a press kit will be designed and distributed to news outlets and blog sources as accompaniment for the coverage that will surround the grand opening of each location. The press kit will include articles and information designed to create positive publicity for Uniqlo by promoting the functionality of its products, its innovative fabric technology, and high quality, low cost business model. The material included in the press kit will introduce Canadians to Uniqlo’s history, its Japanese heritage, values in social responsibility and growing popularity worldwide. Events & Experience The final tactic will be to utilize a secondary source affiliation with the brand by holding a free concert at Yonge and Dundas Square for the flagship store’s grand opening. The new creative director of Uniqlo UT is NIGO, a japanese fashion designer and music producer, who has a strong friendship with Pharrell Williams. The concert will be free through sponsorship from Uniqlo in an effort to raise brand awareness and attention. Our target group retrieves information through popular outlets like music and digital media. The free concert brings positive emotions and feelings where it can be associated to the Uniqlo brand. The associations create a bigger dynamic of what the brand represents. The one-time concert will be remembered through pictures, video and audio to create a memorable memory of the event that took place with Uniqlo sponsorship. NIGO PHARRELL WILLIAMS Retrieved from Google 16 Market Analysis The strategy of Uniqlo starting the Canada expansion by opening a single flagship store in downtown Toronto, the company’s share of the market will be low until further expansion is implemented. It can be expected that H&M and Zara will remain important retailers in the Canadian market and most likely grow their current apparel market shares of 1.1% and 0.4%, respectively (Passport, 2014). Furthermore, it can be projected that Nike will retain and possibly grow their 3.2% share of the menswear market (Passport, 2014). In addition, successful department stores such as Nordstrom and Saks Fifth Avenue, are expected to enter the Canadian market by 2016 (Kopun, 2014). The entry of these two companies will further add competition to an already congested market. Sales Forecast In the Uniqlo Annual Report, the average sales per square metre of each location was approximately 933,000 yen during the 2013 fiscal year (Fast Retailing, 2013, pg. 45). To apply these figures to the Canadian market, we must convert the value of 933,000 yen per square metre to the equivalent dollar amount per square foot. Therefore, annual sales per square foot would be 86,710 yen, or $830 per square foot per year. For example, if the flagship location measures 40,000 square feet, we can estimate that the ideal base case scenario is $33,200,000 (40,000 x 830) in sales. According to Statscan, Canadian apparel retailers saw an average increase of 4.1% in net sales in 2014 (Statistics Canada, 2014). Therefore, we can forecast that the sales of our flagship location will increase at an average rate of 4.1% year-on-year. Below is a chart that displays the sales forecast for 5 years based on the average sales of global Uniqlo locations. Year Amount Increased 2016-2017 Yearly Sales Forecast $30,200,000 2017-2018 $1,361,200 $34,561,200 2018-2019 2019-2020 2021-2022 $1,417,009 $1,475,106 $1,535,585 $35,978,209 $37,453,315 $38,988,900 Market Share Uniqlo sets ambitious growth objectives, planning to aggressively expand locations to increase their global apparel market share (Fast Retailing, 2013, pg. 45). Currently, Uniqlo is growing at a global rate of 23% per year (Fast Retailing, 2011). To apply the growth rate of 23% to Uniqlo in the Canadian market, it is not realistic as the flagship in Toronto will be the first expansion location in the country. Figures for the market share growth of specific locations are not available and could not be used as a benchmark. However, Due to Uniqlo’s aggressive expansion model and with profitable sales figures and the addition of flagship stores in Vancouver, Montreal, and other powerful retail markets in Canada will help to grow Uniqlo’s market share at a greater rate than .1% per year. As Uniqlo expands further into the market, meeting the objective of 1% market share by 2022 will become increasingly attainable. 17 Contingency Plan Preemptive measures have been built-in to Uniqlo’s Canadian expansion plan to minimize risk. To reduce the costs of opening a warehouse and distribution centre in Canada, a strategic partnership will be created with a company who specializes in distribution and logistics, such as Tiger Distribution. Within two years, if sales figures meet expectations, Uniqlo will begin to roll out its own warehouses and distribution centres to support the flagship location and e-commerce sales. If Uniqlo’s Toronto flagship location dramatically underperforms in its first two years of operation, a contingency plan will be executed to vacate the flagship store at Yonge and Dundas Square. However, Uniqlo will continue to offer apparel through the ecommerce channel established during initial expansion. This will allow Uniqlo to continue to compete in the Canadian market, providing apparel to those who are interested. The e-commerce channel will also allow Uniqlo to implement online marketing campaigns to revitalise their brand image. After revitalising the brand image, Uniqlo will reposition to stimulate new demand with the goal of opening another flagship store in the future. 