Chapter 2

advertisement

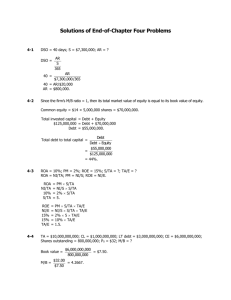

Chapter 2 Financial Statements, Cash Flow, and Taxes SOLUTIONS TO END-OF-CHAPTER PROBLEMS 2-1 NI = $3,000,000; EBIT = $6,000,000; T = 40%; Interest = ? Need to set up an income statement and work from the bottom up. EBIT Interest EBT Taxes (40%) NI $6,000,000 1,000,000 $5,000,000 2,000,000 $3,000,000 EBT = $3,000,000 $3,000,000 (1 T) 0.6 Interest = EBIT - EBT = $6,000,000 - $5,000,000 = $1,000,000. 2-2 NI = $3,100,000; DEP = $500,000; AMORT = 0; NCF = ? NCF = NI + DEP and AMORT = $3,100,000 + $500,000 = $3,600,000. 2-3 EBIT = $170,000; Operating capital = $800,000; kA-T = 11.625%; T = 40%; EVA = ? EVA = = = = 2-4 EBIT(1 - T) - AT dollar cost of capital $170,000(1 - 0.4) – ($800,000 0.11625) $102,000 - $93,000 $9,000. NI = $50,000,000; R/EY/E = $810,000,000; R/EB/Y = $780,000,000; Dividends = ? R/EB/Y + NI – Div $780,000,000 + $50,000,000 – Div $830,000,000 – Div $20,000,000 2-5 = R/EY/E = $810,000,000 = $810,000,000 = Div. EBITDA = $7,500,000; NI = $1,800,000; Int = $2,000,000; T = 40%; DA = ? EBITDA DA EBIT Int EBT Taxes (40%) NI $7,500,000 2,500,000 $5,000,000 2,000,000 $3,000,000 1,200,000 $1,800,000 EBITDA – DA = EBIT; DA = EBITDA – EBIT EBIT = EBT + Int = $3,000,000 + $2,000,000 (Given) $1,800,000 $1,800,000 (1 T) 0.6 (Given) Integrated Case: 2 - 1 2-6 EBIT = $750,000; DEP = $200,000; AMORT = 0; 100% Equity; T = 40%; NI = ?; NCF = ?; OCF = ? First, determine net income by setting up an income statement: EBIT $750,000 Interest 0 EBT $750,000 Taxes (40%) 300,000 NI $450,000 NCF = NI + DEP and AMORT = $450,000 + $200,000 = $650,000. OCF = EBIT(1 - T) + DEP and AMORT = $750,000(0.6) + $200,000 = $650,000. Note that NCF = OCF because the firm is 100 percent equity financed. 2-7 Statements b, c, and d will all decrease the amount of cash on a company’s balance sheet, while Statement a will increase cash through the sale of common stock. This is a source of cash through financing activities. 2-8 a. NOPAT = EBIT(1 – T) = $4,000,000,000(0.6) = $2,400,000,000. b. NCF = NI + DEP and AMORT = $1,500,000,000 + $3,000,000,000 = $4,500,000,000. c. OCF = NOPAT + DEP and AMORT = $2,400,000,000 + $3,000,000,000 = $5,400,000,000. d. FCF = NOPAT – Net Investment in Operating Capital = $2,400,000,000 - $1,300,000,000 = $1,100,000,000. Total Investor-Supplied A-T Cost e. EVA = NOPAT – of Capital Operating Capital = $2,400,000,000 – [($20,000,000,000)(0.10)] = $400,000,000. 2-9 MVA $130,000,000 $630,000,000 X Integrated Case: 2 - 2 = = = = (P0 Number of common shares) BV of equity $60X $500,000,000 $60X 10,500,000 common shares. 2-10 First, determine the firm’s total operating capital: Total operating capital = Net operating working capital Net fixed assets = $5,000,000 $37,000,000 = $42,000,000. Now, you can calculate the firm’s EVA: EVA = EBIT (1 T) (WACC)(Total operating capital) = $6,375,000 (1 0.40) (0.085)($42,000,000) = $3,825,000 $3,570,000 = $255,000. = = = = Beg. R/E Net income Dividends $212,300,000 Net income $22,500,000 $189,800,000 Net income $89,100,000. 2-11 Ending R/E $278,900,000 $278,900,000 Net income 2-12 a. From the statement of cash flows the change in cash must equal cash flow from operating activities plus long-term investing activities plus financing activities. First, we must identify the change in cash as follows: Cash at the end of the year Cash at the beginning of the year Change in cash $25,000 55,000 -$30,000 The sum of cash flows generated from operations, investment, and financing must equal a negative $30,000. Therefore, we can calculate the cash flow from operations as follows: CF from operations CF from investing CF from financing = in cash CF from operations $250,000 $170,000 = -$30,000 CF from operations = $50,000. b. To determine the firm’s net income for the current year, you must realize that cash flow from operations is determined by adding sources of cash (such as depreciation and amortization and increases in accrued liabilities) and subtracting uses of cash (such as increases in accounts receivable and inventories) from net income. Since we determined that the firm’s cash flow from operations totaled $50,000 in part a of this problem, we can now calculate the firm’s net income as follows: Increase in Increase in Depreciation NI and amortization accrued A/R and liabilities inventory NI + $10,000 + $25,000 - $100,000 NI - $65,000 NI CF from = operations = $50,000 = $50,000 = $115,000. Integrated Case: 2 - 3 2-13 Working up the income statement you can calculate the new sales level would be $12,681,482. Sales Operating costs (excl. D&A) EBITDA Depr. & amort. EBIT Interest EBT Taxes (40%) Net income 2-14 $5,706,667/(1 0.55) $12,681,482 0.55 $4,826,667 + $880,000 $800,000 1.10 $4,166,667 + $660,000 $600,000 1.10 $2,500,000/(1 0.4) $4,166,667 0.40 $12,681,482 6,974,815 $ 5,706,667 880,000 $ 4,826,667 660,000 $ 4,166,667 1,666,667 $ 2,500,000 a. Because we’re interested in net cash flow stockholders, we exclude common dividends paid. available to common CF02 = NI available to common stockholders + Depreciation and amortization = $364 + $220 = $584 million. The net cash flow number is larger than net income by the current year’s depreciation and amortization expense, which is a noncash charge. b. Balance of RE, December 31, 2001 Add: NI, 2002 Less: Div. paid to common stockholders Balance of RE, December 31, 2002 $1,302 364 (146) $1,520 The RE balance on December 31, 2002 is $1,520 million. c. $1,520 million. d. Cash + Marketable securities = $15 million. e. Total current liabilities = $620 million. 2-15 a. Sales revenues Costs except deprec. and amort. (75%) EBITDA Depreciation and amortization EBT Taxes (40%) Net income Add back deprec. and amort. Net cash flow Income Statement $12,000,000 9,000,000 $ 3,000,000 1,500,000 $ 1,500,000 600,000 $ 900,000 1,500,000 $ 2,400,000 b. If depreciation and amortization doubled, taxable income would fall to zero and taxes would be zero. Thus, net income would decrease to zero, but net cash flow would rise to $3,000,000. Menendez would save $600,000 in taxes, thus increasing its cash flow: CF = T(Depreciation and amortization) = 0.4($1,500,000) = $600,000. Integrated Case: 2 - 4 c. If depreciation and amortization were halved, taxable income would rise to $2,250,000 and taxes to $900,000. Therefore, net income would rise to $1,350,000, but net cash flow would fall to $2,100,000. d. You should prefer to have higher depreciation and amortization charges and higher cash flows. Net cash flows are the funds that are available to the owners to withdraw from the firm and, therefore, cash flows should be more important to them than net income. e. In the situation where depreciation and amortization doubled, net income fell by 100 percent. Since many of the measures banks and investors use to appraise a firm’s performance depend on net income, a decline in net income could certainly hurt both the firm’s stock price and its ability to borrow. For example, earnings per share is a common number looked at by banks and investors, and it would have declined by 100 percent, even though the firm’s ability to pay dividends and to repay loans would have improved. 2-16 This involves setting up the income statement and working from the bottom up. Sales Revenue* Cost of Goods Sold (60%) EBITDA Deprec. and amort. EBIT Interest EBT Taxes (40%) NI * Sales Revenue - COGS Revenue - 0.6(Revenue) 0.4 Revenue Revenue 2-17 = = = = $2,500,000 1,500,000 $1,000,000 500,000 $ 500,000 100,000 $ 400,000 160,000 $ 240,000 EBITDA $1,000,000 $1,000,000 $2,500,000. 2,500,000 0.6 EBITDA = EBIT + DEP and AMORT (Given) EBIT = EBT + Interest (Given)$240,000 $240,000 EBT = (1 T) 0.6 (Given)$240,000 $240,000 (1 T) 0.6 a. NOPAT = EBIT(1 - T) = $150,000,000(0.6) = $90,000,000. Net operating Non-interest charging b. working capital = Current assets - current liabilities 01 = $360,000,000 - ($90,000,000 + $60,000,000) = $210,000,000. Net operating working capital02 = $372,000,000 - $180,000,000 = $192,000,000. Net plant Net operating c. Operating capital01 = and equipment working capital = $250,000,000 + $210,000,000 = $460,000,000. Integrated Case: 2 - 5 Operating capital02 = $300,000,000 + $192,000,000 = $492,000,000. d. FCF = NOPAT - Net investment in operating capital = $90,000,000 - ($492,000,000 - $460,000,000) = $58,000,000. e. The large increase in dividends for 2002 can most likely be attributed to a large increase in free cash flow from 2001 to 2002, since FCF represents the amount of cash available to be paid out to stockholders after the company has made all investments in fixed assets, new products, and operating working capital necessary to sustain the business. Integrated Case: 2 - 6