Barometer Measures Importance of Dealing With an Advisor

advertisement

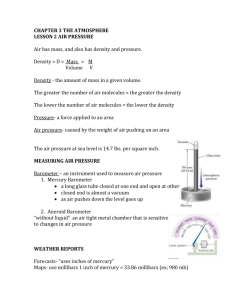

More than 850 financial services companies in more than 70 countries turn to LIMRA first to help them build their businesses and improve their performance. LIMRA INSIGHTS Barometer Measures Importance of Dealing With an Advisor ommunications methods may C change, but the importance of the personal touch remains. By Ashley V. Durham T o stay current with consumer insurance perceptions and behaviors, LIMRA and Life Happens jointly publish the Insurance Barometer Study. Now in its fourth year, it measures consumer financial concerns and attitudes about financial products, with a particular focus on life insurance. Some of the responses are not surprising and reflect attitudes held about life insurance for years. For example, 80 percent of adults still agree that most people need life insurance. However, while one in four adults admits they themselves need more life insurance, only one in 10 said they are very likely to buy a policy within the next year. When they are ready to buy, most people still want to work with a financial advisor or agent, because life insurance can be a relatively complicated purchase. Just over half of the respondents in the 2014 Barometer Study prefer to purchase from an agent or financial advisor in person. At the same time however, one in four under the age of 45 said they’d prefer to apply for life insurance online. There is also a strong preference among all age groups, even among seniors, to use the Internet when researching life insurance. Despite increasing Internet involvement, the financial professional’s presence remains essential. Communication in person or over the phone is still the way most consumers want to work with their financial advisor or agent. Email is almost as popular among the under-45 crowd, but only 30 percent over the age of 45 prefer to communicate by email. Financial advisors and agents have heard a great deal about the importance of staying current with technology. This is especially true with younger consumers, who cite several tech-based pref70 Source: “2014 Insurance Barometer,” LIMRA and Life Happens erences of communication with their financial advisors or agents. Video Web conferences are favored by one in five of the under-45 consumers. Other methods increasing in popularity include instant messaging, text messaging and communicating through a social media site. What does all this mean for a financial advisor or agent running a business? It actually reflects the larger “omnichannel” trend in life insurance, with consumers wanting to interact with the life insurance purchasing process on their terms. Today’s consumers will sometimes seek life insurance information inperson and other times they will browse a company Web page, as 40 percent of consumers told us they had done (half of them within the past year). In the end, consumers want to understand what they are buying and to make sure they InsuranceNewsNet Magazine » June 2014 are getting the right amount of coverage for the right price. We conduct the Barometer Study each year because it allows us to identify and monitor emerging trends with consumers. The survey also reinforces that consumers still seek good advice. Whether it’s a phone conversation with an agent or a discussion held on a financial advisor’s Facebook page, the methods of communication may change, but the importance of the personal touch remains. Ashley V. Durham is a senior analyst in Insurance Research for LIMRA. She is the project director for the U.S. Individual Life Insurance Sales Studies, the U.S. Individual Life Insurance Yearbook and the Insurance Barometer Study. Ashley may be reached at ashley.durham@innfeedback.com. As seen in InsuranceNewsNet Magazine