18 Works Cited Bhasin, K. (2014, January 22). Inside Uniqlo, The Japanese Company with Designs on Dressing the World. The Huffington Post. http://www.huffingtonpost.com/2014/01/22/uniqlo-expansion_n_4598031.html? (accessed November 16, 2014). Chu, J. (2012, July/August). Cheap, Chic, And Made for All: How Uniqlo Plans to Take Over Casual Fashion. Fast Company. http://www.fastcompany.com/1839302/cheap-chic-and-made-all-how-uniqlo-planstake-over-casual-fashion (accessed November 28, 2014). Durisin, M. (2013, April 26). How Clothing Chain Uniqlo Is Taking Over The World. Business Insider. http:// www.businessinsider.com/the-story-of-uniqlo-2013-4?op=1 (accessed November 30, 2014). Fast Retailing. (2011, February 7). Management Strategy: Uniqlo Business Strategy. Fast Retailing. http:// www.fastretailing.com/eng/ir/direction/tactics.html (accessed November 25, 2014). Fast Retailing. (2013). Annual Report 2013. Fast Retailing. http://www.fastretailing.com/eng/ir/library/pdf/ ar2013_en.pdf (accessed November 15, 2014). Fast Retailing. (2014, July 11). Uniqlo Business: Uniqlo Business Strategy. Fast Retailing. http://www. fastretailing.com/eng/group/strategy/tactics.html (accessed November 25, 2014). Government of Canada. (2012, August). Canada-Japan Relations. Government of Canada. http://www. canadainternational.gc.ca/japan-japon/bilateral_relations_bilaterales/index.aspx?lang=eng (accessed November 24, 2014). Hyde, K. (2007, April 26). Uniqlo: From Tokyo to New York to Global Brand. Japan Society. http://www. japansociety.org/multimedia/articles/uniqlo_from_tokyo_to_new_york_to_global_brand (accessed November 18, 2014). Kitayama, A., & Ho, S. (2014, September 17). Interview-Uniqlo expects profit at U.S. stores in ‘couple of years’. CNBC. http://www.cnbc.com/id/102009845 (accessed November 17, 2014). Kopun, F. (2014, May 27). Eaton Centre to expand for Saks Fifth Avenue flagship and include the Bay. Toronto Star. http://www.thestar.com/business/2014/01/27/hudsons_bay_co_to_sell_lease_back_ downtown_toronto_properties.html (accessed November 19, 2014). 19 Maheshwari, S. (2014, March 27). Why Uniqlo’s Goal Of $10 Billion In U.S. Sales By 2020 Isn’t Going To Happen. BuzzFeed. http://www.buzzfeed.com/sapna/why-uniqlos-goal-of-10-billion-in-us-sales-by2020-isnt-goin (accessed November 13, 2014). Passport (2014, June 6). Womenswear in Canada. Passport. (accessed November 17, 2014). Passport. (2014, June 6). Menswear in Canada. Passport. (accessed November 17, 2014). Passport. (2014, June 6). Apparel and Footwear Brand Shares in Canada. Passport. (accessed November 17, 2014). Passport. (2014, June 6). Apparel and Footwear Brand Shares in Asia Pacific. Passport. (accessed November 17, 2014). PMB. (2014). Lifestyles/Attitudes: Men’s Clothing. PMB (accessed November 24, 2014). PMB. (2014). Lifestyles/Attitudes: Women’s Clothing. PMB (accessed November 24, 2014). Retail Insider (2014, June 9) Uniqlo’s Canadian store locations: discussion. Retail Insider. http://www.retailinsider.com/retail-insider/2014/6/uniqlo (accessed November 24, 2014). Statistics Canada. 2013. Toronto, C, Ontario (Code 3520005) (table). National Household Survey (NHS) Profile. 2011 National Household Survey. Statistics Canada Catalogue no. 99-004-XWE. Ottawa. Released September 11, 2013.http://www12.statcan.gc.ca/nhs-enm/2011/dp-pd/prof/index.cfm?Lang=E (accessed December 1, 2014). Statistics Canada. 2014. Retail Sales, by Industry (monthly) (Seasonal adjusted). Statistics Canada. http:// www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/trad42a-eng.htm (accessed December 1, 2014). Uniqlo (2014). Company. Uniqlo. http://uniqlo.archive.tha.jp/us/company/ (accessed November 22, 2014). Uniqlo. (2014, March 6). Pharrell Williams for UNIQLO UT 2014 Spring Summer Collection. Uniqlo. http://www. uniqlo.com/sg/corp/pressrelease/2014/03/pharrell_williams_for_uniqlo_u.html (accessed November 13, 2014). Uniqlo. (2014). HEATTECH. Uniqlo. http://www.uniqlo.com/us/men/featured/heattech.html (accessed November 16, 2014). Uniqlo. (2014). Our Story. Uniqlo. http://www.uniqlo.com/us/company/about-uniqlo.html (accessed November 20 22, 2014). Urstadt, B. (2010, May 9). Uniqlones. New York Magazine. http://nymag.com/fashion/features/65898/index4. html#comments (accessed November 29, 2014). Waseda University. (2011, July 21). Enterprise for Analysis: Fast Retailing Co., Ltd. Waseda University. http:// www.waseda.jp/sem-hirota/studies/thesis/firstretailing.2011singapore.pdf (accessed November 20, 2014). 21